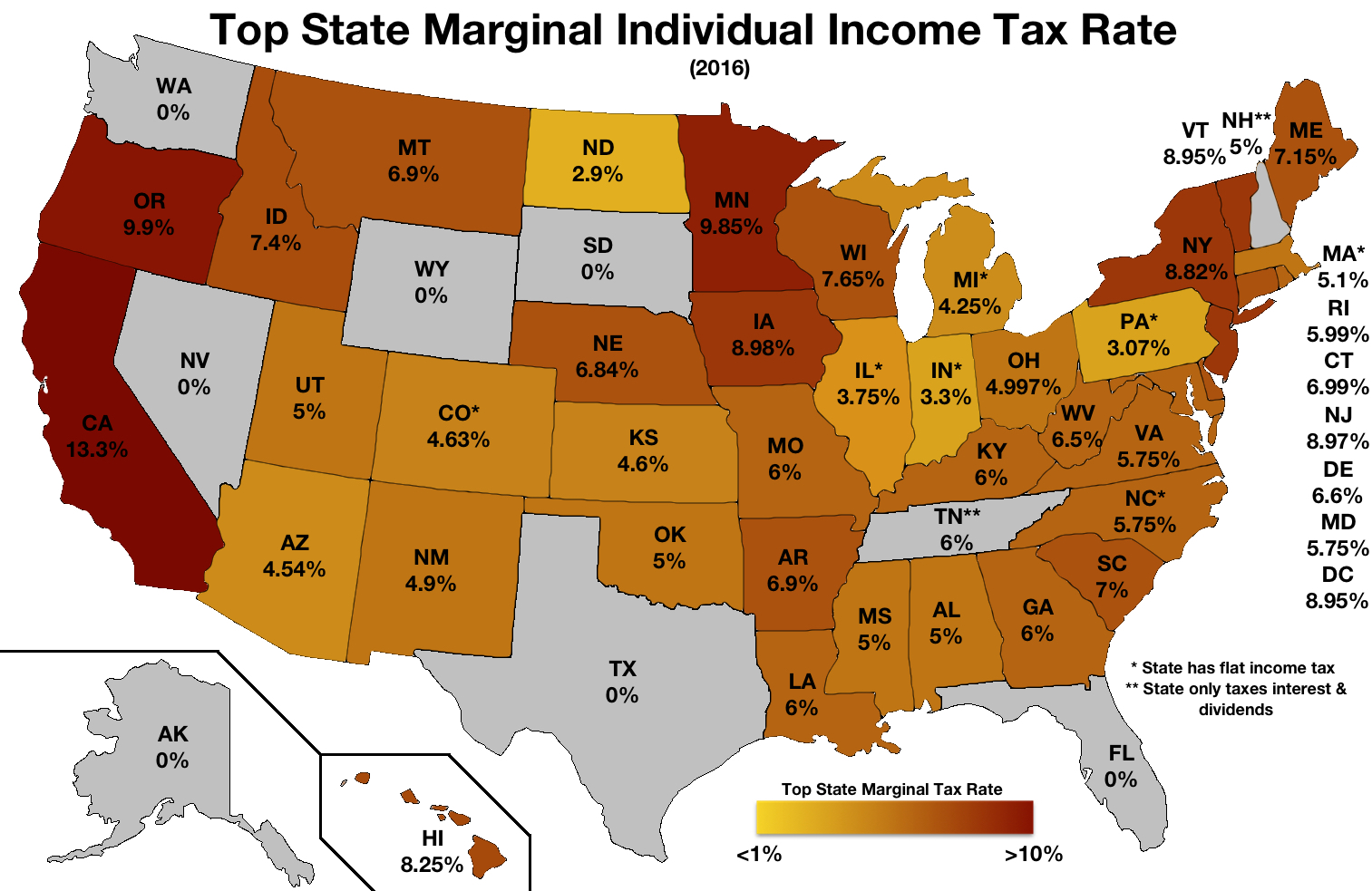

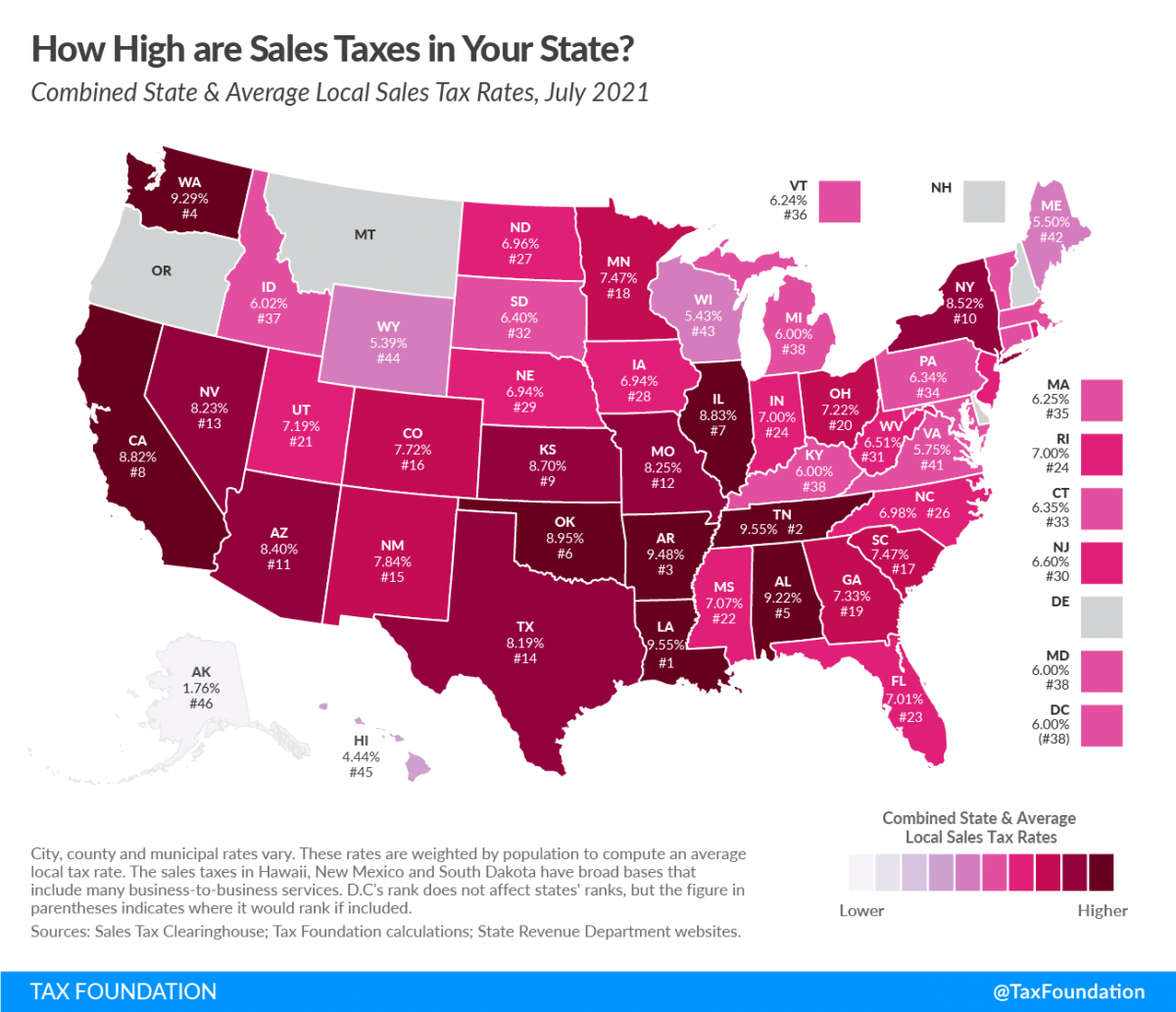

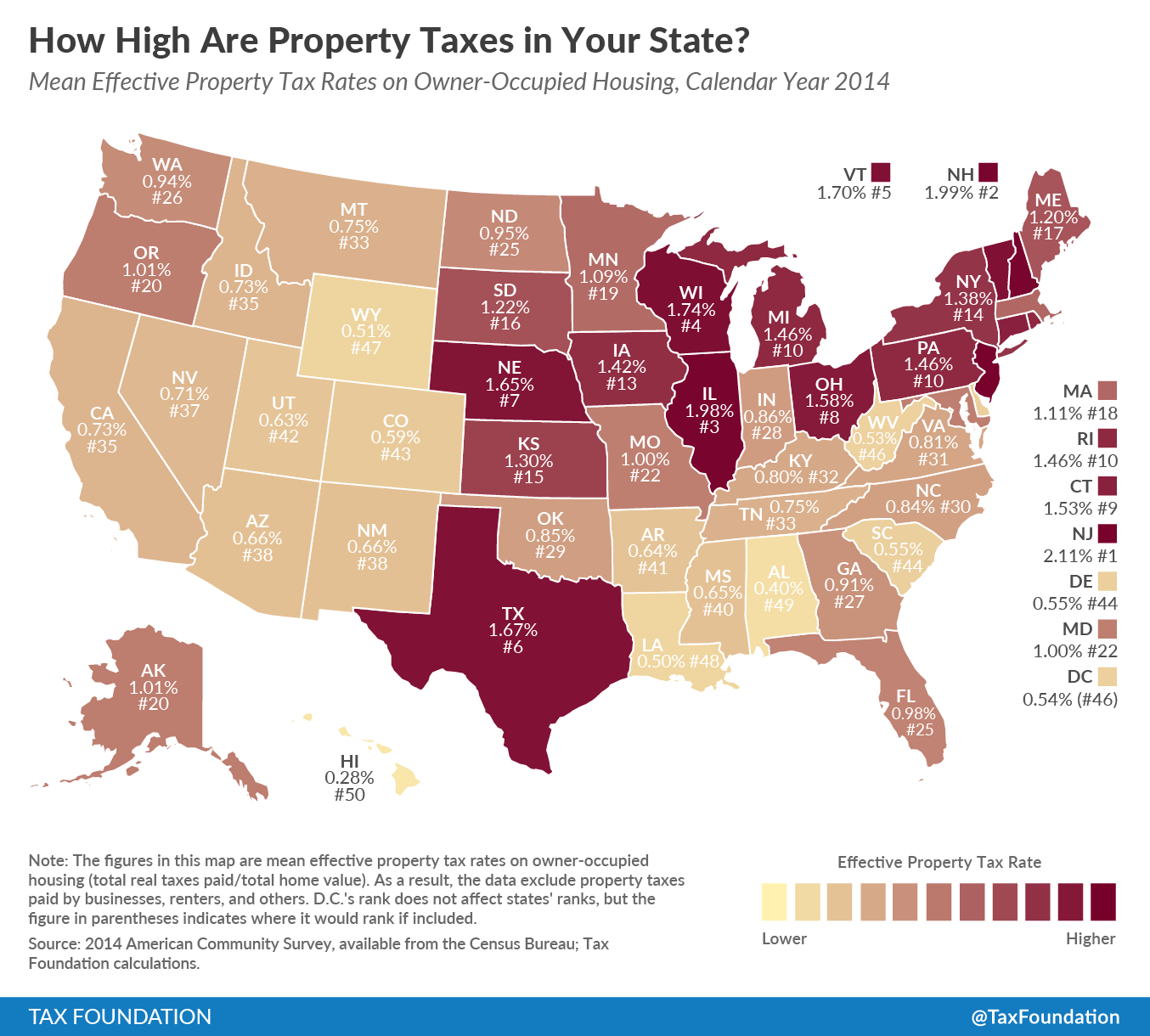

State Taxes In Montana Montana has a graduated state individual income tax with rates ranging from 4 70 percent to 5 90 percent Montana has a 6 75 percent corporate income tax rate Montana does not have a sales tax Montana has a 0 69 percent effective property tax rate on owner occupied housing value

Find out how much you ll pay in Montana state income taxes given your annual income Customize using your filing status deductions exemptions and more Menu burger Tax Simplification Resource Hub Tax Year 2024 Resources for Individuals and Estates and Trusts Find Your Money Unclaimed Property Search Discover If You Have Unclaimed Cash Waiting for You Search the Montana State Self Help Knowledge Base

State Taxes In Montana

State Taxes In Montana

https://i.ytimg.com/vi/QrKQ4zH7PsU/maxresdefault.jpg

Montana Income Tax MT State Tax Calculator Community Tax

https://www.communitytax.com/wp-content/uploads/2020/01/image8.jpg

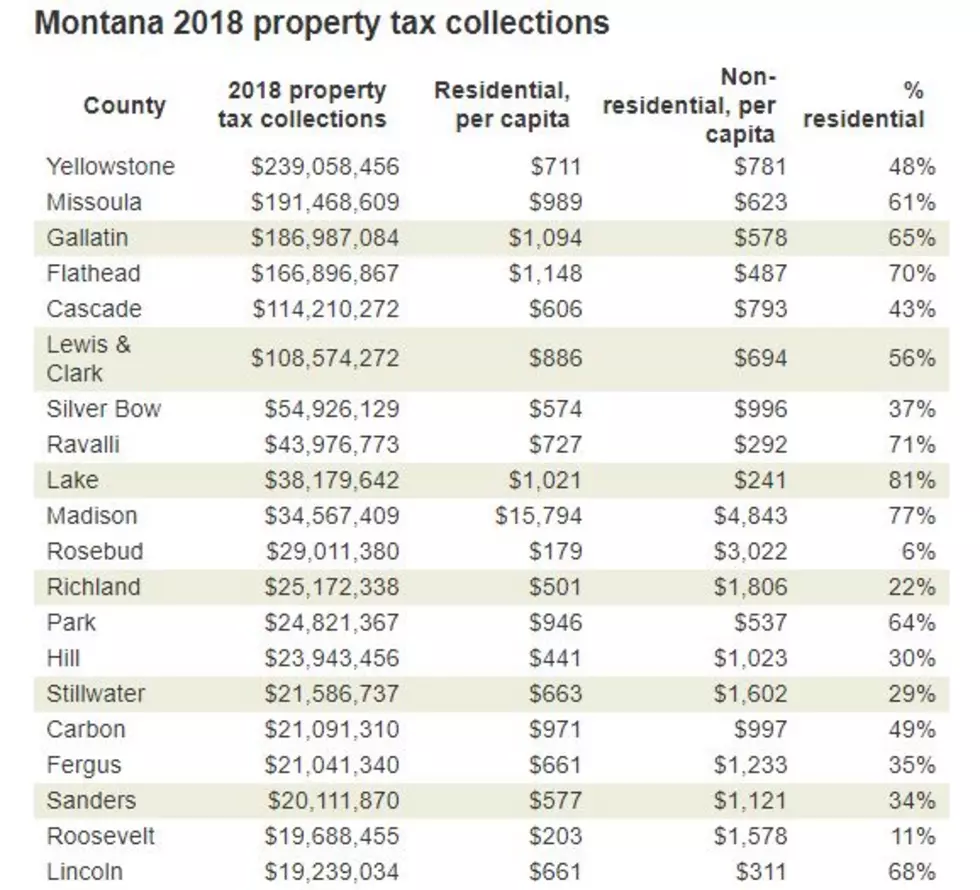

Montana Property Taxes Keep Rising But Missoula Isn t At The Top

https://townsquare.media/site/1098/files/2020/02/Taxes-4.jpg?w=980&q=75

If you live or work in Montana you may need to file and pay individual income tax These resources can help you determine your filing requirements and options Montana state tax rates and rules for income sales property fuel cigarette and other taxes that impact residents

Use our income tax calculator to find out what your take home pay will be in Montana for the tax year Enter your details to estimate your salary after tax Montana s state income tax system is progressive meaning high earners are taxed more than low earners The tax brackets in Montana are the same for all filers regardless of filing status The first 3 600 you earn in taxable income is taxed at 1 00

Download State Taxes In Montana

More picture related to State Taxes In Montana

Montana State Taxes Tax Types In Montana Income Property Corporate

https://files.taxfoundation.org/20190403125958/FINAL-01.png

Hecht Group How To Pay Your Property Taxes Under Protest In Montana

https://img.hechtgroup.com/1665367487428.jpg

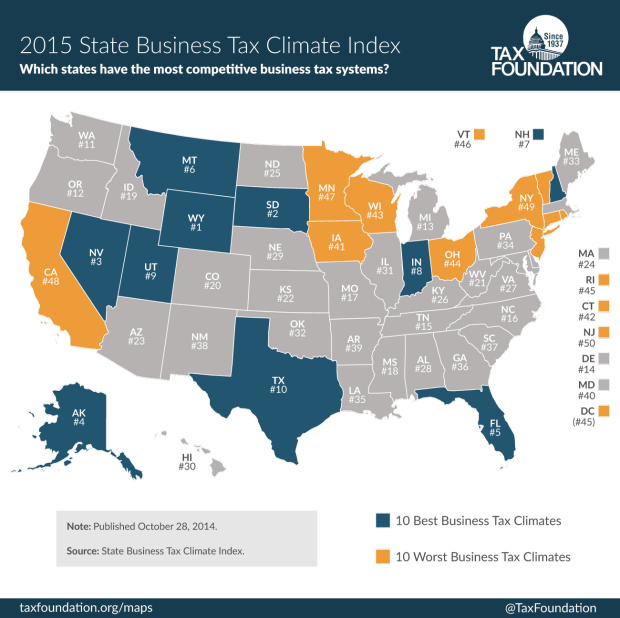

Report Ranks Montana 6th In Nation For Business Tax Climate

https://bloximages.chicago2.vip.townnews.com/ravallirepublic.com/content/tncms/assets/v3/editorial/3/cd/3cdf7675-3820-5489-860d-6048b8529e3a/5454090d0aafb.image.png

FEATURED RESOURCES Election Results File Your Tax Return or Where s my Refund File Upload for W 2s 1099s MW 3s Montana REAL ID File an Unemployment Claim Online Driver License Renewal Montana s tax system ranks 5th overall on the 2025 State Tax Competitiveness Index Montana enacted individual income tax cuts in 2021 reducing the top marginal rate from 6 9 percent to 6 75 percent in 2022 and scheduling further reductions bracket consolidation and structural reforms for 2024 Initially the 2021 law compressed the state

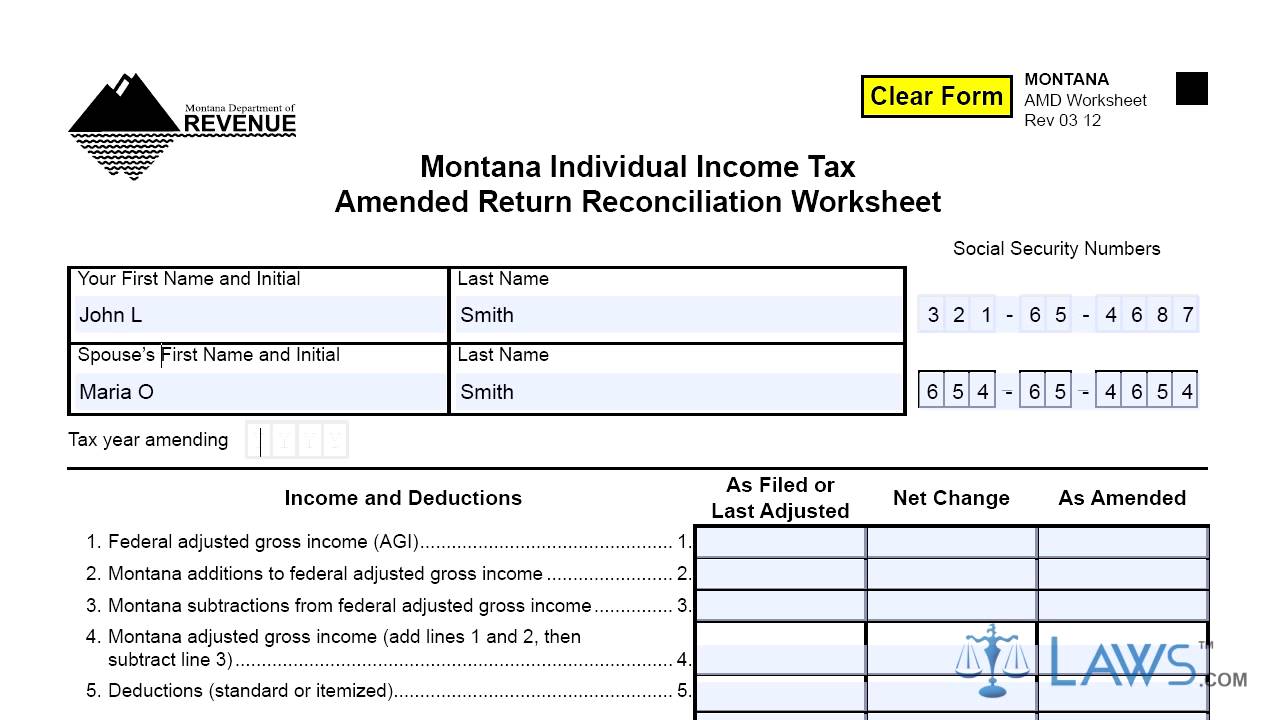

The Montana income tax has seven tax brackets with a maximum marginal income tax of 6 750 as of 2024 Detailed Montana state income tax rates and brackets are available on this page Learn about individual income taxes in Montana that make up the single largest source of revenue comprising nearly 60 percent of the state s General Fund

I Live In One State Work In Another Where Do I Pay Taxes Picnic Tax

https://www.picnictax.com/wp-content/uploads/2020/10/x8266555568_76a0221632_k.jpg.pagespeed.ic_.7UZk5tRppC.jpg

Visualizing Taxes By State

https://cdn.howmuch.net/articles/133_Gas-Tax-per-Gallon-b125.jpg

https://taxfoundation.org › location › montana

Montana has a graduated state individual income tax with rates ranging from 4 70 percent to 5 90 percent Montana has a 6 75 percent corporate income tax rate Montana does not have a sales tax Montana has a 0 69 percent effective property tax rate on owner occupied housing value

https://smartasset.com › taxes › montana-tax-calculator

Find out how much you ll pay in Montana state income taxes given your annual income Customize using your filing status deductions exemptions and more Menu burger

The Union Role In Our Growing Taxocracy California Policy Center

I Live In One State Work In Another Where Do I Pay Taxes Picnic Tax

Montana Payroll Taxes A Complete Guide

Montana Income Tax Information What You Need To Know On MT Taxes

State And Local Sales Tax Rates Midyear 2021 Laura Strashny

State Inheritance And Estate Taxes Rates Economic Implications And

State Inheritance And Estate Taxes Rates Economic Implications And

Taxes Fees Montana Department Of Revenue

How High Are Property Taxes In Your State 2016 Tax Foundation

Form Montana Individual Income Tax Amended Return Reconciliation

State Taxes In Montana - State of Montana Income Taxes Like most states Montana income tax it is calculated on a marginal scale The tax rates range from between 1 00 to 6 75 The highest bracket starts at 21 600