Tax Credit For Education Verkko 27 tammik 2023 nbsp 0183 32 Tax Tip 2022 123 College students should study up on these two tax credits Page Last Reviewed or Updated 27 Jan 2023 Find answers to common questions about the education credits including the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC

Verkko The maximum credit for household expenses that you can claim is 3 500 per person The credit threshold per person is 100 which you have to pay yourself Credit is only granted for the part of the total expense that was paid for work You can claim credit for 60 of the amount that you have paid a company for their work Verkko 25 tammik 2023 nbsp 0183 32 The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies needed for coursework but not living expenses or

Tax Credit For Education

Tax Credit For Education

https://pbs.twimg.com/media/EgcfXF_XgAALE48.jpg

Education Tax Credits Explained

https://www.troutcpa.com/hubfs/Education-Tax-Credits-Explained-In-This-Blog.jpg

Refundable Nonrefundable Education Tax Credits Finance Zacks

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/getty/article/18/250/78495736_XS.jpg

Verkko 10 kes 228 k 2020 nbsp 0183 32 This guidance concerns the taxation of people working for universities of applied sciences and universities in international situations International tax situations include expert fees paid for work abroad lecture fees and the tax treaty regulations concerning teachers and scientific researchers Verkko 12 marrask 2022 nbsp 0183 32 Education tax credits are available for taxpayers who pay qualified higher education expenses for an eligible student to an eligible educational institution such as a college or university

Verkko 19 lokak 2023 nbsp 0183 32 Education tax credits cover common student expenses and can reduce your tax bill on a dollar for dollar basis if you are eligible The American Opportunity Credit provides up to 2 500 in tax credits to cover the tuition fees and course related books supplies and equipment of students in their first four years of Verkko 5 lokak 2023 nbsp 0183 32 You must pay the qualified education expenses for an academic period that starts during the tax year or the first three months of the next tax year Academic periods can be semesters trimesters quarters or any other period of study such as a summer school session

Download Tax Credit For Education

More picture related to Tax Credit For Education

PSK ClientLine Newsletter April 2021 Tax Benefits For Education

https://cdn.ltmclientmarketing.com/WEBCL/articles/2021Apr/Tax_Benefits_for_Education.jpg

Unlock The Hidden Benefits Of Employee Retention Tax Credit For

https://ertcguy.com/wp-content/uploads/2023/05/yellow-card-and-a-red-and-gold-passport-flatlay-Image-of-Taxation-Employee-Retention-Tax-Credit.jpg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Verkko 20 jouluk 2023 nbsp 0183 32 There are two main types of education tax credits the American opportunity tax credit and the lifetime learning tax credit For most people the American opportunity tax credit is more valuable so you ll want to exhaust your eligibility for that before turning to the lifetime learning credit Verkko 22 syysk 2023 nbsp 0183 32 Education tax credits can be claimed in the same year the beneficiary takes a tax free distribution from a Coverdell ESA as long as the same expenses are not used for both benefits If the distribution exceeds qualified education expenses a portion will be taxable to the beneficiary and will usually be subject to an additional 10 tax

Verkko 13 helmik 2023 nbsp 0183 32 You may be able to cut your tax bill by up to 2 500 if you re paying college tuition and you may even be eligible for tax credits that can help cover the cost of continuing education Verkko 7 lokak 2020 nbsp 0183 32 How it Works The credit is 100 of the first 2 000 you spend on qualified education expenses and 25 of the next 2 000 you spend on qualified expenses Let s say you spent 5 000 this year on

Education Tax Credits To Keep You Growing

https://d1qmdf3vop2l07.cloudfront.net/awake-oryx.cloudvent.net/hash-store/276c8ddbf0d73e6e32ee55c66cebdf65.jpeg

ECA Tax Credit Helps Students YouTube

https://i.ytimg.com/vi/O-Wjk2T2ZkY/maxresdefault.jpg

https://www.irs.gov/credits-deductions/individuals/education-credits...

Verkko 27 tammik 2023 nbsp 0183 32 Tax Tip 2022 123 College students should study up on these two tax credits Page Last Reviewed or Updated 27 Jan 2023 Find answers to common questions about the education credits including the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC

https://www.vero.fi/.../deductions/Tax-credit-for-household-expenses

Verkko The maximum credit for household expenses that you can claim is 3 500 per person The credit threshold per person is 100 which you have to pay yourself Credit is only granted for the part of the total expense that was paid for work You can claim credit for 60 of the amount that you have paid a company for their work

The Tax ABCs Of Scholarships JMF

Education Tax Credits To Keep You Growing

Earned Income Tax Credit Dayton OH

Policy Brief Education Tax Credit

Pa Lawmakers Need To Support tax Credit For Education Letter

Lots Of Plans To Boost Tax Credits Which Is Best Brookings

Lots Of Plans To Boost Tax Credits Which Is Best Brookings

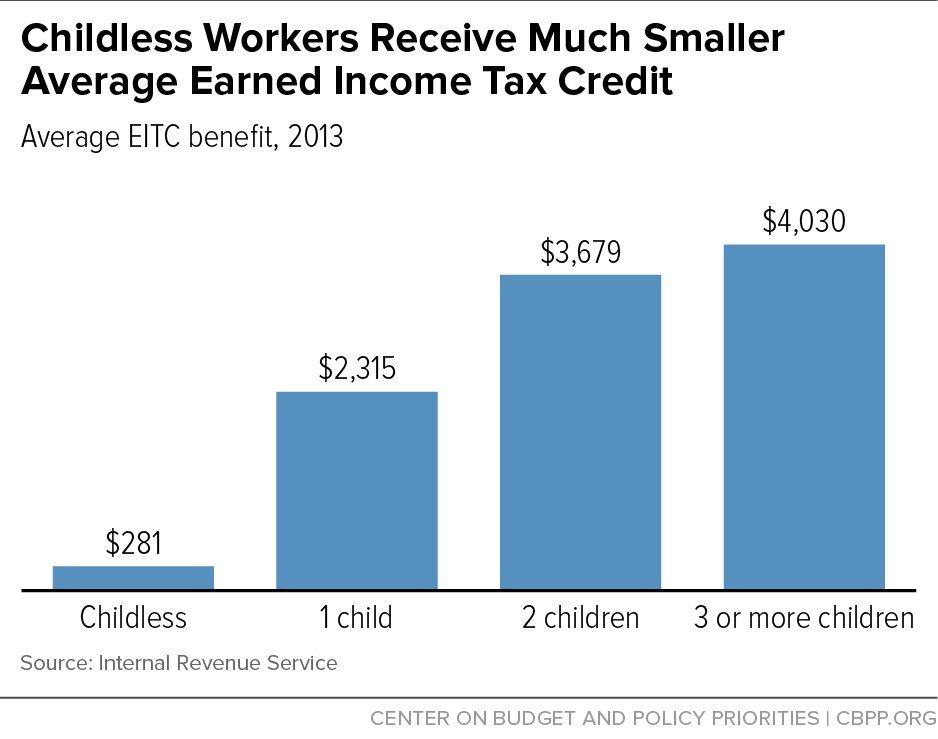

Chart Book The Earned Income Tax Credit And Child Tax Credit Center

Child Tax Credit 2021 Monthly Payment Calculator Storage Unit Size

Tax Year 2016 US Personal Income Tax Intermediate Series Lesson 2

Tax Credit For Education - Verkko 19 lokak 2023 nbsp 0183 32 Education tax credits cover common student expenses and can reduce your tax bill on a dollar for dollar basis if you are eligible The American Opportunity Credit provides up to 2 500 in tax credits to cover the tuition fees and course related books supplies and equipment of students in their first four years of