Tax Deduction For Education Expenses Verkko 5 lokak 2023 nbsp 0183 32 Expenses Cannot Be Paid with Tax Free Funds You cannot claim a credit for education expenses paid with tax free funds You must reduce the amount of expenses paid with tax free grants scholarships and fellowships and other tax free education help What if the Student Withdraws from Classes

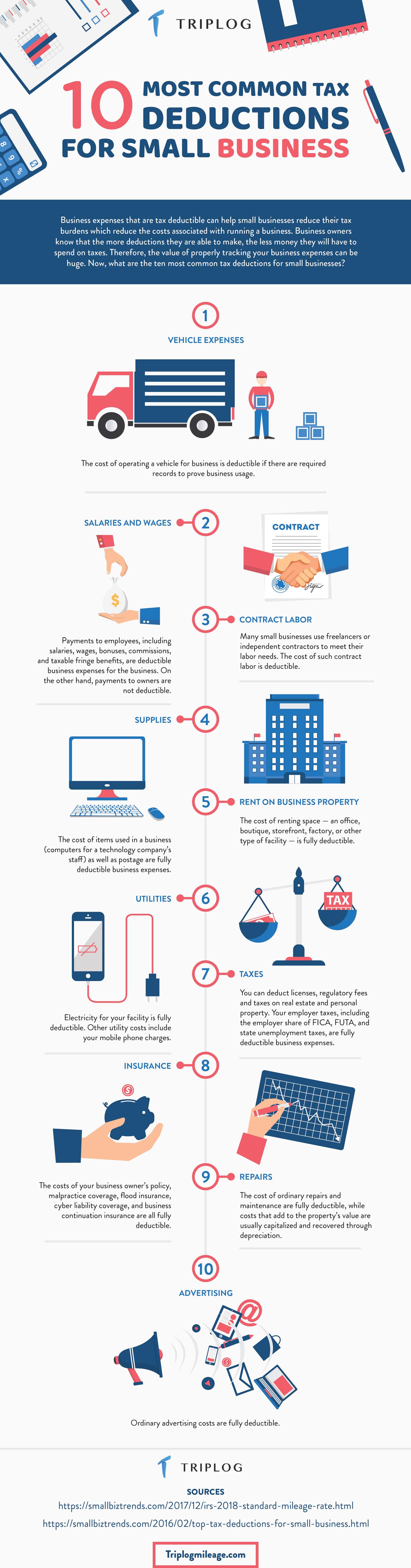

Verkko 2 tammik 2023 nbsp 0183 32 Tax year 2023 The deduction is made in both state taxation and municipal taxation How much can be deducted The maximum deduction is 2 600 but the deduction cannot be greater than the amount of your study grant Verkko Deduct higher education expenses on your income tax return as for example a business expense and also claim an American opportunity credit based on those same expenses Claim an American opportunity credit for any student and use any of that student s expenses in figuring your lifetime learning credit

Tax Deduction For Education Expenses

Tax Deduction For Education Expenses

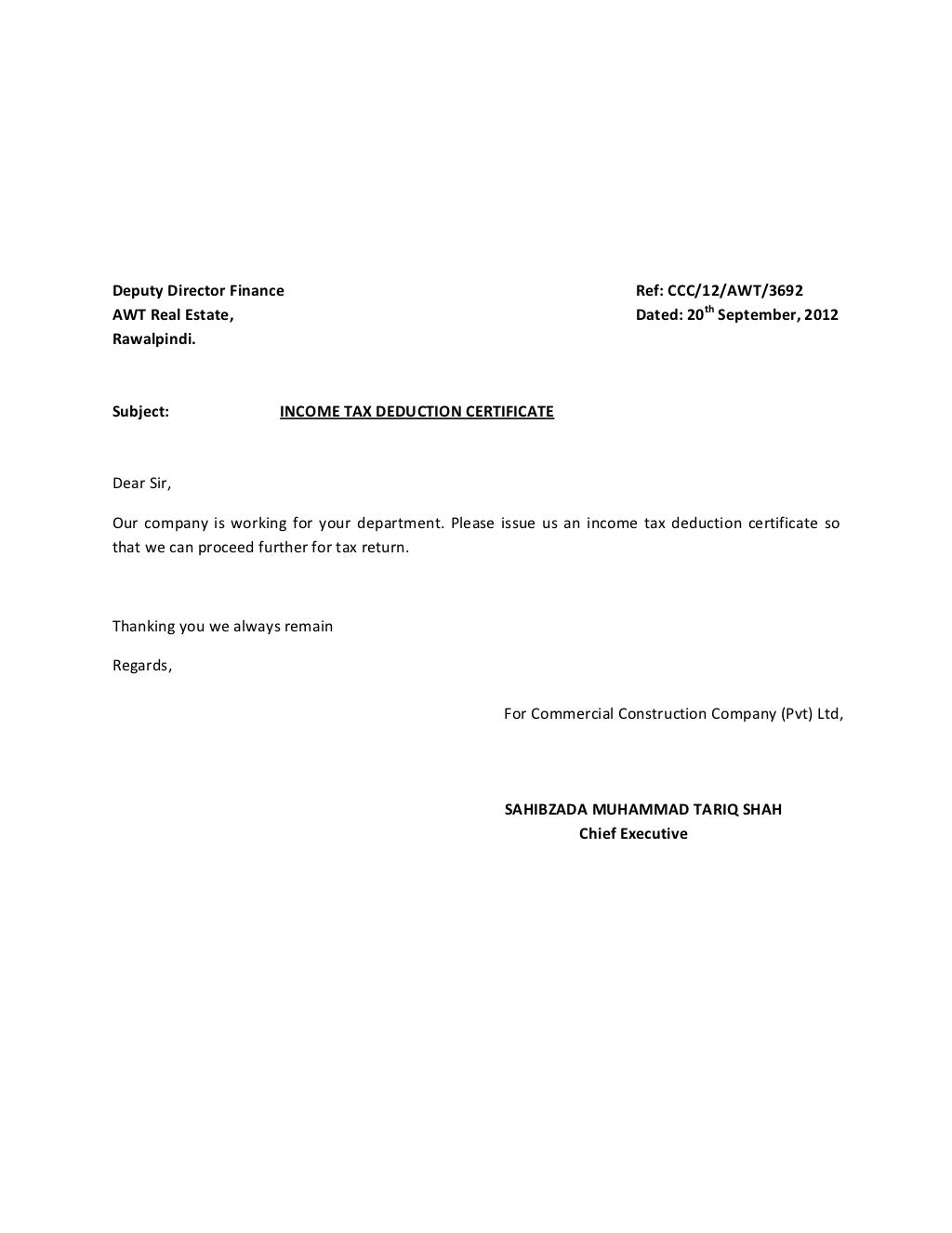

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

Income Tax Deduction Certificate For Tax Returns

https://image.slidesharecdn.com/incometaxdeductioncertificatefortaxreturns-120920083033-phpapp02/95/income-tax-deduction-certificate-for-tax-returns-2-1024.jpg?cb=1348130455

Education Expenses Tax Deduction Bdesignsnow

https://i.pinimg.com/originals/0f/ce/22/0fce22599f0f388518a493e8d69ff795.jpg

Verkko 18 syysk 2023 nbsp 0183 32 Expenses that you can deduct include Tuition books supplies lab fees and similar items Certain transportation and travel costs Other educational expenses such as the cost of research and typing To determine if your work related expenses are deductible see Are My Work Related Education Expenses Verkko 13 helmik 2023 nbsp 0183 32 Educational Tax Credits and Deductions You Can Claim for Tax Year 2022 Several tax breaks can help you cover the cost of education and new laws expand some benefits By Kimberly

Verkko In 2023 educators can deduct up to 300 600 if married filing jointly and both spouses are eligible educators but not more than 300 each of unreimbursed business expenses The educator expense deduction claimed on either Form 1040 Line 23 or Form 1040A Line 16 is available even if an educator doesn t itemize their deductions Verkko 18 lokak 2023 nbsp 0183 32 Topic No 458 Educator Expense Deduction If you re an eligible educator you can deduct up to 300 600 if married filing jointly and both spouses are eligible educators but not more than 300 each

Download Tax Deduction For Education Expenses

More picture related to Tax Deduction For Education Expenses

Section 80C Tax Deduction For Education Expenses YouTube

https://i.ytimg.com/vi/YgFDYxeHVc4/maxresdefault.jpg

Deducting Education Expenses In 2020 Turbo Tax

https://turbo-tax.org/wp-content/uploads/2021/03/image-4kH0DtO8odUcBEwy.jpeg

Business Tax Credit Vs Tax Deduction What s The Difference

https://www.patriotsoftware.com/wp-content/uploads/2019/12/business-tax-credit-vs-tax-deduction-visual.jpg

Verkko Tax Tip 2022 123 College students should study up on these two tax credits Page Last Reviewed or Updated 27 Jan 2023 Find answers to common questions about the education credits including the American Opportunity Tax Credit AOTC and the Lifetime Learning Credit LLC Verkko 15 kes 228 k 2023 nbsp 0183 32 Generally you cannot deduct job related education expenses as an itemized deduction Certain exceptions apply See Tax Topic 513 Work Related Education Expenses To determine if you qualify for any education credits for the work related educational expenses you incur refer to Publication 970 Tax Benefits for

Verkko 14 kes 228 k 2017 nbsp 0183 32 You can deduct Tuition books and fees Equipment and other expenses associated with obtaining the education Ex You can deduct research and typing expenses you incur while writing a paper for a class Transportation expenses You can deduct the cost of travel between your workplace and the school Verkko 17 syysk 2020 nbsp 0183 32 To deduct employee education expenses use quot Employee Benefit Programs quot or similar line on your business tax return For sole proprietors and single member LLCs show these expenses in the quot Expenses quot section of Schedule C For partnerships and multiple member LLCs show these expenses in the quot Deductions quot

How To Pay Tax And Get Tax Deductions In Italy

https://images.ctfassets.net/qr8kennq1pom/1hkRKfxQ8UdzvRCGFOHjQ2/b3b06e93d63b43ca797f64df11eda53b/A_couple_working_on_their_tax_return_in_italy.jpg?fm=jpg&fl=progressive&q=70&w=1920

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

https://www.irs.gov/credits-deductions/individuals/qualified-ed-expenses

Verkko 5 lokak 2023 nbsp 0183 32 Expenses Cannot Be Paid with Tax Free Funds You cannot claim a credit for education expenses paid with tax free funds You must reduce the amount of expenses paid with tax free grants scholarships and fellowships and other tax free education help What if the Student Withdraws from Classes

https://www.vero.fi/.../deductions/tax-deductions

Verkko 2 tammik 2023 nbsp 0183 32 Tax year 2023 The deduction is made in both state taxation and municipal taxation How much can be deducted The maximum deduction is 2 600 but the deduction cannot be greater than the amount of your study grant

2023 Form 1040 Standard Deduction Printable Forms Free Online

How To Pay Tax And Get Tax Deductions In Italy

How To Claim The Tuition And Fees Deduction Tuition Deduction Tax

Itemized Deduction Wor 2015 Itemized Deductions Worksheet Db excel

Tax Savings From Education Loan L Tax Benefits From Study Loan YouTube

5 Best Images Of Itemized Tax Deduction Worksheet 1040 Forms Itemized

5 Best Images Of Itemized Tax Deduction Worksheet 1040 Forms Itemized

Teacher Tax Deductions Teacher Organization Teaching

Investment Expenses What s Tax Deductible Charles Schwab

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

Tax Deduction For Education Expenses - Verkko The maximum annual credit is 2 000 calculated as 20 of the first 10 000 in qualifying educational expenses But there is no limit on the number of years of higher education for which you can claim it As a result although the American Opportunity Tax Credit yields a higher tax credit of up to 2 500 per student and is the best bet for most