Tax Credit On Rental Property The government uses the tax credit to subsidize property owners who acquire construct or rehabilitate affordable rental housing Apartment buildings single family homes townhouses and

The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to The Rent Tax Credit is available for the tax years 2022 to 2025 The Rent Tax Credit reduces the amount of Income Tax that you are due to pay for a tax year To

Tax Credit On Rental Property

Tax Credit On Rental Property

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

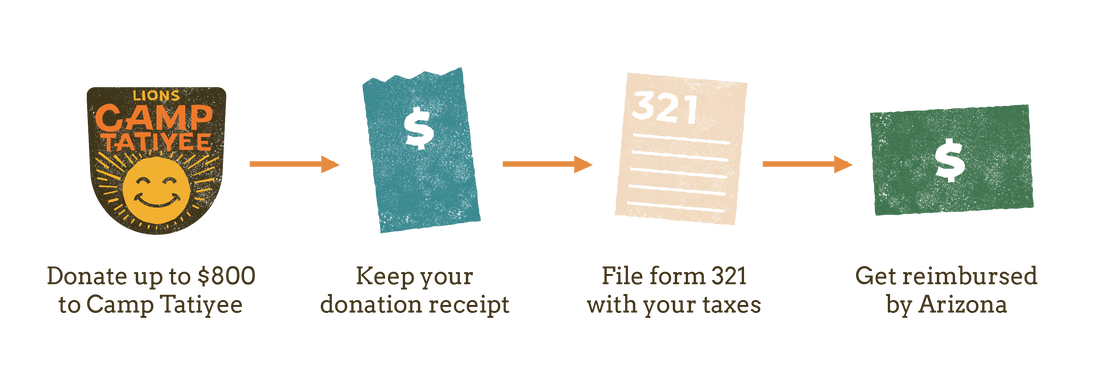

Arizona Charitable Tax Credit Lions Camp Tatiyee

https://www.camptatiyee.org/uploads/1/3/9/8/139890559/ct-webgraphics-2019-e1548359590479_orig.png

Cautious Lawmakers Put 1 48B In Tax Credit Proposals In Holding

https://lailluminator.com/wp-content/uploads/2023/04/Dist22-scaled.jpg

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of As a landlord you ll need to pay income tax on the rent you receive from your properties This guide explains how you calculate what you pay and how income tax is applied to rental income

Individuals will be able to claim a basic rate tax reduction from their Income Tax liability on the portion of finance costs not deducted in calculating the profit The tax relief landlords get on a buy to let mortgage interest has ended Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you calculate its impact on your tax bill

Download Tax Credit On Rental Property

More picture related to Tax Credit On Rental Property

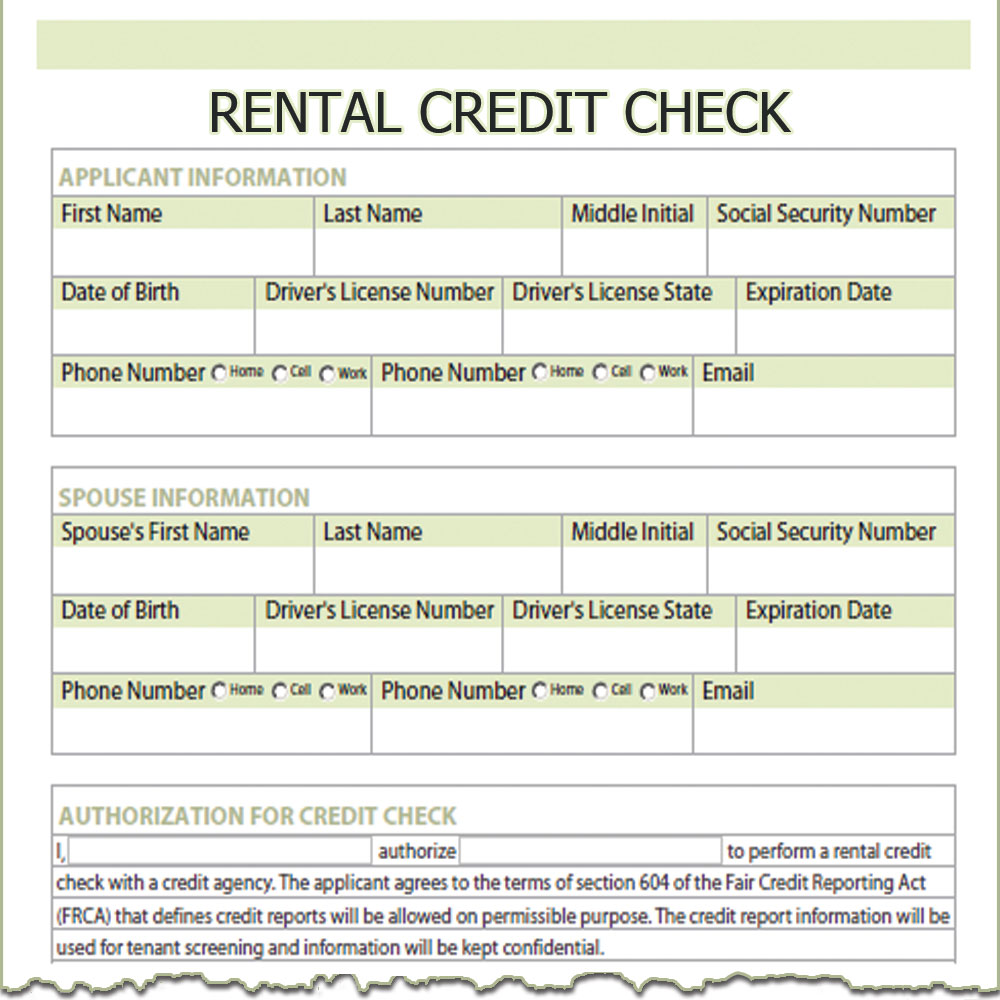

Rental Credit Check

https://www.simplifyem.com/forms/download/rental_credit_check.jpg

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

Is Insurance Claim On Rental Property Taxable ALLCHOICE Insurance

https://allchoiceinsurance.com/wp-content/uploads/2021/05/Is-Insurance-Claim-on-Rental-Property-Taxable-ALLCHOICE-Insurance-North-Carolina-1024x576.jpg

However if a taxpayer is renting a home as their principal residence and makes eligible improvements a tax credit may be available to such tenant For the Together the Helene related and Debby related declarations permit the IRS to postpone certain tax filing and tax payment deadlines for taxpayers who reside or have

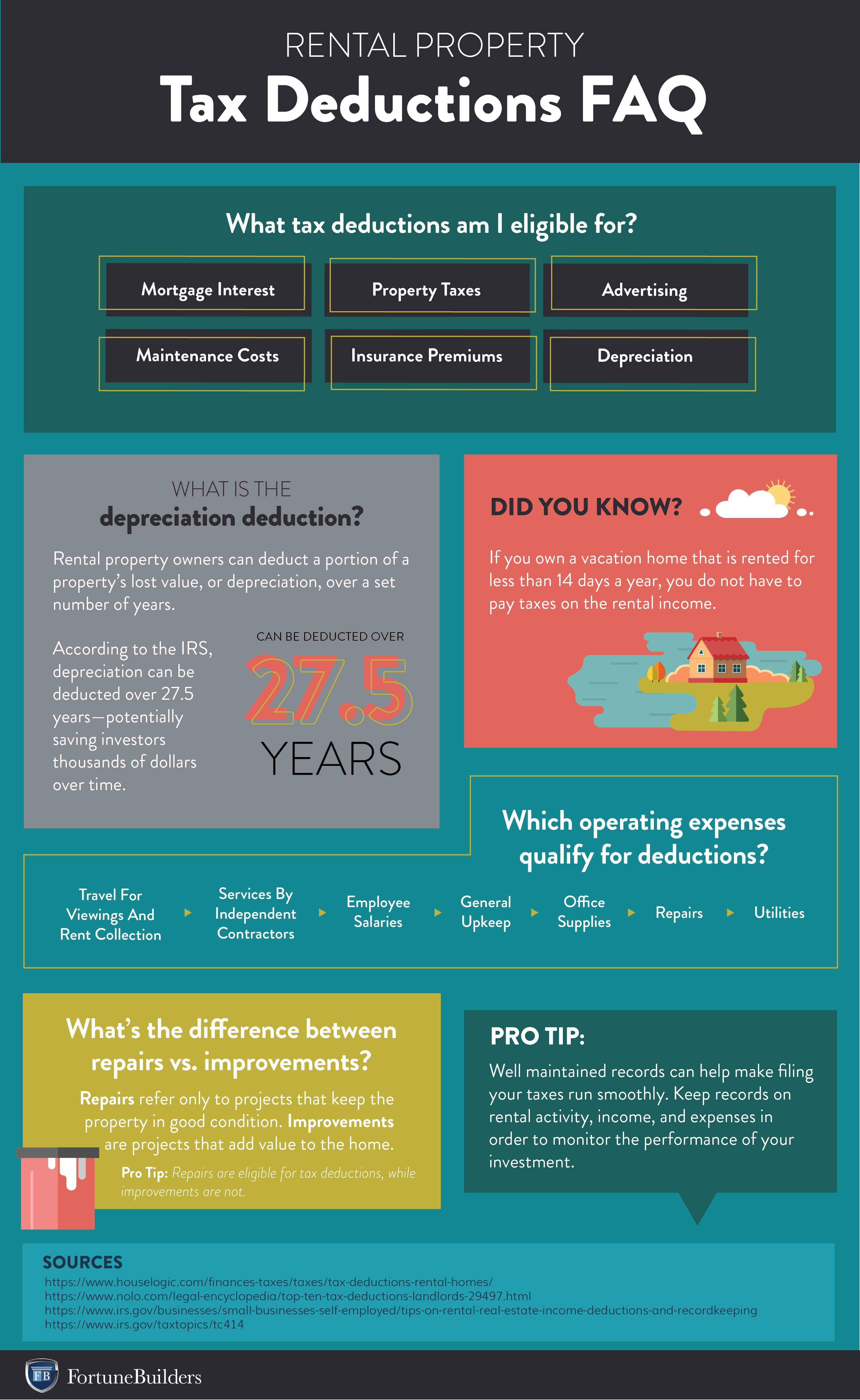

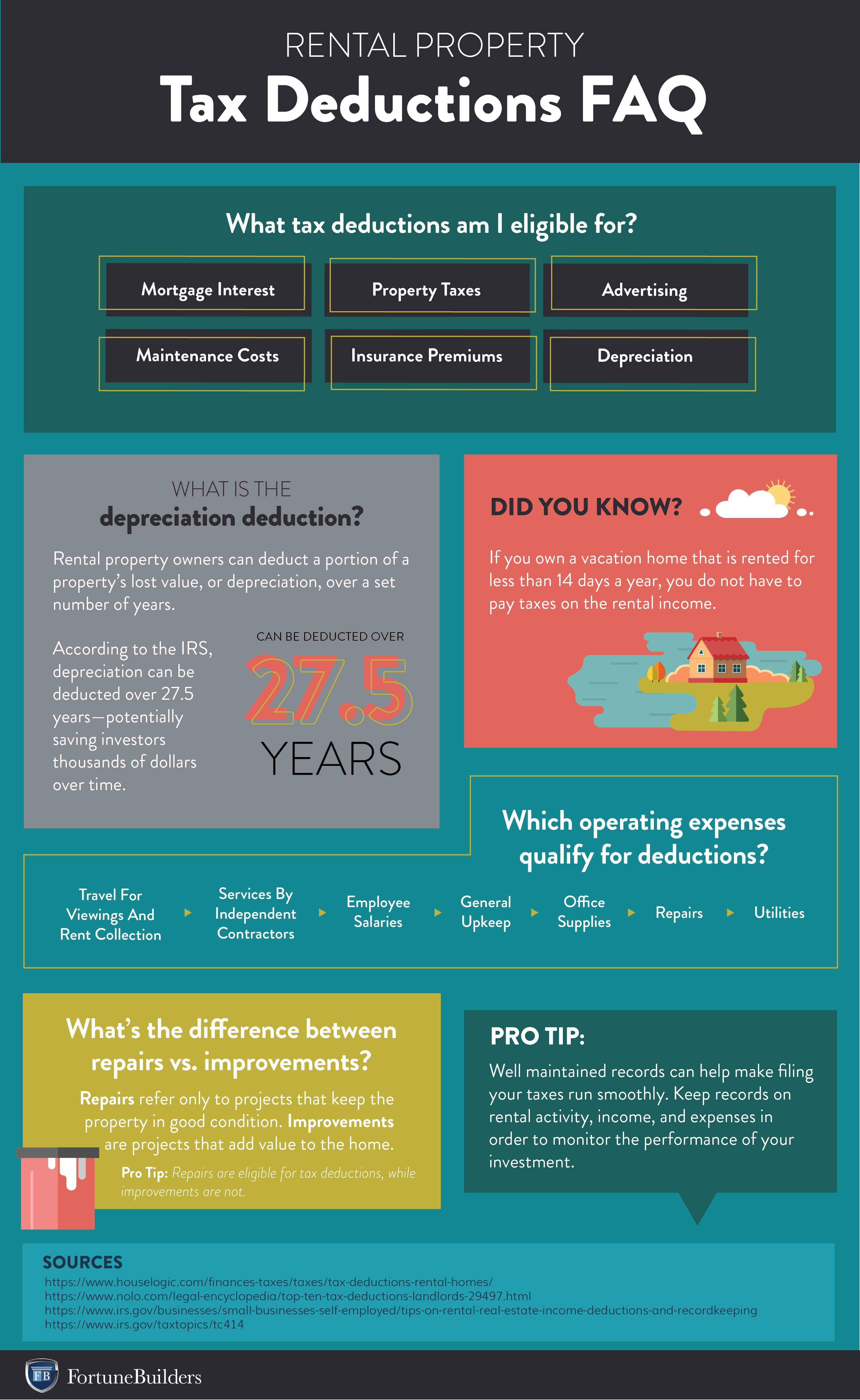

Tax deductions for rental property Owning a rental property can generate some extra income but it can also generate some great tax deductions Here are five big ones that tax pros say A new relief is available for individual landlords of rented residential premises The relief is known as Residential Premises Rental Income Relief RPRIR

Tax Credits For Working Families What Is The Earned Income Tax Credit

https://i.vimeocdn.com/video/1167310911-4fb29b6b078596d6410b96e83c4aad2a24825b00bfcb3268e567fcb1784ab6b3-d

Pin By 360 Realtors LLP On Article Ambiguity Tax Credits Old Things

https://i.pinimg.com/originals/e5/7a/59/e57a596909536f0ec7f6176803502153.jpg

https://www.investopedia.com/tax-credit-…

The government uses the tax credit to subsidize property owners who acquire construct or rehabilitate affordable rental housing Apartment buildings single family homes townhouses and

https://www.vero.fi/en/individuals/property/rental_income

The income you receive as you rent out your investment property is treated as capital income taxed at the tax rate in force The rate for capital income tax is 30 up to

Property Tax Assessment Rural Municipality Of Piney

Tax Credits For Working Families What Is The Earned Income Tax Credit

Rental Agreement Templates Lease Agreement Rental Property Property

Electric Vehicles And Government issued Checks

Tax Credit Al Meezan Group

How Is Rental Income Taxed What You Need To Know FortuneBuilders

How Is Rental Income Taxed What You Need To Know FortuneBuilders

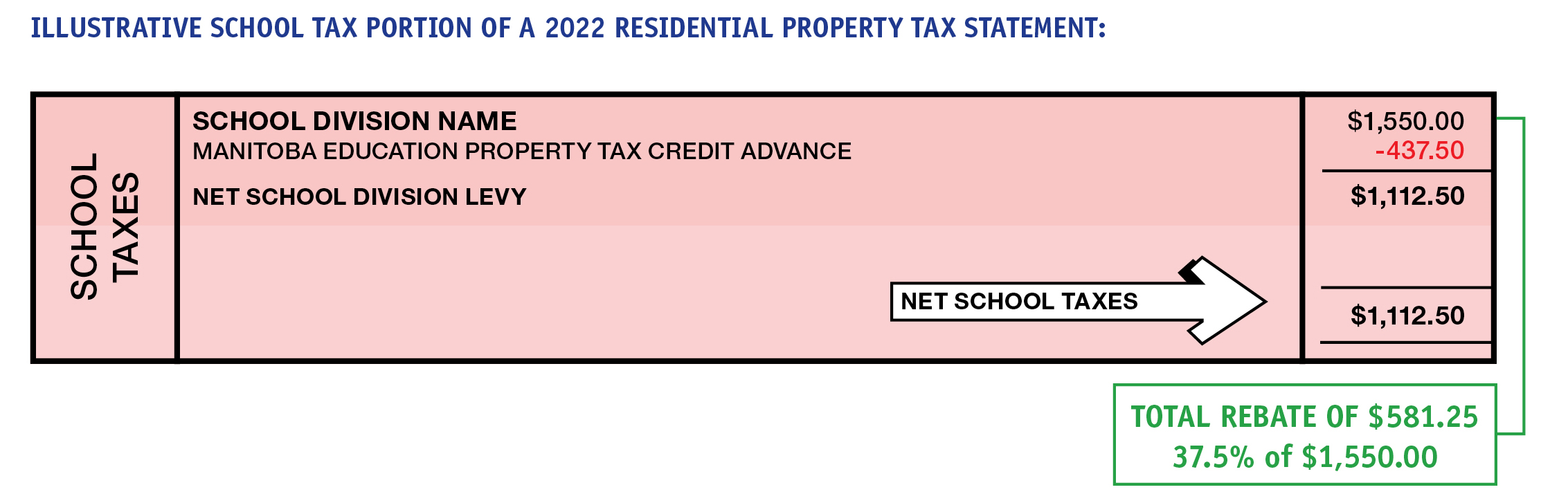

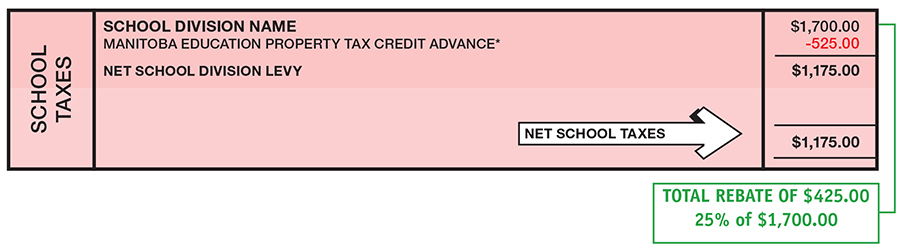

Province Of Manitoba Education Property Tax

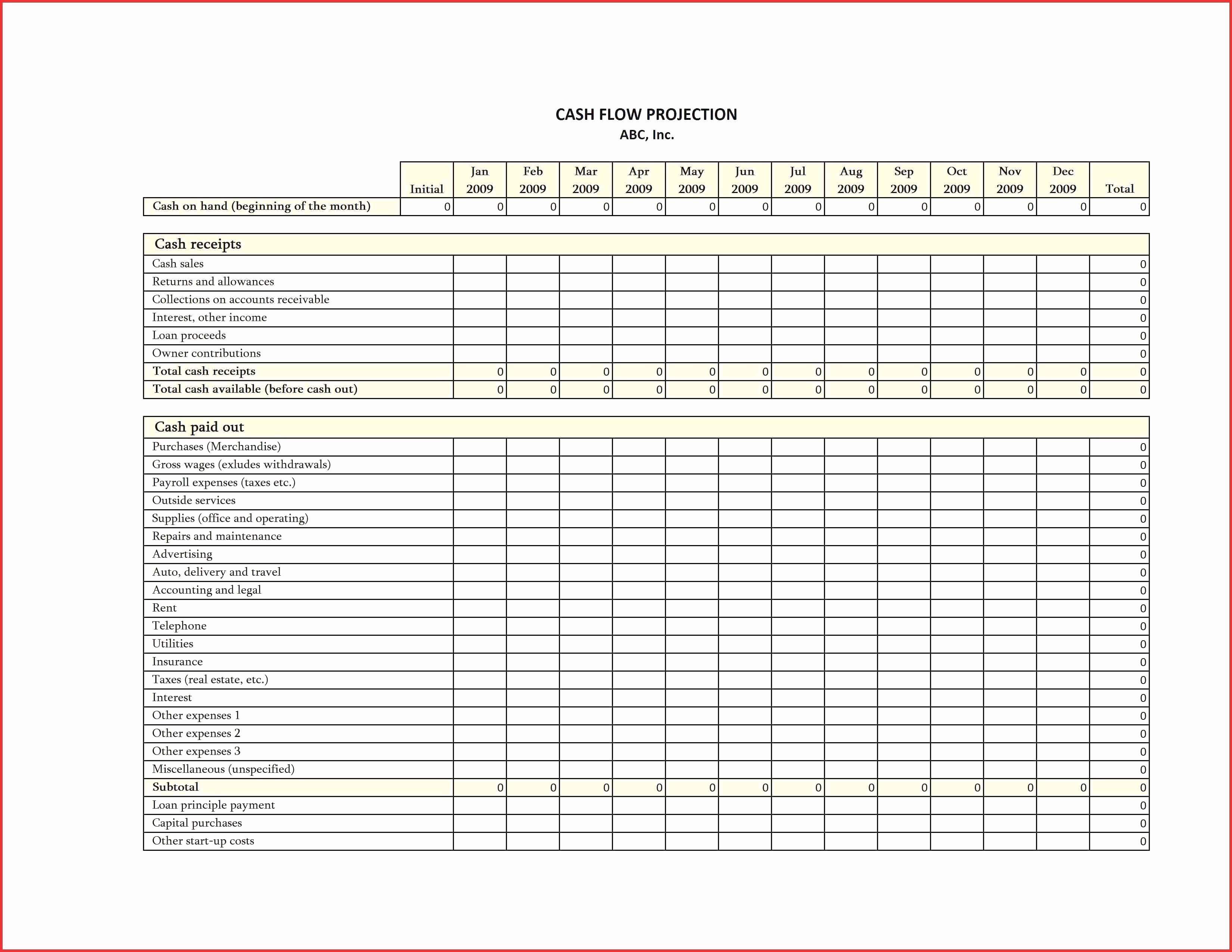

Tax Expenses Template

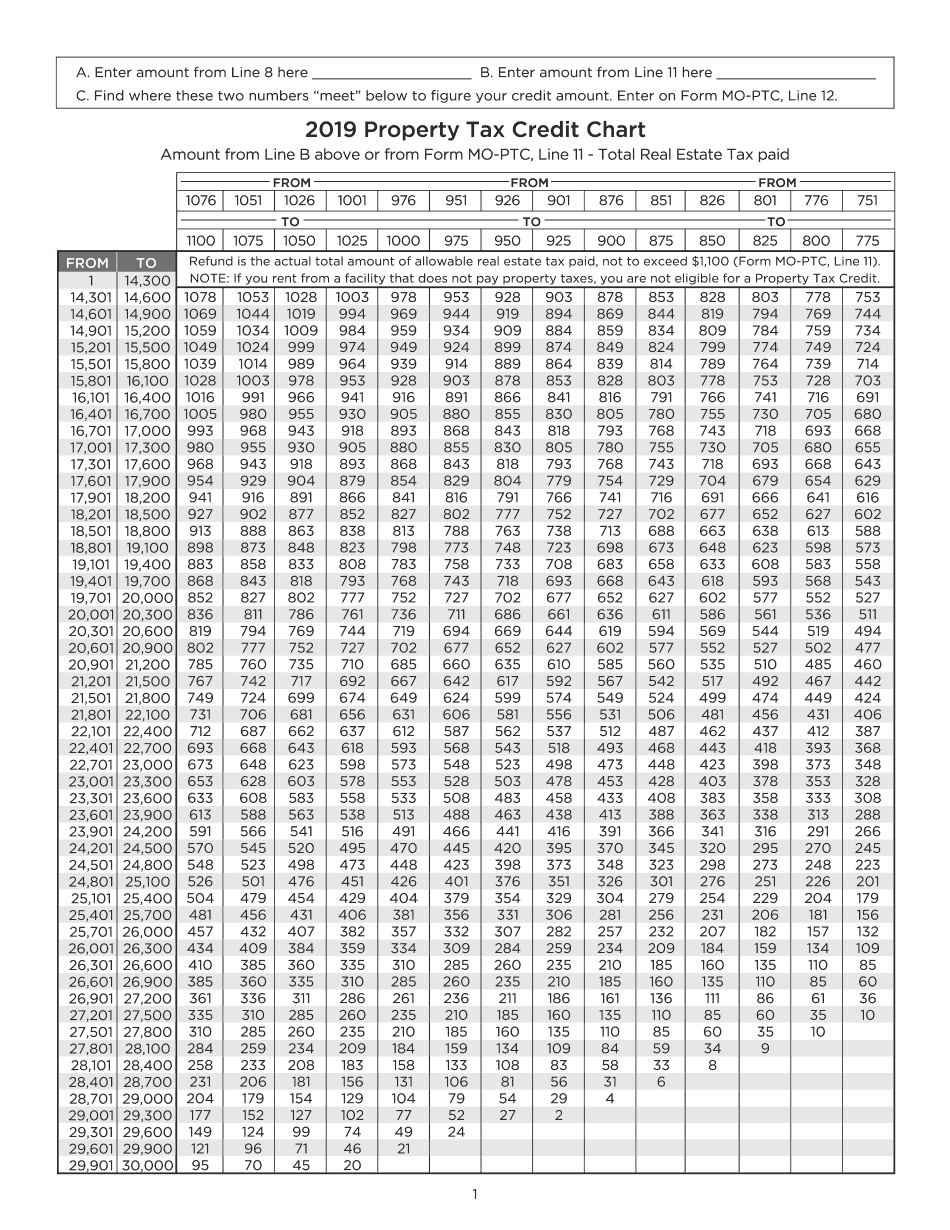

Create Fillable Property Tax Credit Chart Form With Us Fastly Easyly

Tax Credit On Rental Property - As a landlord you ll need to pay income tax on the rent you receive from your properties This guide explains how you calculate what you pay and how income tax is applied to rental income