Tax Relief On Rental Property Mortgage Interest As per my understanding the finance cost mortgage interest expense can claim a tax relief It can be claim 20 of the financal cost e g 7 668 was the interest i paid in tax

The tax relief landlords get on a buy to let mortgage interest has ended Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you calculate its impact on your tax bill Landlords with buy to let properties can breathe a sigh of relief albeit a small one as they are entitled to a 20 tax credit on their mortgage payments This means that for every

Tax Relief On Rental Property Mortgage Interest

Tax Relief On Rental Property Mortgage Interest

https://i.pinimg.com/originals/9b/e0/9e/9be09ea39e340e9897cbb32ea955253f.png

Real Estate Tax Relief Program Official Website Of Arlington County

https://www.arlingtonva.us/files/sharedassets/public/housing/images/homeownership/realestaterelief-thumb.jpg?w=1200

Claiming Tax Relief On Personal Contributions

https://s3.studylib.net/store/data/008863819_1-2f6094913014d745c3da18091a1e8c10-768x994.png

While you can no longer deduct mortgage interest from your rental income the 20 tax credit provides some relief However this change has pushed many landlords into Is your total income without allowable expenses and mortgage interest above 50 270 pushing you into the higher tax band Will you invest a significant amount into your buy to let property on things such as renovations

Dive in explore and let s embark on a journey to transform your tax liability with the reliefs with this article Landlord Tax Relief Basic Rate Relief Before April 2017 Since April 2020 you ve no longer been able to deduct any of your mortgage expenses from your rental income to reduce your tax bill Instead you now receive a tax credit based on 20 of your mortgage interest payments

Download Tax Relief On Rental Property Mortgage Interest

More picture related to Tax Relief On Rental Property Mortgage Interest

How To Get Tax Relief On Loan Interest For Residential Rental Property

https://i.ytimg.com/vi/jKCrZMd5qkc/maxresdefault.jpg

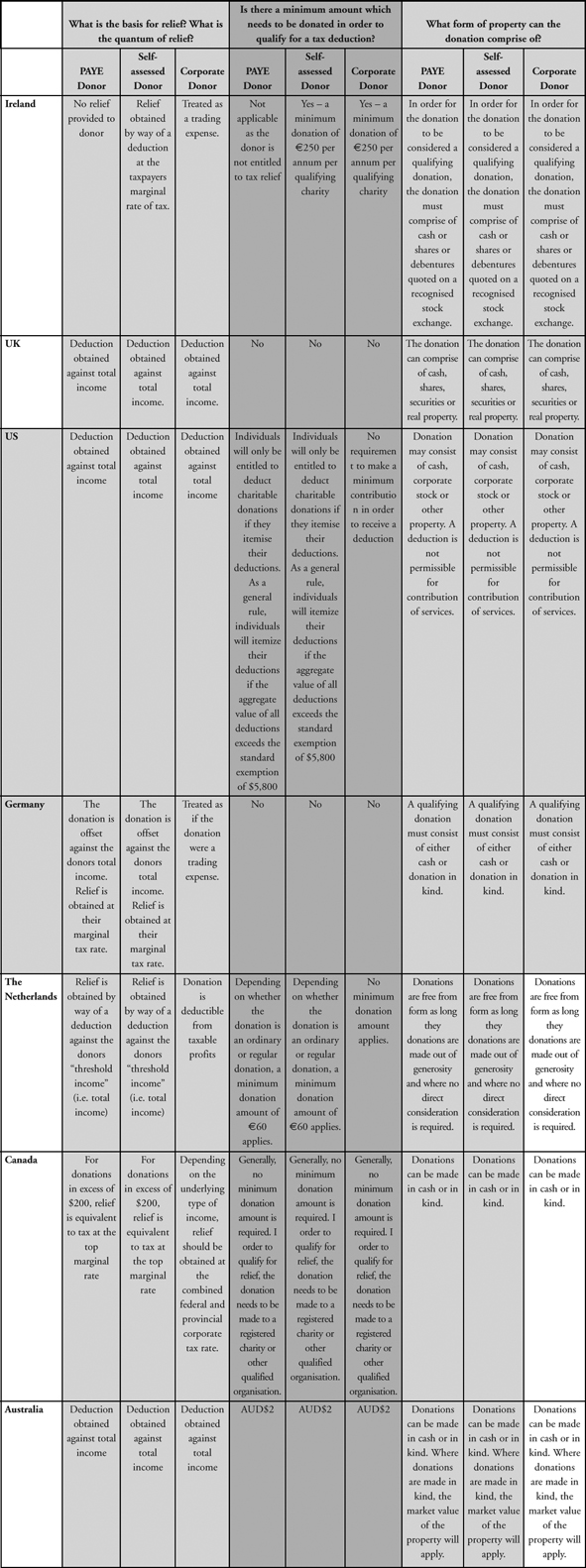

Low Take Up Of Tax Relief On Donations Means Charities Could Be Missing

https://fundraising.co.uk/wp-content/uploads/2022/04/Screenshot-2022-04-06-at-07.18.04.png

Tax Relief For Working From Home During The Pandemic Here s How To

https://s.yimg.com/ny/api/res/1.2/VxoxsArOunrBO2kaWujd.Q--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/evening_standard_239/5225753afabd7db724a3febe71b9bf01

Since 2020 21 individual landlords cannot deduct finance costs including interest from their residential property rental income for tax purposes Tax relief is instead given as a basic rate 20 tax credit set against the total There have been changes to the ability to claim mortgage interest on rental properties from April 2017 Initially the costs were restricted to 75 then 50 and then 25

The buy to let mortgage interest tax relief often referred to as mortgage interest tax relief is a tax credit available to landlords This relief allows landlords to reduce their tax liability based on a specified amount Mortgage interest tax relief is the ability for landlords to deduct their mortgage interest costs from their taxable profits Historically the interest you paid towards a mortgage

Government Responds To Mortgage Interest Tax Relief Petition

https://www.carterjonas.co.uk/-/media/images/news-images-t08/residential/2018-resi-mortgage-interest-tax-relief-petition.ashx

Are You Missing Out On Pension Tax Breaks St Edmundsbury Wealth

https://stedswm.co.uk/wp-content/uploads/2022/05/image001.png

https://community.hmrc.gov.uk › customerforums › sa

As per my understanding the finance cost mortgage interest expense can claim a tax relief It can be claim 20 of the financal cost e g 7 668 was the interest i paid in tax

https://www.which.co.uk › money › tax › income-tax › tax...

The tax relief landlords get on a buy to let mortgage interest has ended Instead you ll receive a tax credit based on 20 of your mortgage interest payments We help you calculate its impact on your tax bill

Rental Property Tax Deductions A Comprehensive Guide Credible Cash

Government Responds To Mortgage Interest Tax Relief Petition

California Mortgage Relief Program Property Tax Relief Yolo County

Tax Relief On Charitable Donations

How To Claim Higher Rate Tax Relief On Pension Contributions

55 Rental Property Mortgage Interest Deduction Limitation JasonJiordan

55 Rental Property Mortgage Interest Deduction Limitation JasonJiordan

Tax Relief On Home Help Comfort Keepers

Tax Accounting Enews February 2020 Edwards Of Gwynedd Accounting

UK Pension Tax Relief Explained 2022 23 Lomond Wealth

Tax Relief On Rental Property Mortgage Interest - Is your total income without allowable expenses and mortgage interest above 50 270 pushing you into the higher tax band Will you invest a significant amount into your buy to let property on things such as renovations