Tax Deduction Daycare The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated

Yes daycare expenses may be tax deductible through the Child and Dependent Care Tax Credit This credit allows eligible parents to claim a percentage of qualifying child care expenses reducing their tax liability This publication explains the tests you must meet to claim the credit for child and dependent care expenses It explains how to figure and claim the credit You may be able to claim the credit if you pay someone to care for your dependent who

Tax Deduction Daycare

Tax Deduction Daycare

https://i.pinimg.com/736x/a6/6a/c6/a66ac6a932b601e863d17aa326a063a6.jpg

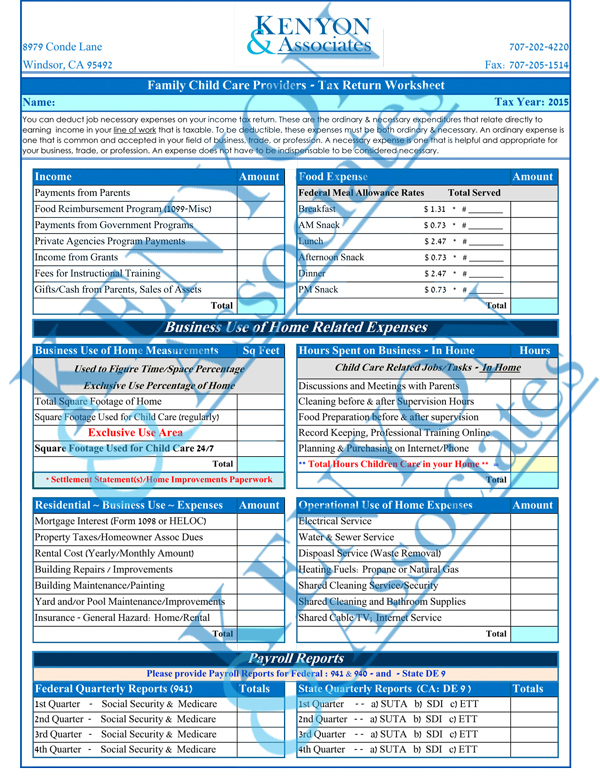

31 Home Daycare Tax Worksheet Worksheet Project List

https://kenyontax.com/userfiles/images/ChildCare-English-Deduction-Worksheet.jpg

Home Daycare Tax Worksheet

https://assets-global.website-files.com/58868bcd2ef4daaf0f072902/61923e7d1bfe911b7d6c2b4b_bonsai.png

Is daycare tax deductible Find out how you can claim a tax credit for daycare expenses including payments made to daycare centers babysitters summer camps and other care providers for a child under 13 or a disabled Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify

Learn more about this tax credit who qualifies for it and how much you can save on your tax bill If you paid someone to care for a child who was under age 13 when the care Fortunately the Internal Revenue Service IRS offers a tax credit or deduction for childcare expenses In this article we ll discuss how much daycare is tax deductible and

Download Tax Deduction Daycare

More picture related to Tax Deduction Daycare

5 Best Photos Of Child Care Provider Tax Form Daycare Provider Tax Db

https://www.latestrebate.com/wp-content/uploads/2023/02/5-best-photos-of-child-care-provider-tax-form-daycare-provider-tax-db-1243x2048.jpg

Tax Deductions For Daycare Business

https://agiled.app/wp-content/uploads/2021/07/1319-1-1024x461.jpg

Tax Tips Home Office Deduction For Daycare Providers

https://www.taxslayer.com/blog/wp-content/uploads/2020/08/Business-use-of-your-home-for-daycare-providers-1-768x432.jpg

Daycare is tax deductible for parents who meet the eligibility criteria and who have incurred qualifying childcare expenses The Child and Dependent Care Credit can help offset Aside from traditional business deductions home daycare operators can take advantage of an expanded deduction for business use of homes even if no rooms are used exclusively for the daycare Here is the

You may be required to pay in home care taxes if you are a home daycare provider part time babysitter and even a friend and family member who helps with childcare or elder care needs Fortunately there are tax write offs Do you wonder if your childcare provider has to pay taxes You could reduce a lot of your daycare tax return burden TFX has prepared this comprehensive daycare provider

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

https://i.pinimg.com/originals/b6/d7/02/b6d702bf4eecf4b5cf332c646707fe5c.png

10 Tax Deductions For Daycare Providers

https://info.ezchildtrack.com/hs-fs/hubfs/Blog Images/10-tax-deductions-for-daycare.jpeg?width=650&name=10-tax-deductions-for-daycare.jpeg

https://www.irs.gov › newsroom › child-and-dependent-care-credit-faqs

The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons The credit is calculated

https://www.care.com › daycare-tax-credi…

Yes daycare expenses may be tax deductible through the Child and Dependent Care Tax Credit This credit allows eligible parents to claim a percentage of qualifying child care expenses reducing their tax liability

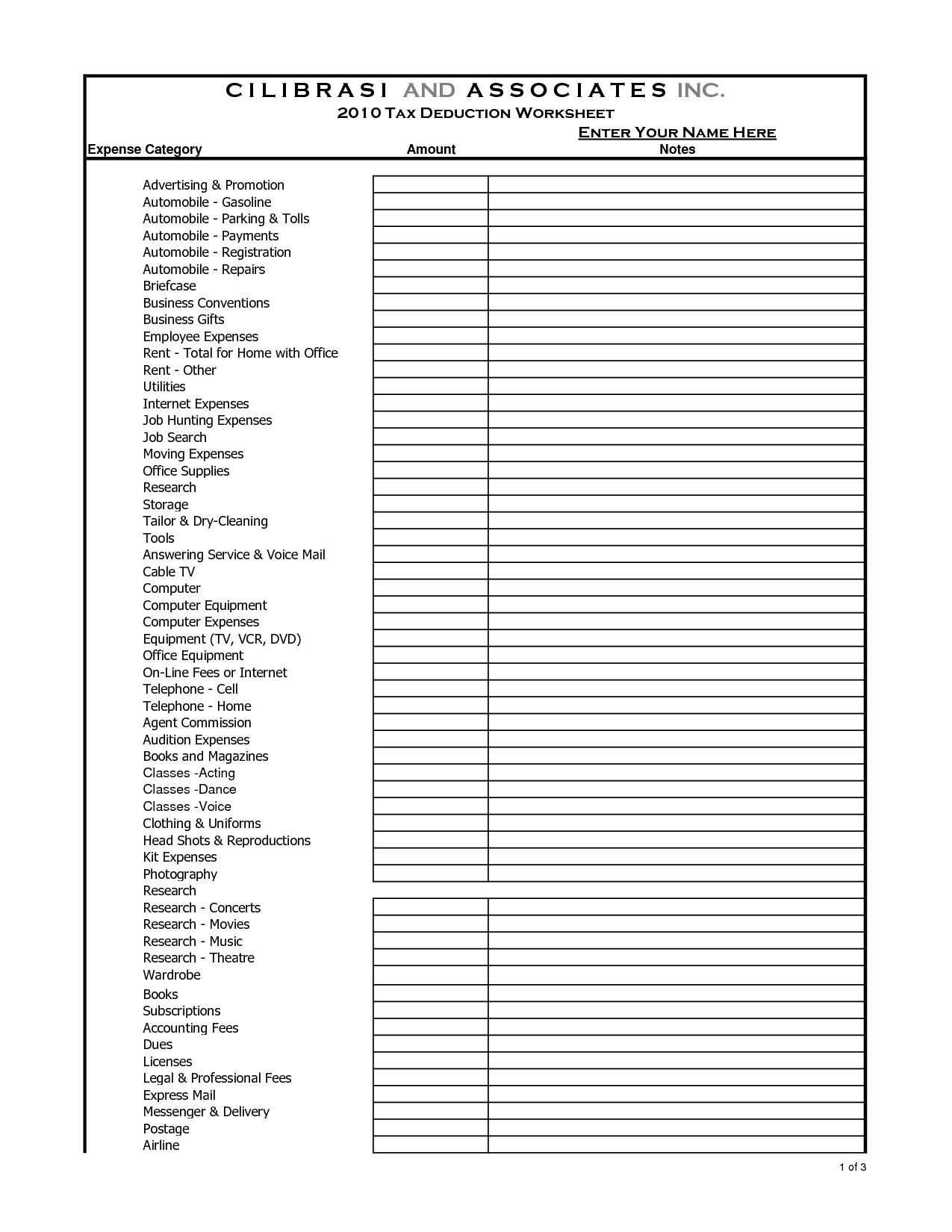

8 Tax Itemized Deduction Worksheet Worksheeto

The BIG List Of Common Tax Deductions For Home Daycare Home Daycare

10 Home Based Business Tax Worksheet Worksheeto

Home Daycare Tax Worksheet Personal Budget Spreadsheet Budgeting

13 Car Expenses Worksheet Worksheeto

Free Daycare Provider Tax Deduction Checklist Smartcare YouTube

Free Daycare Provider Tax Deduction Checklist Smartcare YouTube

Pin On Where Imagination Grows

HOME DAYCARE TAX DEDUCTIONS OFFICE DEDUCTION CHILDCARE PROVIDER

Daycare Business Income And Expense Sheet To File childcare

Tax Deduction Daycare - Fortunately the Internal Revenue Service IRS offers a tax credit or deduction for childcare expenses In this article we ll discuss how much daycare is tax deductible and