Tax Deduction Philippines Verkko 2 hein 228 k 2023 nbsp 0183 32 Taxes Losses Bad debts Depreciation Charitable and other contributions subject to certain limitations Research and development R amp D expenditures In lieu of these allowable deductions an individual other than a non resident alien may elect an optional standard deduction OSD not exceeding 40 of

Verkko Income Tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as amended or other Verkko 1 hein 228 k 2023 nbsp 0183 32 Taxes Corporate taxpayers can claim a deduction for all taxes paid or accrued within the taxable year in connection with their trade or business except for the following Philippine CIT Income taxes imposed by authority of any foreign country unless the taxpayer elects to take a deduction in lieu of a foreign tax credit

Tax Deduction Philippines

Tax Deduction Philippines

https://www.aseanbriefing.com/news/wp-content/uploads/2016/12/Income-Tax-Rates-in-the-Philippines.jpg

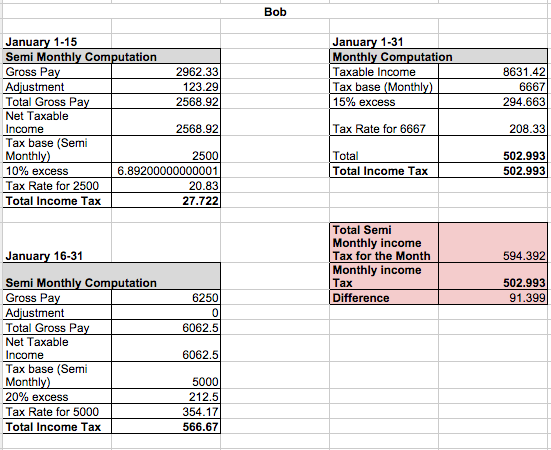

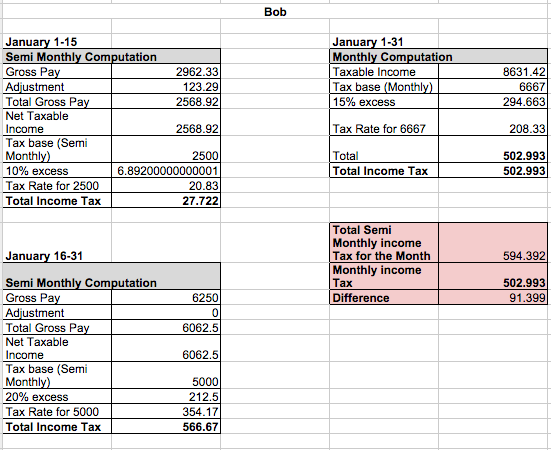

How PayrollHero Computes The Philippine BIR Tax Deduction

http://support.payrollhero.com/files/2015/06/gsjQUSz8sbKWoy9NUaV3.png

Tax Computation Worksheet Subtraction Amount Worksheet Resume Examples

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/03/tax-computation-worksheet-in-malaysia.jpg

Verkko 1 tammik 2023 nbsp 0183 32 Individual Taxes on personal income Last reviewed 02 July 2023 The Philippines taxes its resident citizens on their worldwide income Non resident citizens and aliens whether or not resident in the Philippines are taxed only on income from sources within the Philippines Verkko 23 lokak 2023 nbsp 0183 32 Navigate the Philippines tax landscape with our guide Understand key policies meet deadlines and employ strategies to ensure compliance and minimize tax headaches

Verkko 5 kes 228 k 2023 nbsp 0183 32 As a responsible citizen of the country a Filipino individual earning at least 1 000 monthly is mandated to pay tax to the government amounting to a percentage of their taxable income an amount calculated by deducting an individual s benefits contributions from their gross monthly income Verkko 2 hein 228 k 2023 nbsp 0183 32 Tax computation Husband PHP Wife PHP Gross income Salary 1 652 000 68 000 Living allowances 100 000 Total taxable income 752 000 68 000 Tax due On first 400 000 22 500 On remainder of 352 000 at 20 70 400 On first 250 000 0 Total tax 92 900 0 Less Tax withheld by employer per Form 2316 2

Download Tax Deduction Philippines

More picture related to Tax Deduction Philippines

Payslip Sample In The Philippines 2022 TAXGURO

https://www.philippinetaxationguro.com/wp-content/uploads/2022/11/Screen-Shot-2022-11-22-at-9.05.06-PM-690x291.png

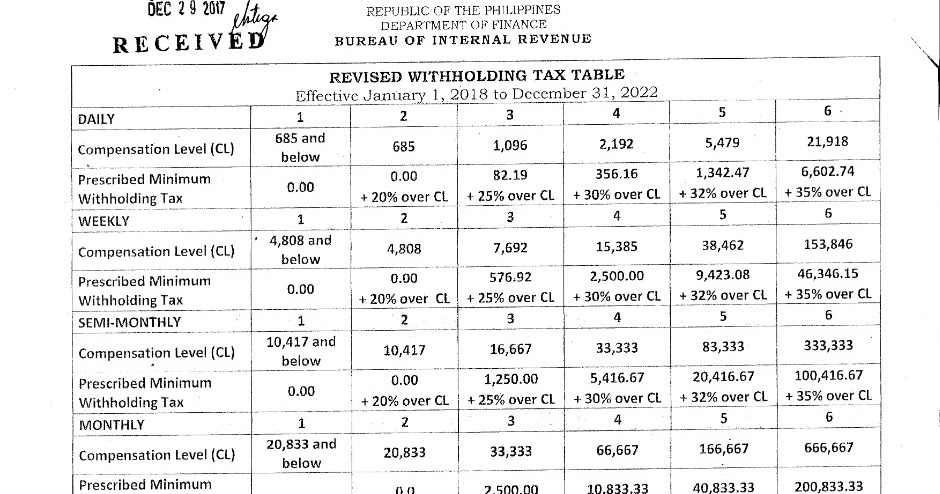

Revised Withholding Tax Table Bureau Of Internal Revenue

https://i2.wp.com/governmentph.com/wp-content/uploads/2018/12/2020-Revised-Withholding-Tax-Table.jpg?resize=1200%2C628

8 Images Annual Withholding Tax Table 2017 Philippines And Description

https://alquilercastilloshinchables.info/wp-content/uploads/2020/06/Philippines-Tax-Updates-TRAIN-LAW-and-the-Minimum-Wage-Earners-....jpg

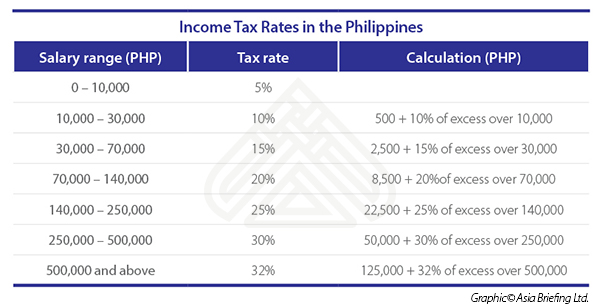

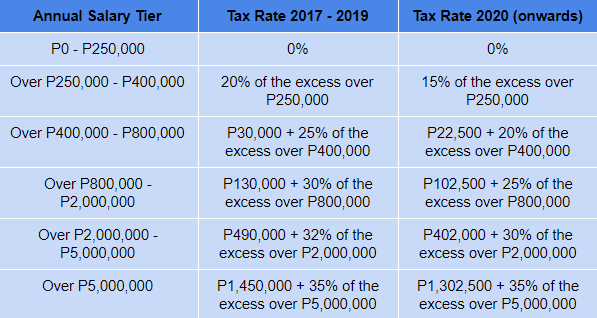

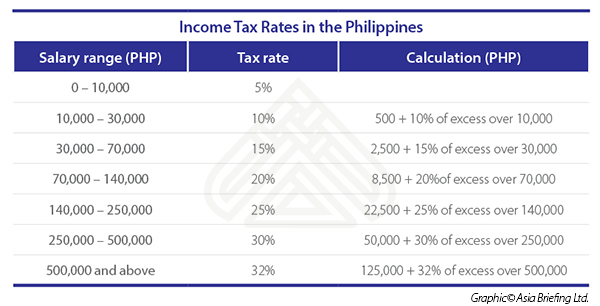

Verkko To access Withholding Tax Calculator click here To estimate the impact of the TRAIN Law on your compensation income click here For inquiries or suggestions on the Withholding Tax Calculator you may e mail contact us bir gov ph Verkko 16 maalisk 2023 nbsp 0183 32 While employers don t contribute to their employees income tax they must act as the withholding agent by deducting income taxes from their employees monthly wages The Philippines uses a graduated income tax composed of six income brackets 0 to 250 000 0 250 001 to 400 000 15 400 001 to 800 000

Verkko 11 kes 228 k 2023 nbsp 0183 32 The 2023 tax table is a guide that shows the tax rates and brackets deductions and exemptions applicable to taxpayers in the Philippines It is a crucial tool for calculating the amount of income tax payable to the government based on an individual s taxable income Verkko In computing for the income tax in the Philippines certain deductible expenses are subtracted from gross income They are technically termed as allowable deductions from gross income and they could be under itemized deductions or under optional standard deductions OSD

What Do The Salary Deductions On Your Payslip Mean MoneyMax ph

https://25174313.fs1.hubspotusercontent-eu1.net/hub/25174313/hubfs/assets_moneymax/Screen-Shot-2018-07-16-at-9.44.21-PM-e1531751041618.png?width=600&height=247&name=Screen-Shot-2018-07-16-at-9.44.21-PM-e1531751041618.png

2017 Philippine Tax Reform What Changes To Expect In Your Payroll

http://justpayroll.ph/wp-content/uploads/2017/09/Tax-Reform-2017-Salary-Tier.png

https://taxsummaries.pwc.com/philippines/individual/deductions

Verkko 2 hein 228 k 2023 nbsp 0183 32 Taxes Losses Bad debts Depreciation Charitable and other contributions subject to certain limitations Research and development R amp D expenditures In lieu of these allowable deductions an individual other than a non resident alien may elect an optional standard deduction OSD not exceeding 40 of

https://www.bir.gov.ph/index.php/tax-information/income-tax.html

Verkko Income Tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as amended or other

PHILIPPINE TAX TALK THIS DAY AND BEYOND Revised Withholding Tax Table

What Do The Salary Deductions On Your Payslip Mean MoneyMax ph

Sample Computation Income Tax 2018 R Philippines

Tax deduction checklist Etsy

How To Compute VAT In The Philippines YouTube

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

Tax Deduction Letter Sign Templates Jotform

Premium Photo Tax Deduction

Example Tax Deduction System For A Single Gluten free GF Item And

Tax Deduction Philippines - Verkko 5 kes 228 k 2023 nbsp 0183 32 As a responsible citizen of the country a Filipino individual earning at least 1 000 monthly is mandated to pay tax to the government amounting to a percentage of their taxable income an amount calculated by deducting an individual s benefits contributions from their gross monthly income