Tax Exemption For Home Equity Loan For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750 000 That cap includes your existing mortgage balance one vacation or second home and any deductible home

According to the Tax Cuts and Jobs Act home equity loan interest is tax deductible through 2026 This means you can deduct your home equity loan interest if it meets the IRS guidelines and you itemize your deductions Home equity loan and HELOC interest may be tax deductible if the borrowed money was used to buy build or improve your home By Barbara Marquand Updated Jan 10 2024 Edited by Mary

Tax Exemption For Home Equity Loan

Tax Exemption For Home Equity Loan

https://realtybiznews.com/wp-content/uploads/2022/05/iStock-1285857830-scaled.jpg

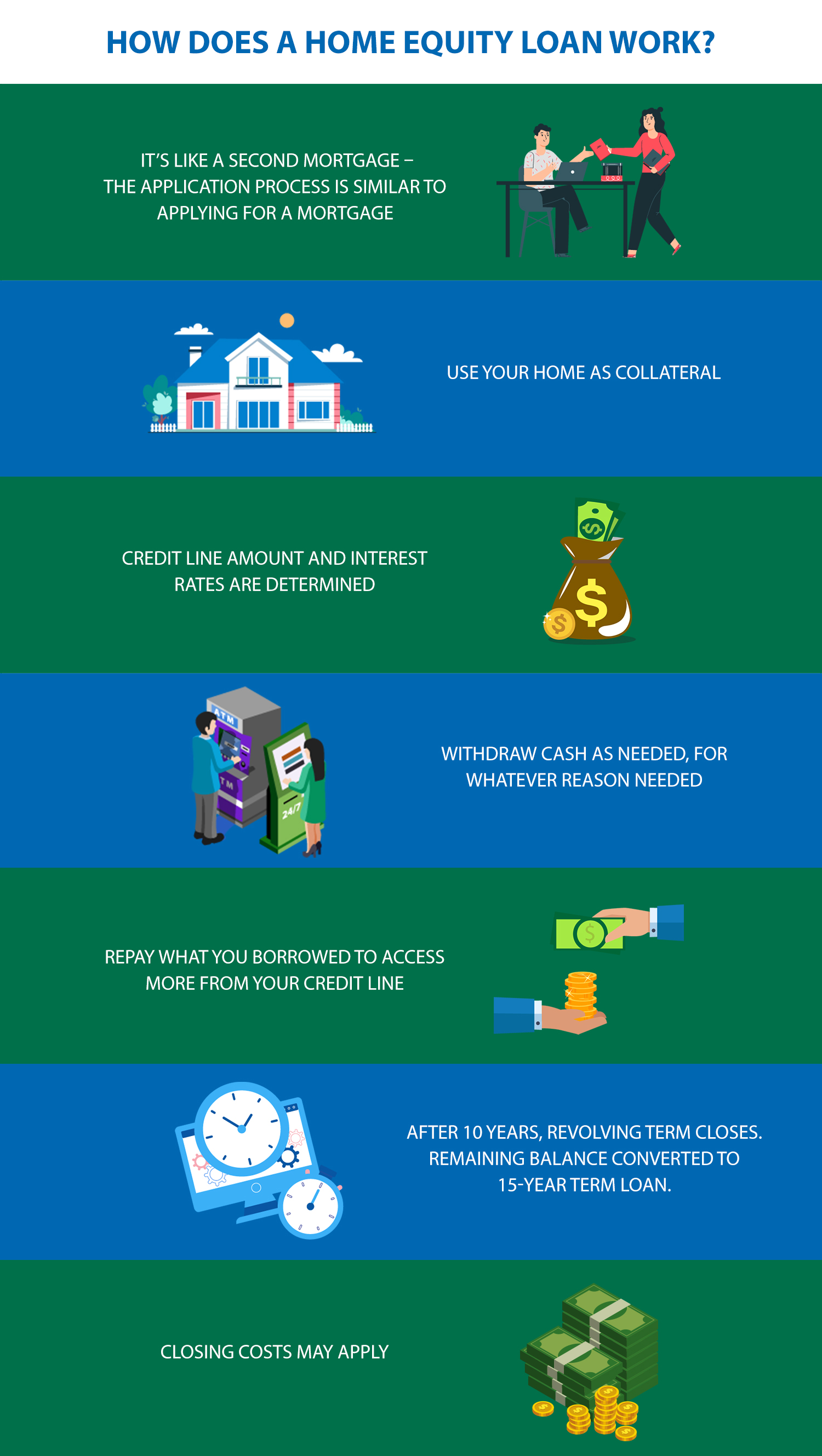

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

https://www.cobaltcu.com/sites/default/files/2022-01/Home-Equity-Loan-VS-Line-of-Credit.png

After Selling My Flat Should I Buy 54EC Tax Exemption Bonds Or Pay Tax

https://freefincal.com/wp-content/uploads/2022/09/After-selling-my-flat-should-I-buy-54EC-Tax-Exemption-Bonds-or-pay-tax-and-invest-in-equity.jpg

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially Since the TCJA passed home equity loans and HELOCs qualify for the home mortgage interest deduction only to the extent that the proceeds are used to buy build or substantially improve

Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayer s home that secures the loan Home Loan Tax Benefit Income Tax Benefit on House Loan Updated on Feb 5th 2023 3 41 39 AM 10 min read CONTENTS Show Buying your own house is a dream come true for everyone The Indian government has always shown a great inclination to encourage citizens to invest in houses

Download Tax Exemption For Home Equity Loan

More picture related to Tax Exemption For Home Equity Loan

Home Equity Line Of Credit Creekhills Credit Union

https://www.palisadesfcu.org/files/palisades/1/image/Asana On Page Images/Palisades CU _ Home Equity Line of Credit Graphic.jpg

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

https://www.bestfinance-blog.com/wp-content/uploads/2021/04/AdobeStock_165000956-scaled.jpeg

Should You Use A Home Equity Loan To Pay Off Credit Cards Credible

https://www.credible.com/blog/wp-content/uploads/2021/12/Home-Equity-Loan-to-Payoff-Credit-Card-014452.png

Is Home Equity Loan Interest Tax Deductible Tax time is hard but there s some good news If you used a home equity loan for home renovations or improvements you re in for a A Homeowner s Guide to Taxes The Tax Benefits of Owning a Home Acquisition debt vs home equity debt What s the difference Interest on home equity debt is no longer

When is a home equity loan tax deductible First of all only the interest paid on a home equity loan qualifies for a tax deduction You won t be allowed to deduct any money you Under the current guidelines taxpayers who took out a home equity loan after Dec 15 2017 can apply the deduction to Interest paid on up to 750 000 of their mortgage debt for individual taxpayers and married couples filing jointly if the loan was used to buy build or improve their main home or second home

Home Equity Cover Letter Velvet Jobs

https://asset.velvetjobs.com/cover-letter-templates/home-equity-cover-letter-template-v15.png

How Home Equity Loans Affect Taxes Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/10/2022-optima-tax-home-equity-loans-scaled.jpg

https://www. forbes.com /advisor/home-equity/are...

For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750 000 That cap includes your existing mortgage balance one vacation or second home and any deductible home

https://www. rocketmortgage.com /learn/are-home...

According to the Tax Cuts and Jobs Act home equity loan interest is tax deductible through 2026 This means you can deduct your home equity loan interest if it meets the IRS guidelines and you itemize your deductions

How To Borrow Using Your Home Equity Loans Canada

Home Equity Cover Letter Velvet Jobs

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

What Are The Negatives Of A Home Equity Loan Leia Aqui Is Pulling

Secure Form Home Equity Loan Application CU Answers Store

Home Equity Calculator Percentage MarjoryCollette

Applying For A Home Equity Loan What To Consider First Mortgage

Applying For A Home Equity Loan What To Consider First Mortgage

Should I Pay Off Debt With A Home Equity Loan YouTube

Equity Loan Application Form Fill Out Sign Online DocHub

Sample Letter Exemption Doc Template PdfFiller

Tax Exemption For Home Equity Loan - Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially