Tax Rebate Student Loan Web The student loan isn t tax free educational assistance so the qualified expenses don t need to be reduced by any part of the loan proceeds Joan is treated as having paid 1 000 in qualified education expenses 3 000

Web 22 juil 2022 nbsp 0183 32 In a typical tax season if you owe money on defaulted student loans you may not get a tax refund But thanks to the latest student loan relief rules your tax refund won t be taken Web 25 ao 251 t 2022 nbsp 0183 32 As an example Rossman shows how federal student loan forgiveness of 10 000 would have traditionally been taxed prior to Biden s tax update Say as a federal

Tax Rebate Student Loan

Tax Rebate Student Loan

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png?fit=840%2C691&ssl=1

Future Of Biden s Student Debt Plan Hangs In The Balance Before

https://media-cldnry.s-nbcnews.com/image/upload/t_fit-760w,f_auto,q_auto:best/rockcms/2022-10/221021-student-debt-cancellation-rally-mjf-1352-df3fe7.jpg

Est mulos Econ micos EN VIVO SSI Payment Direct Payments Tax Rebates

https://e00-us-marca.uecdn.es/assets/multimedia/imagenes/2022/08/27/16616349622789.jpg

Web 20 sept 2022 nbsp 0183 32 How can I apply for a refund Borrowers who want a specific amount refunded can apply by calling their loan service provider Right now refunds are only being done via phone and not through any Web 25 janv 2023 nbsp 0183 32 The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies needed for coursework but not living expenses or

Web 1 d 233 c 2022 nbsp 0183 32 To qualify you must be enrolled for at least one academic period at least half time each year The credit covers 100 of the first 2 000 in qualified expenses plus 25 of the next 2 000 Eligible Web 5 sept 2023 nbsp 0183 32 The Supreme Court blocked Biden s student debt cancellation plan so borrowers who received student loan refund checks for payments made during the

Download Tax Rebate Student Loan

More picture related to Tax Rebate Student Loan

They ll Get You Either Coming Or Going Imgflip

https://i.imgflip.com/78io87.jpg

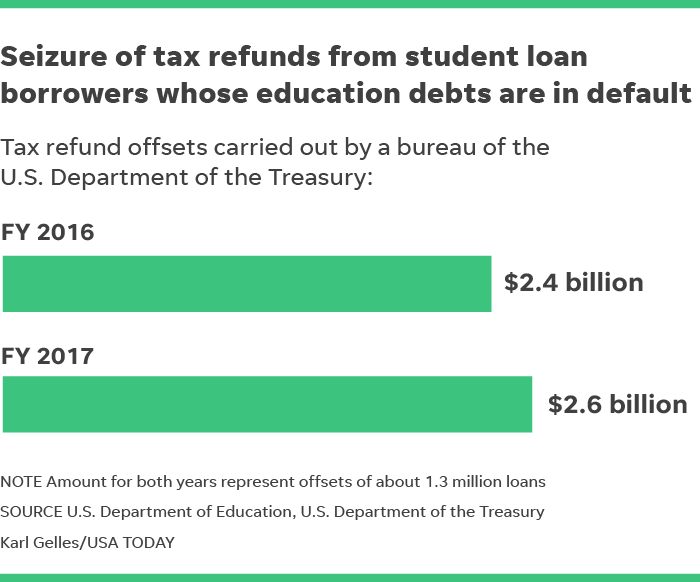

Tax Refunds Of 2 6B Were Seized During 17 To Repay Student Loans In

https://www.gannett-cdn.com/media/2018/04/17/USATODAY/USATODAY/636595805484628789-041718-TAX-SEIZURES-Online.png

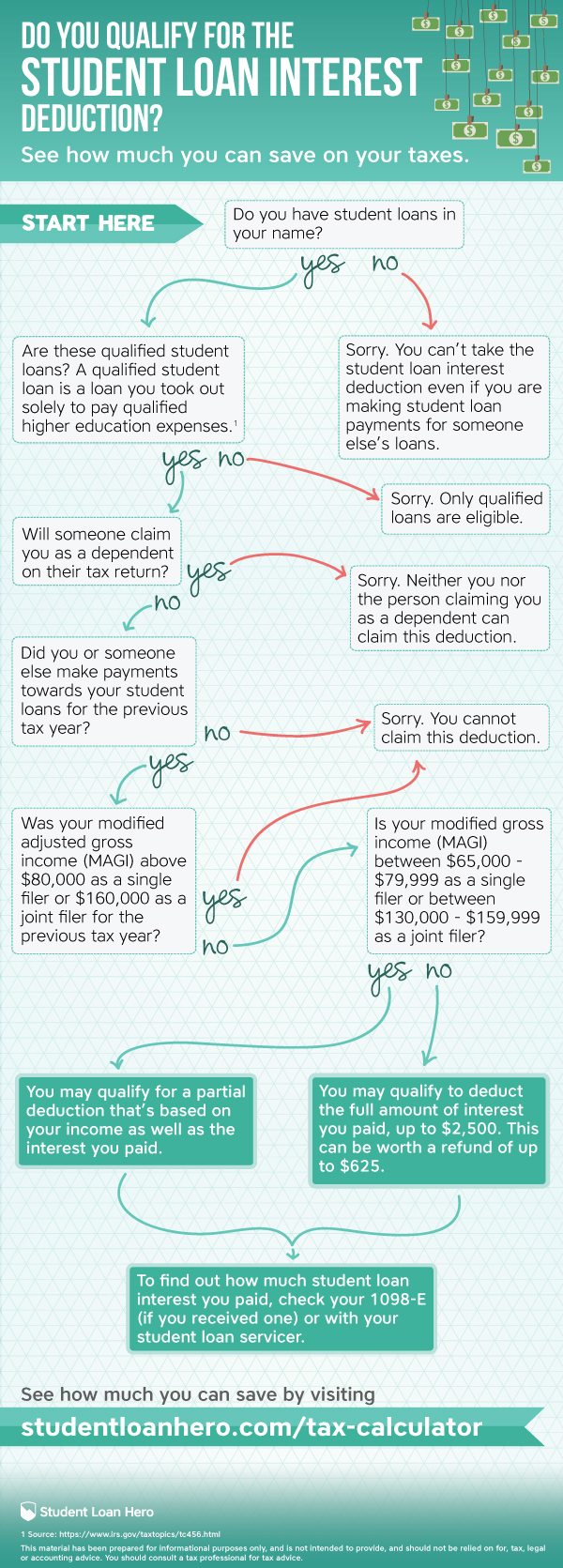

Student Loan Tax Deduction

https://sc.cnbcfm.com/applications/cnbc.com/resources/files/2017/11/02/student-loan-interest-deduction.jpg

Web 31 oct 2019 nbsp 0183 32 The student loan repayments are considered taxable income The Department for Education will pay Income Tax up to the basic rate currently income of Web 21 mars 2023 nbsp 0183 32 Before the Covid pandemic nearly 13 million taxpayers took advantage of the student loan interest deduction which allows borrowers to deduct up to 2 500 a

Web 5 sept 2023 nbsp 0183 32 Biden s Student Loan Forgiveness Backup Plan President Biden s initial student loan forgiveness plan would have cancelled 10 000 or up to 20 000 in some Web 29 d 233 c 2016 nbsp 0183 32 Your student loan Plan 1 2 or 4 deduction will be calculated based on 9 of your total income above the threshold of your plan type Your PGL deduction will be

How Can You Find Out If You Paid Taxes On Student Loans

https://blog.turbotax.intuit.com/wp-content/uploads/2020/05/You-can-deduct-student-loan-interest-if-you-meet-the-following-qualifications.jpg?resize=150

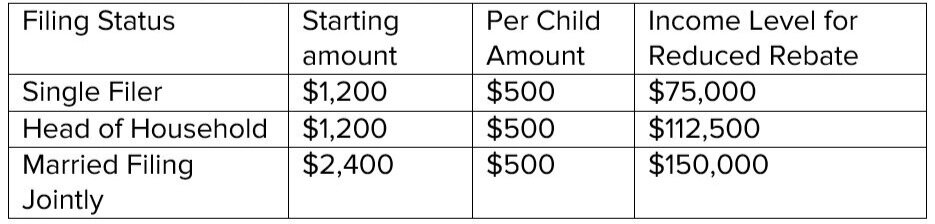

CARES Act Q A About Recovery Rebates Student Loans Health Care

https://images.squarespace-cdn.com/content/v1/532635b2e4b074f7f885535d/1585940969594-9CKMS7GZO2KXR9HQ6Z9X/1.jpg

https://www.irs.gov/publications/p970

Web The student loan isn t tax free educational assistance so the qualified expenses don t need to be reduced by any part of the loan proceeds Joan is treated as having paid 1 000 in qualified education expenses 3 000

https://www.forbes.com/advisor/student-loan…

Web 22 juil 2022 nbsp 0183 32 In a typical tax season if you owe money on defaulted student loans you may not get a tax refund But thanks to the latest student loan relief rules your tax refund won t be taken

Thousands Of Households To Get 150 Free Cash Next Week In 2022

How Can You Find Out If You Paid Taxes On Student Loans

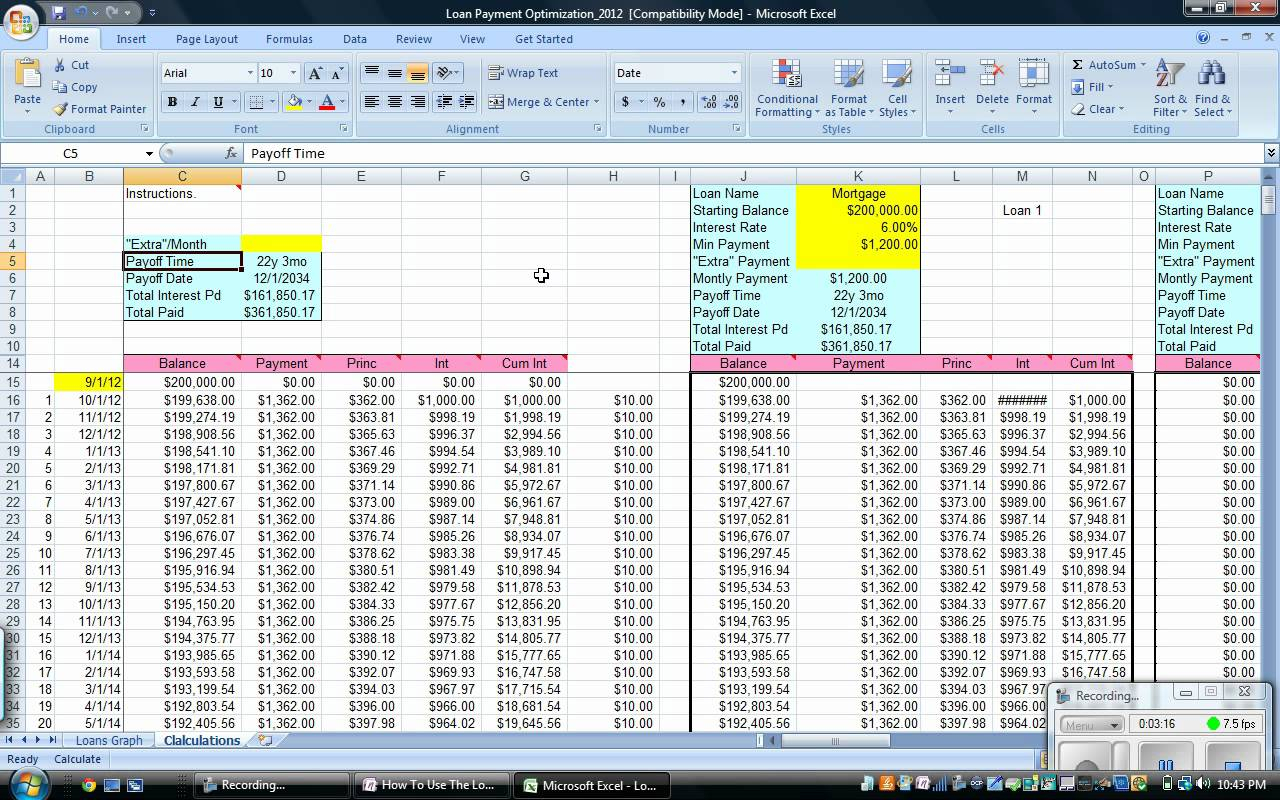

Student Loan Excel Spreadsheet Studentqw

Recovery Rebate Income Limits Recovery Rebate

Est mulos Econ micos EN VIVO Tax Refund Green Card Tax Rebate

Student Loans Deduction Nitisara Omran

Student Loans Deduction Nitisara Omran

What Does Rebate Lost Mean On Student Loans

Will The Department Of Education Refund Offset TAXW

CARES Act Recovery Rebates Distributions RMD Waivers Student Loan

Tax Rebate Student Loan - Web 25 janv 2023 nbsp 0183 32 The American opportunity tax credit lets you claim all of the first 2 000 you spent on tuition school fees and books or supplies needed for coursework but not living expenses or