Tax Refund Business Expenses Like all other taxpayers if a business has paid more taxes than was due on its return the business could be eligible for a refund Read on to understand how

Guide to Business Expense Resources Note We have discontinued Publication 535 Business Expenses the last revision was for 2022 Below is a Whether or not a business can receive a tax refund depends on the following Your business structure The types of taxes you pay A business does not have to have both factors to be eligible for a

Tax Refund Business Expenses

Tax Refund Business Expenses

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Cost And Budget Management Gururo

https://gururo.com/wp-content/uploads/2021/01/refund.png

Where s My Refund Up As Well As All IRS Systems Refund Schedule 2022

https://www.refundschedule.com/wp-content/uploads/2014/02/8773411-magnifying-glass-on-income-tax-return1.jpg

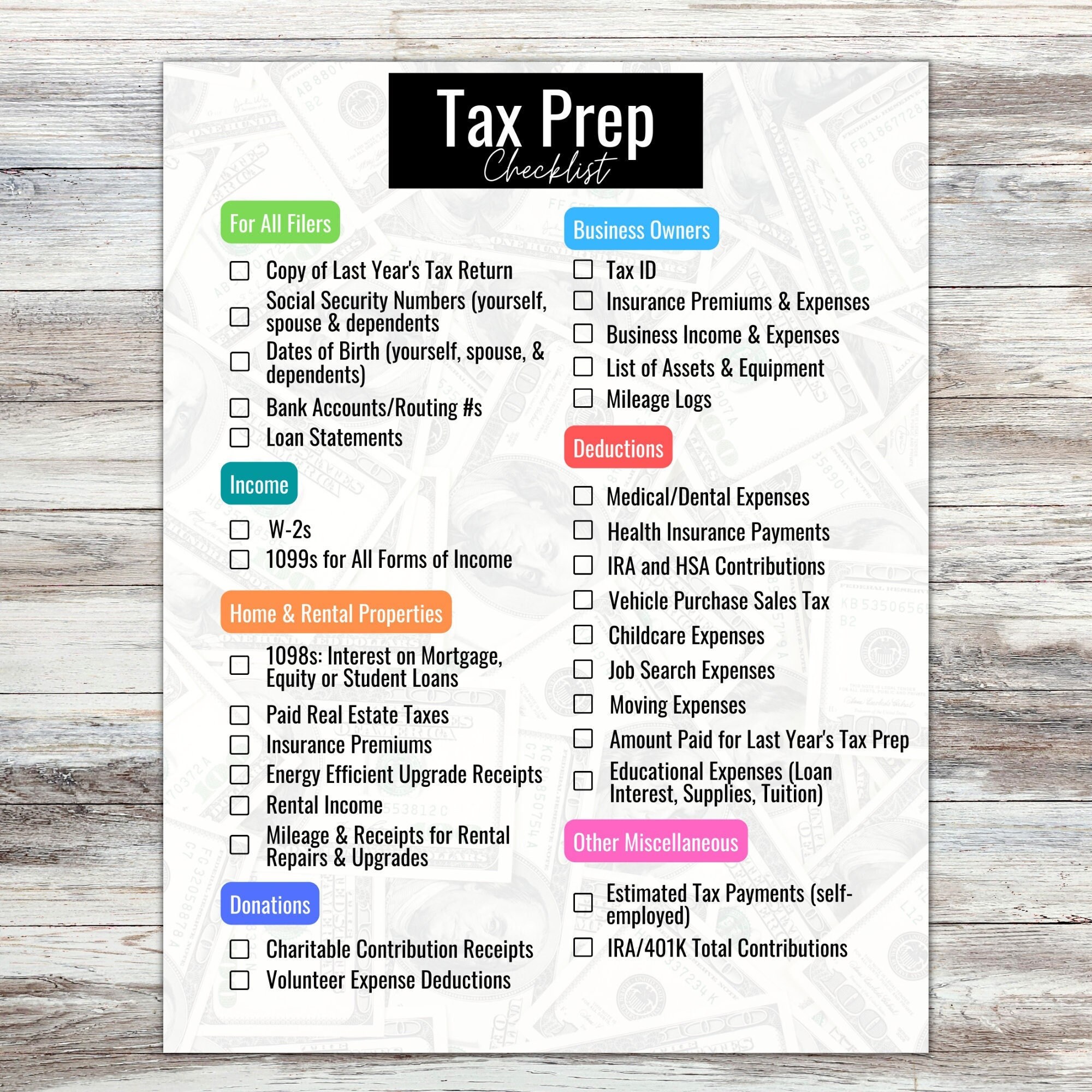

Date April 5 2022 With this year s tax deadline quickly approaching small businesses need to get their documents and records in order to make sure they re not paying more Tax deductible expenses are almost any ordinary necessary and reasonable expenses that help to earn business income Deductible expenses are

For example tax refunds mean that an individual or business overpaid their tax burden This usually happens if there are little or no allowances which causes over OVERVIEW You can only deduct business expenses on your income taxes that the IRS deems reasonable TABLE OF CONTENTS Video transcript Hello I m Sara from

Download Tax Refund Business Expenses

More picture related to Tax Refund Business Expenses

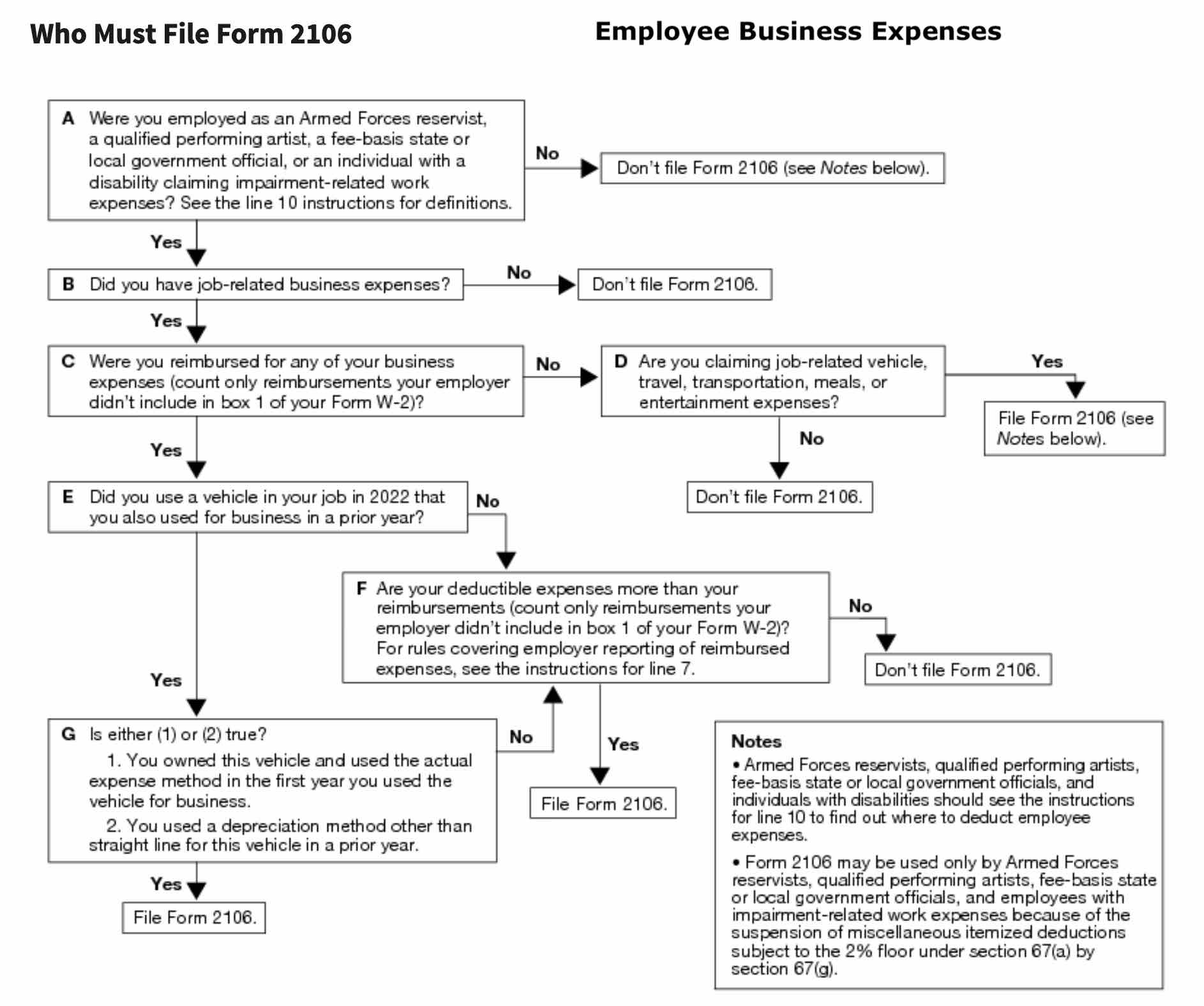

Can You Deduct Unreimbursed Employee Expenses In 2022

https://www.efile.com/image/Form-2016-employee-business-expenses.jpg

Pin On Spreadsheet Samples

https://i.pinimg.com/originals/b8/cc/16/b8cc16d85363f90f6aebf2d3fad272cb.png

5 Effective Ways To Cut Down On Business Expenses BusinessMole

https://www.businessmole.com/wp-content/uploads/2021/07/currency-2317703_1280-1152x759.jpg

What business expenses can you deduct What is the standard deduction The standard deduction is a tax write off that every single American can take Here are 1 Best answer ThomasM New Member Yes if you took a deduction for it on a prior year return then you would add it back to income in 2016 If you claimed the

One of the most fundamental steps in maximizing your tax refund is to maintain meticulous records of all business related expenses These expenses can include What work expenses are eligible for a refund Claiming tax relief on work related expenses means that the tax you d usually be charged on an item is removed

Small Business Spreadsheet For Taxes In 2022 Business Tax

https://i.pinimg.com/originals/8c/13/7e/8c137e33b838bda3155b46d186746f5e.png

Pin On Money

https://i.pinimg.com/originals/bd/fc/61/bdfc61093339587b842cb921b92aee62.png

https://www.doola.com/blog/will-i-get-a-refund-if-my-business-loses-money

Like all other taxpayers if a business has paid more taxes than was due on its return the business could be eligible for a refund Read on to understand how

https://www.irs.gov/forms-pubs/guide-to-business-expense-resources

Guide to Business Expense Resources Note We have discontinued Publication 535 Business Expenses the last revision was for 2022 Below is a

What Self Employed Expenses Can I Claim For Simple Taxes

Small Business Spreadsheet For Taxes In 2022 Business Tax

Tax Financial Accounting Solutions

What You Need To Know About Tax Refund Loans Optima Tax Relief

6 Wise Things To Do With Your Tax Refund Tax Refund Money Making

My 1 400 Tax Refund Disappeared I Was Left With 62 Cents To Feed My

My 1 400 Tax Refund Disappeared I Was Left With 62 Cents To Feed My

Business Expenses To Claim On Your Federal Tax Forms

Income Tax Refund 1

Income Tax Refund Complaint Complete Guide

Tax Refund Business Expenses - OVERVIEW You can only deduct business expenses on your income taxes that the IRS deems reasonable TABLE OF CONTENTS Video transcript Hello I m Sara from