Tax Return Business Expenses Business expenses are the costs of running a company and generating sales Given that broad mandate the IRS doesn t provide a master list of allowable small business and startup deductions As long as an expense is ordinary and necessary to running a business in your industry it s deductible

How to claim Overview If you re self employed your business will have various running costs You can deduct some of these costs to work out your taxable profit as long as they re allowable Guide to Business Expense Resources Note We have discontinued Publication 535 Business Expenses the last revision was for 2022 Below is a mapping to the major resources for each topic For a full list go to the Publication 535 for 2022 PDF

Tax Return Business Expenses

Tax Return Business Expenses

https://www.greenback.com/assets/f/blogs/all-things-sales-tax/hdr.png

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

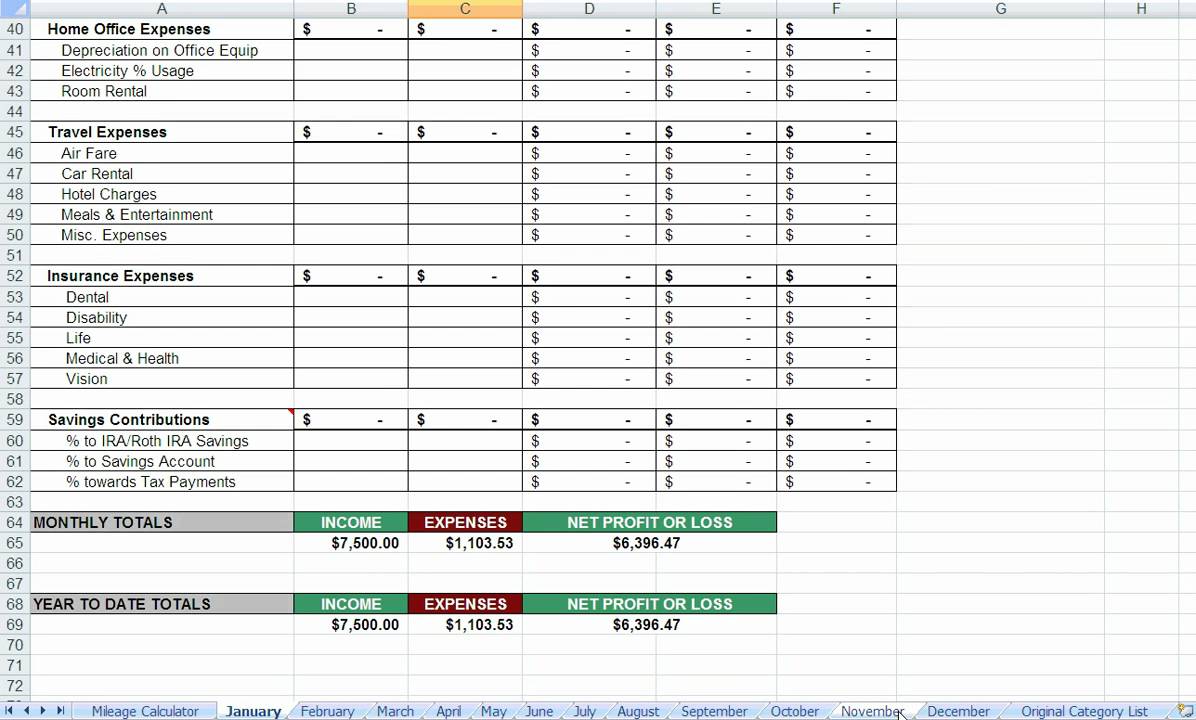

Tax Deductions Excel Spreadsheets Budgeting Tracking Finance Spending

https://i.etsystatic.com/7329950/r/il/0a4d8c/1935516758/il_fullxfull.1935516758_mwfz.jpg

A small business tax deduction is an IRS qualifying expense that you can subtract from your taxable income These deductions can reduce the amount of income subject to federal and state taxation What counts as a business expense According to the IRS business expenses must be both ordinary and necessary to be deductible What Business Taxes Can I Deduct as a Business Expense Building Your Business Business Taxes What Business Tax Costs Can Be Deducted Payments for Business Taxes Which are Deductible Which are Not By Jean Murray Updated on September 13 2022 Fact checked by J R Duren In This Article View All Photo Anchiy

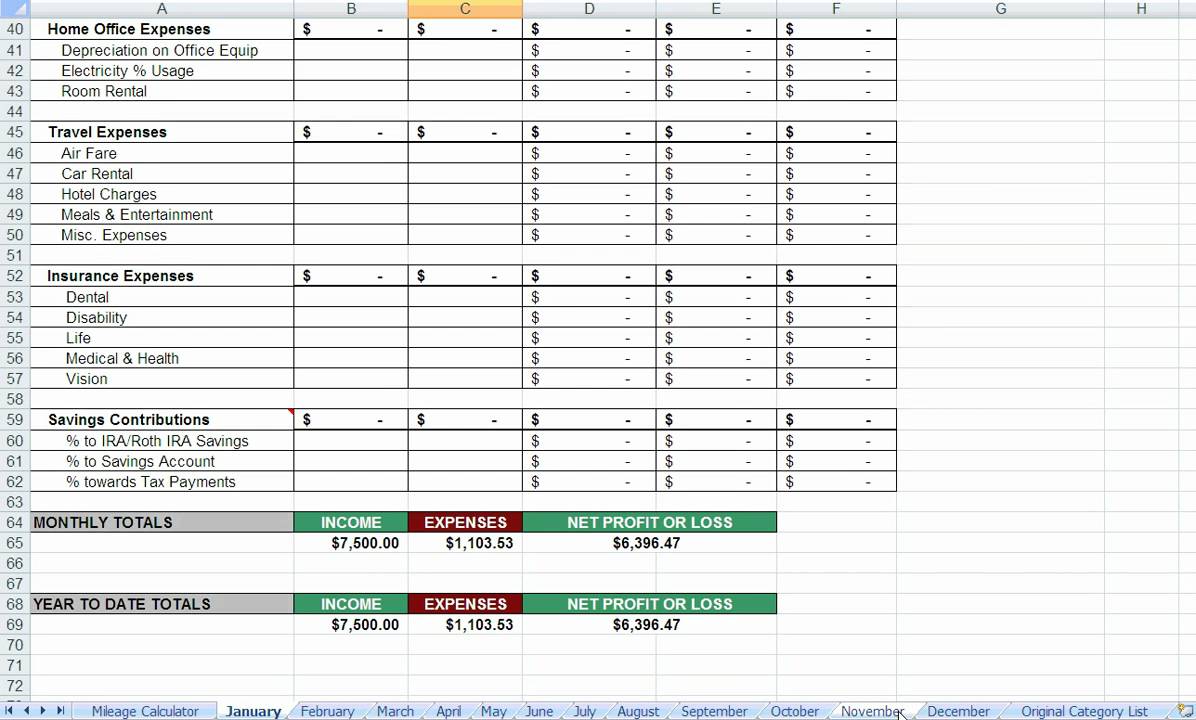

1 Startup and organizational costs Our first small business tax deduction comes with a caveat it s not actually a tax deduction Business startup costs are seen as a capital expense by the The IRS says a business expense must be ordinary necessary and directly related to running a company to be deductible Most small business expenses fall into specific categories Schedule C the IRS form which sole proprietors use to report their income has a business expenses list with 20 broad categories that include Advertising

Download Tax Return Business Expenses

More picture related to Tax Return Business Expenses

Corporate Income Tax Annual Tax Return Form Excel Template And Google

https://image.slidesdocs.com/responsive-images/sheets/corporate-income-tax-annual-tax-return-form-excel-template_d9bd2fc9f4__max.jpg

Business Expenses And Tax Deductions For Birth Professionals

https://www.inspiredbirthpro.com/wp-content/uploads/2010/03/Business-Expenses-and-Tax-Deductions1-682x1024.png

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Checklist Tax

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

Every business should seek to take advantage of special tax deductions offered for expenses they incur Whether you re self employed or running your own business entity the Internal Revenue Service may allow you to deduct most of your business costs including many dollar for dollar deductions Introduction This publication provides general information about the federal tax laws that apply to you if you are a self employed person or a statutory employee

Types of business expenses you may be able to claim deductions for include day to day operating expenses purchases of products or services for your business certain capital expenses such as the cost of depreciating assets like machinery and equipment used in your business You can deduct expenses for employees including salaries bonuses payroll taxes fringe benefits such as health insurance sick pay and vacation pay What kind of deductions can I take as a small business Sure you pay tax on your

Spreadsheet For Tax Expenses Expense Spreadsheet Spreadsheet Templates

http://db-excel.com/wp-content/uploads/2018/02/spreadsheet-for-tax-expenses.jpg

Business Expenses Revolut IE

https://www.revolut.com/_next/image/?url=https:%2F%2Fassets.revolut.com%2Fwebsite%2Fassets%2Fbusiness%2FExpenses%2FIE%2FValueProp-03-IE.jpg%3Fauthuser%3D0&w=3840&q=75

https://www.netsuite.com/portal/resource/articles/...

Business expenses are the costs of running a company and generating sales Given that broad mandate the IRS doesn t provide a master list of allowable small business and startup deductions As long as an expense is ordinary and necessary to running a business in your industry it s deductible

https://www.gov.uk/expenses-if-youre-self-employed

How to claim Overview If you re self employed your business will have various running costs You can deduct some of these costs to work out your taxable profit as long as they re allowable

Freelance Accounting Personal Tax Services

Spreadsheet For Tax Expenses Expense Spreadsheet Spreadsheet Templates

Corporate Income Tax Return Excel Template And Google Sheets File For

Pin On Spreadsheet Samples

Small Business Spreadsheet For Taxes In 2022 Business Tax

Business Expenses To Claim On Your Federal Tax Forms

Business Expenses To Claim On Your Federal Tax Forms

How To Deduct Business Expenses On Your Income Tax Return Tax Rates

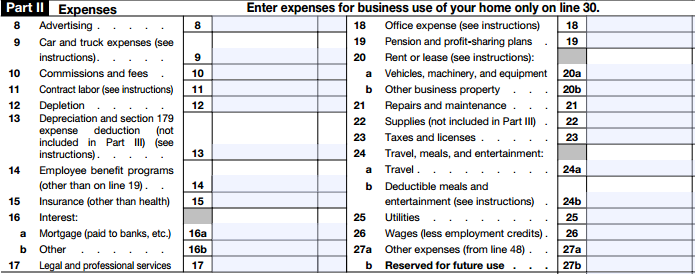

IRS Form 2106 Employee Business Expenses Wassman CPA Services LLC

Self employed Keep Your Tax And Expenses In Or For Your Tax Return

Tax Return Business Expenses - Tax deductible business expenses If you re self employed your business will have various running costs You can deduct some of these as part of your annual tax return to work out your