Tax Return Calculator Uk Self Employed Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2024 2025 tax year

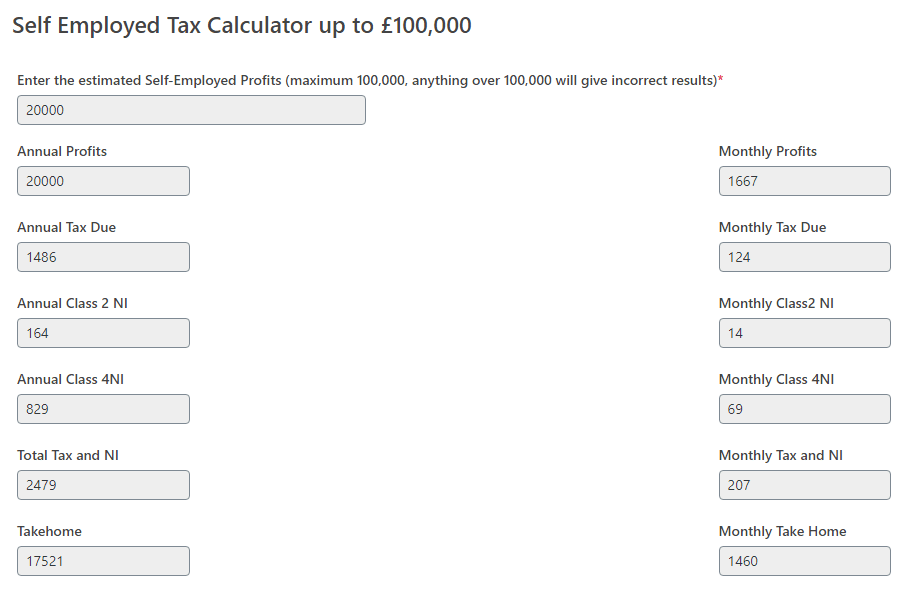

Tax Calculator for the Employed and Self Employed Employed and Self Employed uses tax information from the tax year 2024 2025 to show you take home pay See what happens when you are both employed and self employed at the same time with UK income tax National Insurance student loan and pension deductions If you are self employed use this simplified Self Employed Tax Calculator to work out your tax and National Insurance liability The calculator uses tax information from the tax year 2024 2025 to show you take home pay

Tax Return Calculator Uk Self Employed

Tax Return Calculator Uk Self Employed

https://i0.wp.com/www.employementform.com/wp-content/uploads/2022/10/self-employed-canada-tax-form.png

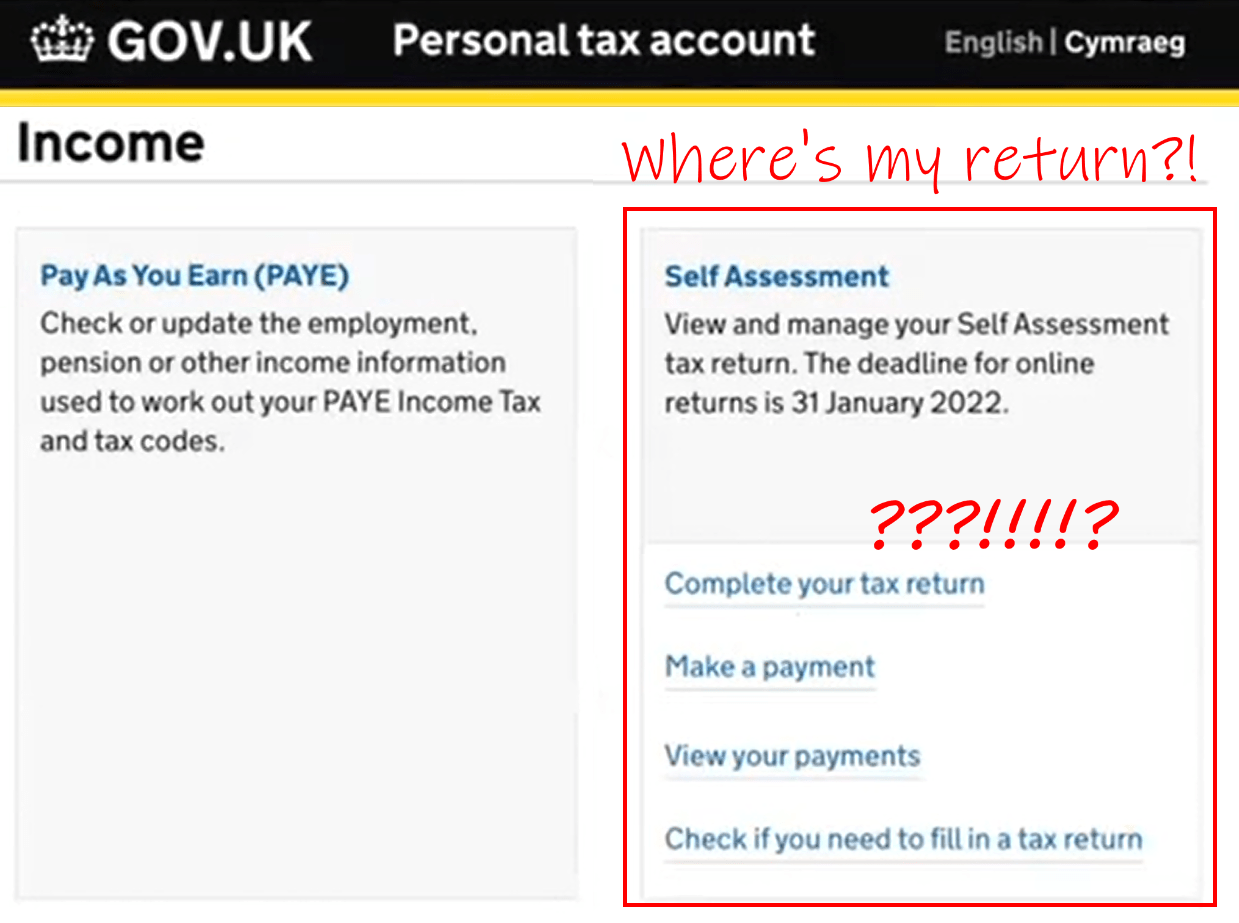

Pay Your Personal Tax Return By The End Of January Alterledger

https://www.alterledger.com/wp-content/uploads/2022/01/Pay-your-tax-by-end-of-Jan.gif

Tax Return Calculator Why 1080 ATO Refund May Never Come News

https://content.api.news/v3/images/bin/7e0cac065231206b73b1222dd0d01ada

Get an accredited accountant to sort your employed PAYE and self employed income and file your Self Assessment tax return straight to HMRC Letting the professionals handle it makes the whole process stress free Our employed and self employed calculator gives you an estimated income and national insurance tax bill based on your annual gross salary self employment income self employment expenses and pension contributions

SELF EMPLOYED or CIS Our calculator can accurately calculate taxes for people who are self employed or working within CIS Construction Industry Scheme Ticking this option will change the NI contribution class from Class 1 to Class 4 and Class 2 To use the tax calculator self employed UK enter your gross annual income Add up and enter your allowable business expenses that can be subtracted from your income before taxes The self employed tax calculator UK will estimate your profit after tax and national insurance

Download Tax Return Calculator Uk Self Employed

More picture related to Tax Return Calculator Uk Self Employed

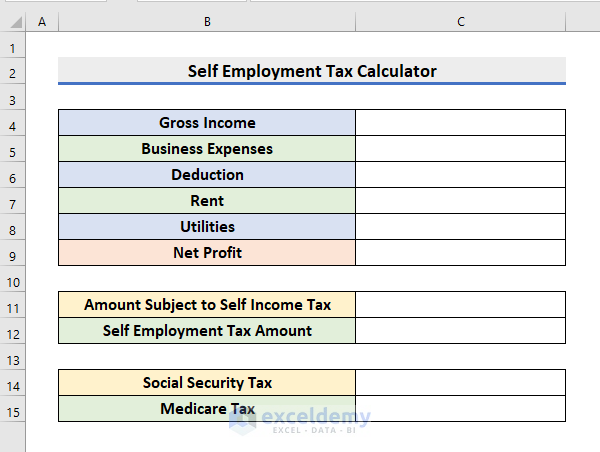

Calculate Self Employment Tax Deduction ShannonTroy

https://images.squarespace-cdn.com/content/v1/5e94adbc25a0ae61d843b475/1631660630025-G3GPPIMYRC8BMWX8LPIM/how_to_calculate_federal_tax_liability_self_employed_example

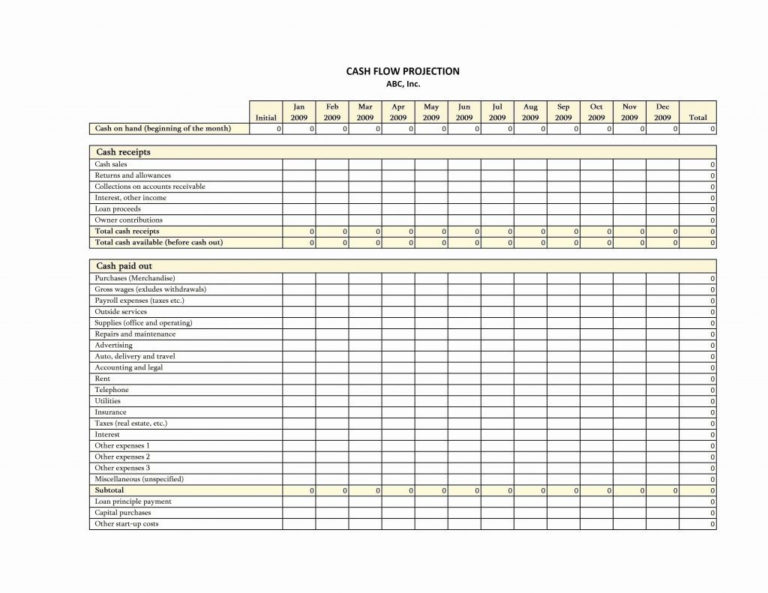

Self Employed Tax Spreadsheet Pertaining To Self Employed Expense Sheet

https://db-excel.com/wp-content/uploads/2019/01/self-employed-tax-spreadsheet-pertaining-to-self-employed-expense-sheet-tax-calculator-spreadsheet-return-sample-768x593.jpg

Help You Save Now This Specific No Cost Editable Self Employed Expense

https://i.pinimg.com/originals/51/dc/16/51dc16af007a47e9f8ce05c1511b2ed3.jpg

If you re self employed the self employed tax calculator can help you estimate your Self Assessment tax bill You may be able to claim a refund if you ve paid too much tax Use our self employed tax and NI calculator to work out how much income tax and national insurance you will pay for the current tax year

This calculator calculates the Income Tax and National insurance based on the tax rates and bands in England Northern Ireland The rates are different in Scotland Wales has the same tax rates and bands as England NI for 2020 21 Uk self employed tax calculator will determine your profit before tax and the expected amount of income tax and national insurance due

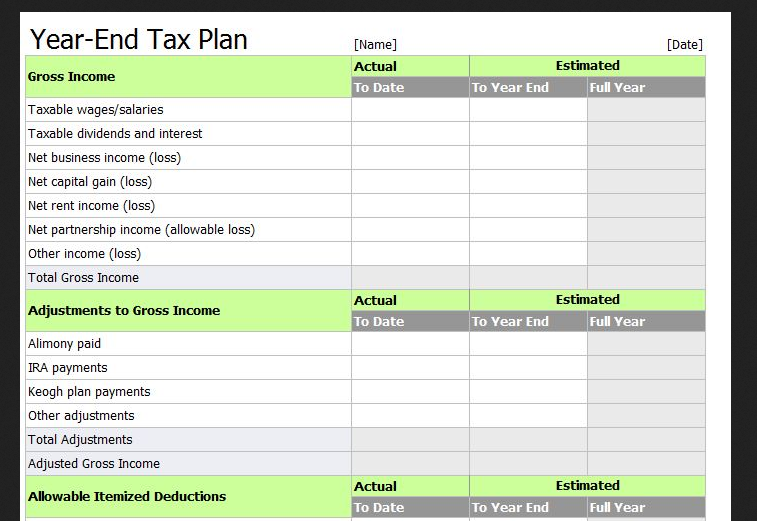

33 Self Employed Expense Worksheet Support Worksheet

https://cdn.michaelkummer.com/wp-content/uploads/2014/12/calculate-tax-feature.jpg?strip=all&lossy=1&ssl=1

2021 Tax Brackets Calculator SapphoBucci

https://www.exceldemy.com/wp-content/uploads/2022/06/self-employment-tax-calculator-excel-spreadsheet-1.png

https://www.uktaxcalculators.co.uk/.../self-employed-tax-calculator

Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2024 2025 tax year

https://www.employedandselfemployed.co.uk/tax-calculator

Tax Calculator for the Employed and Self Employed Employed and Self Employed uses tax information from the tax year 2024 2025 to show you take home pay See what happens when you are both employed and self employed at the same time with UK income tax National Insurance student loan and pension deductions

Self employed Tax Calculator

33 Self Employed Expense Worksheet Support Worksheet

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

How To Obtain Your Tax Calculations And Tax Year Overviews

You ve Filed A Tax Return So Why Doesn t It Show In HMRC s Personal

2021 UK Form SA100 Fill Online Printable Fillable Blank PdfFiller

2021 UK Form SA100 Fill Online Printable Fillable Blank PdfFiller

Tax Return Spreadsheet Template Uk Db excel

How To Obtain Your Tax Calculations And Tax Year Overviews

UK Self Employed Tax Calculator Online Free Tool

Tax Return Calculator Uk Self Employed - SELF EMPLOYED or CIS Our calculator can accurately calculate taxes for people who are self employed or working within CIS Construction Industry Scheme Ticking this option will change the NI contribution class from Class 1 to Class 4 and Class 2