Virginia Corporate Income Tax Return Due Date Verkko For taxable years beginning on and after January 1 2022 the Virginia corporate income tax deduction for business interest has increased to 30 of the business

Verkko Typically most people must file their tax return by May 1 Fiscal year filers Returns are due the 15th day of the 4th month after the close of your fiscal year If the due date Verkko PTE income tax returns are due by the 15th day of the 4th month following the close of the business s taxable year For calendar year filers that means April 15 If the filing

Virginia Corporate Income Tax Return Due Date

Virginia Corporate Income Tax Return Due Date

https://www.taxestalk.net/wp-content/uploads/can-i-file-income-tax-return-for-ay-2017-18.png

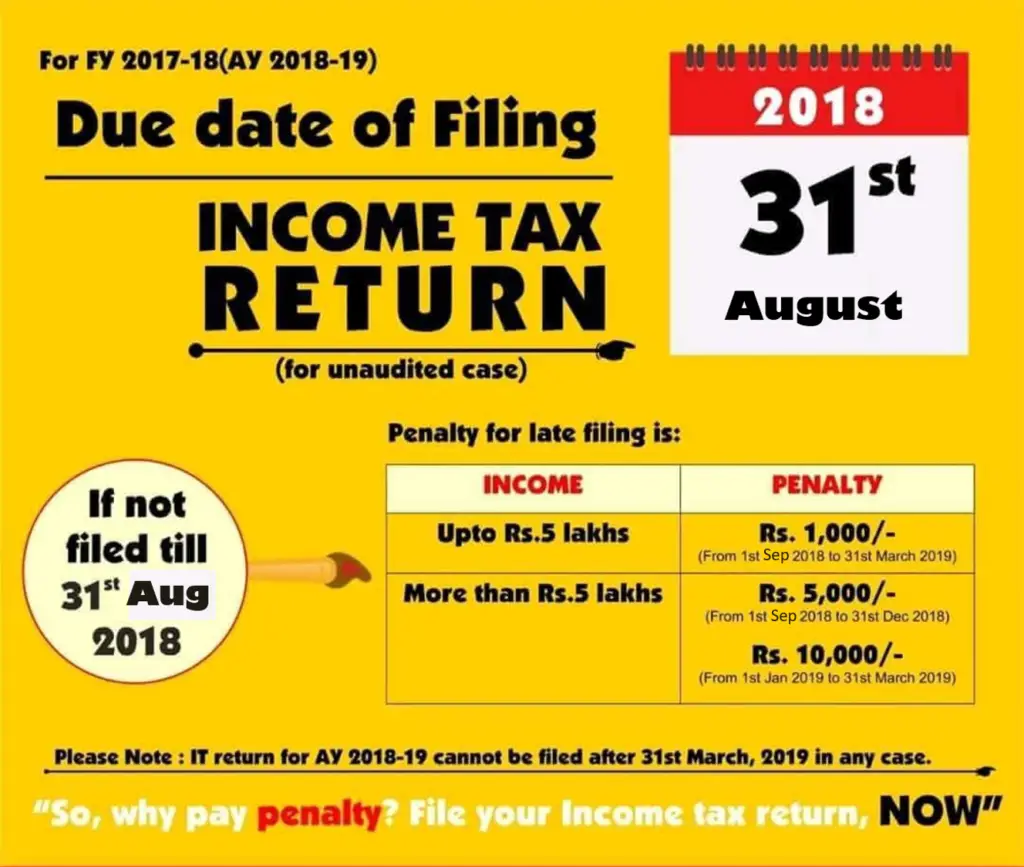

The Biggest Problem With Income Tax Return Filing And Due Date How You

https://www.avcindia.co.in/wp-content/uploads/2021/03/Income-Tax-Return-Filing.png

Income Tax Return And The Key Changes

https://www.weandgst.in/wp-content/uploads/2019/04/1200px-Income_Tax_Department_May_2018.jpg.png

Verkko Corporate tax returns in Virginia are due on the 15th day of the fourth month after a tax year s end When filing based on the calendar year your return is due on April 15 Verkko If you file your report after the due date you will be subject to a penalty of 10 of the tax due amount Interest Enter the amount due at the underpayment rate established by

Verkko Virginia usually releases forms for the current tax year between January and April We last updated Virginia Form 500 from the Department of Taxation in January 2023 Verkko 500CP DOC ID 502 soon as you realize you owe tax For fiscal year filers file Form 500CP with your payment on or before the due date of your return The due date for

Download Virginia Corporate Income Tax Return Due Date

More picture related to Virginia Corporate Income Tax Return Due Date

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

https://pbs.twimg.com/media/Ftfrk2DagAECRKs.jpg

Explained All About Belated Filing Of Income Tax Returns

https://images.moneycontrol.com/static-mcnews/2022/01/Filing-a-belated-income-tax-return.jpg

Income Tax India On Twitter Dear Taxpayers Do Remember To File Your

https://pbs.twimg.com/media/FYUq-cDVEAE1wYC.jpg:large

Verkko Virginia Filing Due Date Corporation tax returns are due by April 15 or by the 15 th day of the 4 th month following the end of the taxable year for fiscal year filers Verkko due dates was disrupted Effective for tax years beginning on or after December 31 2015 the Surface Transportation and Veterans Health Care Choice Improvement Act

Verkko 500V Virginia Verkko 500CP For Period Filing Basis Calendar Fiscal Short For Taxable Year Ending Account Number 35 FEIN F Account Suffix Demographics Entity Type Name of Corporation

How Many Uears Of Tax Teturs For Home Loan

https://www.manishanilgupta.com/public/assets/upload/blog/5f6af0338d718_Income Tax.jpeg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

https://www.tax.virginia.gov/sites/default/files/vatax-pdf/20…

Verkko For taxable years beginning on and after January 1 2022 the Virginia corporate income tax deduction for business interest has increased to 30 of the business

https://www.tax.virginia.gov/when-to-file

Verkko Typically most people must file their tax return by May 1 Fiscal year filers Returns are due the 15th day of the 4th month after the close of your fiscal year If the due date

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

How Many Uears Of Tax Teturs For Home Loan

.png)

Income Tax Return Who Is Required Which Form Due Dates Fy 2022 23 Ay

Important Things To Keep In Mind While Filing Your Income Tax Return

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Is Corporate Income Tax Needed Eye Witness News

Is Corporate Income Tax Needed Eye Witness News

Latest ITR Forms Archives Certicom

ITR Income Tax Return E verification To Complete Filing Process All

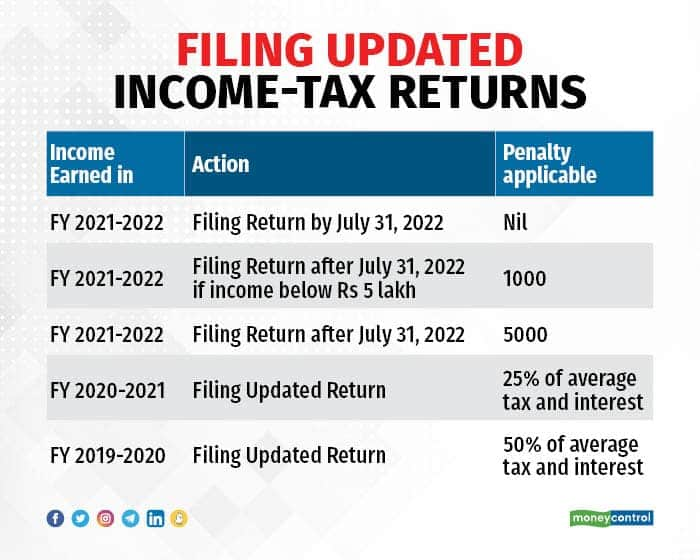

Revised Belated And Updated Income Tax Returns Do You Know The

Virginia Corporate Income Tax Return Due Date - Verkko Corporate tax returns in Virginia are due on the 15th day of the fourth month after a tax year s end When filing based on the calendar year your return is due on April 15