What Appliances Qualify For Energy Tax Credit These expenses may qualify if they meet requirements detailed on energy gov 1 Solar wind and geothermal power generation 2 Solar water heaters 3 Fuel cells 4 Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of See more

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and

What Appliances Qualify For Energy Tax Credit

What Appliances Qualify For Energy Tax Credit

https://www.rwcnj.com/wp-content/uploads/2018/01/Depositphotos_14725837_m-2015.jpg

Kitchen Appliance In Bahrain Buy Online Bahrain

https://yyfakhro.com/wp-content/uploads/2020/04/appliances-e1576685982524-scaled.jpg

Most Energy Efficient Appliances In 2023

https://www.solarreviews.com/content/images/blog/post/focus_images/1092_shutterstock_701043430.jpg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q

Energy Efficient Upgrades That Qualify for Federal Tax Credits Looking for the ENERGY STAR label makes it easy to identify products for your home that save energy save There are lots of ways to save on energy bills around the home by upgrading your appliances Water heaters air conditioners and certain stoves qualify for a 30 percent tax credit when you upgrade to newer

Download What Appliances Qualify For Energy Tax Credit

More picture related to What Appliances Qualify For Energy Tax Credit

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

https://static1.squarespace.com/static/55b78a58e4b0e36966db31f9/t/56c73587cf80a157221137e4/1455896001786/

Energy Efficient Appliances That Qualify For Tax Deductions TheStreet

https://www.thestreet.com/.image/ar_16:9%2Cc_fill%2Ccs_srgb%2Cfl_progressive%2Cg_faces:center%2Cq_auto:good%2Cw_768/MTg5MTk4OTA3NjEwMjQ1MDEx/anti-fatigue-kitchen-rugs.jpg

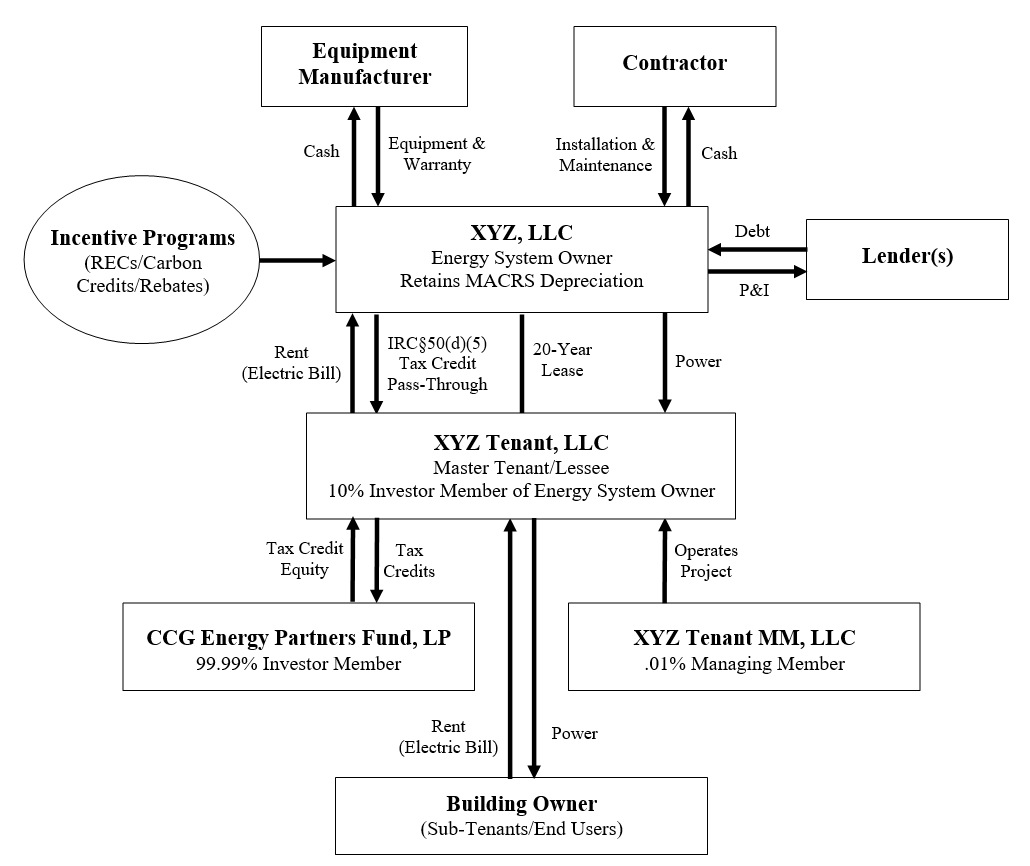

Solar Energy Transactional Structures CityScape Capital Group The

https://images.squarespace-cdn.com/content/v1/5b072f6789c172576d276207/1527364069036-7KEFSJLYUBE4USCMBKKY/setc_multitier_lease.png

What is the energy efficient home improvement credit The energy efficient home improvement credit can help homeowners cover costs related to qualifying Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q What do consumers do to get the credit s A Fill out IRS Form 5695 following IRS instructions and include it when filing your tax return Include any relevant product receipts

For qualifying property placed in service after 2022 the nonbusiness energy property credit has been expanded and renamed as the energy efficient home improvement credit Please note not all ENERGY STAR certified products qualify for a tax credit ENERGY STAR certifies energy efficient products in over 75 categories which meet strict energy

Blog BlackFridaySlash Best Deals For The Best ProductsBest

http://s35428.pcdn.co/wp-content/uploads/2020/10/Bestkitchenappliancesetstoinvestin.jpg.optimal.jpg

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

These expenses may qualify if they meet requirements detailed on energy gov 1 Solar wind and geothermal power generation 2 Solar water heaters 3 Fuel cells 4 Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of See more

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

Does A New Roof Qualify For Energy Tax Credit In Florida Bay To Bay

Blog BlackFridaySlash Best Deals For The Best ProductsBest

Free Appliances Available For Those Who Qualify Free Appliances

How To Get Free Appliances In 2020 The Logic Of Money Best Money

What Is Federal Tax Credit For Electric Cars ElectricCarTalk

What Roof Shingles Qualify For Energy Tax Credit A Guide To Saving And

What Roof Shingles Qualify For Energy Tax Credit A Guide To Saving And

What Are The Best Energy Efficient Appliances For A New Home

Energy Tax Credit Which Home Improvements Qualify SCL

Savvy Working Gal Appliances Don t Qualify For The Energy Credit

What Appliances Qualify For Energy Tax Credit - Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q