What Is Deduction From Gross Total Income Verkko 5 jouluk 2023 nbsp 0183 32 A deduction is an expense that can be subtracted from a taxpayer s gross income in order to reduce the amount of income that is subject to taxation It lowers your taxable income for the

Verkko 12 jouluk 2023 nbsp 0183 32 Gross income for an individual also known as gross pay when it s on a paycheck is an individual s total earnings before taxes or other deductions This includes income from all sources not Verkko Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions It comprises all incomes received by an individual from all sources including wages rental income interest income and dividends

What Is Deduction From Gross Total Income

What Is Deduction From Gross Total Income

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Deductions From Gross Total Income 5 1 LEARNING OUTCOMES DEDUCTIONS

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a592d9a114307ad79f8df40397379f9d/thumb_1200_1548.png

Deductions From Gross Total Income

https://image.slidesharecdn.com/d4mgti-181004013618/95/deductions-from-gross-total-income-2-638.jpg?cb=1538622203

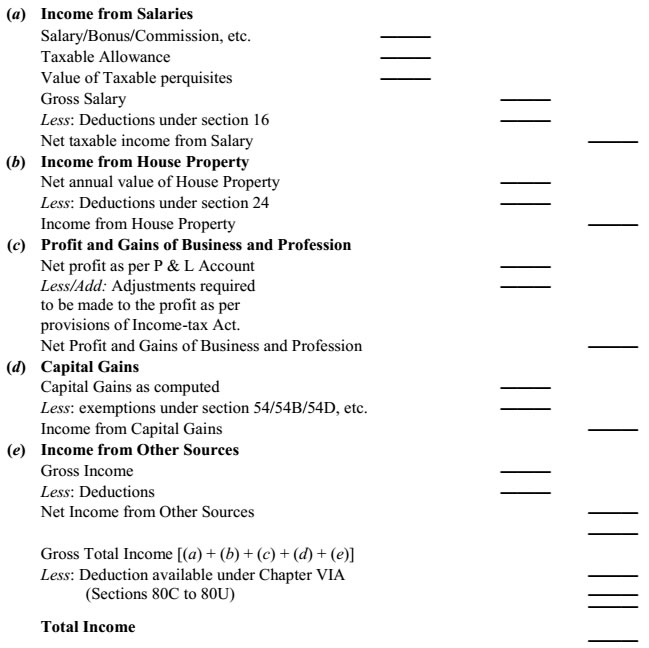

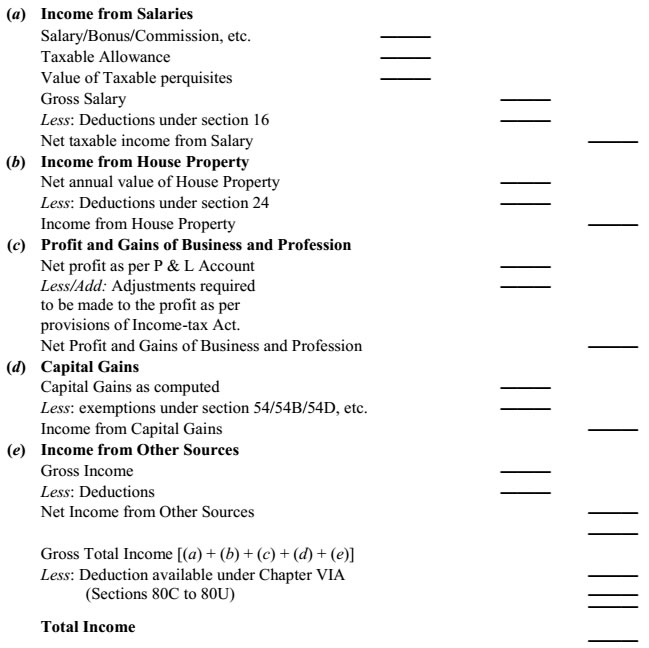

Verkko The aggregate of income computed under each head after giving effect to the provisions for clubbing of income and set off of losses is known as quot Gross Total Income quot In computing the total income of an assessee certain deductions are permissible under sections 80C to 80U from Gross Total Income These deductions are however not Verkko 28 jouluk 2023 nbsp 0183 32 Gross total income refers to the total of income computed under the five heads of income Taxable income is obtained after deducting various deductions under Chapter VI A from gross total income Q Is a surcharge calculated on total income or on taxable income

Verkko Lecture By Prof Nainesh Patel Video includes Concept of Deductions from Gross Total Income of Direct Tax T Y B Com Semester 5 Verkko 30 huhtik 2023 nbsp 0183 32 A tax deduction is an amount that you can deduct from your taxable income to lower the amount of taxes that you owe You can choose the standard deduction a single deduction of a fixed

Download What Is Deduction From Gross Total Income

More picture related to What Is Deduction From Gross Total Income

How To Calculate Net Take Home Salary Haiper

https://www.patriotsoftware.com/wp-content/uploads/2019/12/gross-vs.-net-pay-visual.jpg

Lecture 44 Deduction From Gross Total Income YouTube

https://i.ytimg.com/vi/xBgqekzmPZk/maxresdefault.jpg

2023 Paycheck Calculator HoaiAnastazia

https://apspayroll.com/wp-content/uploads/2021/07/Gross-Pay-Calculation.png

Verkko Deductions from section 80C to 80U are deducted from Gross Total Income to arrive at total income of the assessee which is also known as taxable income However deductions are not allowed from the following items although they form part of Gross Total Income a Short term capital gain under sec 111A b Long term capital gain Verkko 30 syysk 2023 nbsp 0183 32 Gross income however can incorporate much more basically anything that s not explicitly designated by the IRS as being tax exempt Tax exempt income includes child support payments most

Verkko 22 maalisk 2022 nbsp 0183 32 Gross Total Income 6 96 000 Less Deductions under Chapter VI A Under Section 80C Premium paid in respect of policy taken on life of son Note 1 25 000 Premium paid in respect of policy taken on own life Note 2 20 000 Under Section 80D Medical insurance premium paid Note 3 50 000 Under section 80TTB Interest on Verkko 29 marrask 2023 nbsp 0183 32 Gross income guides financial planning budgeting and investment strategies Its components encompass wages business profits rental income investments and more Exclusions like gifts and inheritances affect taxable income Calculating gross income involves summing earnings pre deductions Contrasting

FAQs On Deduction Available From Gross Total Income Taxmann

https://www.taxmann.com/post/wp-content/uploads/2022/03/7.Landscape-2-1.jpg

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

How To Calculate Net Income In Finance Haiper

https://www.investopedia.com/thmb/kXfSkhhw0-QCdPUbrNqPeI9rpn4=/2092x0/filters:no_upscale():max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg

https://www.investopedia.com/terms/d/deduction.asp

Verkko 5 jouluk 2023 nbsp 0183 32 A deduction is an expense that can be subtracted from a taxpayer s gross income in order to reduce the amount of income that is subject to taxation It lowers your taxable income for the

https://www.investopedia.com/terms/g/grossincome.asp

Verkko 12 jouluk 2023 nbsp 0183 32 Gross income for an individual also known as gross pay when it s on a paycheck is an individual s total earnings before taxes or other deductions This includes income from all sources not

DEDUCTIONS FROM GROSS TOTAL INCOME YouTube

FAQs On Deduction Available From Gross Total Income Taxmann

Deductions From Gross Total Income Under Section 80C To 80 U Of Income

Tax Savings Deductions Under Chapter VI A Learn By Quicko

SOLUTION Deductions From Gross Total Income Studypool

Gross Total Income Section 80B 5 Definations Under I Tax

Gross Total Income Section 80B 5 Definations Under I Tax

Download Adjusted Gross Income Calculator Excel Template ExcelDataPro

Section 80C Deductions List To Save Income Tax FinCalC Blog

Qualified Business Income Deduction And The Self Employed The CPA Journal

What Is Deduction From Gross Total Income - Verkko DEDUCTIONS FROM GROSS INCOME These deductions are items allowed to be deducted from Gross Income to determine Taxable Income a For tax purposes such deductions partake the nature of tax exemptions hence only those explicitly provided by existing laws are allowed to be deducted from Gross Income