What Is Rebate In Tax Understanding Tax Rebates and Adjustments Rebates These are partial or full refunds of taxes you ve already paid Adjustments These reduce your taxable income before calculating your tax liability Claiming Your Tax Benefits Here s a breakdown of common adjustments and rebates available in Pakistan 1 Utility Bill Adjustments

A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act Income Tax Refund Refund can be only claimed if the person has filed their Income Tax Return electronically A manual Return does not entitle you to a refund The refund amount should be clearly reflected in your Income Tax Return in Iris

What Is Rebate In Tax

What Is Rebate In Tax

https://i.ytimg.com/vi/Hztq_FdPKLk/maxresdefault.jpg

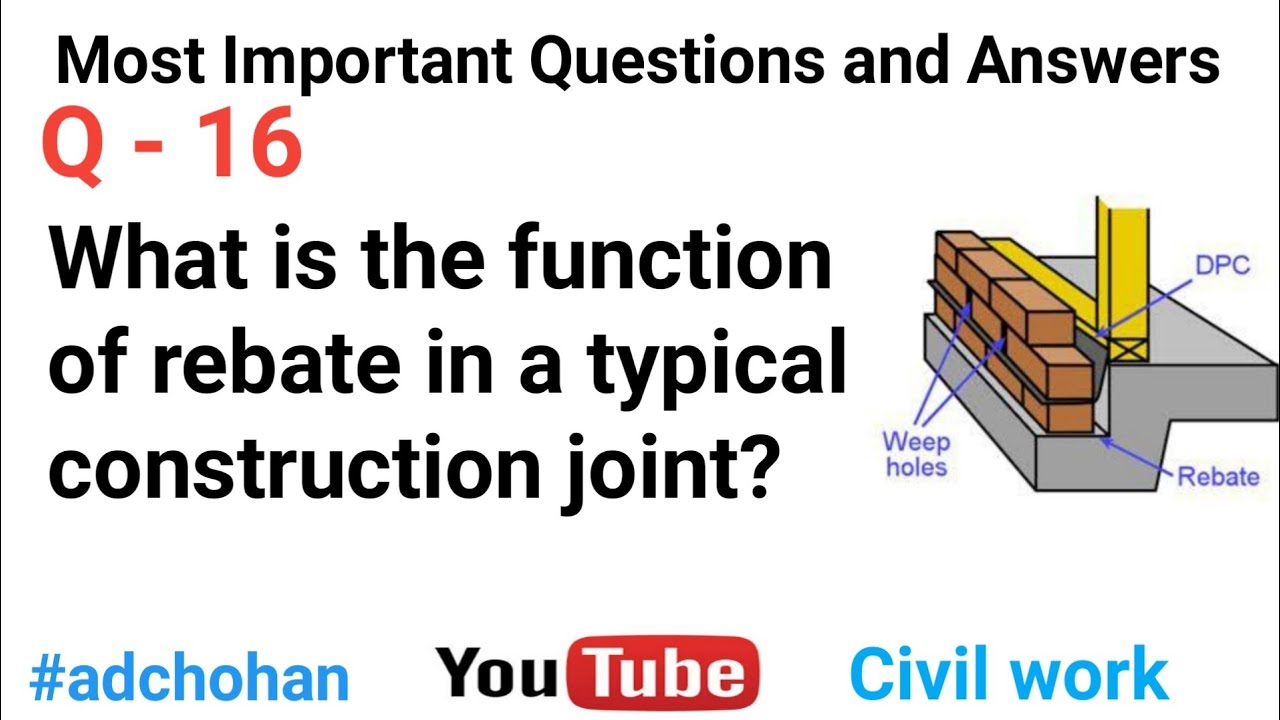

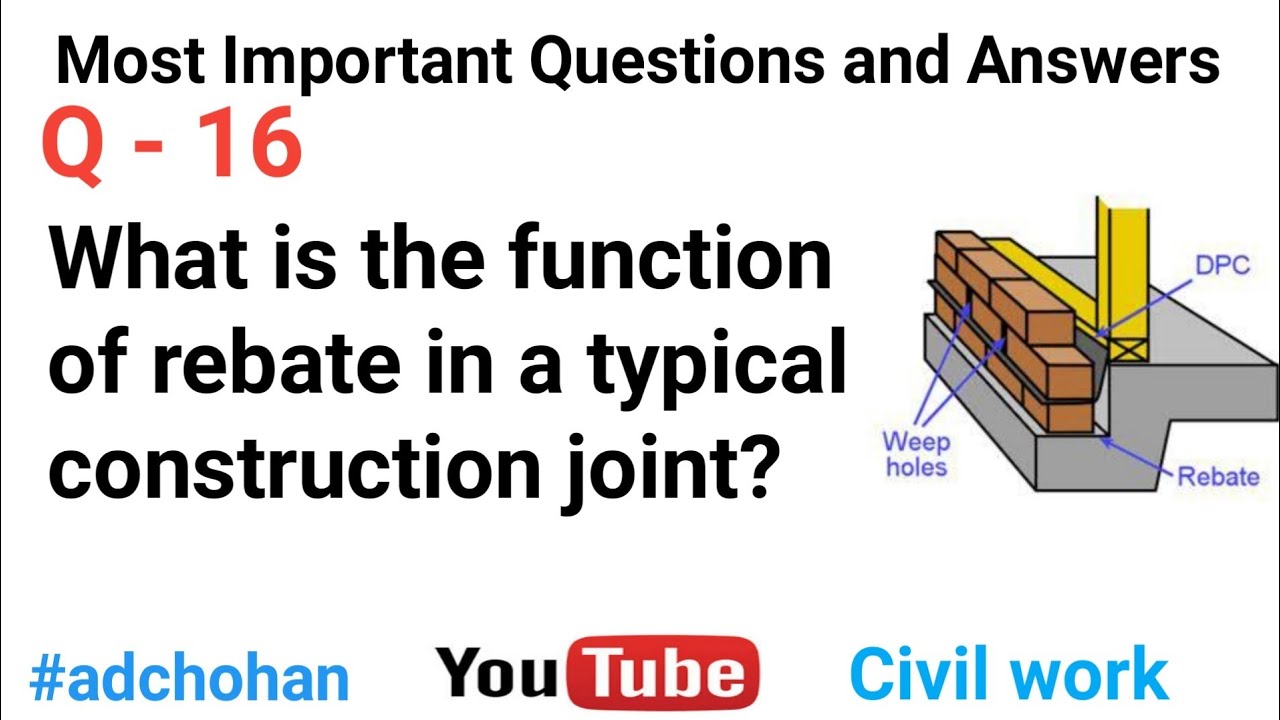

Function Of Rebate Construction Joint Most Important Questions And

https://i.ytimg.com/vi/ZNSQDuNEIag/maxresdefault.jpg

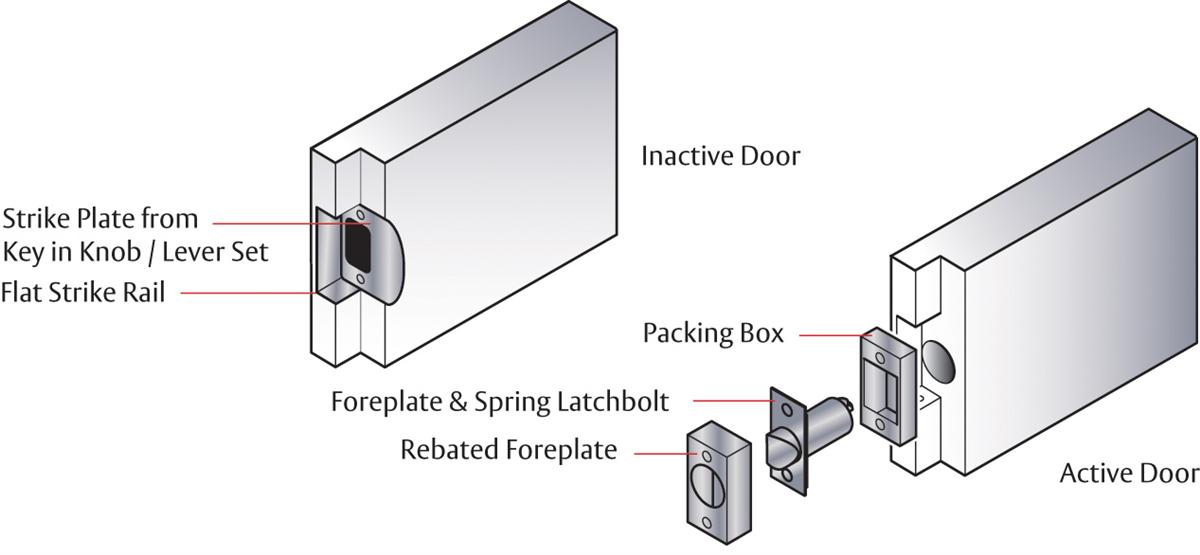

Lockwood Symmetry Series Universal Rebate Kit LOCKWOOD

https://www.lockweb.com.au/au/en/product-assets/door-locks/locksets/symmetry-series-universal-rebate-kit/assets/images/cbadc-130426071256135.jpg

Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24 Your income tax liability becomes nil after claiming the rebate under Section 87A Save Up to 20 Tax on your taxable income Home Tax Rebate Calculator Pay up to 20 less tax on your salary by investing in Pension Funds managed by UBL Fund Managers Calculate your tax savings Pension schemes offer considerable tax savings for individual clients

Everything about New regime for AY 2024 25 is answered Slide 1 TAX slabs for New vs Old for AY 2024 25 Slide 2 87A rebate for New regime Slide 3 New regime List of Deductions not allowed as compare to Old Slide 4 NEW vs Centralized System of online payment of Sales Tax FED refunds Refund of amount overpaid Persons that can claim Refund Refund of sales tax paid as input tax can be claimed by the following registered persons in the respective situations

Download What Is Rebate In Tax

More picture related to What Is Rebate In Tax

What Is Rebate GETBATS Blog

https://blog.getbats.com/uploads/images/202104/image_750x_607662dab7d45.jpg

Rebate PNG Images Transparent Free Download PNGMart

http://www.pngmart.com/files/7/Rebate-PNG-Image.png

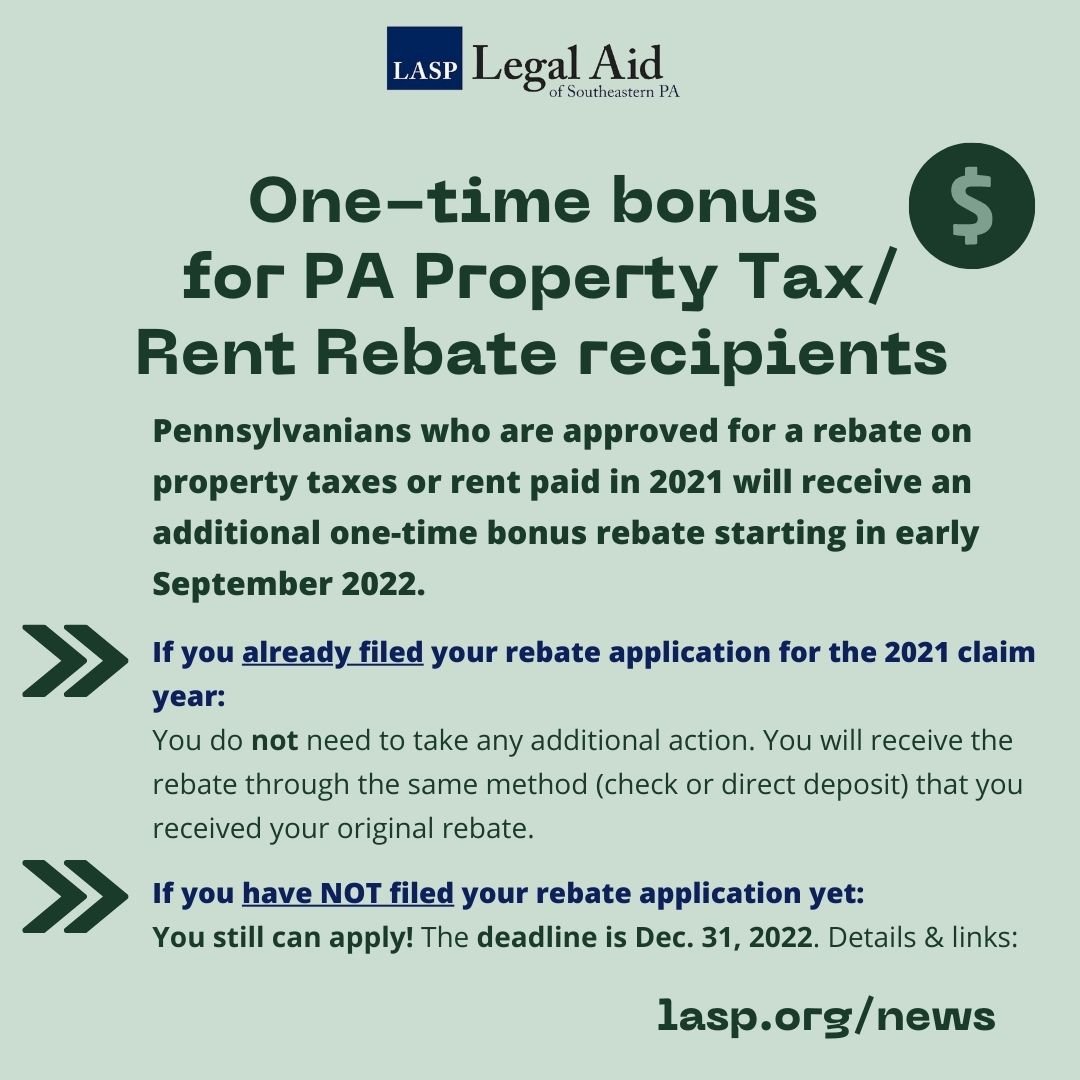

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

http://static1.squarespace.com/static/5d8d4c603aab2563d4a30208/t/62ebf2c02ff2b767de17f485/1659630272071/2022-8-4+one-time+bonus+rebate+-+property+tax+rebate-insta.jpg?format=1500w

Head of Income Under the Income Tax Ordinance 2001 all Income are broadly divided into following five heads of Income Salary Income from property Income from business Capital gains and Income from Other Sources Resident An individual is Resident for a Tax Year if It is a benefit provided by the government to incentivize and provide relief to certain categories of taxpayers The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2023 24 under the old regime

[desc-10] [desc-11]

What Is Rebate In Forex Brokers

https://www.brokerxplorer.com/upload/images/20200715152632_rebate-in-forex.jpg

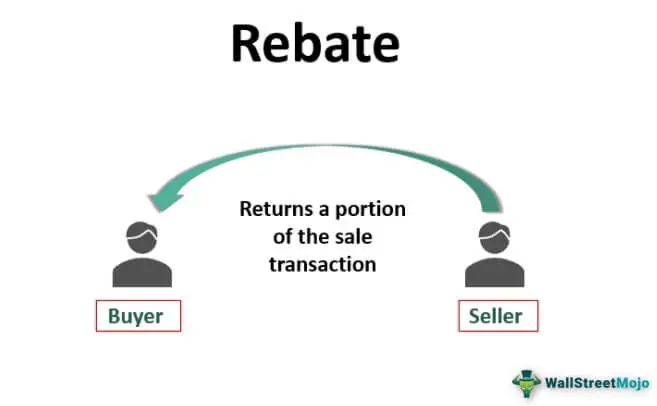

Rebate What Is It Example Vs Discount Types Regulations

https://www.wallstreetmojo.com/wp-content/uploads/2021/01/Rebate.jpg.webp

https://taxationpk.com/understanding-tax...

Understanding Tax Rebates and Adjustments Rebates These are partial or full refunds of taxes you ve already paid Adjustments These reduce your taxable income before calculating your tax liability Claiming Your Tax Benefits Here s a breakdown of common adjustments and rebates available in Pakistan 1 Utility Bill Adjustments

https://www.bajajfinserv.in/insights/income-tax-rebate

A tax rebate essentially entails a reduction in the tax amount that individuals are required to pay It serves as an incentive offered by the government to encourage savings and is specifically outlined in Section 237 of the Income Tax Act

Difference Between Income Tax Deductions Exemptions And Rebate Plan

What Is Rebate In Forex Brokers

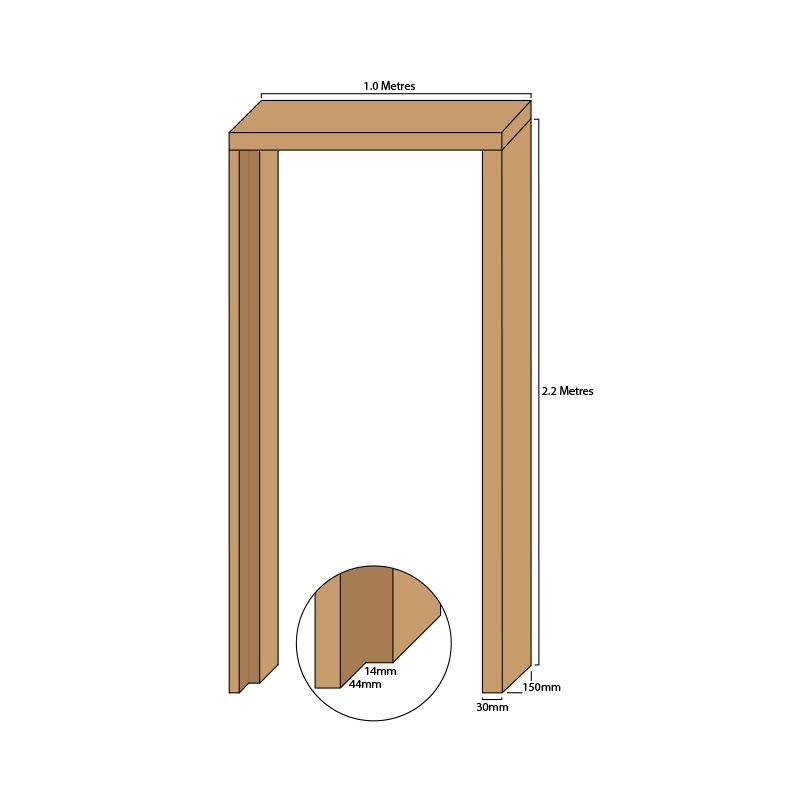

Tulipwood Single Door Casing 30mm Thickness Rebated 44mm

What Is A Rebate Enable

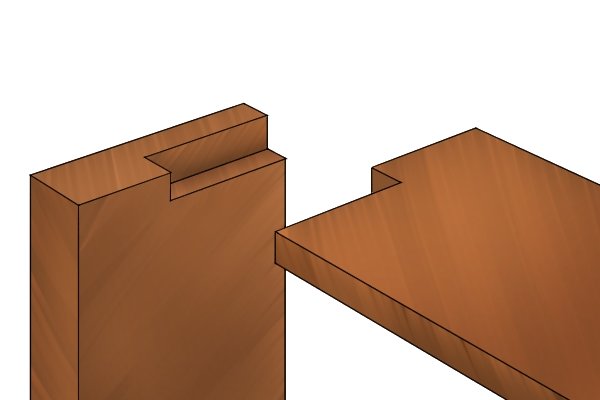

Wood Joints Guide

What Is Rebate In Hindi

What Is Rebate In Hindi

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Repair Door Frame rebate Separating YouTube

All You Need To Know About 87a Tax Rebate For Annual Year 2017 18

What Is Rebate In Tax - Everything about New regime for AY 2024 25 is answered Slide 1 TAX slabs for New vs Old for AY 2024 25 Slide 2 87A rebate for New regime Slide 3 New regime List of Deductions not allowed as compare to Old Slide 4 NEW vs