What Is Tax Form For Tuition Tuition paying students at eligible colleges or other post secondary institutions should receive a copy of Internal Revenue Service Form 1098 T from their school each year

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details Students enrolled at designated educational institutions receive a form T2202 the Tuition and Enrollment Certificate which tells the CRA how much tuition can

What Is Tax Form For Tuition

What Is Tax Form For Tuition

https://i.pinimg.com/originals/42/3a/a8/423aa844203f1214b94766580e5da739.jpg

Daycare Statement Template

https://www.signnow.com/preview/100/315/100315789/large.png

Tax Lecture Notes 11 India Tax Structure 2011 This Guide Provides

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/01891a6244cbe5bf07c39cc78c54c570/thumb_1200_1553.png

Form 1098 T is a tax document prepared by higher education institutions to report payments of qualified tuition and related expenses QTRE as well as scholarships and Qualified expenses are amounts paid for tuition fees and other related expense for an eligible student that are required for enrollment or attendance at an

Schools must make Form 1098 T available to any student who paid in the previous tax year qualified educational expenses Tuition any fees that are required for enrollment Learn what the 1098 T form is how it affects your taxes and where to get it from your school or loan servicer

Download What Is Tax Form For Tuition

More picture related to What Is Tax Form For Tuition

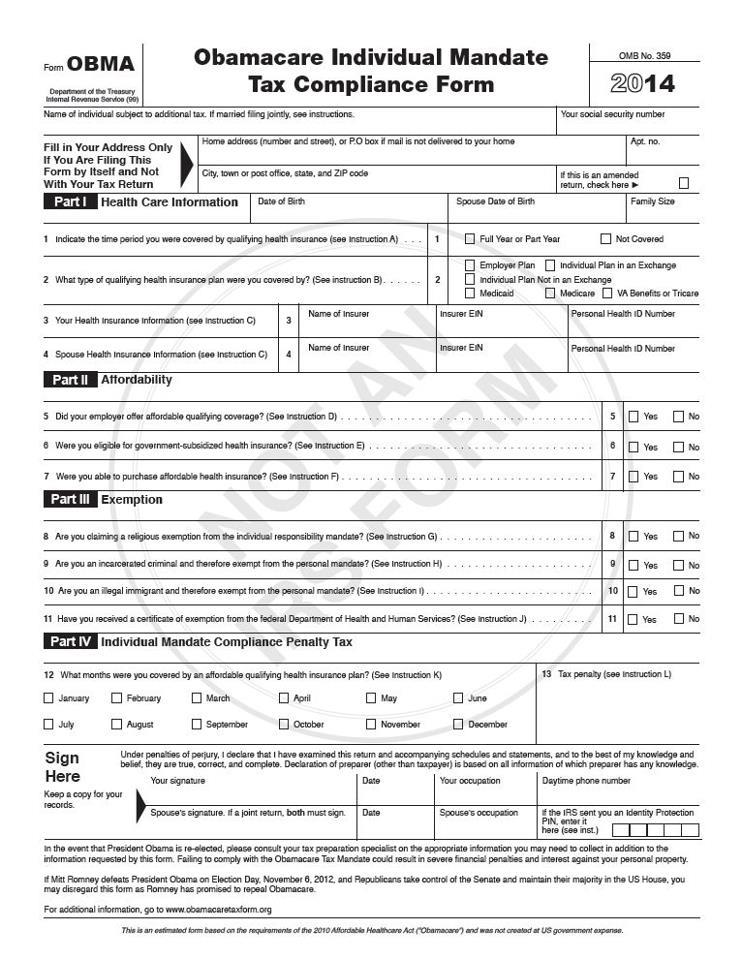

Projected IRS Tax Form For Obamacare Individual Mandate Released

http://www.westernjournalism.com/wp-content/uploads/2012/10/Tax-Form-SC.jpg

What Is Tax Avoidance Tax Avoidance Is The Use Of Lawful Means To

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/815c348a4a4ee15a46473a5b0a43da03/thumb_1200_1553.png

Form 1040X The Amended Tax Return

https://irstaxpros.com/wp-content/uploads/2021/05/Untitled-design-73-1.jpg

A form 1098 T Tuition Statement is used to help figure education credits and potentially the tuition and fees deduction for qualified tuition and related expenses The IRS Form 1098 T is an information form filed with the Internal Revenue Service The IRS Form 1098 T that you receive reports amounts paid for qualified tuition and related

With a 1098 T the business your college reports how much qualified tuition and expenses you or your parents paid it during the tax year The IRS uses You may receive a Form 1098 T Tuition Statement from your educational institution The form provides information necessary to complete your tax return

Small Business Hub Taxes Invoice2go

https://invoice2go.imgix.net/2021/10/How-Long-To-Keep-Tax-Records.jpg?auto=format&ixlib=react-9.3.0&w=400&h=225&dpr=4&q=23

What Is Tax Assessed Value Tax Appraised Value And Market Assessed Value

https://wp-tid.zillowstatic.com/1/shutterstock_4697778532-55d5d8.jpg

https://turbotax.intuit.com/tax-tips/college-and...

Tuition paying students at eligible colleges or other post secondary institutions should receive a copy of Internal Revenue Service Form 1098 T from their school each year

https://www.taxfyle.com/blog/form-1098-t

Form 1098 T also known as the Tuition Statement is a vital tax form sent by educational institutions to students and the Internal Revenue Service IRS It details

Edit Document Tax Declaration Form And Keep Things Organized

Small Business Hub Taxes Invoice2go

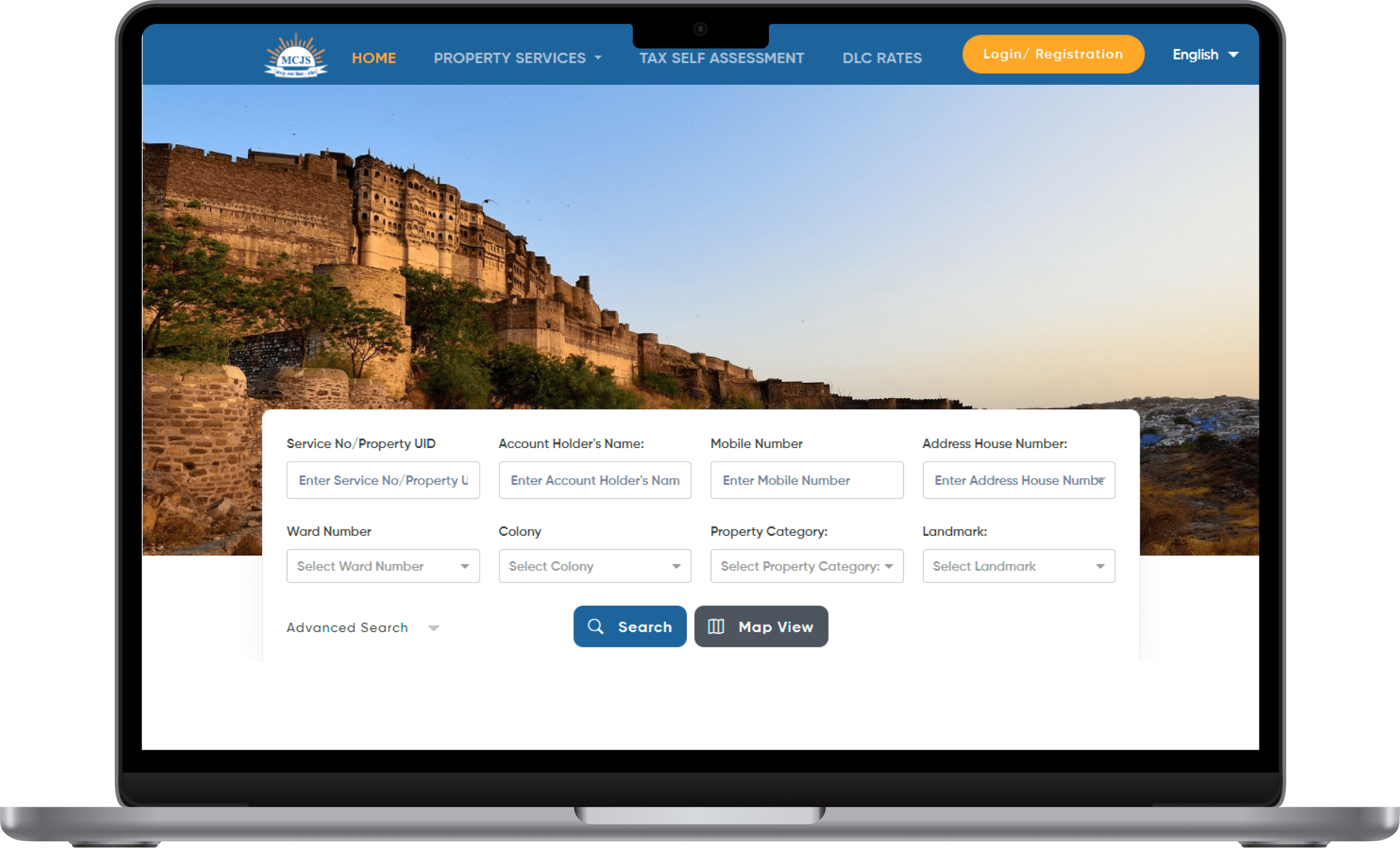

Tax Management System CraftedQ

Document Tax Practice Study Materials What Is Tax Management

2024 Taxes Credits And Deductions You Won t Want To Miss MoneyTalk

Tax Forms Revolution Technologies

Tax Forms Revolution Technologies

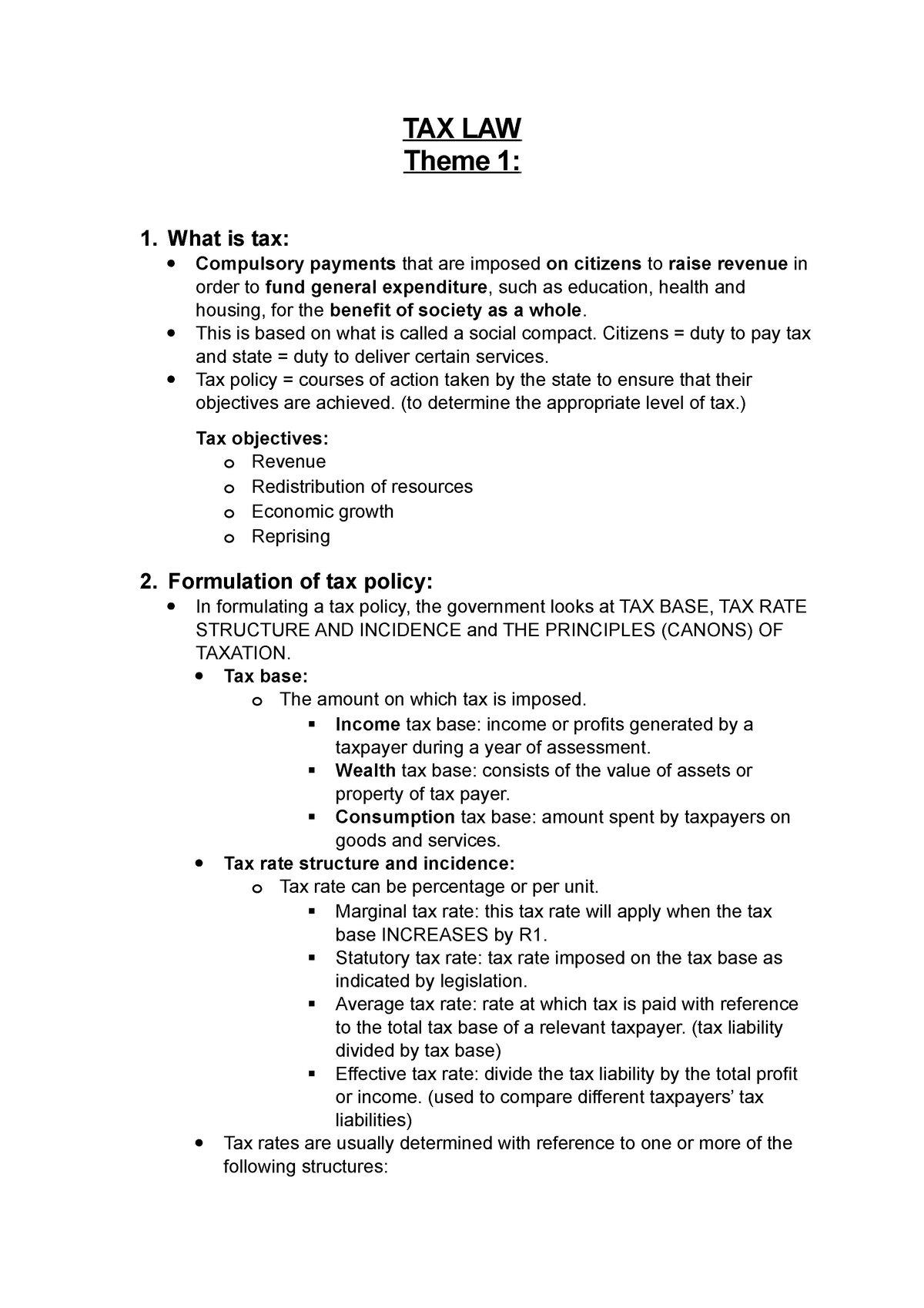

Theme 1 Notes BLR 310 TAX LAW Theme 1 1 What Is Tax Compulsory

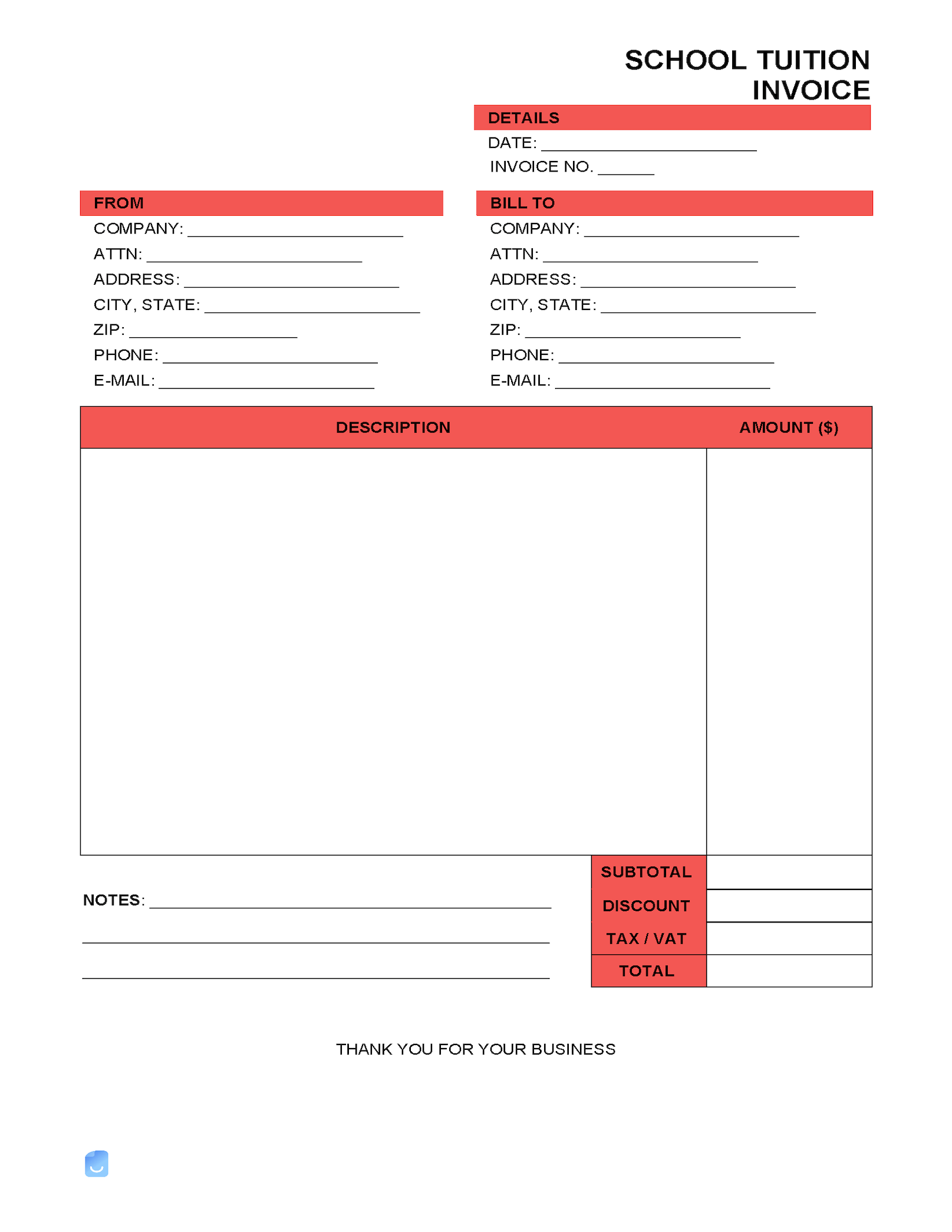

School Tuition Invoice Template Invoice Maker

1098 T Form How To Complete And File Your Tuition Statement

What Is Tax Form For Tuition - Form 1098 T is a tax document prepared by higher education institutions to report payments of qualified tuition and related expenses QTRE as well as scholarships and