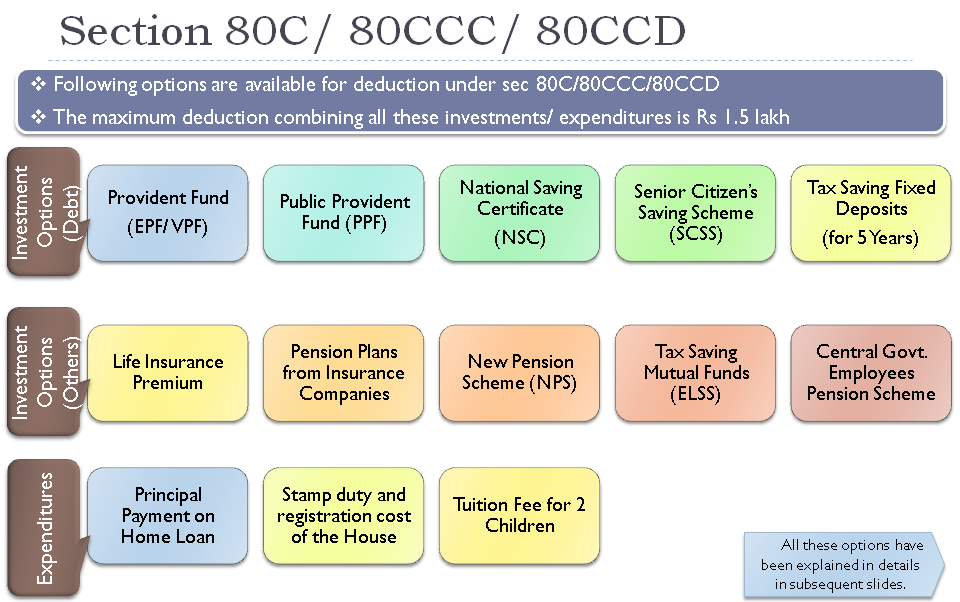

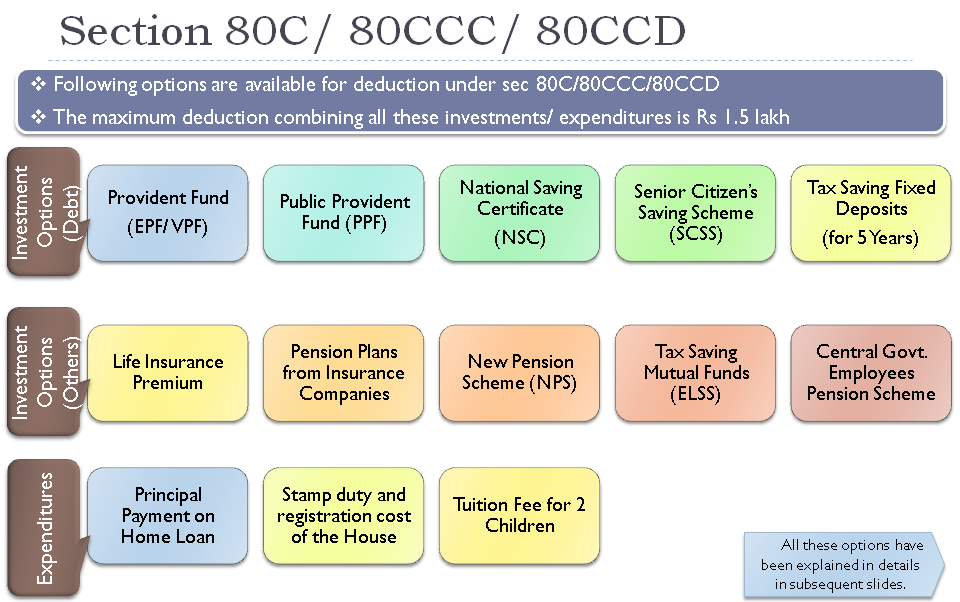

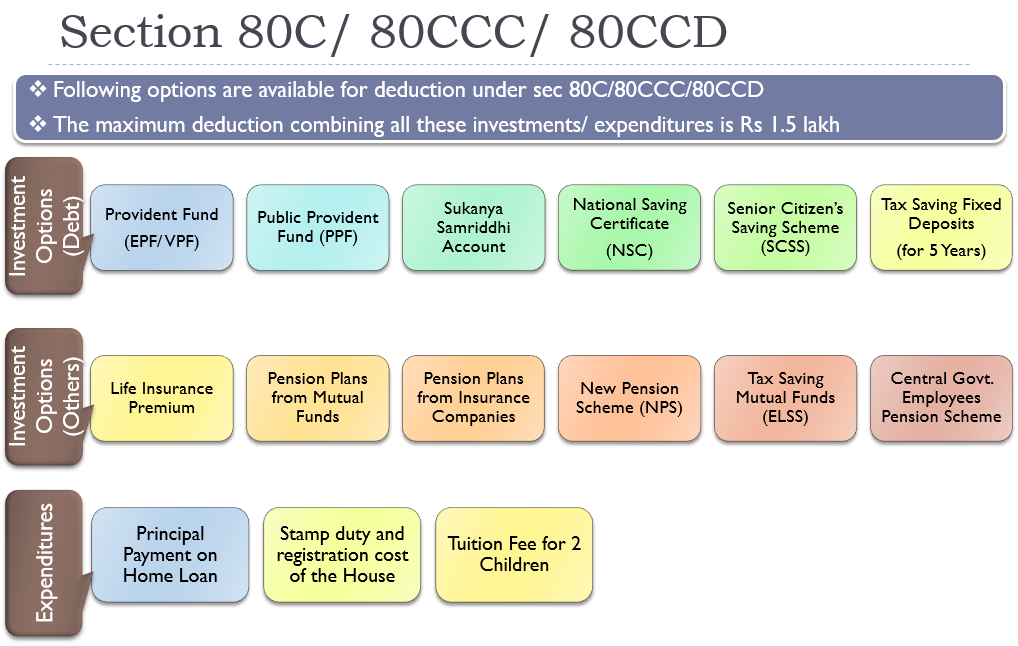

What Is The Maximum Tax Exemption Under 80c Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum

The maximum deduction that an individual or Hindu undivided family HUF is eligible to avail under Section 80C is cumulatively restricted at INR 1 5 lakh for a Here are the available exemptions You can claim a deduction of upto 20 of gross income under Section 80CCD 1 but within the overall limit of Rs 1 5 lakh under Section 80CCE Additional tax

What Is The Maximum Tax Exemption Under 80c

What Is The Maximum Tax Exemption Under 80c

https://lexntax.com/wp-content/uploads/2018/01/Deduction-Under-Income-Tax-1024x640-1.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

Section 80C limit in interim Budget 2024 Various investments and expenditures specified under Section 80C allow individuals to claim a maximum Tax exemption under ELSS mutual funds is available u s 80C of the Income Tax Act 1961 with a tax rebate limit of INR 1 50 000 per year With this a taxpayer can

Investments in SCSS are eligible for tax benefits under Section 80C up to a maximum of Rs 1 5 lakh The scheme provides a safe and reliable investment option for senior citizens to earn regular income In that case they can claim an additional deduction for up to Rs 50 000 in a financial year under section 80CCD 1B Section 80CCD 1B deduction can be claimed

Download What Is The Maximum Tax Exemption Under 80c

More picture related to What Is The Maximum Tax Exemption Under 80c

Exemptions Allowances And Deductions Under Old New Tax Regime

https://www.taxhelpdesk.in/wp-content/uploads/2023/06/EXEMPTIONS-ALLOWANCES-DEDUCTIONS-AVAILABLE-UNDER-THE-OLD-NEW-TAX-REGIME-1.jpg

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

INCOME TAX DEDUCTION UNDER SECTION 80C TO 80U PDF

https://moneyexcel.com/images/incometaxchart.png

One such deduction is section 80C which allows individuals and HUFs to claim deductions for investments and expenses mentioned under the Income Tax Act Section 80C has two subsections 80CCC Under 80CCC for the Income Tax Act 1961 annuity and pension plans are entitled to tax exemptions For payment towards these plans the maximum deduction available is Rs 1 5 lakh per year

The maximum amount of deduction you can claim under this section per financial year is Rs 1 50 000 a combined limit that includes sections 80CCC and 80CCD 1 The Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C An additional Rs 50 000 can also be invested in the NPS for tax deductions under

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Exemption In Lieu Of 80C Tax Benefits

https://geod.in/wp-content/uploads/2015/02/Saving-tax.jpg

https://groww.in/p/tax/section-80c

Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum

https://www.forbes.com/advisor/in/tax/tax-income-tax-deduction-80c

The maximum deduction that an individual or Hindu undivided family HUF is eligible to avail under Section 80C is cumulatively restricted at INR 1 5 lakh for a

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Section 80C Deductions List To Save Income Tax FinCalC Blog

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Budget 2014 Impact On Money Taxes And Savings

Budget 2014 Impact On Money Taxes And Savings

Tax Savings Deductions Under Chapter VI A Learn By Quicko

How To Claim Tax Exemptions Here s Your 101 Guide

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

What Is The Maximum Tax Exemption Under 80c - Section 80C limit in interim Budget 2024 Various investments and expenditures specified under Section 80C allow individuals to claim a maximum