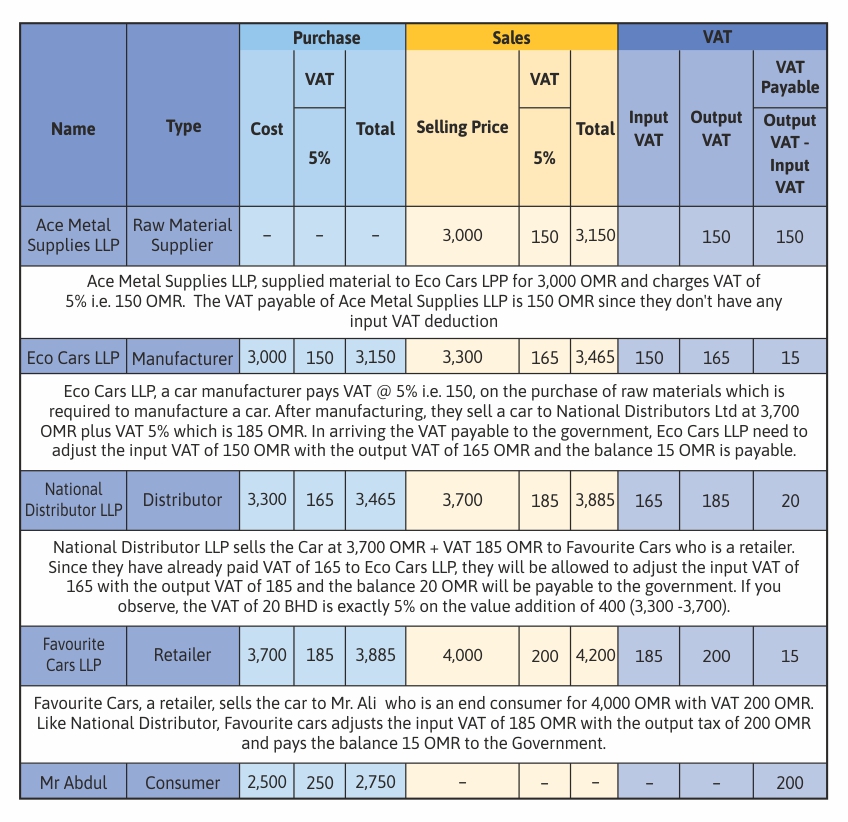

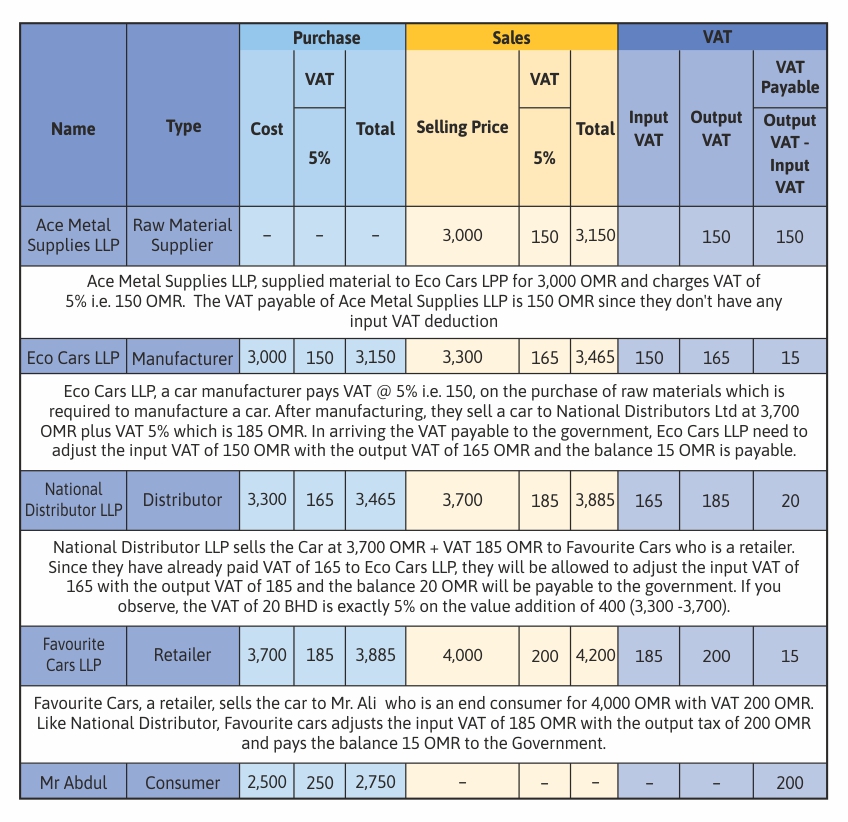

What Is Vat And How Does It Work How Does Value Added Tax VAT Work VAT is intricate in its workings but at its core it s a multi stage tax Businesses collect the tax on behalf of the government when they buy goods or services they are charged VAT and when they sell goods or services they charge VAT The idea is to tax the value addition at each transaction stage

VAT Value Added Tax is a tax added to most products and services sold by VAT registered businesses Businesses have to register for VAT if their VAT taxable turnover is more than 90 000 It is a consumption tax placed on a product whenever value is added at each stage of the supply chain from production to the point of sale Unlike sales tax which is only charged at the final sale to the consumer VAT is collected at multiple points in the production and distribution chain What s the Purpose of VAT

What Is Vat And How Does It Work

What Is Vat And How Does It Work

https://i.ytimg.com/vi/3D76qcKuSp8/maxresdefault.jpg

What Is VAT And How Does It Work YouTube

https://i.ytimg.com/vi/N2H76YfrsPM/maxresdefault.jpg

What Is VAT And How Does It Work Easy Guide To VAT

http://excelaccountancy.com/wp-content/uploads/2023/04/What-is-VAT-And-How-Does-It-Work.jpg

Understand how a value added tax VAT works how it differs from a sales tax and the arguments for and against it Value added tax or VAT is the tax you have to pay when you buy goods or services The standard rate of VAT in the UK is 20 with about half the items households spend money on subject to this

Value added tax or VAT is the tax you have to pay when you buy goods or services The standard rate of VAT in the UK is 20 with about half the items households spend money on subject to Value added tax VAT is the international alternative to U S sales tax and is applied to the sale of goods and services in over 160 countries However VAT tax is more complex than simple

Download What Is Vat And How Does It Work

More picture related to What Is Vat And How Does It Work

What Is VAT Euro VAT Refund

https://eurovat.com/images/VAT-Number.jpg

How Does A VAT Loan Work And What Exactly Is A VAT Loan

https://westwon.co.uk/wp-content/uploads/2021/07/VAT--scaled.jpg

What Is WordleBot How Does It Work New Changes To WordleBot 2 0

https://www.rd.com/wp-content/uploads/2022/09/RD-What-Is-Wordlebot-and-How-Does-It-Work-GettyImages1.gif

A Value Added Tax VAT is a consumption tax assessed on the value added in each production stage of a good or service Every business along the value chain receives a tax credit for the VAT already paid The end consumer does not making it a tax on final consumption The Mechanics of a Value Added Tax VAT vs a Sales Tax Value Added Tax VAT is an indirect tax applied to products and services VAT is a very common tax that applies to a broad range of transactions For a registered business managing VAT is a critical accounting function If businesses do not meet their VAT obligation they risk serious fines and other penalties

[desc-10] [desc-11]

What Is VAT How Does It Work Tally Solutions

https://resources.tallysolutions.com/mena/wp-content/uploads/2021/03/what-is-vat-and-how-does-it-work_table.jpg

What Is VAT And How Does It Affect My Business Williamson Croft

https://www.williamsoncroft.co.uk/wp-content/uploads/2020/08/What-Is-VAT.jpg

https://www.financestrategists.com/tax/value-added-tax

How Does Value Added Tax VAT Work VAT is intricate in its workings but at its core it s a multi stage tax Businesses collect the tax on behalf of the government when they buy goods or services they are charged VAT and when they sell goods or services they charge VAT The idea is to tax the value addition at each transaction stage

https://www.gov.uk/how-vat-works

VAT Value Added Tax is a tax added to most products and services sold by VAT registered businesses Businesses have to register for VAT if their VAT taxable turnover is more than 90 000

VAT Or Non VAT What Should You Choose JCSN Accounting Services

What Is VAT How Does It Work Tally Solutions

Input VAT Vs Output VAT Explained YouTube

What Is Printram How Does It Work YouTube

How Does VAT Work

What Is HTTPS And How Does It Work June Dang Blog

What Is HTTPS And How Does It Work June Dang Blog

What Is Phishing And How Does It Work 2022 2023 Update Online

What Is Samsung Care And How Does It Work WebSetNet

Vat Refund Form RefundForms

What Is Vat And How Does It Work - Value added tax VAT is the international alternative to U S sales tax and is applied to the sale of goods and services in over 160 countries However VAT tax is more complex than simple