What Items Are Tax Exempt In Texas The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section

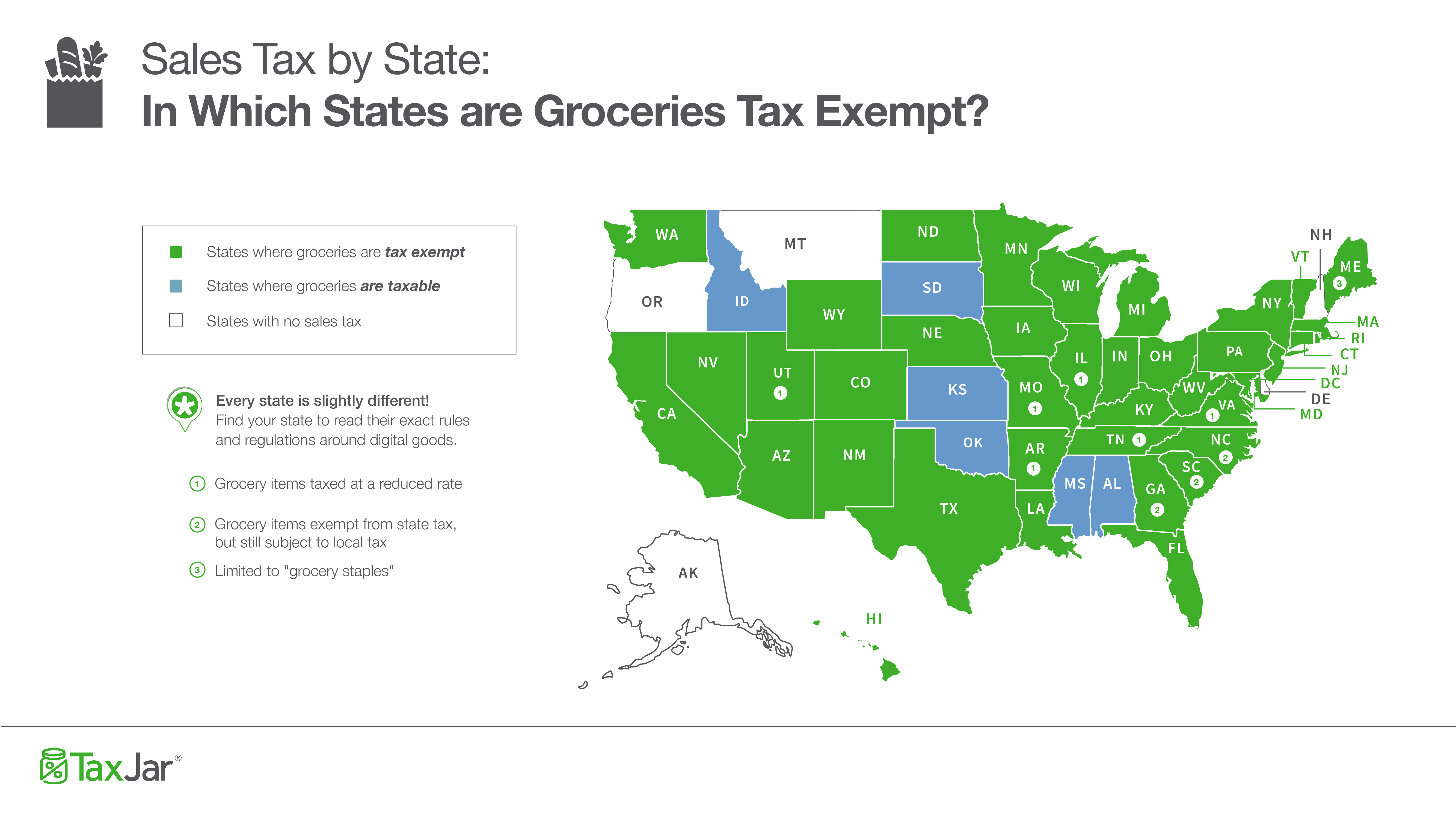

For example flour sugar bread milk eggs fruits vegetables and similar groceries food products are not subject to Texas sales and use tax Tax is due however on many Nontaxable items included many products on families grocery lists including fresh canned and frozen bakery goods milk butter and other

What Items Are Tax Exempt In Texas

What Items Are Tax Exempt In Texas

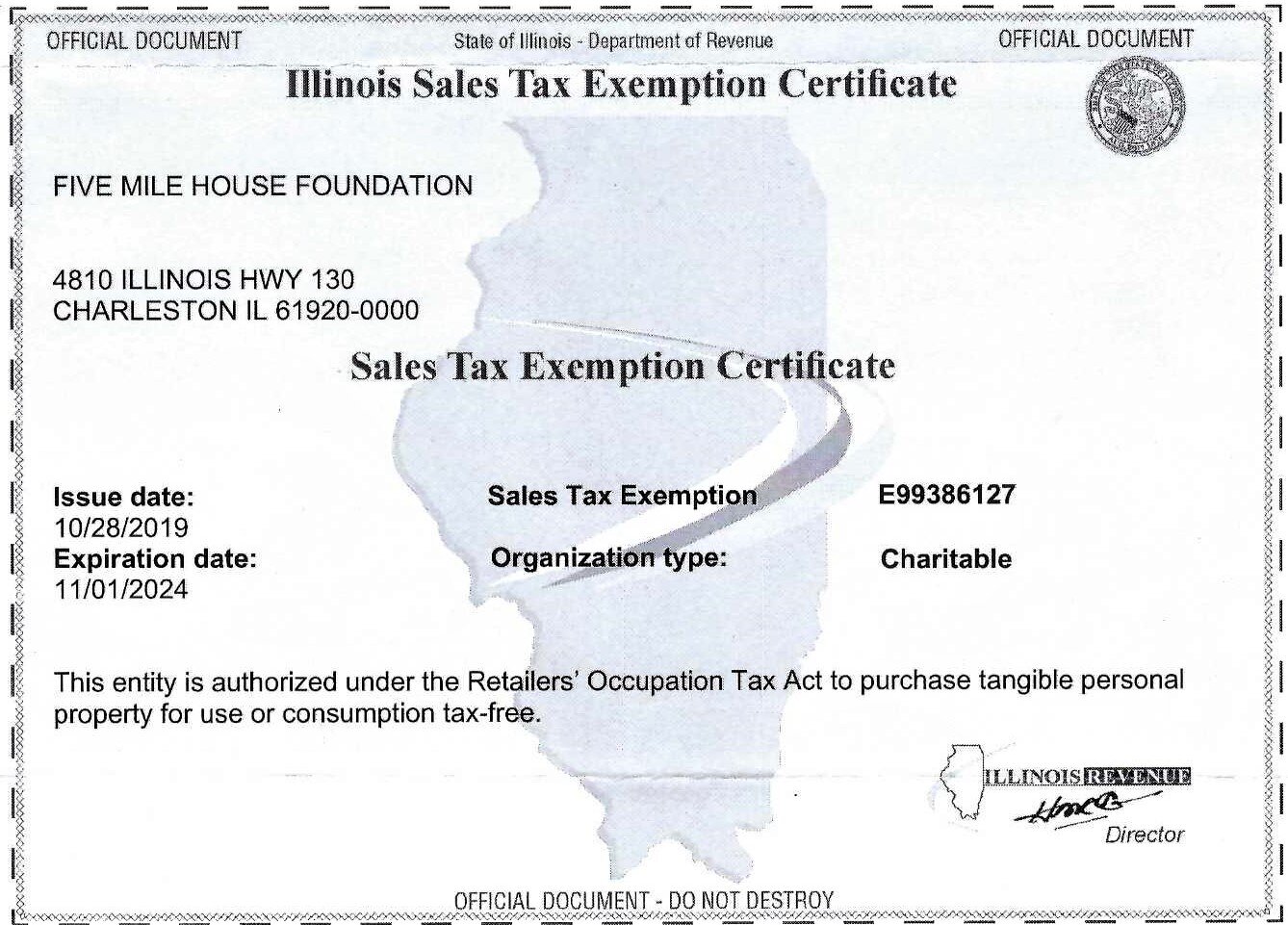

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg

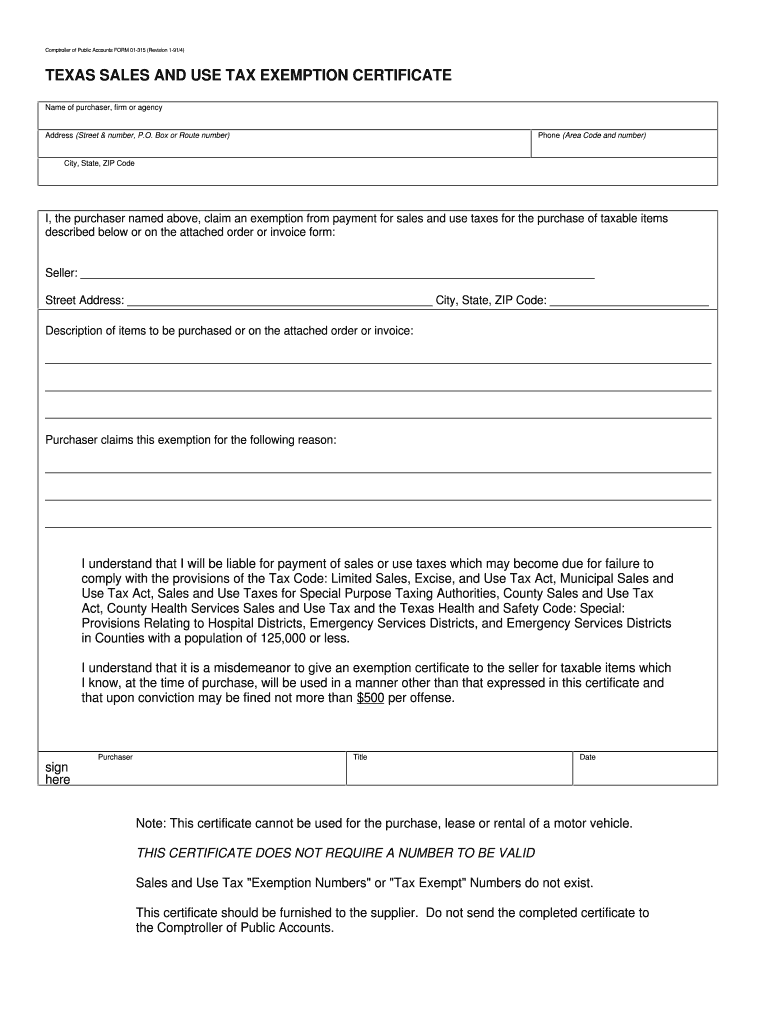

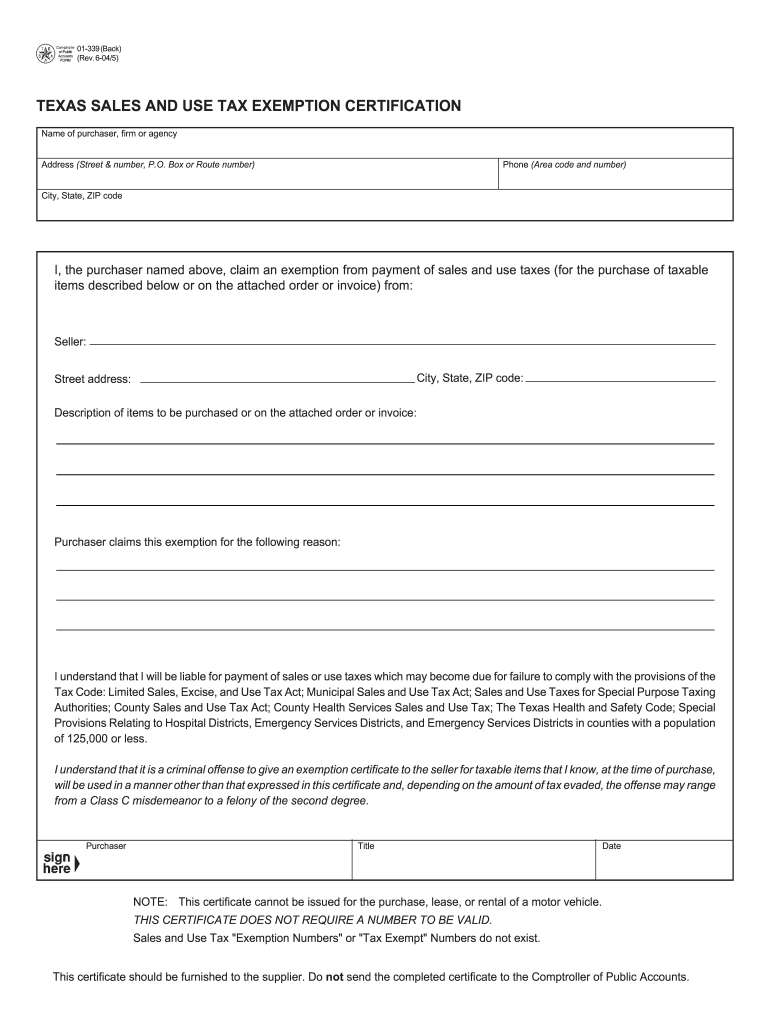

Tax Exempt Form Texas 2023 ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/texas-tax-exempt-certificate-fill-and-sign-printable-template-online-3.png

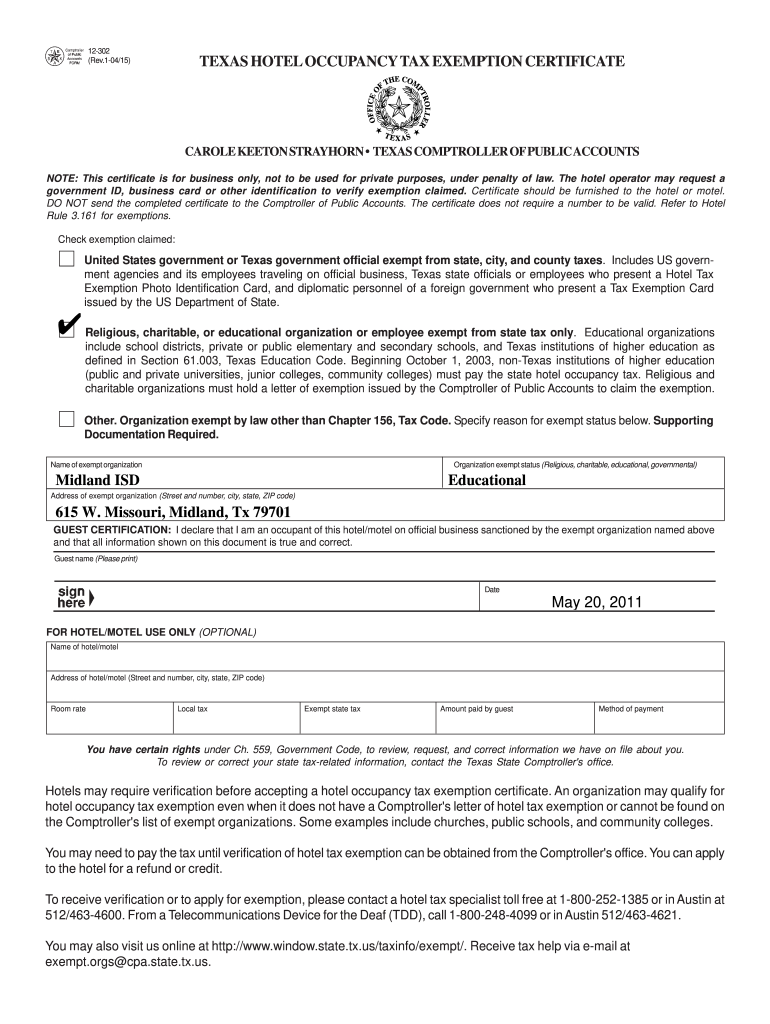

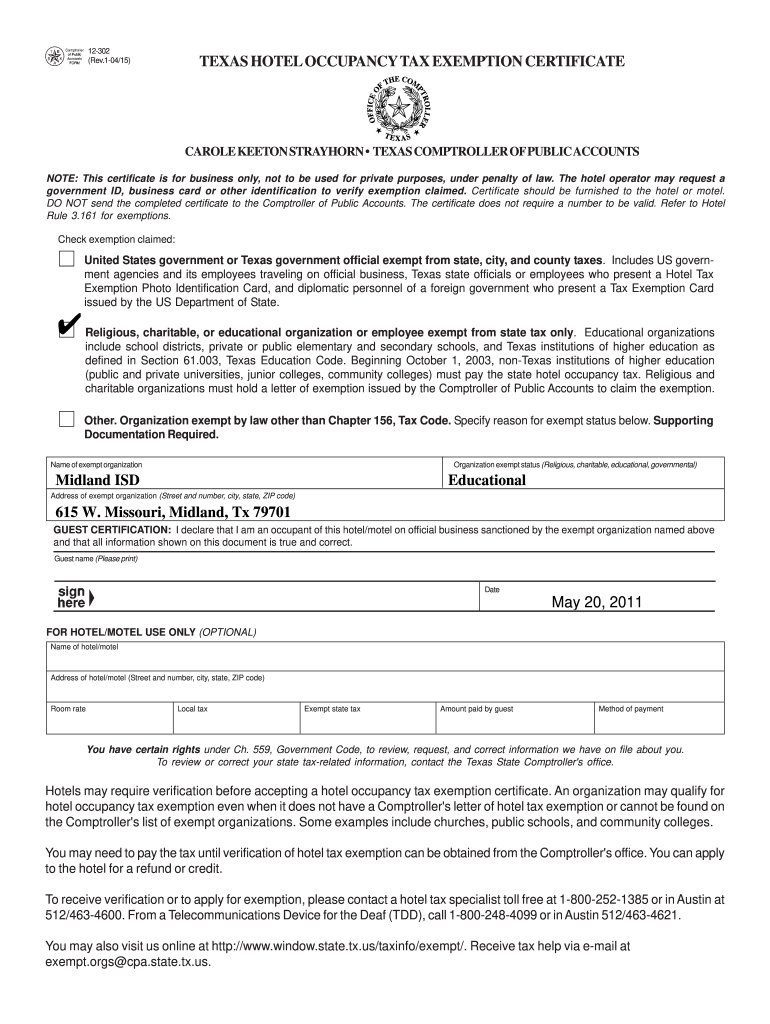

Louisiana Hotel Tax Exempt Form Fill Online Printable Fillable

https://www.pdffiller.com/preview/11/44/11044398/large.png

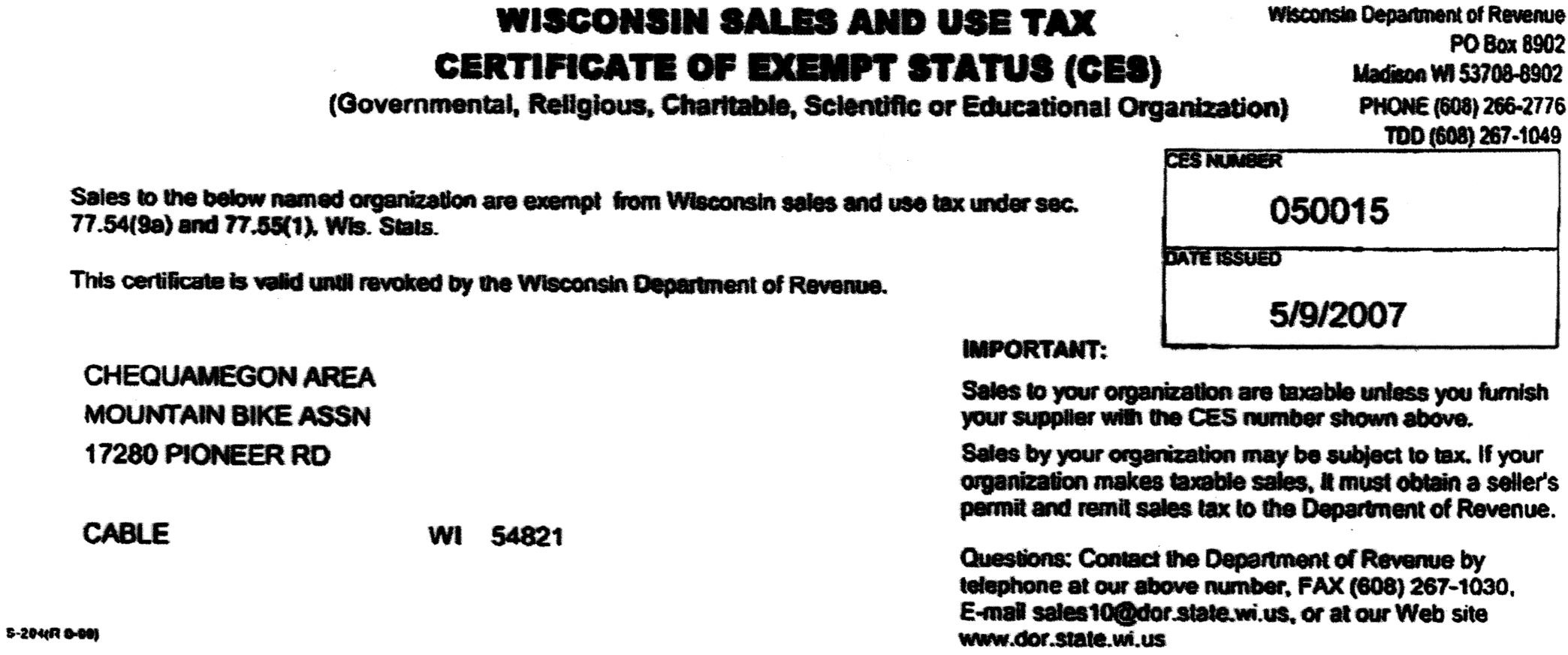

Tax exempt Organizations Goods purchased by tax exempt organization such as government agencies nonprofits or schools may qualify as a tax exempt purchase Common Texas sales tax exemptions include those for necessities of life including most food and health related items In addition goods for resale such as

Businesses must collect use taxes and submit them to the Comptroller s Office if the business does not have tax exempt status and purchases the goods from a Dietary and nutritional supplements are exempt from sales tax and can be purchased tax free Examples of Exempt Dietary and Nutritional Supplements Example of Non Exempt

Download What Items Are Tax Exempt In Texas

More picture related to What Items Are Tax Exempt In Texas

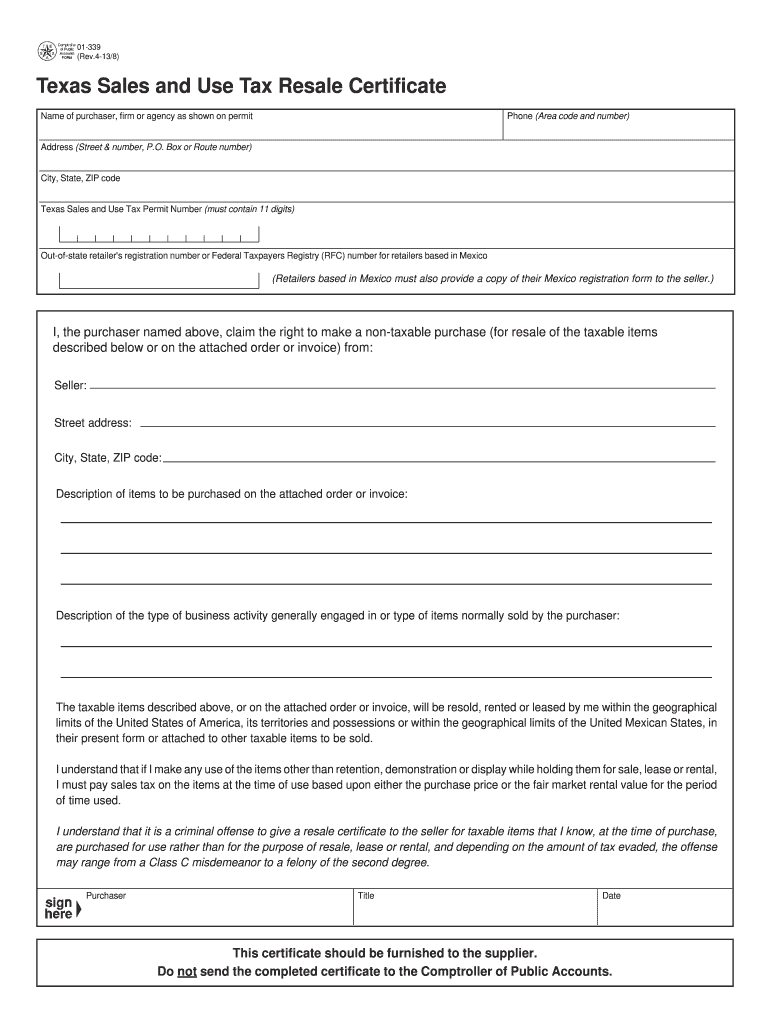

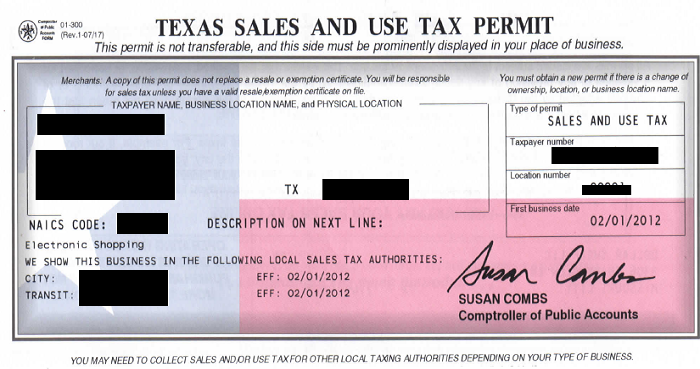

Texas Sales And Use Tax Permit Fill And Sign Printable Template

https://www.pdffiller.com/preview/0/139/139353/large.png

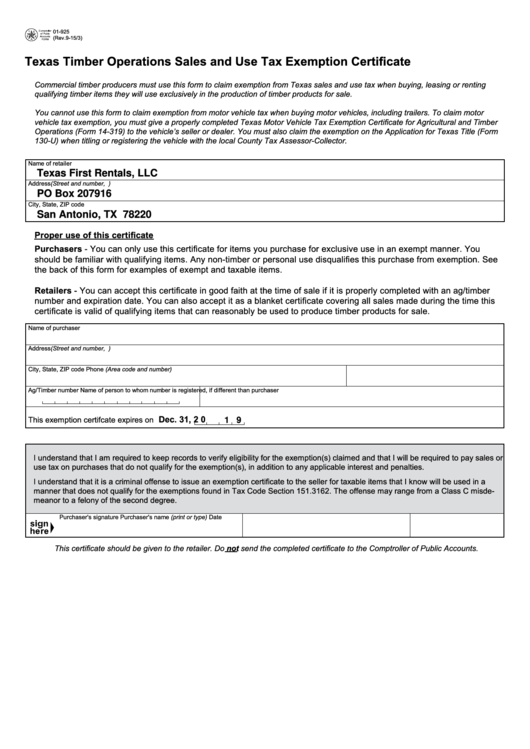

Fillable Texas Timber Operations Sales And Use Tax Exemption

https://data.formsbank.com/pdf_docs_html/135/1359/135919/page_1_thumb_big.png

Texas Tax Exempt PDF 1991 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/31/836/31836164/large.png

Certain items are exempt from sales tax in Texas providing relief to consumers Some common exemptions include Food including groceries and food The state of Texas provides certain forms to be used when you wish to purchase tax exempt items such as prescription medicines The Resale Certificate can be utilized

Texas state sales tax rate The state sales tax in Texas is 6 25 Local tax can t exceed 2 which means that 8 25 is the maximum combined sales tax that can Since books are taxable in the state of Texas Mary charges her customers a flat rate sales tax of 8 250 on all sales This includes Texas s sales tax rate of 6 250

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

Sales Tax By State Are Grocery Items Taxable

http://blog.taxjar.com/wp-content/uploads/2015/01/Blog-Nexus-2_Sales_Tax_by_State-In_Which_States_are_Groceries_Tax_Exempt-.png

https://comptroller.texas.gov/taxes/publications/96-1045.php

The Texas Tax Code provides an exemption from franchise tax and sales tax to Nonprofit organizations with an exemption from Internal Revenue Service IRS under IRC Section

https://comptroller.texas.gov/taxes/publications/96-280.php

For example flour sugar bread milk eggs fruits vegetables and similar groceries food products are not subject to Texas sales and use tax Tax is due however on many

Taxact Online Fillable Tax Forms Printable Forms Free Online

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

16 Best Images Of Sales And Use Tax Worksheet Texas Sales And Use Tax

What Is A Sales And Use Tax Permit

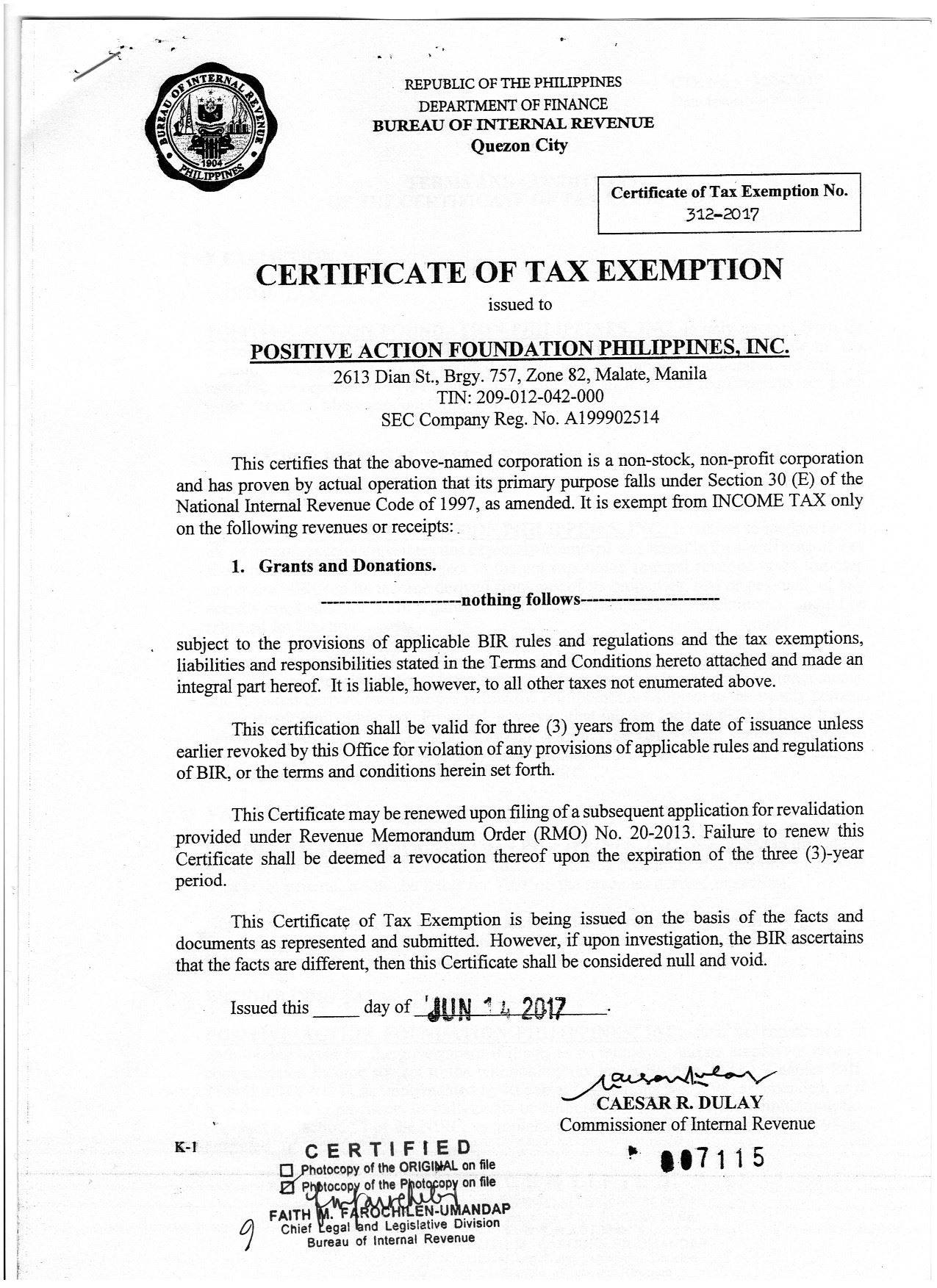

2017 PAFPI Certificate Of TAX Exemption PAFPI

Bupa Tax Exemption Form Florida Sale For Resale Exemption Certificate

Bupa Tax Exemption Form Florida Sale For Resale Exemption Certificate

Sales Tax Exemption Request Letter Malayagif

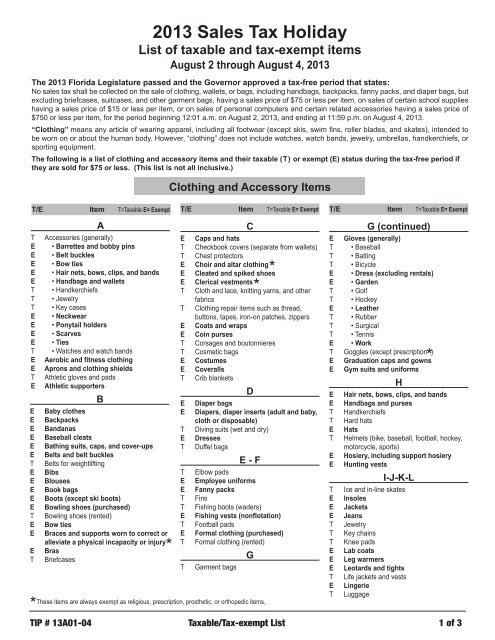

List Of Tax exempt And Taxable Items

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

What Items Are Tax Exempt In Texas - The state mainly categorizes restaurant and bar services equipment and supplies as taxable and tax exempt Tax Exempt Items Starting with the tax exempt