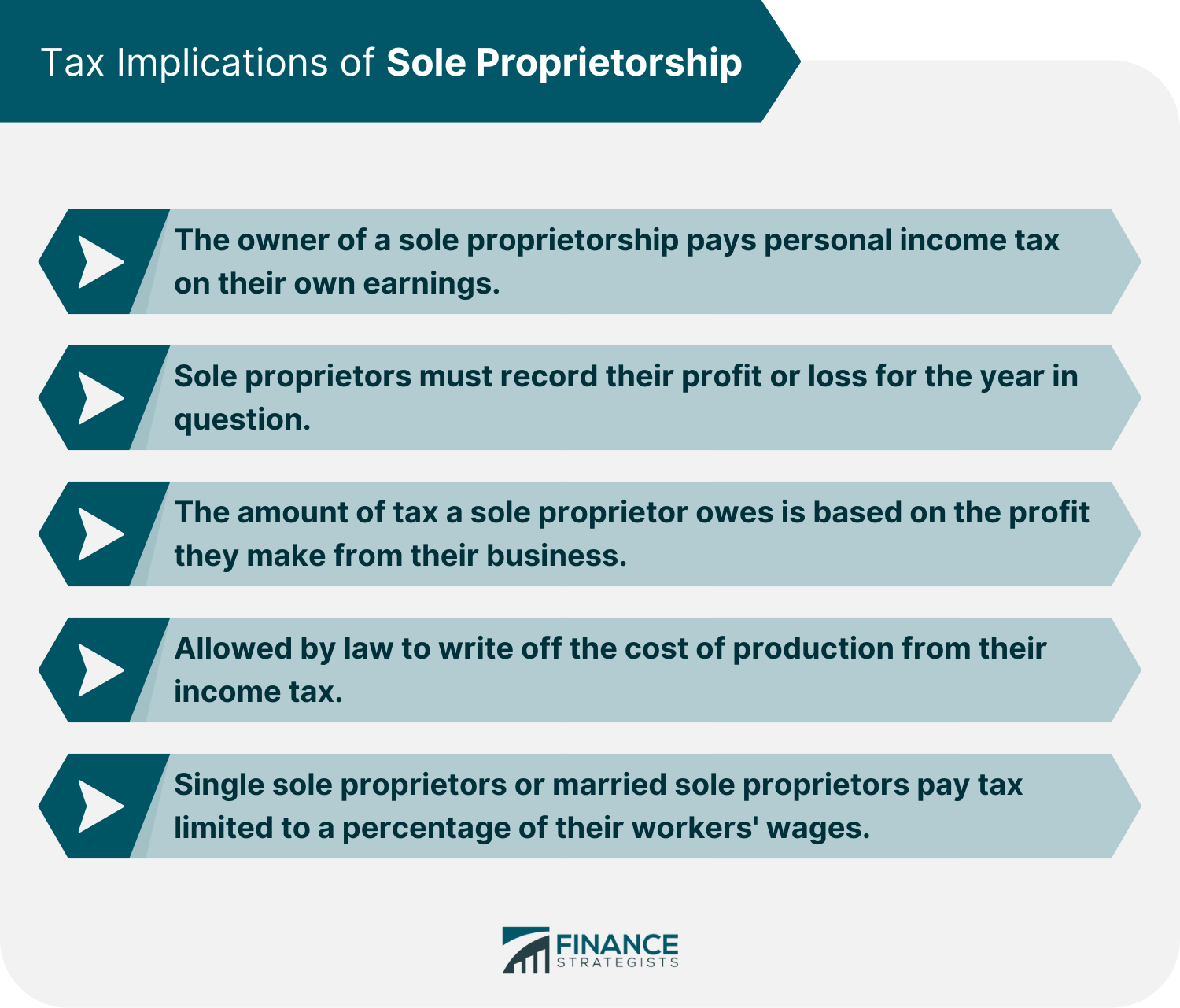

What Tax Deductions Can I Claim As A Sole Proprietor This being said 50 of your self employment taxes are deductible These specific sole proprietorship taxes are reported on a special form Schedule SE which

As a sole proprietor you are in charge of your own business You ll face additional taxes and reporting requirements but you may also be eligible for certain You can also claim personal deductions Personal deductions for sole proprietor taxes may include health insurance premiums paid out of pocket child and dependent care expenses mortgage

What Tax Deductions Can I Claim As A Sole Proprietor

What Tax Deductions Can I Claim As A Sole Proprietor

https://g.foolcdn.com/editorial/images/438247/tax-forms_tax-mistakes_gettyimages-500216674.jpg

Sole Trader Tax Deductions How To Optimise Your Taxes In 2022

https://uploads-ssl.webflow.com/5efd455be224bd10a27ddf8c/628f57631956b41f6612c16a_tax deductions table.png

The Deductions You Can Claim Hra Tax Vrogue

https://images.ctfassets.net/ifu905unnj2g/5pTiksjFeNz6NJxIHRTFCO/1a3452b342e68decbc284efdc894ead5/Small_Business_Tax_Deductions_graphic.png

If you re a sole proprietor who works out of your home you can deduct the costs of rent mortgage interest property taxes insurance utilities repairs maintenance and other To file your annual income tax return you will need to use Schedule C Form 1040 Profit or Loss from Business Sole Proprietorship to report any income or loss from a

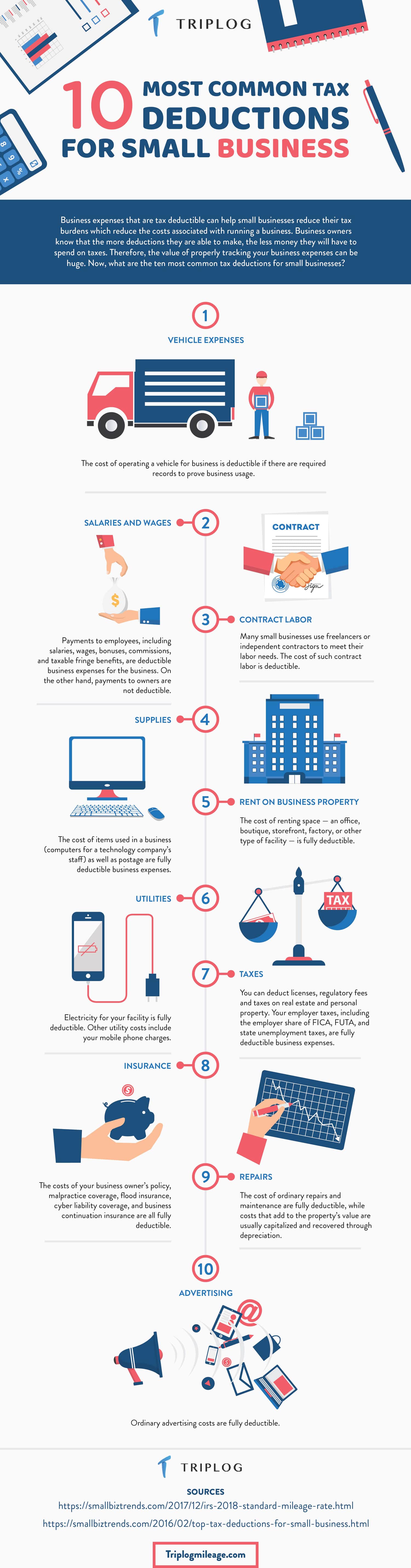

10 valuable tax deductions for the self employed Ordinary and necessary business expenses Qualified business income QBI deduction Self employment tax As a sole proprietor you must pay the full self employment tax rate of 15 3 When you work for an employer you only pay half and the employer pays half But as a

Download What Tax Deductions Can I Claim As A Sole Proprietor

More picture related to What Tax Deductions Can I Claim As A Sole Proprietor

Top 10 Tax Deductions Synchrony Bank Synchrony Bank

https://www.synchronybank.com/images/hero-top-10-tax-deductions-you-should-know-about_1140x570.jpg

Lot Of Things Newsletter Image Library

https://d2zqka2on07yqq.cloudfront.net/wp-content/uploads/2022/04/common-small-business-tax-deductions-1.png

10 Tax Deductions You Can Claim As A Landlord Baselane

https://www.baselane.com/wp-content/uploads/elementor/thumbs/Landlord-Tax-Deductions-polmq827l0ght88yubanndjvrrzbwgrlwvxwnmbuk2.png

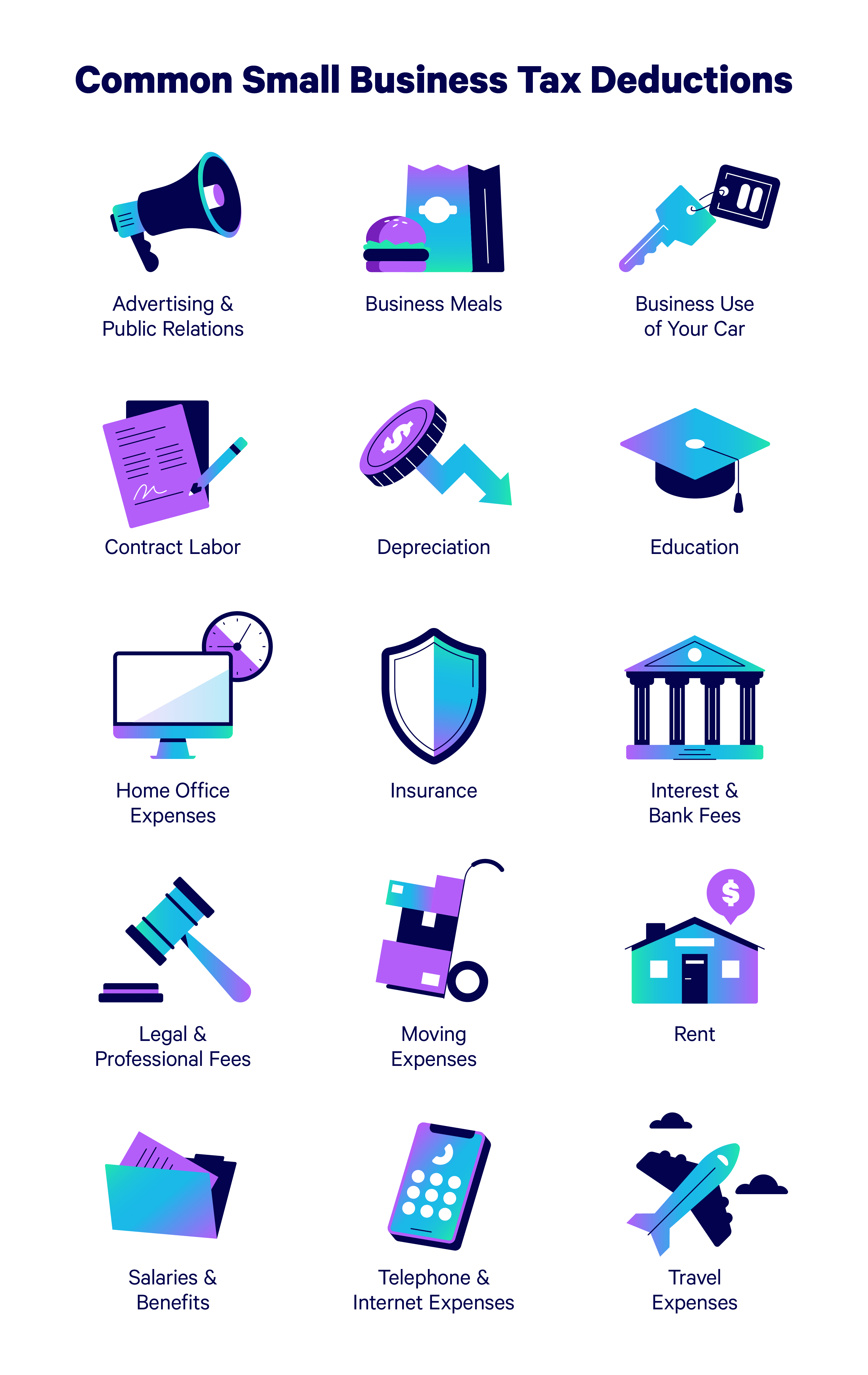

How to claim small business tax deductions To claim small business tax deductions as a sole proprietorship you must fill out a Schedule C tax form The Schedule C form is used to Sole proprietorships LLCs and partnerships cannot deduct charitable contributions as a business expense but the business owner may be able to claim the deduction on their

If you re operating your business as a sole proprietor you can only deduct up to 5 000 of business start up costs However the 5 000 cap is reduced on a dollar for dollar basis If your business is set up as a sole proprietorship LLC or partnership you should claim charitable donations on your personal taxes If your business is an S

What Tax Deductions Can I Claim Working From Home Fitzroy Financial

https://fitzroyfa.com.au/wp-content/uploads/2020/06/What-tax-deductions-can-I-claim-working-from-home-1024x667.jpg

Are Funeral Expenses Tax Deductible Hetywin

https://www.53.com/content/dam/fifth-third/article-images/FifthThird_Sole_Proprietorship_Tax_Writeoffs.jpg

https://www.nerdwallet.com/article/small-business/...

This being said 50 of your self employment taxes are deductible These specific sole proprietorship taxes are reported on a special form Schedule SE which

https://turbotax.intuit.com/tax-tips/small...

As a sole proprietor you are in charge of your own business You ll face additional taxes and reporting requirements but you may also be eligible for certain

What Is The Difference Between A Tax Credit And Tax Deduction

What Tax Deductions Can I Claim Working From Home Fitzroy Financial

Sole Proprietorship Definition Pros Cons And Tax Implications

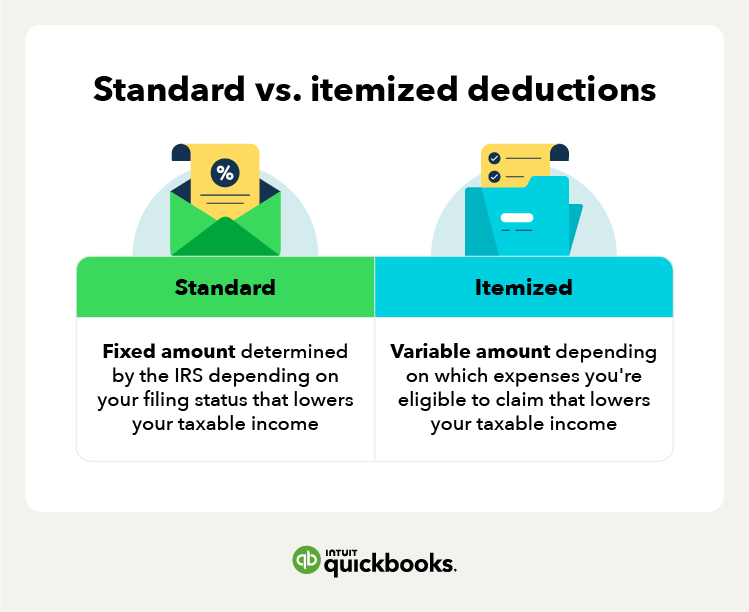

Small Business Expenses Tax Deductions 2023 QuickBooks

How To Write Off Expenses As An Independent Contractor Oyster

Corporation Prepaid Insurance Tax Deduction Financial Report

Corporation Prepaid Insurance Tax Deduction Financial Report

10 Most Common Small Business Tax Deductions Infographic

What Tax Deductions Can I Claim As A Locum Healthcare Professional

What Can I Use Proof Of Employment If I Am A Sole Proprietor Or Self

What Tax Deductions Can I Claim As A Sole Proprietor - 10 valuable tax deductions for the self employed Ordinary and necessary business expenses Qualified business income QBI deduction Self employment tax