Withholding Tax Rate In Us Web Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by companies in WWTS territories to residents and non residents are provided Double taxation agreements between territories often provide reduced WHT rates

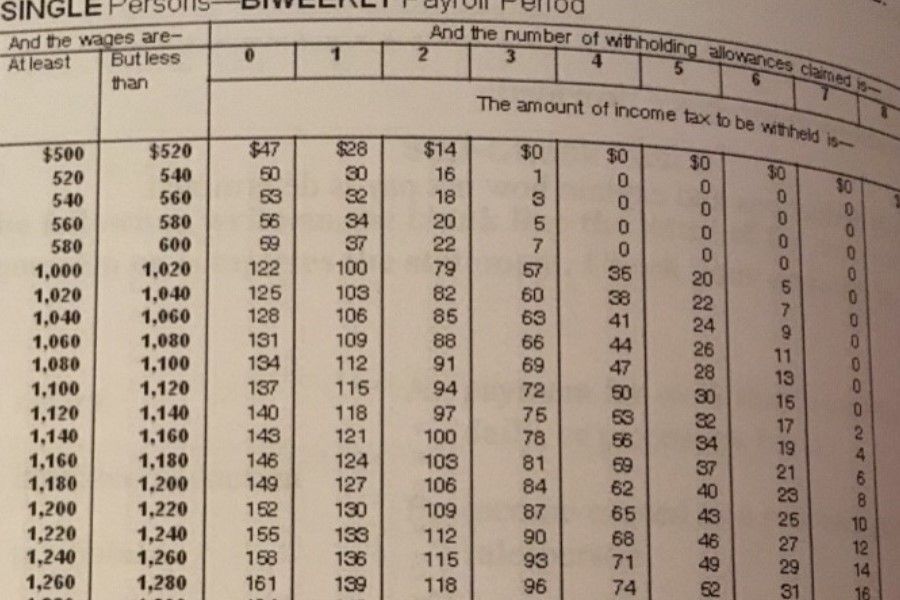

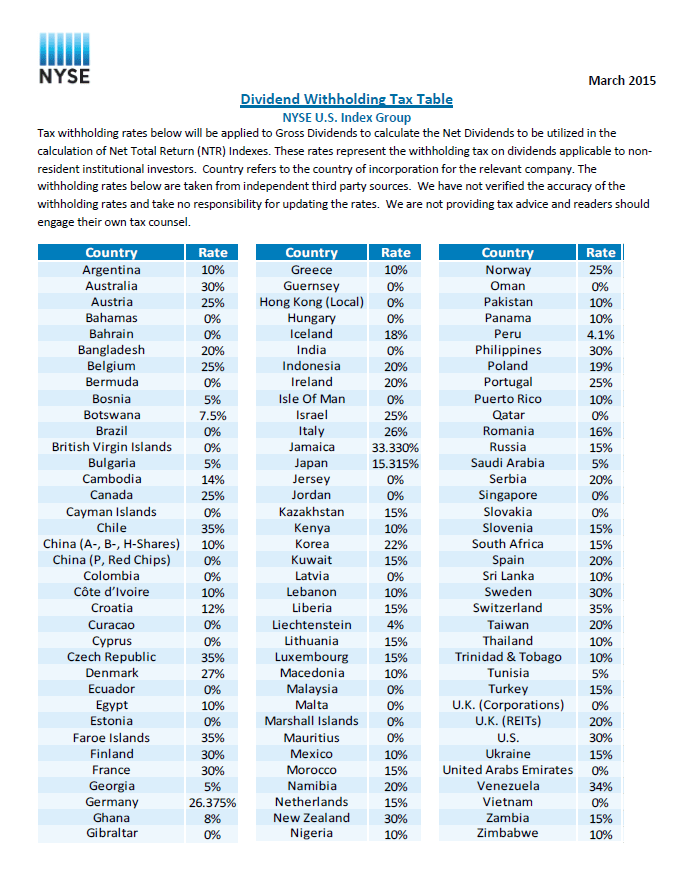

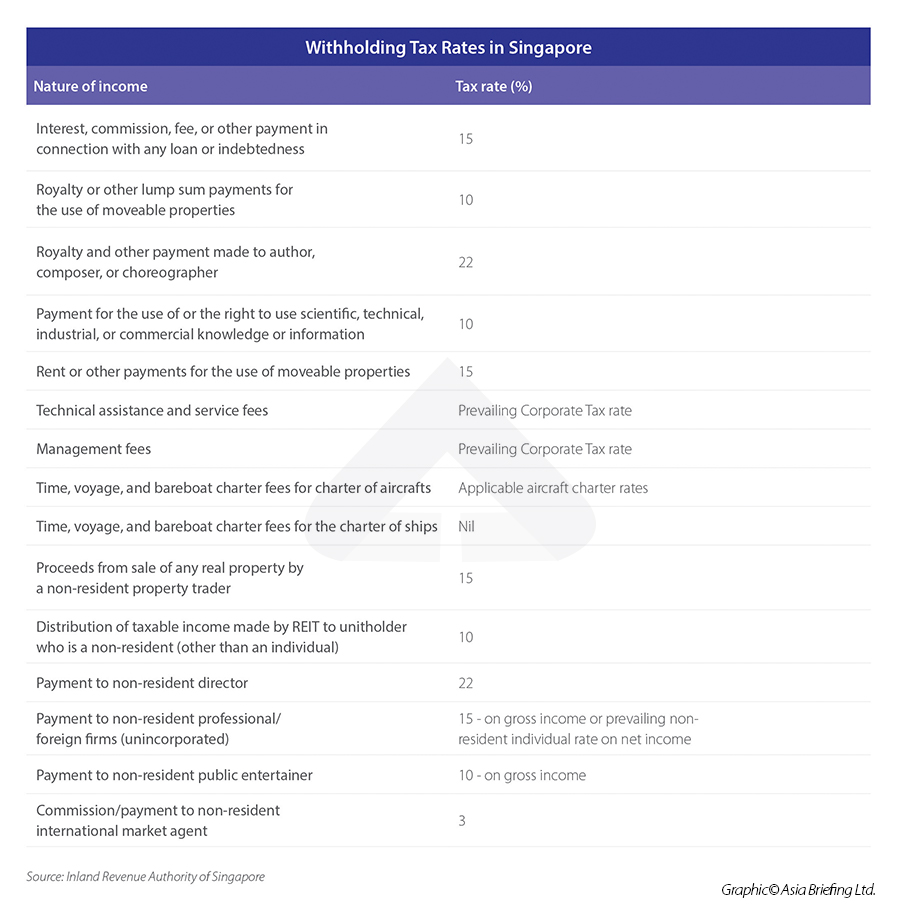

Web Three key types of withholding tax are imposed at various levels in the United States Wage withholding taxes 1 Withholding tax on payments to foreign persons and Backup withholding on dividends and interest Web 24 Nov 2023 nbsp 0183 32 Most types of U S source income received by a foreign person are subject to U S tax of 30 percent The tax is generally withheld Non Resident Alien withholding from the payment made to the foreign person

Withholding Tax Rate In Us

Withholding Tax Rate In Us

https://payroll.utexas.edu/sites/default/files/standard-withholding-rate-schedule-01.png

Overview Of Withholding Tax Rates Between USA Singapore Australia And

https://www.researchgate.net/publication/311807016/figure/tbl1/AS:668318025383938@1536350842656/Overview-of-withholding-tax-rates-between-USA-Singapore-Australia-and-Hong-Kong.png

Withholding Tax Charts For 2021 Federal Withholding Tables 2021

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-federal-withholding-tables-16.jpg

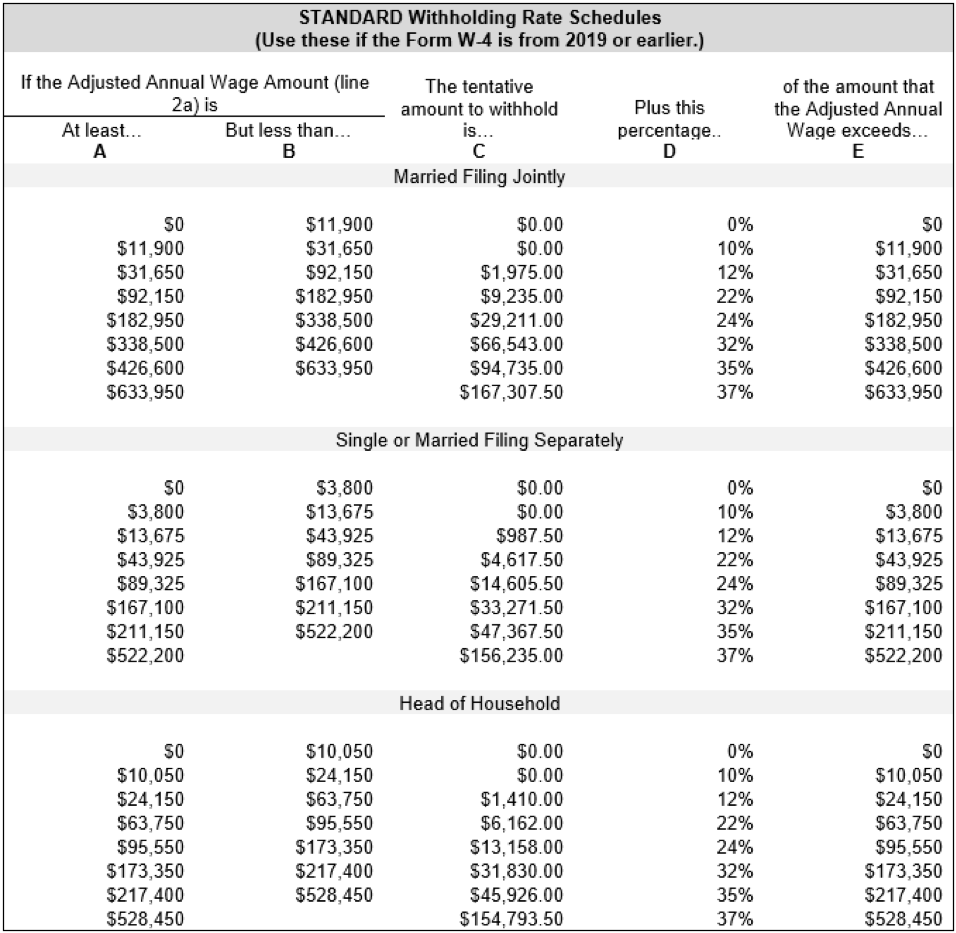

Web The Withholding Tax Rate in the United States stands at 30 percent Withholding Tax Rate in the United States averaged 30 00 percent from 2022 until 2023 reaching an all time high of 30 00 percent in 2023 and a record low of 30 00 percent in 2023 10Y 25Y 50Y MAX Compare Export API Embed United States Withholding Tax Rate Web Vor 3 Tagen nbsp 0183 32 There are seven tax rates 10 12 22 24 32 35 and 37 The income thresholds for the 2023 tax brackets were adjusted significantly up about 7 from 2022 due to record high

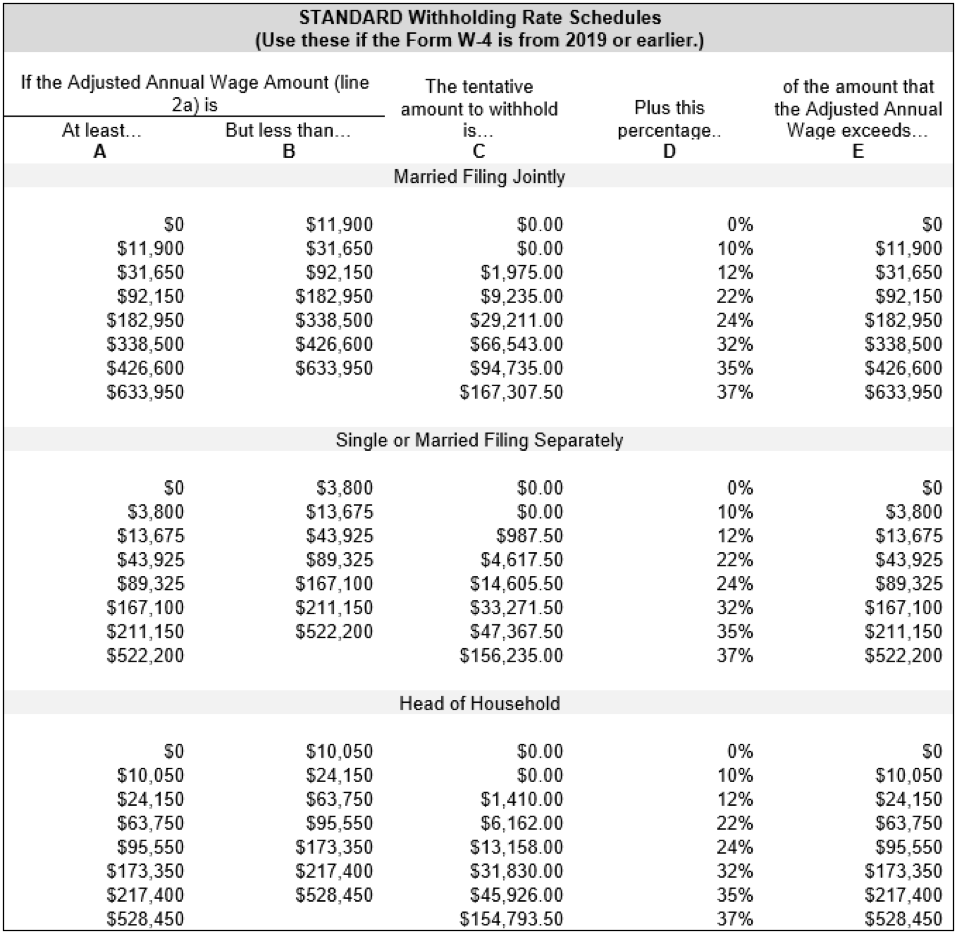

Web For federal purposes employers may opt to use a flat tax rate of 22 on supplemental wages up to 1 million for the year however a mandatory flat tax rate of 37 applies to supplemental wages over 1 million Note that the flat 37 rate applies even if an employee has submitted a federal Form W 4 claiming exemption from federal income tax withholding Web Worksheet 1B is used with the STANDARD Withholding Rate Schedules in the 2023 Percentage Method Tables for Automated Payroll Systems and Withholding on Periodic Payments of Pensions and Annuities that are included in How To Treat 2019 and Earlier Forms W 4 as if They Were 2020 or Later Forms W 4

Download Withholding Tax Rate In Us

More picture related to Withholding Tax Rate In Us

Here s How The New US Tax Brackets For 2019 Affect Every American

https://static1.businessinsider.com/image/5c33833ebd7730076d294700-2400/2019-tax-brackets-table-1.png

Dividend Withholding Tax Rates By Country 2015 TopForeignStocks

http://topforeignstocks.com/wp-content/uploads/2015/09/Dividend-withholding-taxe-rates-2015.png

How Federal Income Tax Rates Work Full Report Tax Policy Center

http://www.taxpolicycenter.org/sites/default/files/publication/137756/01_6.png

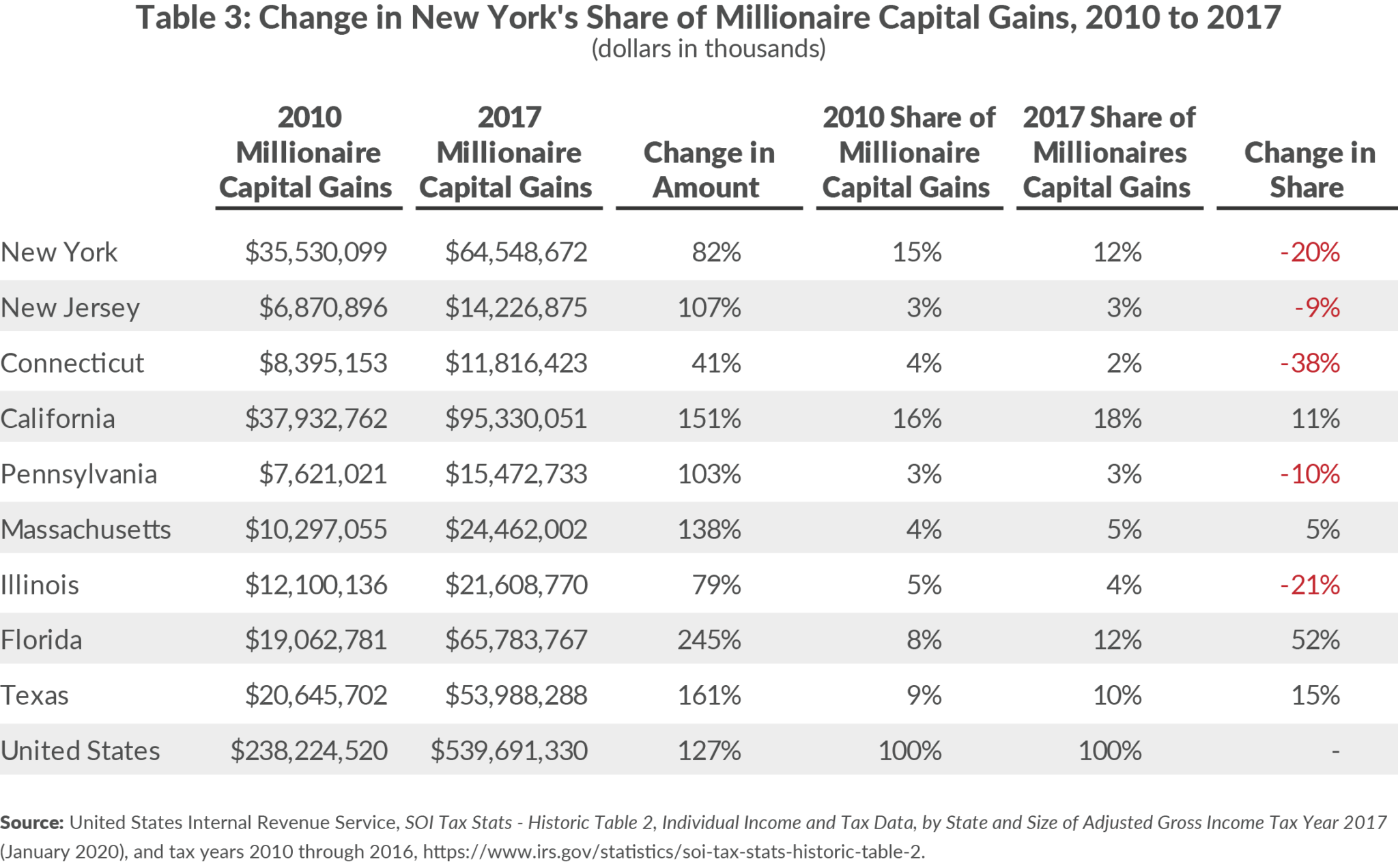

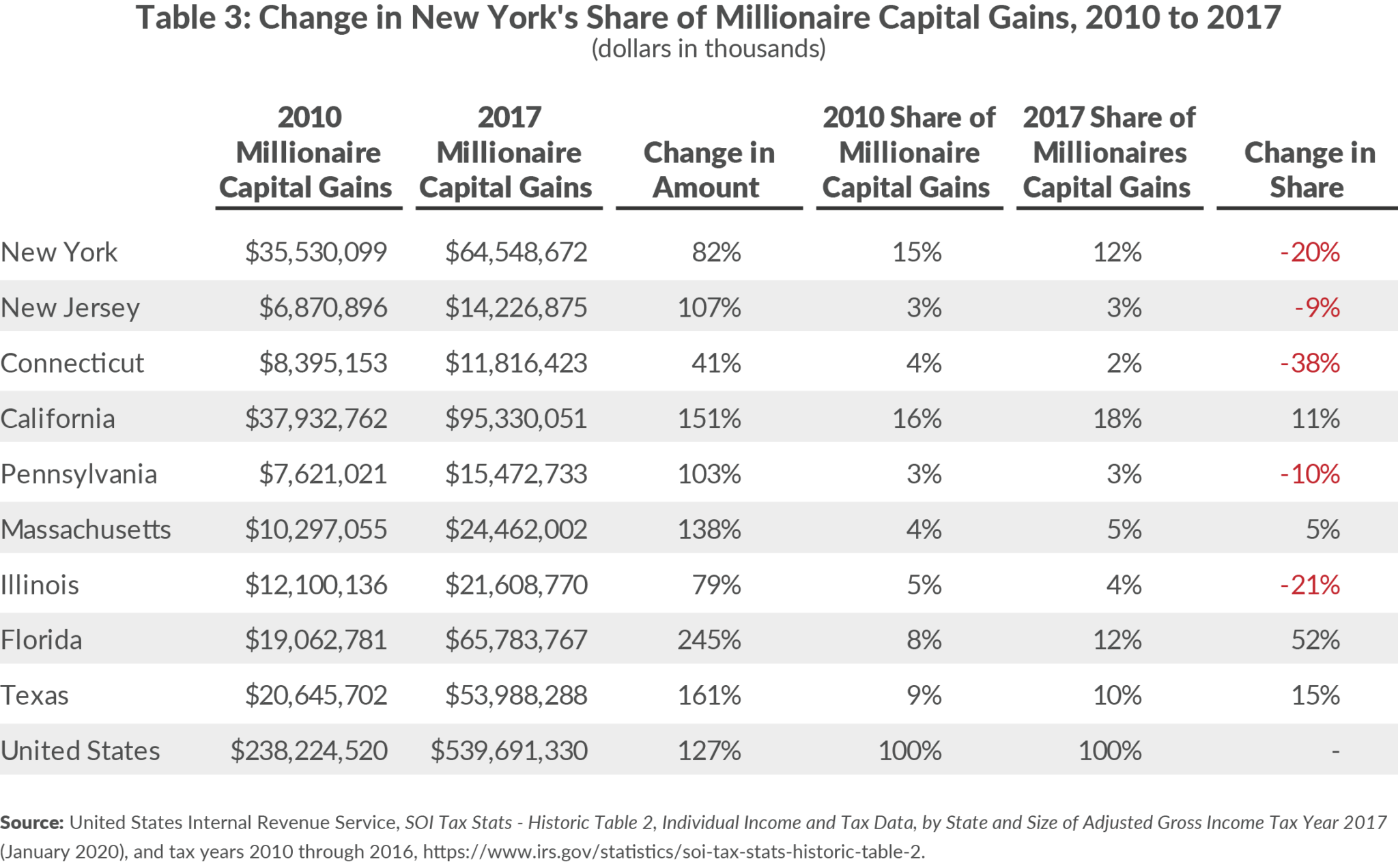

Web 8 Aug 2023 nbsp 0183 32 The maximum federal income tax rate on qualified dividends received from a domestic corporation is 20 The maximum federal tax rate on capital gains is 20 for assets held for more than 12 months The graduated rates of tax apply to capital gains from assets held for 12 months or less Web Vor einem Tag nbsp 0183 32 A single person with 140 000 in taxable income in 2024 would be in the 24 tax bracket This doesn t mean all of their income is taxed at that rate Their effective tax rate would be much lower

Web 26 Nov 2023 nbsp 0183 32 Tax withholding is a way for the U S government to maintain its pay as you go or pay as you earn income tax system This means taxing individuals at the source of income rather than trying Web 26 Dez 2023 nbsp 0183 32 Resources Page Last Reviewed or Updated 26 Dec 2023 Learn about income tax withholding and estimated tax payments Use the IRS Withholding Calculator to check your tax withholding and submit Form W 4 to your employer to adjust the amount

Us Federal Tax Brackets Revenue NutriFlex

https://federal-withholding-tables.net/wp-content/uploads/2021/07/2021-tax-brackets-new-york-state-newreay-2048x1272.png

Federal Tax Withholding Calculator

https://www.coursehero.com/qa/attachment/7836069/

https://taxsummaries.pwc.com/quick-charts/withholding-tax-wht-rates

Web Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by companies in WWTS territories to residents and non residents are provided Double taxation agreements between territories often provide reduced WHT rates

https://en.wikipedia.org/wiki/Tax_withholding_in_the_United_States

Web Three key types of withholding tax are imposed at various levels in the United States Wage withholding taxes 1 Withholding tax on payments to foreign persons and Backup withholding on dividends and interest

2020 State Individual Income Tax Rates And Brackets Tax Foundation

Us Federal Tax Brackets Revenue NutriFlex

IRS Withholding Tables And A Bigger Paycheck In 2018

LEA Global A Guide To Withholding Taxes In Singapore Accounting

How High Are Income Tax Rates In Your State Your Survival Guy

2023 Earnings Tax Withholding Tables All Finance News

2023 Earnings Tax Withholding Tables All Finance News

Foreign Dividend Tax Rates How To Reclaim Withholding Tax In 2022

Tax Foundation Washington Has Nation s 4th Highest Combined State

Federal Tax Withholding 2022 Tripmart

Withholding Tax Rate In Us - Web Vor 3 Tagen nbsp 0183 32 There are seven tax rates 10 12 22 24 32 35 and 37 The income thresholds for the 2023 tax brackets were adjusted significantly up about 7 from 2022 due to record high