Wood Stove Tax Credit Form The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness Biomass Stoves Boilers Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax

Wood Stove Tax Credit Form

Wood Stove Tax Credit Form

https://i.pinimg.com/originals/22/c8/ae/22c8aee94b1d3618dc6a9a6338210c03.jpg

The 2023 Federal 30 Tax Credit On Wood Pellet Stoves We Love Fire

https://i.pinimg.com/originals/01/5d/18/015d1814a6cae680ad5cbbebe0b02ba5.jpg

Save The Biomass Stove Tax Credit

https://imagesoneclickpolitics.global.ssl.fastly.net/uploads/promoted_message/custom_campaign_image/6734/custom_campaign_image_Woodstove.jpg

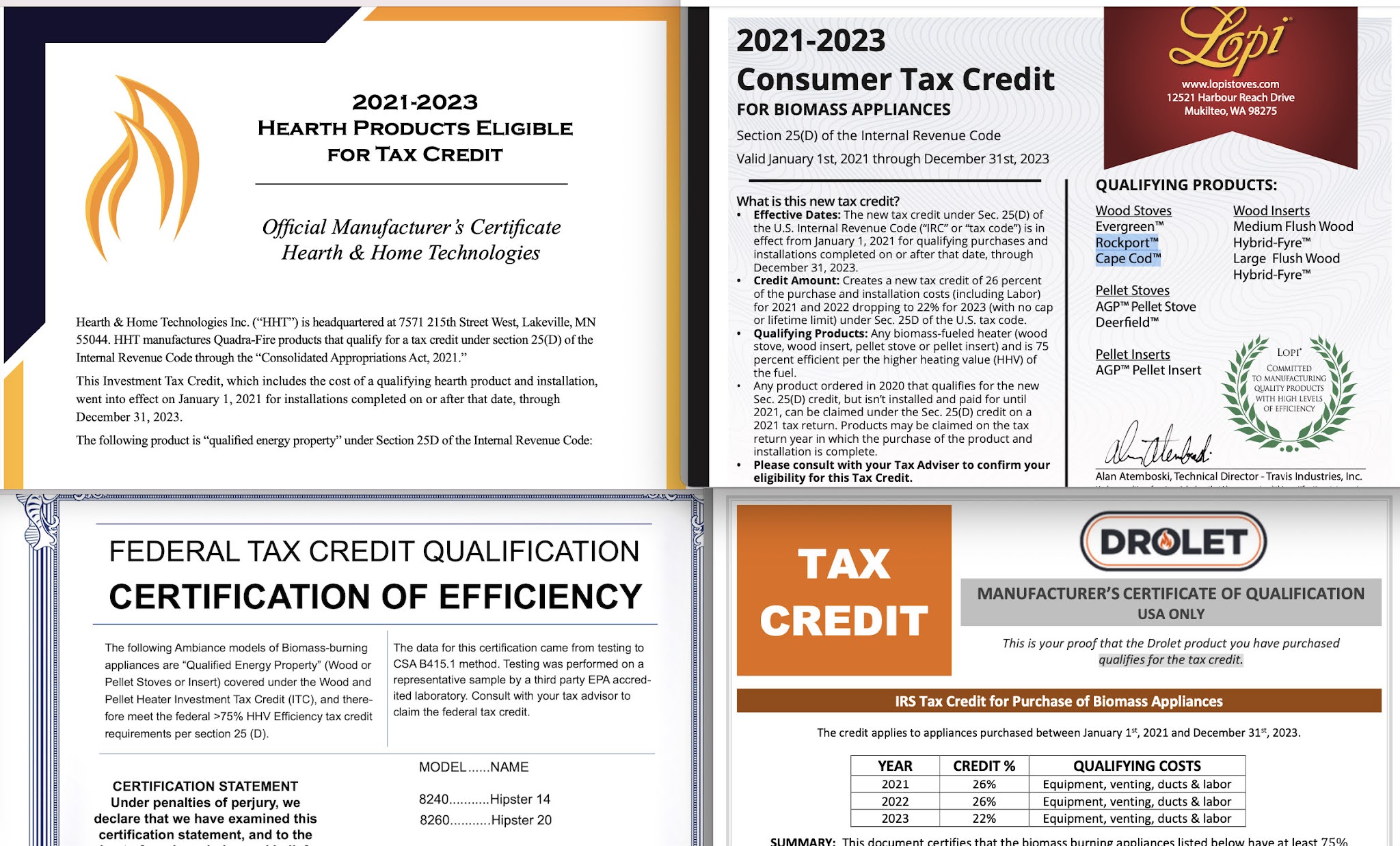

You claim the 30 tax credit on your federal income tax return form starting on the 2023 tax return that you will file in 2024 The credit is a reduction of the total income tax owed This is a non refundable tax credit From January 1 2023 through December 31 2032 taxpayers who install qualifying wood and pellet stoves will receive a 30 tax credit that is capped at 2 000 annually based on the full cost of the unit including installation

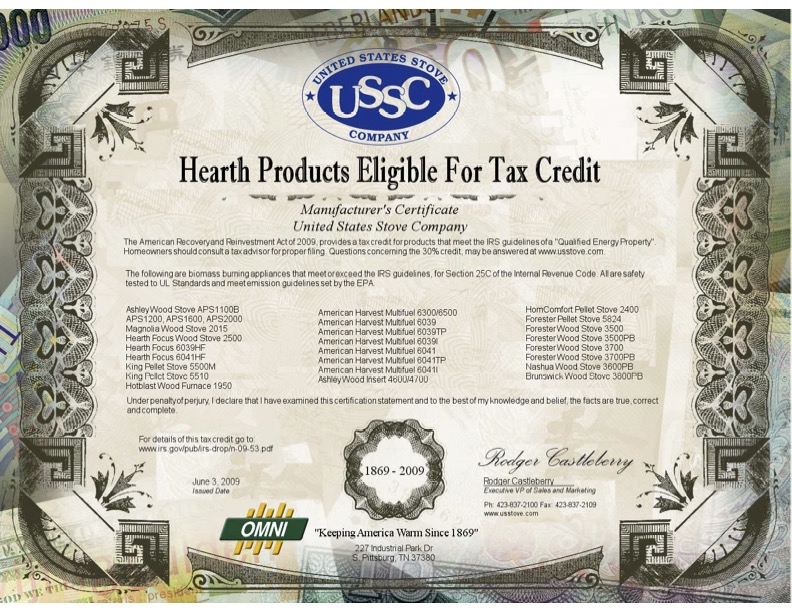

A The tax credit was signed into law on December 21 2020 and stoves purchased and installed in 2021 and 2022 will qualify for the 26 tax credit In 2023 the tax credit reduces to 22 The sales receipt must indicate that the Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped at 2 000

Download Wood Stove Tax Credit Form

More picture related to Wood Stove Tax Credit Form

Kuma Ashwood LE Wood Stove Mazzeo s Stoves Fireplaces

https://www.mazzeosinc.com/wp-content/uploads/2020/04/Ashwoodle_1200.jpg

2021 Wood Burning Stove Tax Credit EXPLAINED YouTube

https://i.ytimg.com/vi/Hwidq9meTLw/maxresdefault.jpg

![]()

Wood Burning Stove Tax Credit

https://sp-ao.shortpixel.ai/client/to_webp,q_glossy,ret_img,w_1747,h_1200/https://www.fourdayfireplace.com/wp-content/uploads/2021/09/How-You-Can-Save-on-Taxes-With-a-Wood-Burning-Stove.jpeg

Beginning January 1 2021 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems will be able to claim a 26 tax credit under Sec 25 D Beginning with the 2023 tax return you will file in 2024 you can claim a 30 tax rebate on your federal income tax return To claim your tax rebate you will need documents about the purchase and installation of the

Choose from 14 eligible Wood Stoves Wood Inserts Pellet Stoves Pellet Inserts from Regency and save big with the 2024 US Biomass Tax credit How to Claim Your US Biomass Tax Credit Purchase an You will need to file Form 5695 Residential Energy Credits when you file your tax return for year in which your qualified energy property was originally placed in service Page

Tax Credit Wood And Pellet Stoves The Stove Center

https://cdn.shopify.com/s/files/1/0111/6880/9018/articles/Tax_Credit_2021_800x.jpg?v=1625851065

Tax Credit Spavinaw Stove Company Gentry AR

https://irp.cdn-website.com/486121ac/dms3rep/multi/Screen+Shot+2021-09-29+at+11.37.54+AM.png

https://www.irs.gov/instructions/i5695

The residential energy credits are The residential clean energy credit and The energy efficient home improvement credit Also use Form 5695 to take any residential clean energy credit

https://www.irs.gov/forms-pubs/about-form-5695

Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take your nonbusiness

You Could Qualify For A 300 Tax Credit The Biomass Stove Tax Credit

Tax Credit Wood And Pellet Stoves The Stove Center

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit

Images For 362394 STOVE TAX Cast Iron Contemporary Auctionet

Tax Credit For Wood And Pellet Heaters 2022 Update Cookstove Community

Stove Packages Wood And Pellet Stove Tax Credit

Stove Packages Wood And Pellet Stove Tax Credit

Heated Up Consumers Can Now Rely On Almost All Stove Tax Credit

Tax Credit For Wood Stove 2021 Revised Info On Federal Credit What

Everything You Need To Know About Wood Stove Tax Credit In 2023 US

Wood Stove Tax Credit Form - Beginning in 2023 consumers buying highly efficient wood or pellet stoves or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped at 2 000