Can You Deduct Mileage To Work On Taxes Mileage can be deducted for volunteer work and medical care but IRS restrictions limit the amount you can claim The Tax Cuts and Jobs Act

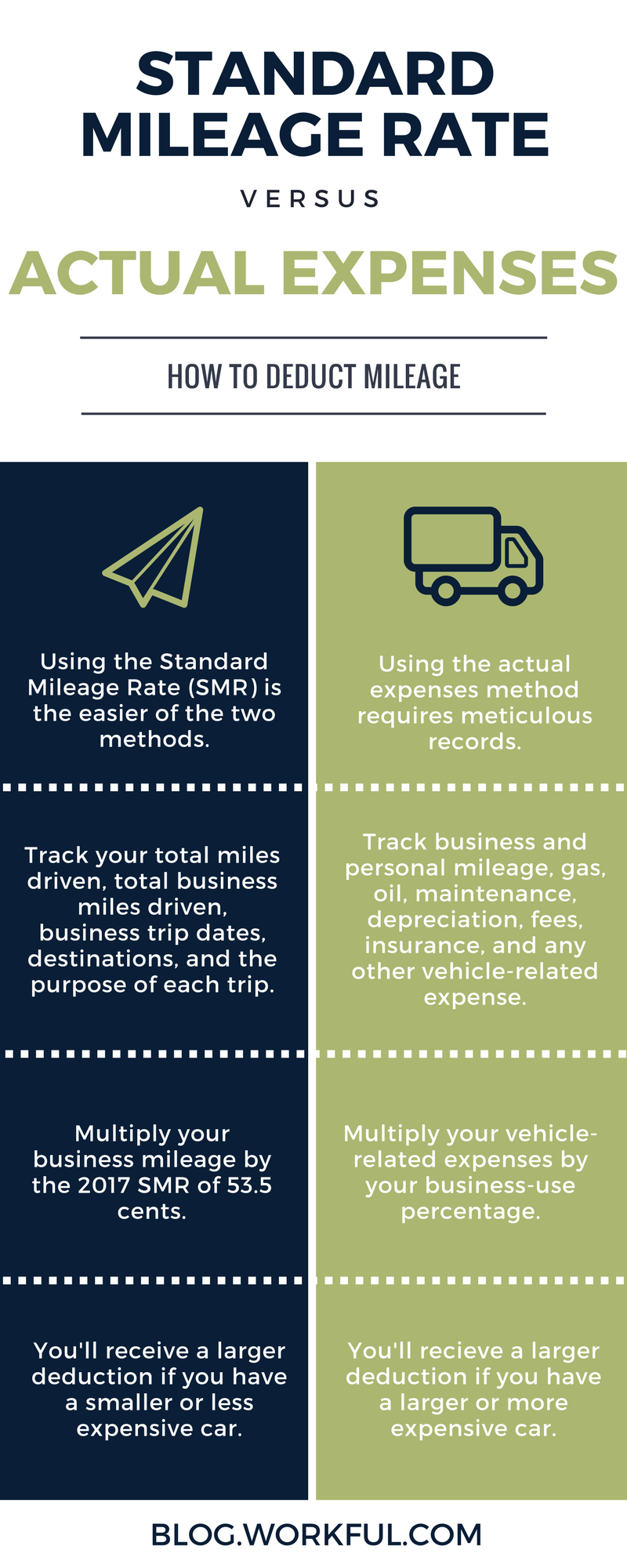

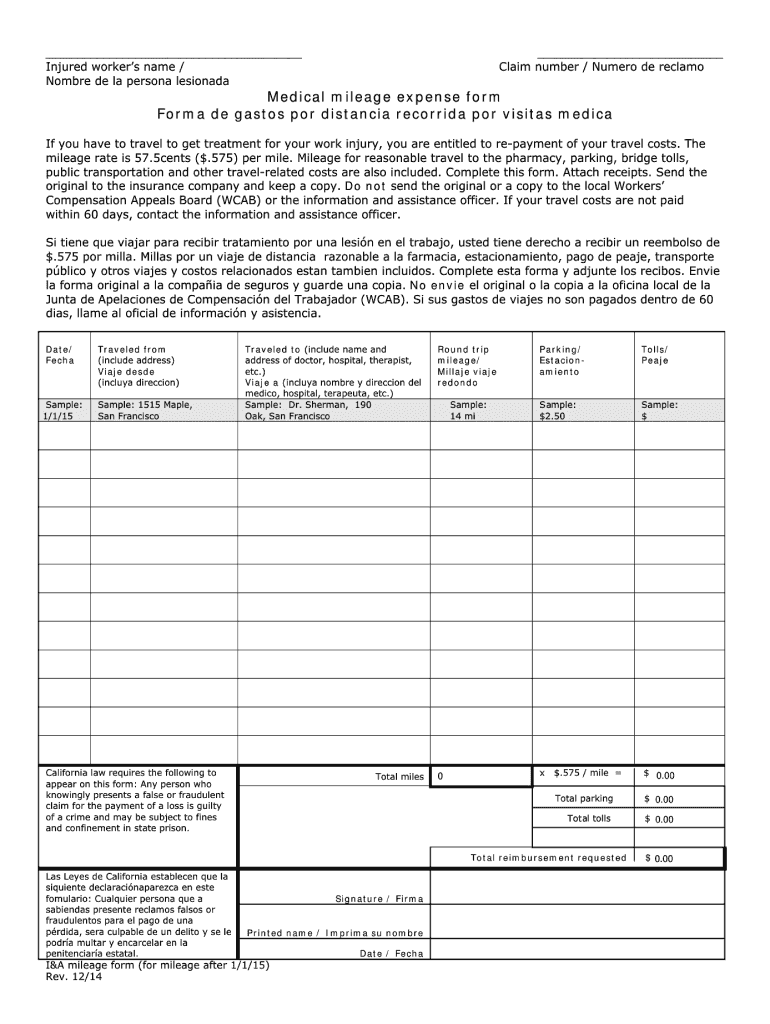

Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for both You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 22 cents per mile for 2023 or you can deduct your actual costs of gas and oil Deducting parking costs and tolls is also allowed

Can You Deduct Mileage To Work On Taxes

Can You Deduct Mileage To Work On Taxes

https://storage.googleapis.com/driversnote-marketing-pages/US-infographic-how-to-deduct-mileage-landscape.png

Mileage Log For Taxes Requirements And Process Explained MileIQ

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6110c7808a1a34e392da06a0_610f13719242da6fd79cc8b1_MileIQ-vs-paper-mileage-log-1.jpeg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

You can deduct actual expenses or the standard mileage rate as well as business related tolls and parking fees If you rent a car you can deduct only the business use portion for If you use the standard mileage rate for a year you can t deduct your actual car expenses for that year You can t deduct depreciation lease payments maintenance and repairs

If you re wondering whether you re eligible or how exactly to claim a mileage deduction on your tax return you re in the right place You ll learn how to track mileage which forms If you travel for work you may be able to deduct mileage expenses from your taxes Find out if you qualify and how to document it

Download Can You Deduct Mileage To Work On Taxes

More picture related to Can You Deduct Mileage To Work On Taxes

Calculate Gas Mileage Reimbursement AntonioTavish

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Example Of Free 25 Printable Irs Mileage Tracking Templates Gofar

https://i.pinimg.com/originals/ef/80/33/ef80334d3a23f7799ac429aaf9a31cd4.jpg

When Can You Deduct Mileage Peavy And Associates PC

https://peavyandassociates.com/wp-content/uploads/2022/07/car-773360_640.jpg

Eligibility for claiming mileage on taxes FAQ Claiming a mileage deduction is an important part of reducing taxes for anyone who uses their vehicle for business Are you Whether you use the standard mileage or standard mileage method you ll deduct your self employed car expenses on Schedule C of Form 1040 Do you need to keep records of your mileage and vehicle expenses

If you re self employed you typically can deduct expenses for the miles you drive or for the actual automobile costs for business purposes You can calculate your driving The IRS business standard mileage rate cannot be used to claim an itemized deduction for unreimbursed employee travel expenses under the Tax Cuts and Jobs

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Can I Deduct Mileage To And From Work YouTube

https://i.ytimg.com/vi/9zpy0BVnPUw/maxresdefault.jpg

https://money.usnews.com/money/pers…

Mileage can be deducted for volunteer work and medical care but IRS restrictions limit the amount you can claim The Tax Cuts and Jobs Act

https://www.irs.gov/newsroom/heres-the-411-on-who...

Individuals who own a business or are self employed and use their vehicle for business may deduct car expenses on their tax return If a taxpayer uses the car for both

Can I Deduct Expenses For Growing Food That I Donate Nj

Tax Deductions You Can Deduct What Napkin Finance

The Deductions You Can Claim Hra Tax Vrogue

How To Deduct Mileage On Taxes Asbakku

Mileage Deduction Standard Mileage Rate Workful Blog

Mileage Form 2021 IRS Mileage Rate 2021

Mileage Form 2021 IRS Mileage Rate 2021

Tax Deductions Write Offs To Save You Money Financial Gym

How To Calculate Mileage Reimbursement Remember If You Don t

Can I Deduct Donations Of My Time To Charitable Organizations Amy

Can You Deduct Mileage To Work On Taxes - If you travel for work you may be able to deduct mileage expenses from your taxes Find out if you qualify and how to document it