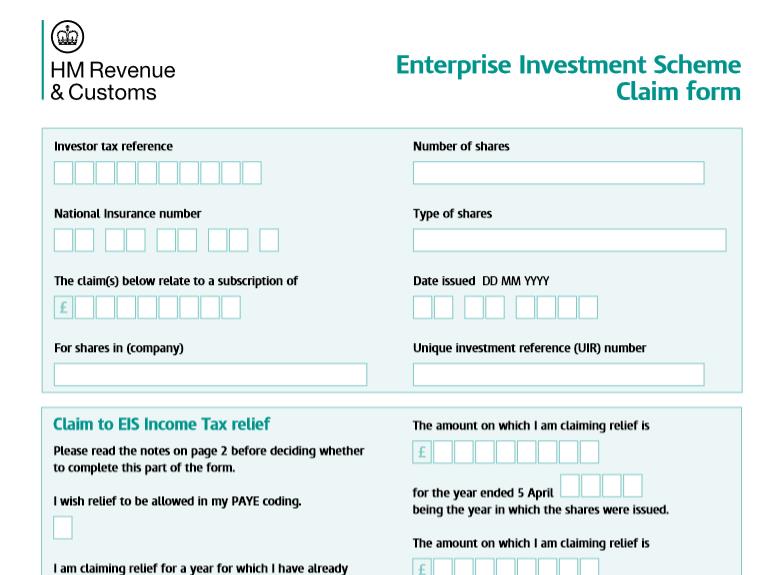

Eis Income Tax Relief Carry Back Time Limit This helpsheet explains how to claim Income Tax relief under the Enterprise Investment Scheme It also gives some guidance on the circumstances in which an investor is

An individual may carry back current year EIS investments to the previous year provided that the limit in the previous year is not exceeded For example a subscription of say 2 million non KIC EIS shares may be made There is no limit on the amount which may be carried back but the relief available in the earlier tax year will be subject to the overriding limit for relief for that year Example 2

Eis Income Tax Relief Carry Back Time Limit

Eis Income Tax Relief Carry Back Time Limit

https://www.globalbankingandfinance.com/wp-content/uploads/2022/02/iStock-952066494.jpg

How To Claim EIS Income Tax Relief Step by step Guide

https://static-web-wealthclub.s3.amazonaws.com/images/Online_Self-Assessment_Fill_your_return-min.width-500.jpg

How To Claim EIS Income Tax Relief Key Business Consultants

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2020/11/Claiming-EIS-Income-Tax-Relief-Step-by-Step-Guide.jpg

Relief can be carried back to the previous tax year subject to being within the annual limit Capital Gains Tax CGT exemption on disposal of EIS shares on which income tax relief has been claimed CGT deferral is available on gains Carry back relief You can choose to treat an investment as though it was made in the previous tax year This means that up to 2 million can be invested in a tax year 1 million in the current tax year and 1 million carried back to the

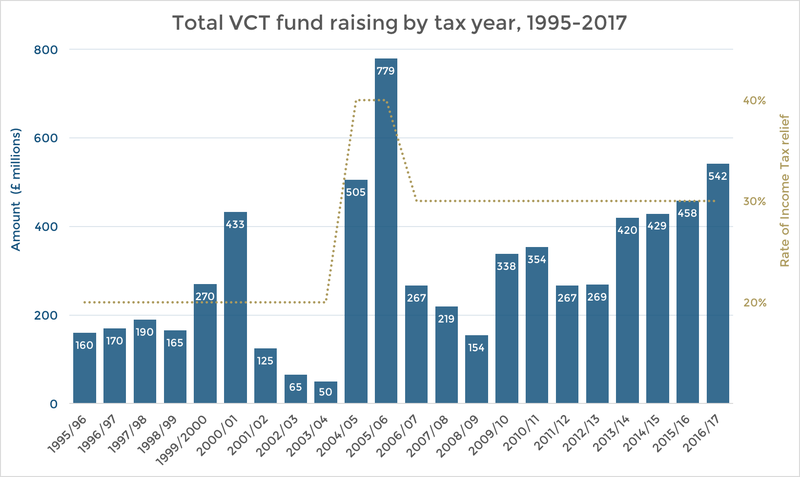

EIS offers income tax reliefs and capital gains tax CGT reliefs to individual investors who subscribe to new shares in such companies A subscription for eligible shares of a qualifying Income tax relief An investor who subscribes in cash for ordinary or non cumulative fixed preference shares in an EIS qualifying company can obtain income tax relief of up to 30 per cent on investments of up to 1m each year

Download Eis Income Tax Relief Carry Back Time Limit

More picture related to Eis Income Tax Relief Carry Back Time Limit

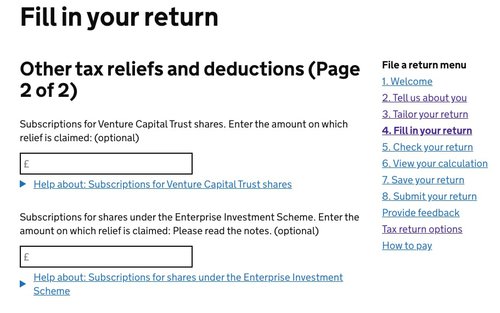

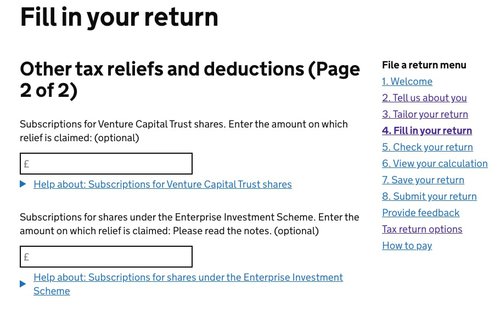

How To Claim EIS Income Tax Relief During HMRC Self assessment

https://www.syndicateroom.com/images/dashboard-screenshot-final.png

Income Tax Relief Maximum Income Tax Relief On Eis

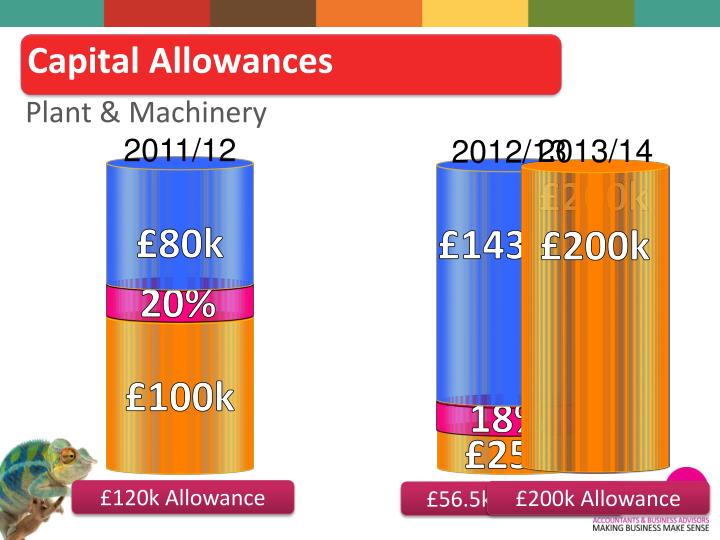

http://image1.slideserve.com/1672557/plant-machinery2-n.jpg

How To Claim EIS Income Tax Relief In 2022 Key Business Consultants

https://www.keybusinessconsultants.co.uk/wp-content/uploads/2021/09/EIS-Income-Tax-Relief-scaled.jpg

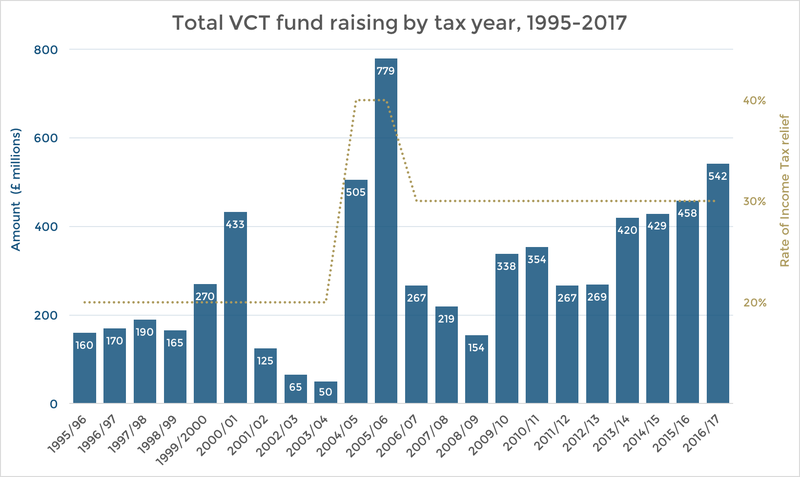

Investors can claim up to 30 income tax relief on EIS investments which gives an incentive for some of the risk normally associated with funding small companies The maximum investment that investors can claim relief on in a You must keep your whole investment in a Venture Capital Trust for 5 years If any of the shares stop qualifying in this time you ll lose the Income Tax relief on those shares

What reliefs are available under the EIS The main tax relief is that 30 of your investment can be immediately claimed back from HMRC if you have sufficient Income Tax When you invest in an EIS eligible opportunity EIS relief carry back enables you to claim tax relief on income tax that you paid in the previous financial year Even if your EIS

Income Tax Relief How To Claim Eis Income Tax Relief

https://static-web-wealthclub.s3.amazonaws.com/images/vct-total-fund-raising-history-and-tax-relief.width-800.png

Income Tax Relief How To Claim Eis Income Tax Relief

http://www.ekpedia.co.kr/images/intro02.jpg

https://www.gov.uk/government/publications/...

This helpsheet explains how to claim Income Tax relief under the Enterprise Investment Scheme It also gives some guidance on the circumstances in which an investor is

https://www.rossmartin.co.uk/seis-eis/5…

An individual may carry back current year EIS investments to the previous year provided that the limit in the previous year is not exceeded For example a subscription of say 2 million non KIC EIS shares may be made

EIS SEIS Loss Relief Explained Kuber Ventures EIS SEIS BPR

Income Tax Relief How To Claim Eis Income Tax Relief

EIS Tax Relief The Investors Best Kept Secret That Wealth Managers

EIS Income Tax Relief Restriction For Connected Parties Thompson

Blog Angels Den

BGV Blog How Do You Claim SEIS And EIS Income Tax Relief

BGV Blog How Do You Claim SEIS And EIS Income Tax Relief

EIS Enterprise Investment Scheme Income Tax Relief Scheme

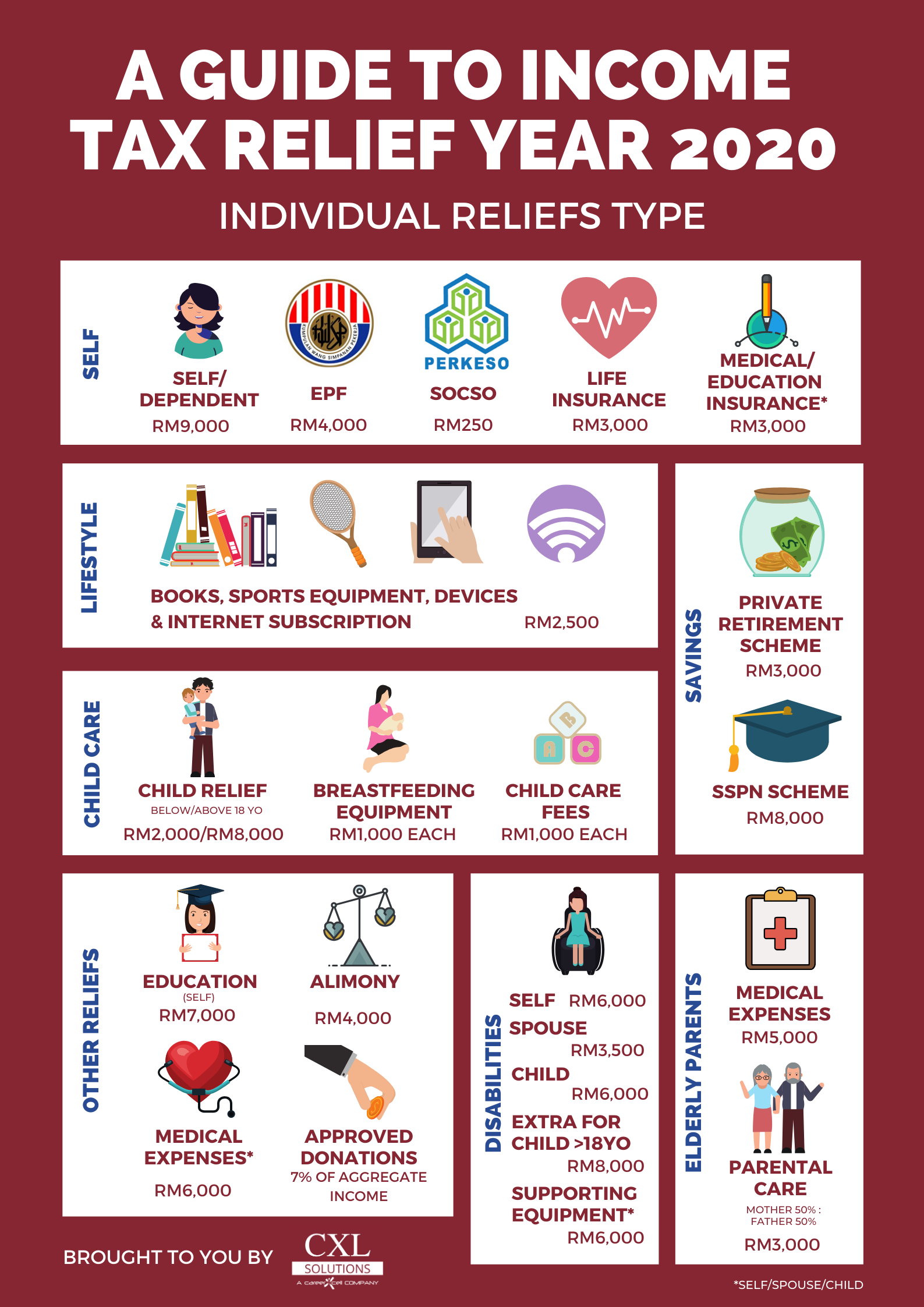

Breaking It Down Income Tax Relief For The Year 2020 YA 2019 CXL

Here s How To Claim EIS Tax Reliefs This Tax Year

Eis Income Tax Relief Carry Back Time Limit - Income tax relief An investor who subscribes in cash for ordinary or non cumulative fixed preference shares in an EIS qualifying company can obtain income tax relief of up to 30 per cent on investments of up to 1m each year