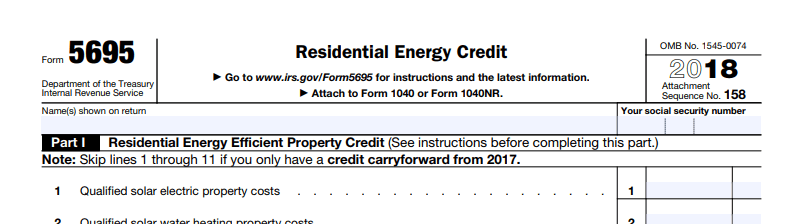

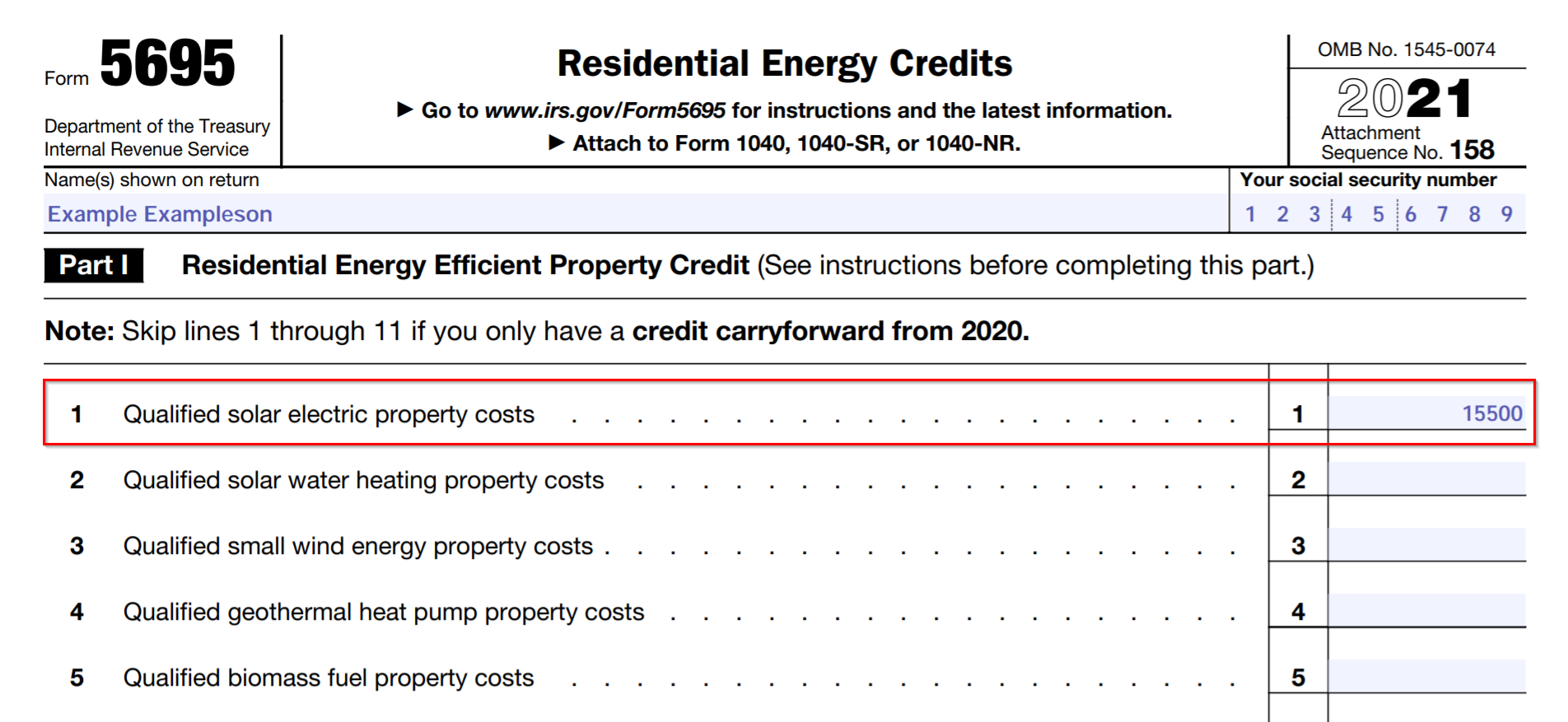

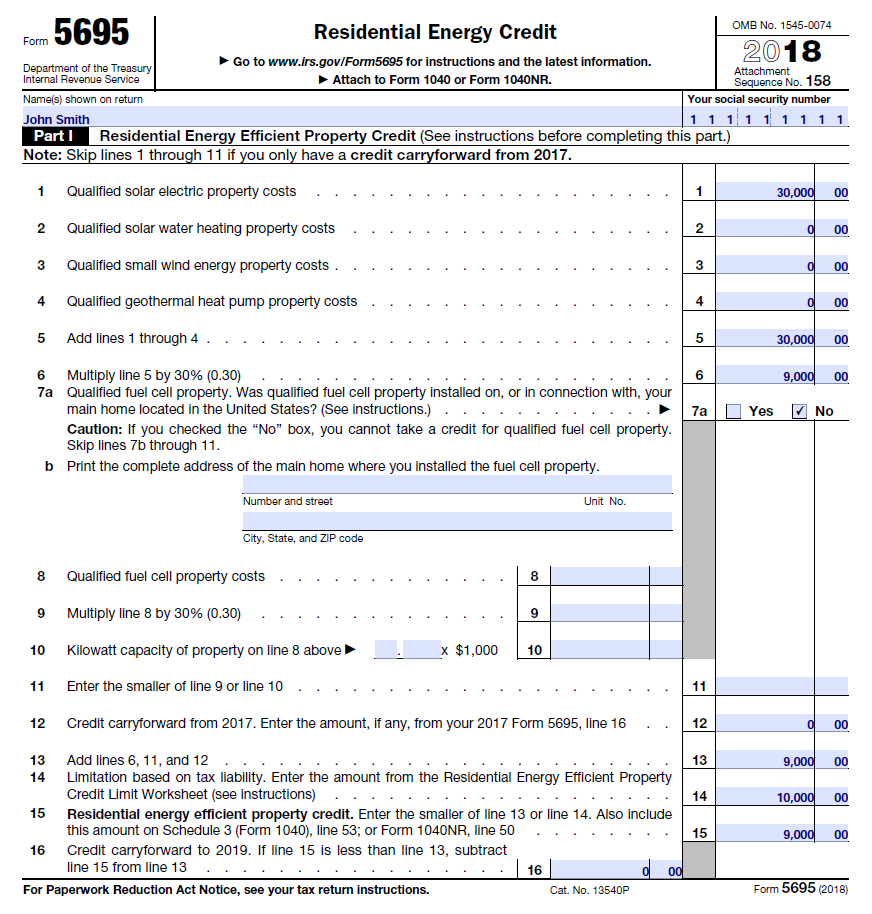

Federal Solar Tax Rebate Form Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to Web your federal tax credit For example if your solar PV system was installed before December 31 2022 installation costs totaled 18 000 and your state government gave

Federal Solar Tax Rebate Form

Federal Solar Tax Rebate Form

https://www.solarreviews.com/content/images/blog/irs_form2021.png

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/tax-credit-form.png

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

http://southerncurrentllc.com/wp-content/uploads/How-To-Claim-Solar-Tax-Credit-2017.png

Web 17 f 233 vr 2023 nbsp 0183 32 Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file Use Form 5695 to figure and take Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit of

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC Web This webpage provides an overview of the federal investment and production tax credits for businesses that own solar facilities including both photovoltaic PV and concentrating solar thermal power CSP energy

Download Federal Solar Tax Rebate Form

More picture related to Federal Solar Tax Rebate Form

The Declining Federal Solar Tax Credit And Top Things To Know For 2019

https://www.ticktockenergy.com/wp-content/uploads/2019/05/Tax-Form-5695.png

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

https://s3.amazonaws.com/solarassets/wp-content/uploads/2022/08/1040-with-federal-solar-tax-credit.png

How To Claim The Solar Investment Tax Credit YSG Solar YSG Solar

https://www.ysgsolar.com/sites/default/files/styles/panopoly_image_original/public/form_1040_rec.png?itok=pf_SEkRq

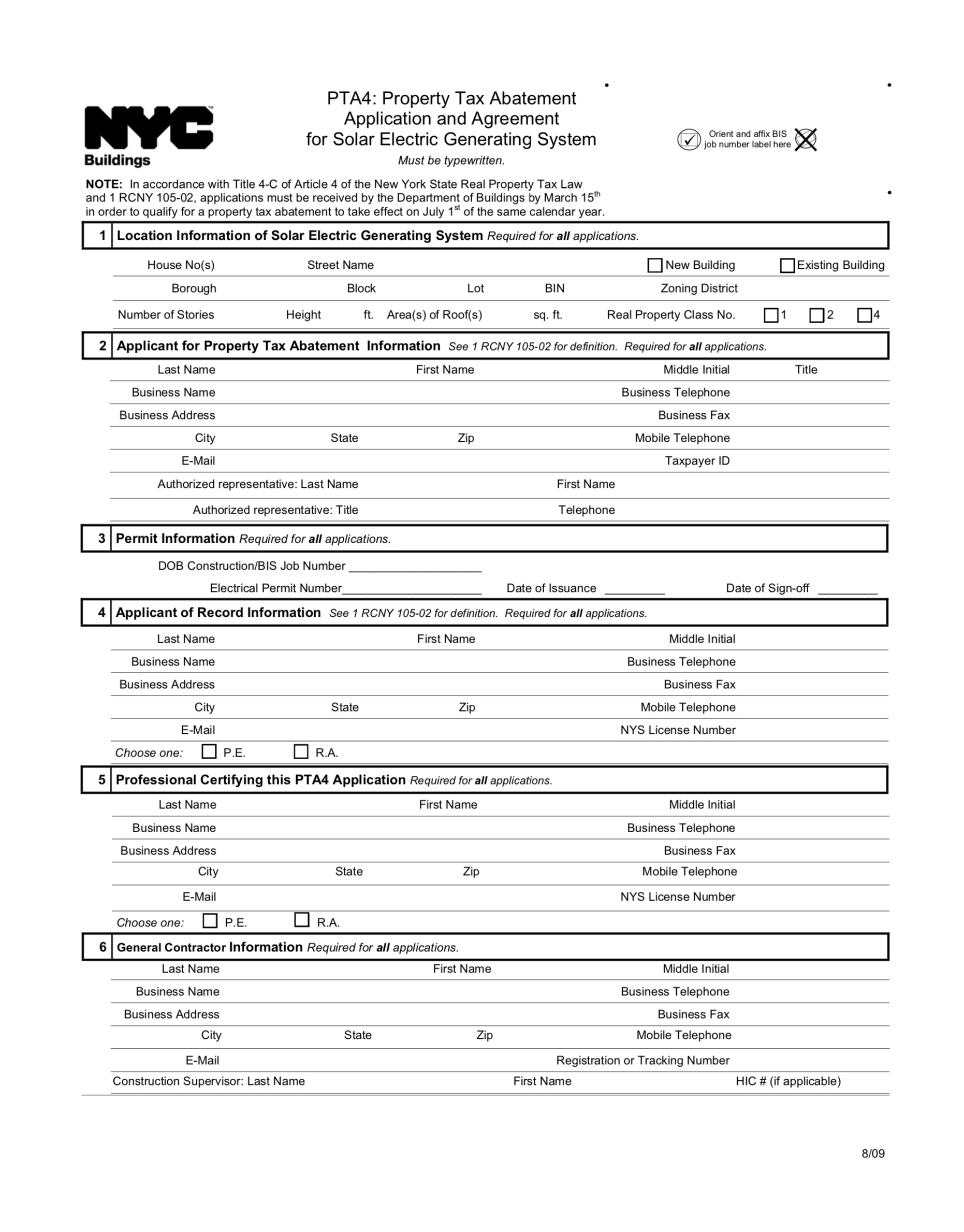

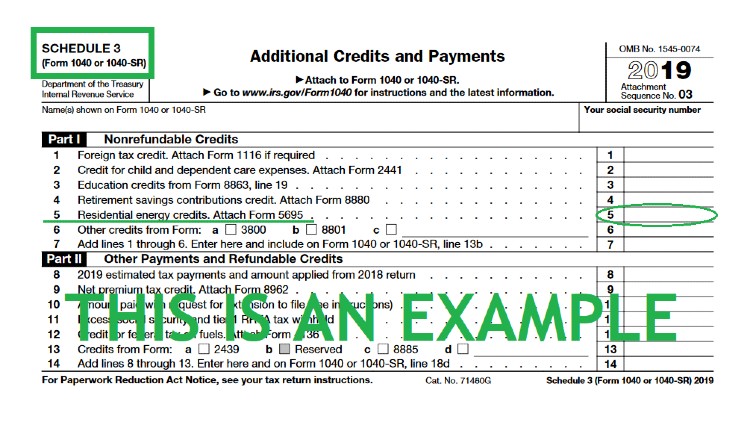

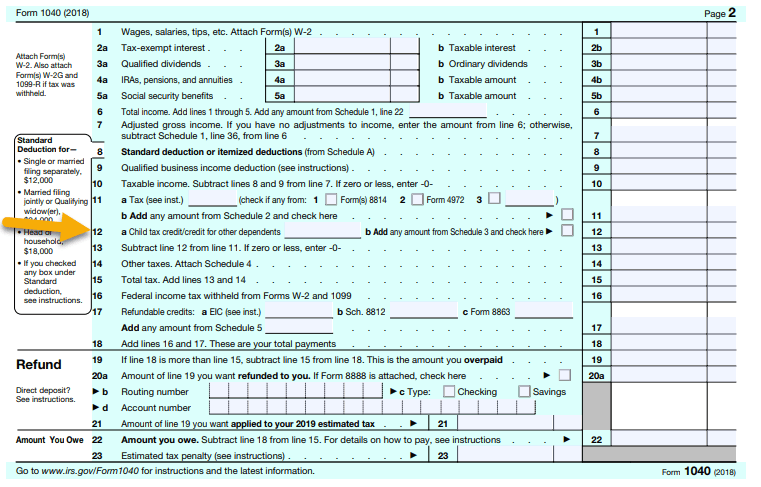

Web 4 mai 2023 nbsp 0183 32 Additional information is also available on energy gov which compares the credit amounts for tax year 2022 and tax year 2023 Energy Efficient Home Web 26 avr 2023 nbsp 0183 32 You will need four IRS tax forms to file for your solar tax credit Form 1040 Schedule 3 Form 1040 Form 5695 Instructions for Form 5695 latest version You ll also need Receipts from your solar

Web 8 oct 2021 nbsp 0183 32 Enter the amount from line 3 of the worksheet on page 4 of Form 5695 s detailed instructions In our example we will assume 2 500 of tax liability available to Web Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

https://i1.wp.com/southerncurrentllc.com/wp-content/uploads/IRS-Form-1040-Solar-Tax-Credit-Claim.png?resize=760%2C581

NYC Solar Property Tax Abatement Form PTA4 Explained Sologistics

https://images.squarespace-cdn.com/content/v1/5c9195a701232cc26820169f/1568139294591-H965RBL0G7P40I5QT4WZ/ke17ZwdGBToddI8pDm48kGOMHX6mYlKeQUDB-8DjRi17gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1USJtzInKmjaV_t2jk-slkYuCadpbNq49e5l2yx0ntfsRPWPOvZ4Spbhjs3xQZUzKCg/NYCDOBFormPTA4.jpg

https://www.irs.gov/instructions/i5695

Web For qualified fuel cell property see Lines 7a and 7b later You may be able to take a credit of 30 of your costs of qualified solar electric property solar water heating property

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web How do I claim the federal solar tax credit After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach IRS Form 5695 to

Solar Tax Credit And Your Boat

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Filing For The Solar Tax Credit Wells Solar

Here s How To Claim The Solar Tax Credits On Your Tax Return Southern

Filing For The Solar Tax Credit Wells Solar

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

Federal Solar Tax Credit Take 30 Off Your Solar Cost Solar 2022

How To Claim The Federal Solar Tax Credit SAVKAT Inc

2019 Tax Form 1040 1040 Form Printable

Home Energy Tax Credit Documentation

Federal Solar Tax Rebate Form - Web 1 Make sure you have a tax liability to use the Federal ITC against For people who are retired or on welfare the Federal ITC won t be a benefit You made energy saving