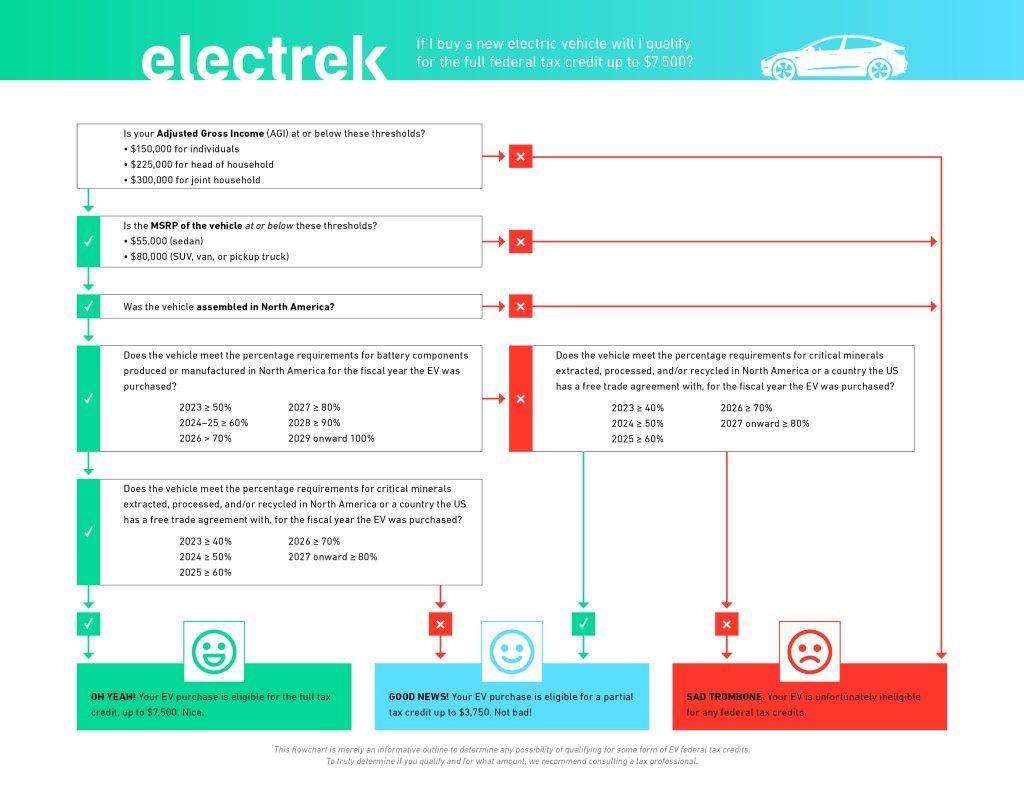

Federal Tax Credit Income Limit Ev The federal EV tax credit is worth up to 7 500 for qualifying new electric vehicles and 4 000 for qualifying used electric vehicles

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The What are the income limits to qualify for any federal EV tax credits Modified adjusted gross income limits are 150 000 for individuals 225 000 for heads of households and 300 000 for

Federal Tax Credit Income Limit Ev

Federal Tax Credit Income Limit Ev

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg?quality=82&strip=all&w=1024

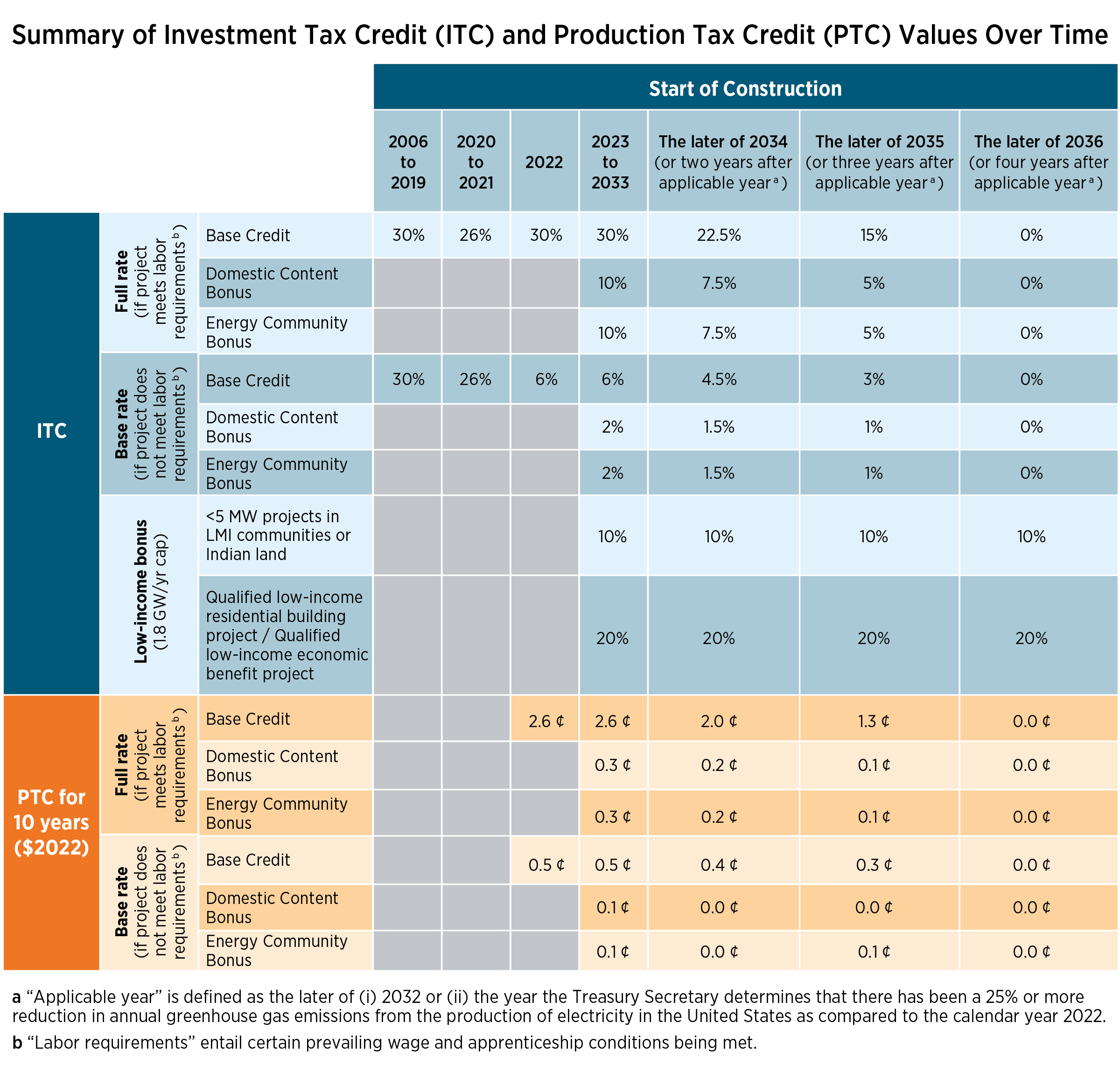

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

Electric Vehicles And Government issued Checks

https://images.ctfassets.net/w0ps5rolaaeh/42PI5EpyRwqMKGzrMyu3Bu/58b857bea6c6222b611b64a85df57739/ev-money-tax-credit.webp

Income Limits for the EV Tax Credit in 2024 To be eligible for the EV tax credit your modified adjusted gross income AGI should not exceed the following limits 300 000 Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can take a

If you bought a new qualified clean vehicle in 2022 or before you may still be eligible for a clean vehicle tax credit but some restrictions apply For a full summary of those restrictions review this IRS guide What is the Income Limit for EV Tax Credit 2024 The income limit for the 2024 EV tax credit is 300 000 for married couples filing jointly 225 000 for heads of household and

Download Federal Tax Credit Income Limit Ev

More picture related to Federal Tax Credit Income Limit Ev

Federal Tax Credit Calculation

https://media-exp1.licdn.com/dms/image/C4E12AQG5Q0qM6sabVQ/article-cover_image-shrink_720_1280/0/1627170582682?e=2147483647&v=beta&t=c68LlSF5_z0QfUc4QA18VjSk4YxcSaHzB4e4tRsjpiw

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

https://journalistsresource.org/wp-content/uploads/2018/04/tax-forms.jpg

U S Lawmakers Propose To Extend EV Tax Credit At A Cost Of 11 4

https://www.carscoops.com/wp-content/uploads/2019/04/6b9f9c16-ev-tax-credit-.jpg

EV tax credit income limit In order to claim the EV tax credit your modified adjusted gross income MAGI must fall below certain limits These limits vary by your tax filing status as well as whether the car you are purchasing is As of Jan 1 2024 eligible buyers can take the EV tax credit as a discount when purchasing a qualifying vehicle However one of the most important points is that there are income

These are the current EV income limits If it helps you qualify you can opt to use your AGI from the year before you took delivery of the vehicle For instance let s say you re a joint married filer who bought an EV in 2023 and Federal EV tax credits in 2024 top out at 7 500 if you re buying a new car and 4 000 if you re buying a used car while the bank or the automaker s finance company can

Child Tax Credit

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

How Does The Federal Solar Tax Credit Work CRJ Contractors

https://secureservercdn.net/198.71.233.235/b3x.784.myftpupload.com/wp-content/uploads/2020/02/federal-tax-credit-guide-1.png?time=1654102940

https://www.nerdwallet.com › article › taxe…

The federal EV tax credit is worth up to 7 500 for qualifying new electric vehicles and 4 000 for qualifying used electric vehicles

https://www.irs.gov › credits-deductions › credits-for...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The

See The EIC Earned Income Credit Table Income Tax Return Income

Child Tax Credit

Child Tax Credit Income Limit 2024 Credits Zrivo

EV Tax Credit 2024 Credits Zrivo

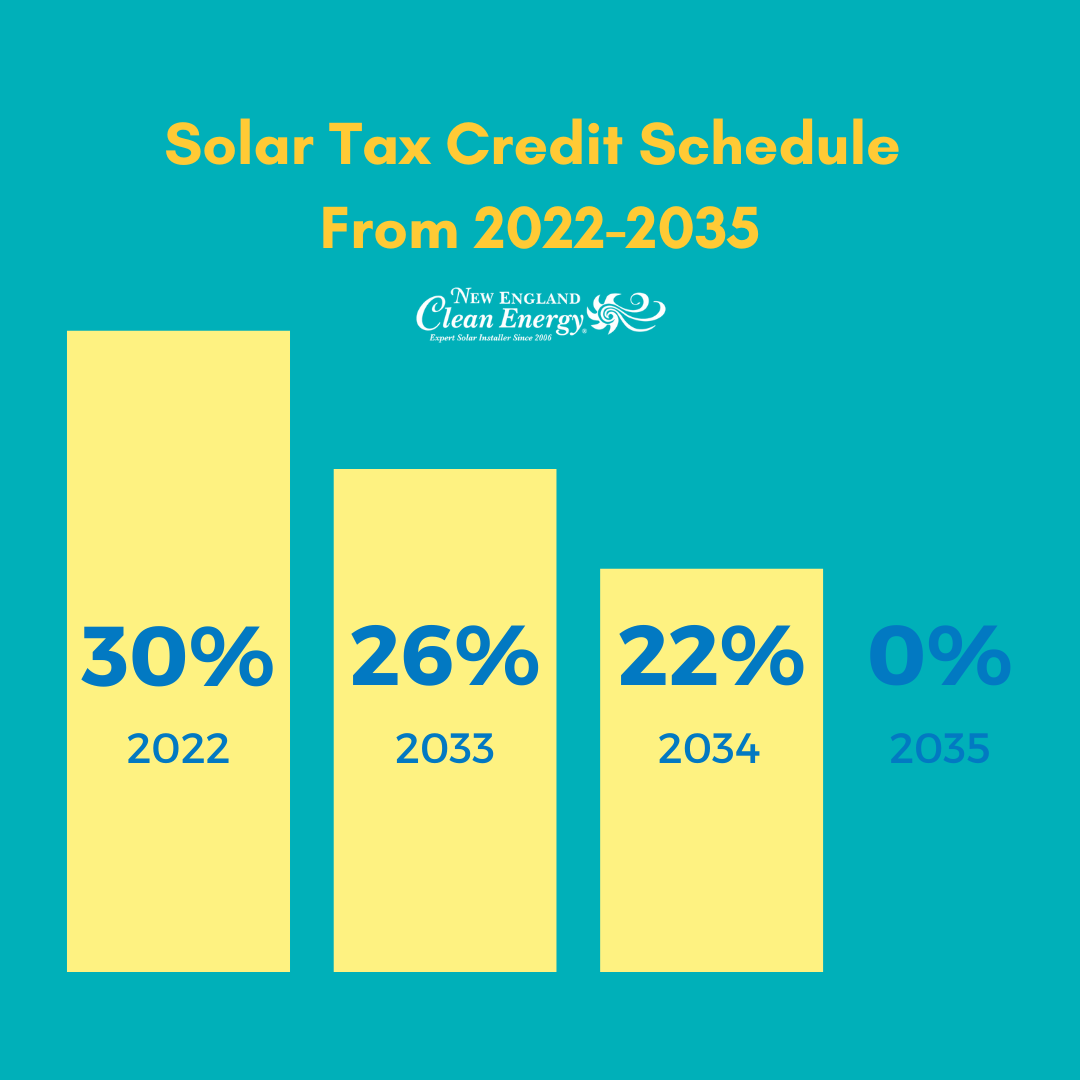

Solar Tax Credit How Do I Get It New England Clean Energy

Federal EV Tax Credit Explained YouTube

Federal EV Tax Credit Explained YouTube

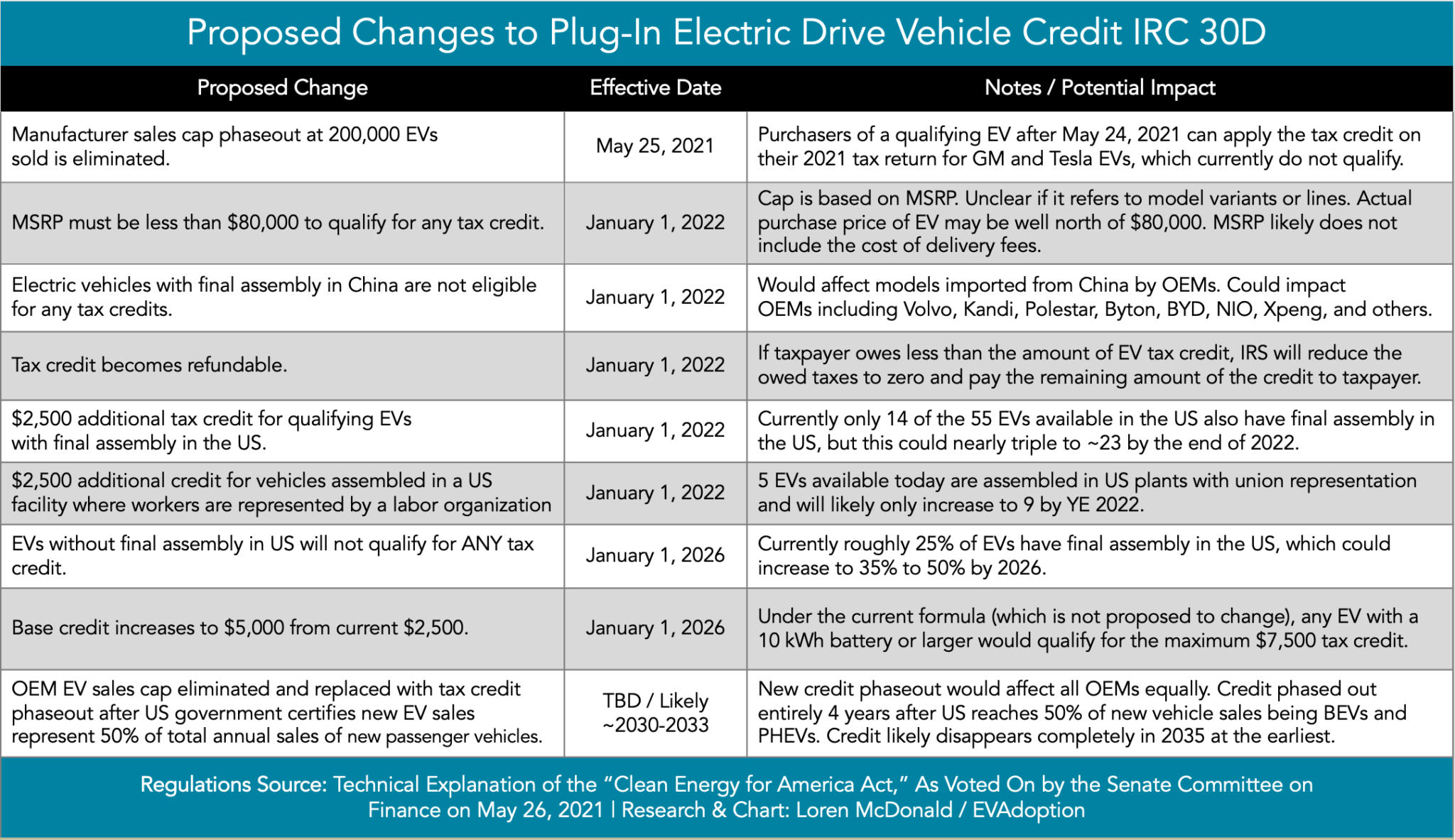

Impact Of Proposed Changes To The Federal EV Tax Credit Part 1

Help Getting The Earned Income Tax Credit The New York Times

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

Federal Tax Credit Income Limit Ev - The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive