How Is Foreign Tax Credit Calculated The Foreign Tax Credit FTC allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar for dollar basis You can claim foreign tax credits by filing IRS Form 1116 directly available for download here as part of your annual tax return to the IRS

The foreign tax credit is a U S tax break that offsets income tax paid to other countries To qualify the tax must be imposed on you by a foreign country or U S possession and you must have The Foreign Tax Credit FTC is a tax provision that allows U S taxpayers to reduce their U S income tax liability by the amount of foreign taxes paid or accrued on income earned outside the United States

How Is Foreign Tax Credit Calculated

How Is Foreign Tax Credit Calculated

https://image.khaleejtimes.com/?uuid=459c6558-0668-57f3-80a8-948c65ab7cb3&function=cropresize&type=preview&source=false&q=75&crop_w=0.99999&crop_h=0.96429&x=0&y=0&width=1200&height=675

Demystifying IRS Form 1116 Calculating Foreign Tax Credits SF Tax

https://sftaxcounsel.com/wp-content/uploads/2021/01/shutterstock_1898463574.jpg

IRS Form 1116 Foreign Tax Credit With An Example 1040 Abroad

http://staging10.1040abroad.com/wp-content/uploads/2019/02/how-to-file-foreign-tax-credit-part-3-and-4.jpg

How to Claim the Foreign Tax Credit File Form 1116 Foreign Tax Credit to claim the foreign tax credit if you are an individual estate or trust and you paid or accrued certain foreign taxes to a foreign country or U S possession For 2023 your foreign tax credit limit is 700 If you choose to claim a credit for your foreign taxes in 2023 you would be allowed a credit of 700 consisting of 600 paid in 2023 and 100 of the 200 carried over from 2022

What is the Foreign Tax Credit The Foreign Tax Credit FTC is one method U S expats can use to offset foreign taxes paid abroad dollar for dollar Tax credits in general work like this If you owe the U S government 1 500 in taxes and you have a 500 tax credit you ll end up only owing 1 000 and the Foreign Tax Credit By using the Foreign Tax Credit calculation you are reducing your US taxable income as an American abroad Additionally when you use the FTC for credit onto your own US taxes you lessen the burden of your US tax liability

Download How Is Foreign Tax Credit Calculated

More picture related to How Is Foreign Tax Credit Calculated

How To Calculate Your Foreign Tax Credits Carryover With Examples

https://brighttax.com/wp-content/uploads/2022/08/Untitled-design-20-1024x683.png

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

https://resize.hswstatic.com/w_1200/gif/foreign-tax-credit-orig.jpg

So How Do Foreign Tax Credits Work Let s Fix The Australia US Tax

http://fixthetaxtreaty.org/wp/wp-content/uploads/2021/07/FTC1.jpg

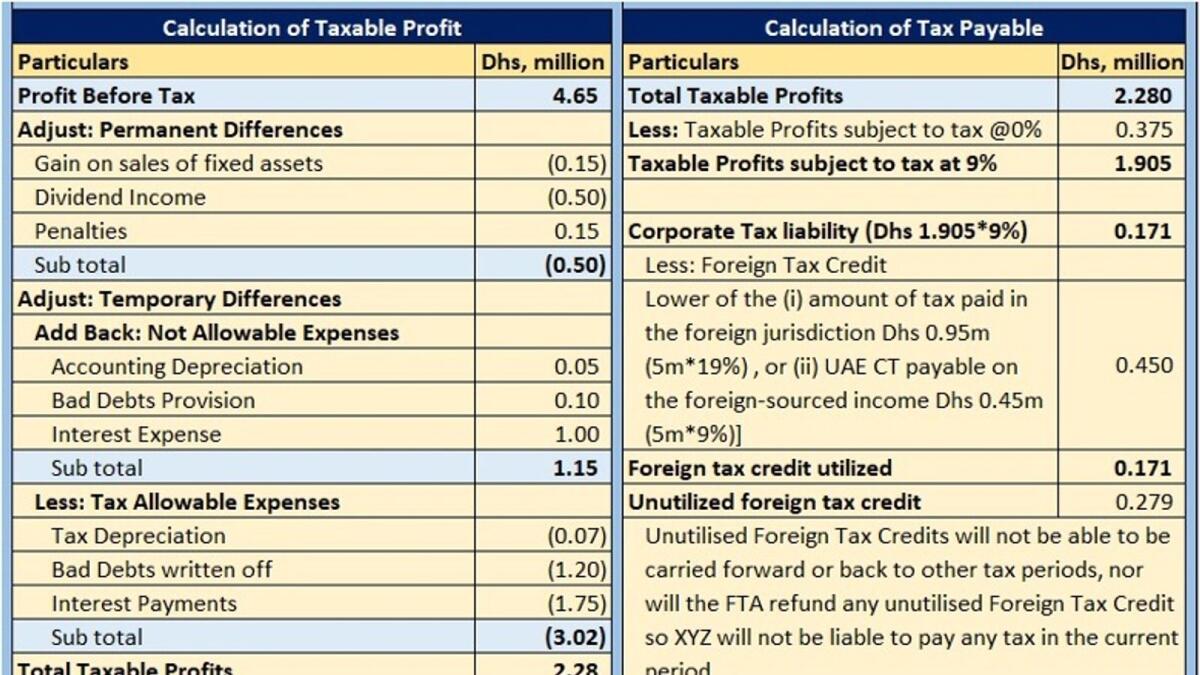

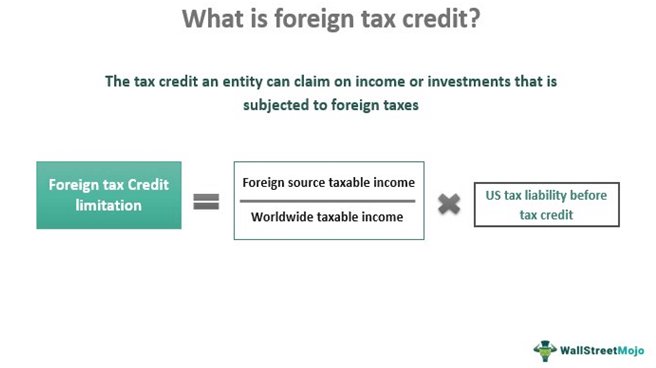

The foreign tax credit limitation is calculated as a taxpayer s precredit U S tax liability multiplied by a ratio not to exceed one where the numerator is the taxpayer s foreign source taxable income and the denominator is the The Foreign Tax Credit FTC carryover allows US taxpayers earning abroad to carry forward unused credits for up to 10 years offsetting future US tax liabilities This can also be carried back to the previous year

The foreign tax credit is a U S tax credit for income tax paid to other countries The general objective is to help taxpayers avoid double taxation on foreign income How to Calculate the Foreign Tax Credit If you re wondering How much foreign tax credit can I get The answer is that you can claim a dollar for dollar representation of the qualified foreign income taxes you ve paid However there is a limit to the amount of your claim that can be applied to a single tax year

Foreign Tax Credit Form 1116 And How To File It example For US Expats

https://1040abroad.com/wp-content/uploads/2019/02/How-to-file-Foreign-Tax-Credit-part-1-1.jpg

Foreign Tax Credits IRS Form 1116 Explained By Golding Golding

https://i.ytimg.com/vi/rNFHhJAsONs/maxresdefault.jpg

https://brighttax.com/blog/how-to-calculate...

The Foreign Tax Credit FTC allows US expats to reduce their tax liability based on what they already paid in foreign taxes on a dollar for dollar basis You can claim foreign tax credits by filing IRS Form 1116 directly available for download here as part of your annual tax return to the IRS

https://www.investopedia.com/terms/f/foreign-tax-credit.asp

The foreign tax credit is a U S tax break that offsets income tax paid to other countries To qualify the tax must be imposed on you by a foreign country or U S possession and you must have

IRS Form 1116 Walkthrough Foreign Tax Credit YouTube

Foreign Tax Credit Form 1116 And How To File It example For US Expats

What Is The Foreign Tax Credit And How Can I Use It YouTube

What Is Foreign Tax Credit Explained YouTube

Foreign Tax Credit Meaning Example Limitation Carryover

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

San Francisco Foreign Tax Credit Attorney SF Tax Counsel

Foreign Tax Credit Part 1 Overview YouTube

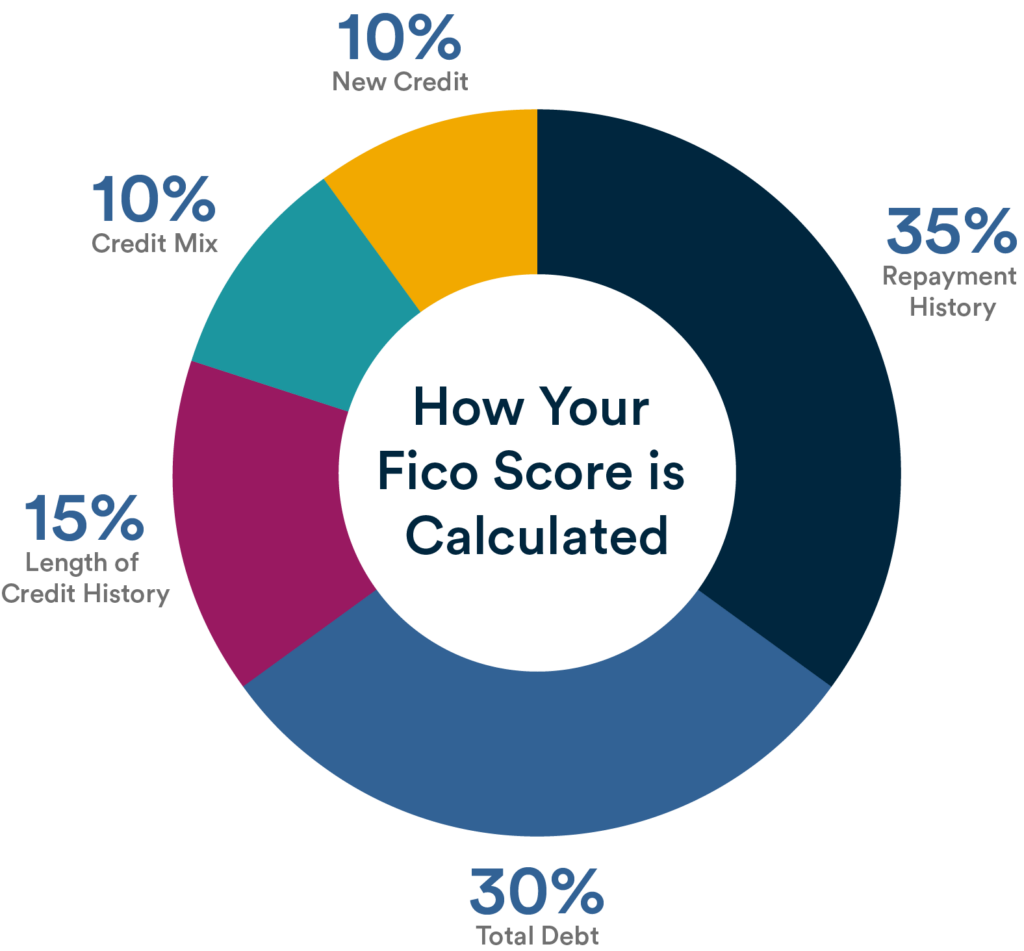

Your FICO Credit Score What Is It And Why Is It Important Laurel Road

The US Foreign Tax Credit A Guide For Americans Living Abroad Wise

How Is Foreign Tax Credit Calculated - By using the Foreign Tax Credit calculation you are reducing your US taxable income as an American abroad Additionally when you use the FTC for credit onto your own US taxes you lessen the burden of your US tax liability