How To Claim Rebate On Home Loan Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act Additionally principal If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

How To Claim Rebate On Home Loan

How To Claim Rebate On Home Loan

https://cdn.zeebiz.com/sites/default/files/styles/zeebiz_850x478/public/2020/04/28/117658-bank-loan-pti.jpg?itok=G0GkZm2Q&c=4d7c9c9efe3dff224ff5225977fd6c8f

Income Tax Return Filing To Linking Aadhaar With UAN These 4 Financial

https://static.india.com/wp-content/uploads/2021/12/income-tax-return-itr-filing-post-office-1.jpg

New Mexico Tax Rebate 2022 How To Claim The New 500 Checks Marca

https://phantom-marca.unidadeditorial.es/b9913983e500a2b2e16ff626ec92fde2/crop/0x0/1320x743/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/14/16394824903699.jpg

Check out in detail how to calculate home loan tax benefits income tax sections that provide tax rebate steps to claim tax benefits on home loan Every home loan borrower should be aware of the following income tax rebates on home loans Cheapest home loan interest rates for amounts above Rs 75 lakh PSU banks vs private banks Deduction on

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C Home Loan Tax Benefits Know How to Get Income Tax Benefits on Your Home Loan FY 2023 24 Check Tax benefits under sections how to Claim

Download How To Claim Rebate On Home Loan

More picture related to How To Claim Rebate On Home Loan

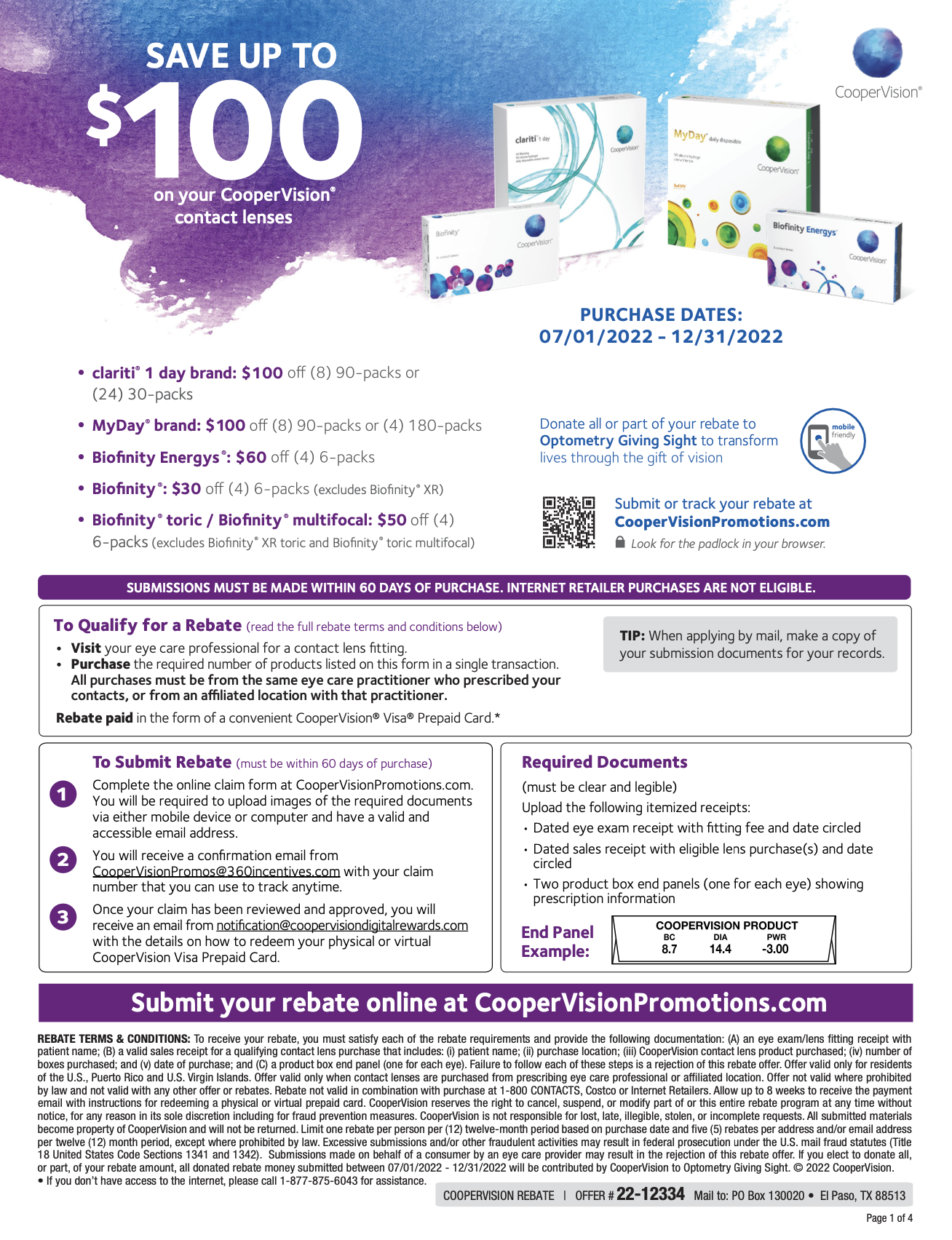

How To Claim A CooperVision And Biofinity Contacts Rebate 2022

https://printablerebateform.net/wp-content/uploads/2022/09/Biofinity-Contacts-Rebate-2022.png

Do You Have A Soakaway How To Claim A Surface Water Drainage Rebate On

https://cdn.mos.cms.futurecdn.net/sXeHpkQkohSHZMxsvAUtqc-1200-80.jpg

How To File My Renters Rebate RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2022/10/how-to-claim-a-rent-rebate-woproferty.jpg

If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income through this itemized deduction of mortgage interest In the past homeowners What is the mortgage interest deduction Is mortgage interest deductible Mortgage interest deduction limit What qualifies for the mortgage interest deduction

If you take out a home loan jointly each borrower can claim a deduction for home loan interest up to Rs 2 lakh under Section 24 b and a tax deduction for principal A home loan provides a number of benefits upon repayment through tax deductions under the Income Tax Act of 1961

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

https://static.india.com/wp-content/uploads/2023/01/budget-2023-banner.png

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

https://housing.com/news/home-loans-guid…

Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first home you can claim benefits under

https://www.icicibank.com/blogs/home-lo…

Individuals who have taken a home loan for purchasing or constructing a residential property can claim tax deductions on the interest paid on the loan under Section 24 of the Income Tax Act Additionally principal

How To Claim Your Uniform Tax Rebate Indigo Clothing

Increase In Rebate Limit Relief On Home Loan Here s What Taxpayers

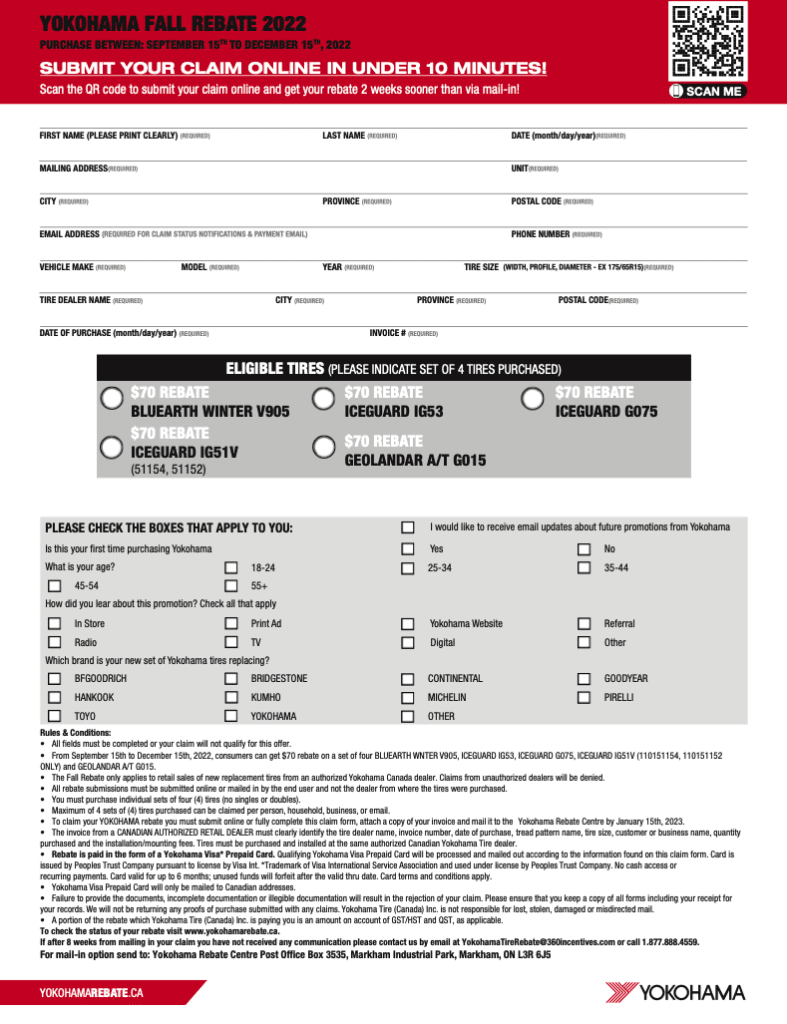

Yokohama Tire Rebate Form 2023 Printable Rebate Form

Here Is How To Claim Rebate Under Section 87A Of Income tax Act

Home Loan Tax Rebate Have You Claimed Certain Tax Advantages Yet

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

How To Claim Uniform Tax Rebate DNS Accountants YouTube

Here Is How To Claim Rebate Under Section 87A Of Income tax Act

8 Incredible Tips How To Claim Recovery Rebate Credit On Turbotax

How To Claim Rebate On Home Loan - Check out in detail how to calculate home loan tax benefits income tax sections that provide tax rebate steps to claim tax benefits on home loan