Income Tax Rebate For Central Government Employees Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am

Web 1 f 233 vr 2022 nbsp 0183 32 Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This Web 22 sept 2022 nbsp 0183 32 Section 80CCD relates to the tax deduction for the contributions made in the National Pension System NPS and the Atal Pension Yojana APY Under this section

Income Tax Rebate For Central Government Employees

Income Tax Rebate For Central Government Employees

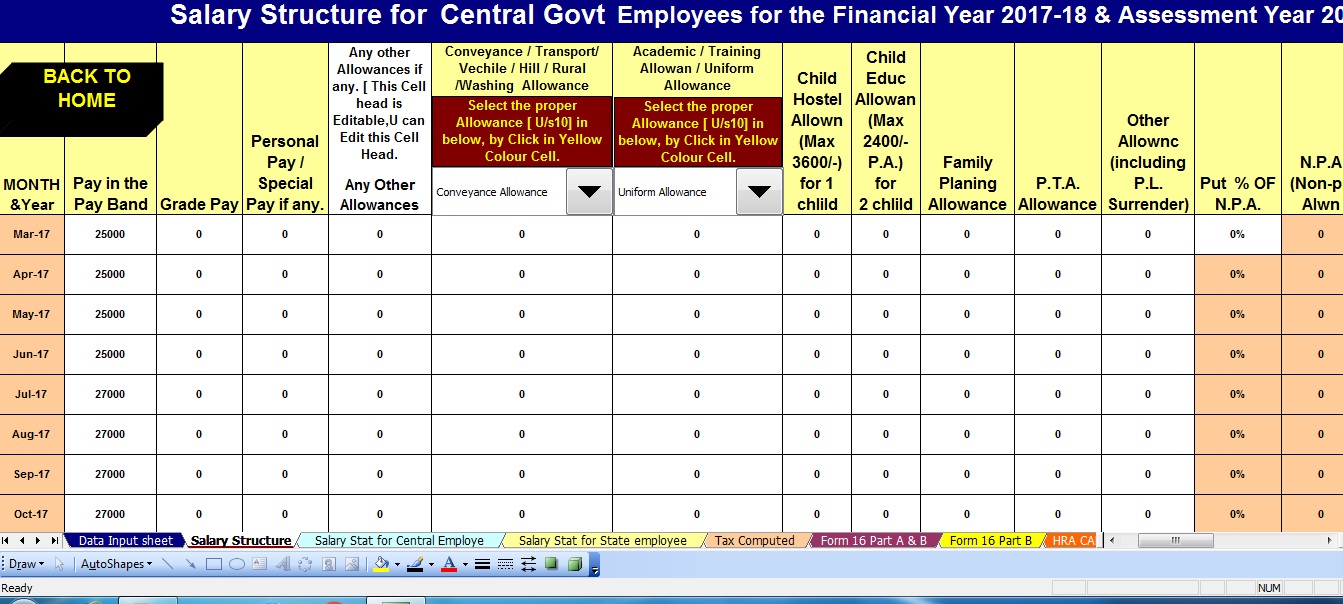

https://tdstax.files.wordpress.com/2017/04/0a132-central2b25262bstate2bpage2b2.jpg

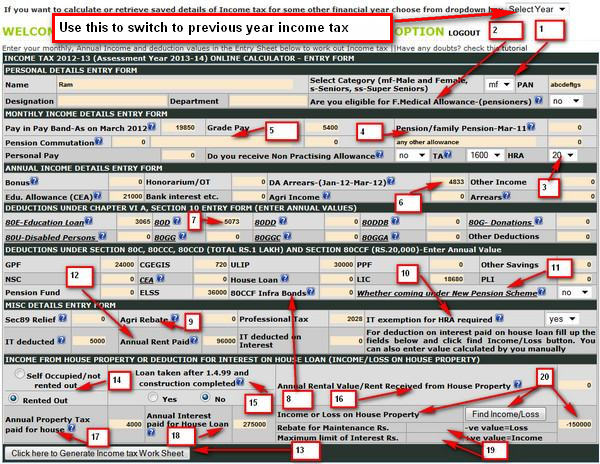

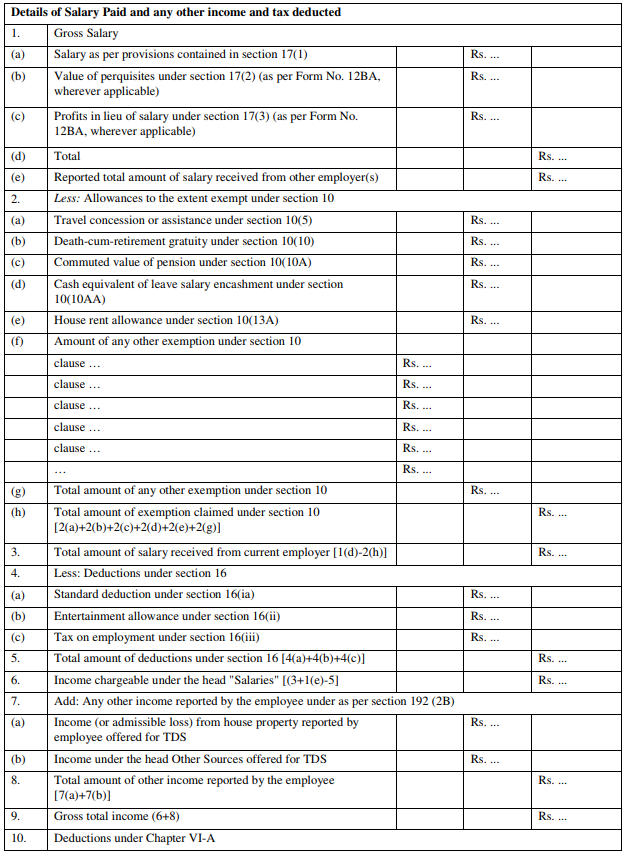

Income Tax Calculator 2012 13 For Central Government Employees

http://www.gconnect.in/images/stories/2012/jul/it-2012-entry-sheet.jpg

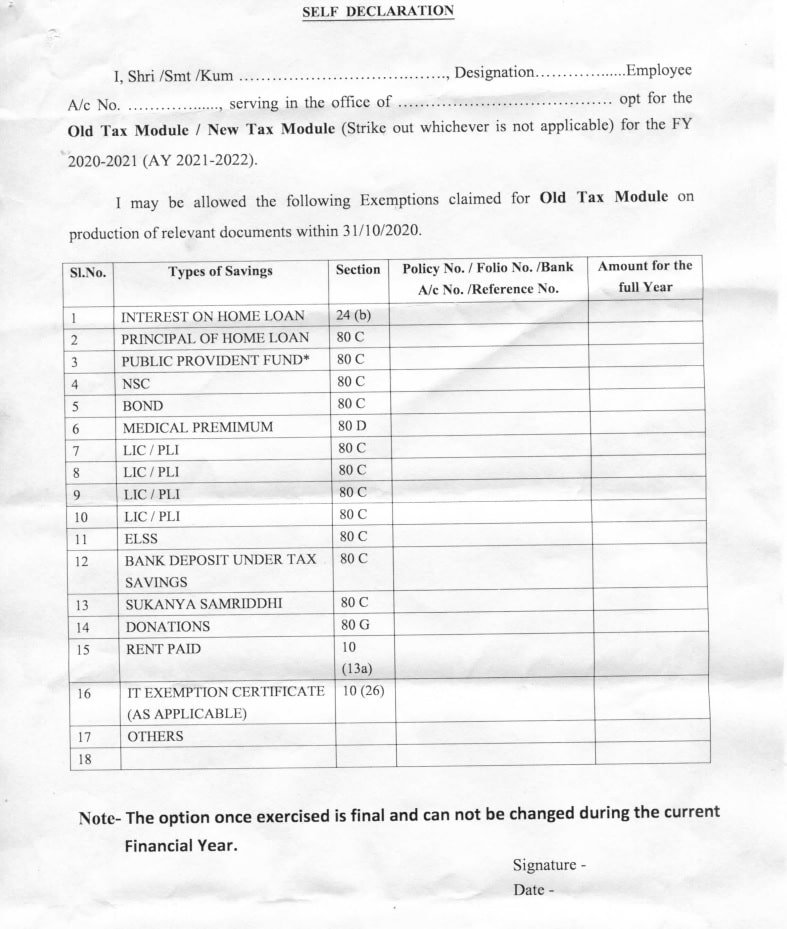

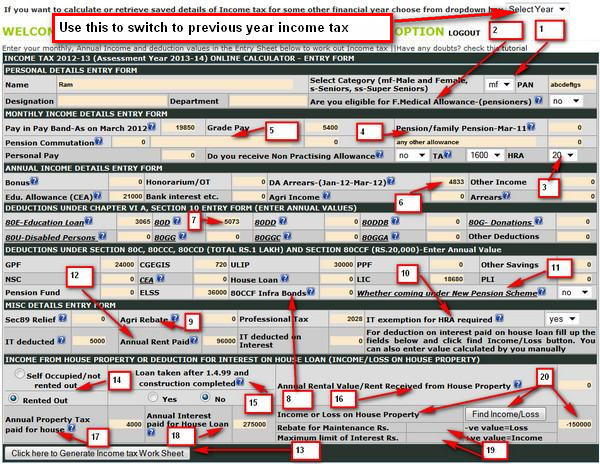

New Income Tax Regime Declaration Form 2020 21 PDF Download For

https://7thpaycommissionnews.in/wp-content/uploads/2020/07/New-Income-Tax-Regime-Declaration-Form-2020-21-PDF-Download-for-Government-Employees.jpg

Web As per the Finance Act 2021 the rates of income tax for the FY 2021 22 i e Assessment Year 2022 23 are as follows Rates of tax A Normal Rates of tax In the case of every Web 21 sept 2022 nbsp 0183 32 Recently the government announced that the contribution of employers in NPS for the central government would rise from 10 to 14 Additionally the

Web rebate shall be 100 of income tax or Rs 12 500 whichever is less The Rates for Charging Income Tax for Financial Year 2020 21 i e AY 2021 22 Other than Senior Web 1 f 233 vr 2022 nbsp 0183 32 The income tax slabs for the financial year 2022 23 remain the same The FM further announced that both the Central and state government employees tax

Download Income Tax Rebate For Central Government Employees

More picture related to Income Tax Rebate For Central Government Employees

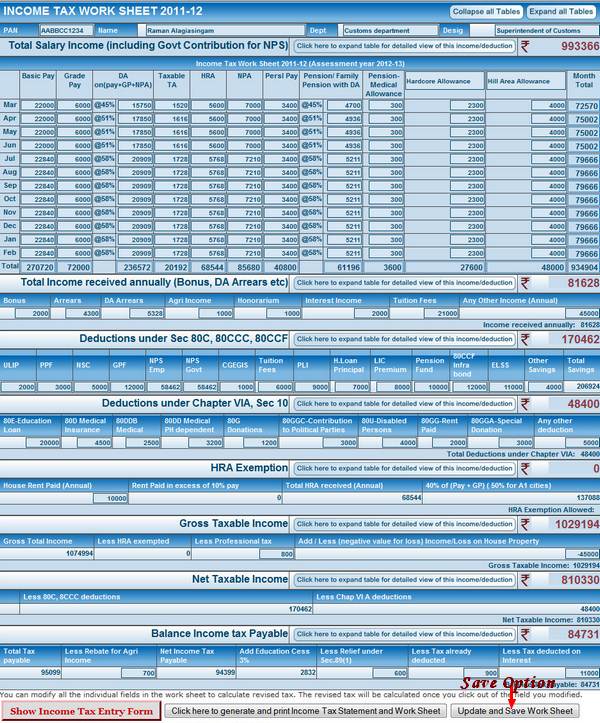

Income Tax Calculator 2012 13 For Central Government Employees

http://www.gconnect.in/images/stories/2012/jul/it-2012-work-sheet-expanded.jpg

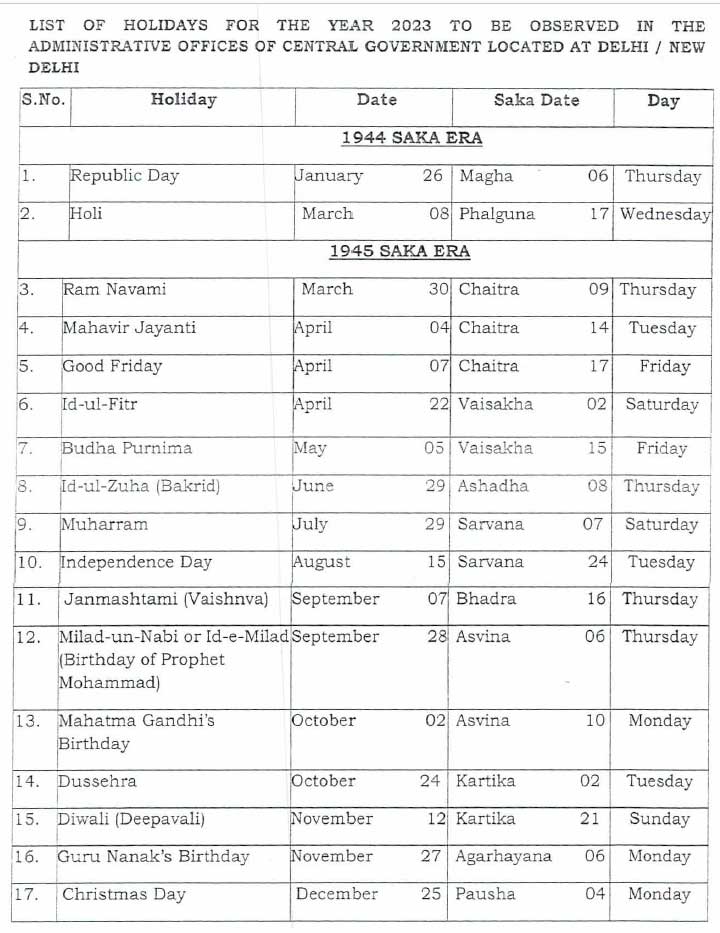

Central Government Offices Gazetted Holidays 2023 Central Government

https://www.centralgovernmentnews.com/wp-content/uploads/2022/06/CENTRAL-GOVERNMENT-EMPLOYEES-GAZETTED-HOLIDAYS-2023-DOPT-HOLIDAYS-2023.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Web Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay Web 1 f 233 vr 2022 nbsp 0183 32 Currently only central government employees are eligible to claim tax benefit of 14 The corporate surcharge will be reduced from 12 to 7 FM said Finance Minister Nirmala Sitharaman in

Web Wondering how to calculate income tax exemption in HRA Use our simple and free online tool to calculate income tax exemptions on your HRA as a Central or State Web Commuted Pension received by an employee Central Government State Government Local Authority Employees and Statutory Corporation Fully Exempt 3 10 10A ii

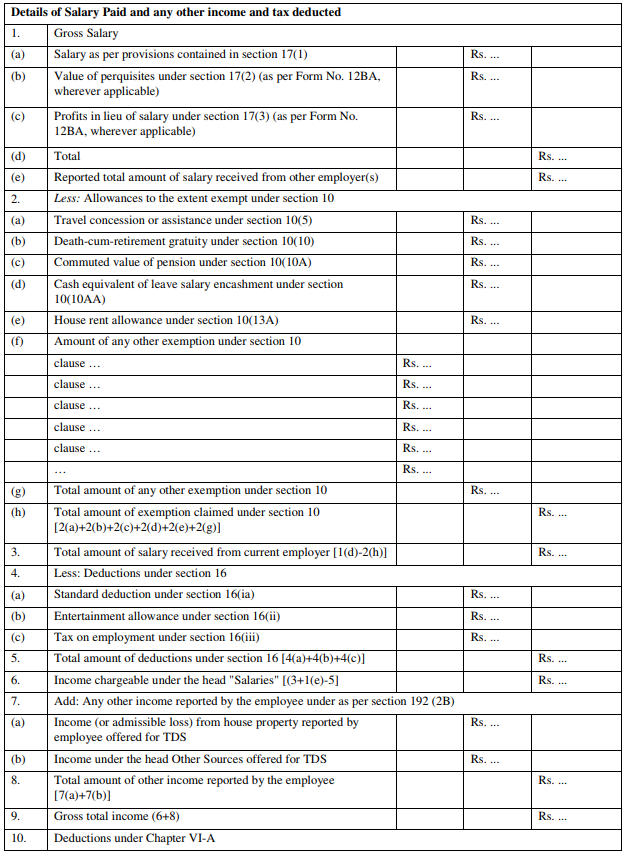

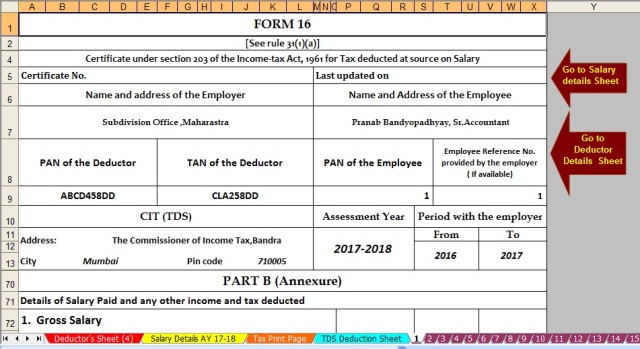

CBDT Notification 2019 Important Amendment In Form 16 Central

https://7thpaycommissionnews.in/wp-content/uploads/2019/04/New-format-of-form-16-1.png

Malaysia Personal Income Tax Guide 2020 YA 2019

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/tax-reliefs-rebates-income-tax.png?is-pending-load=1

https://incometaxindia.gov.in/Booklets Pamphlets/e-PDF__…

Web A retired employee above 60 years of age who is in receipt of pension income from his former employer can claim a deduction upto Rs 50 000 against such salary income Am

https://www.financialexpress.com/budget/emp…

Web 1 f 233 vr 2022 nbsp 0183 32 Employer s contribution towards NPS Tier I is eligible for tax deduction under Section 80CCD 2 of the Income Tax Act 14 of salary for central government employees and 10 for others This

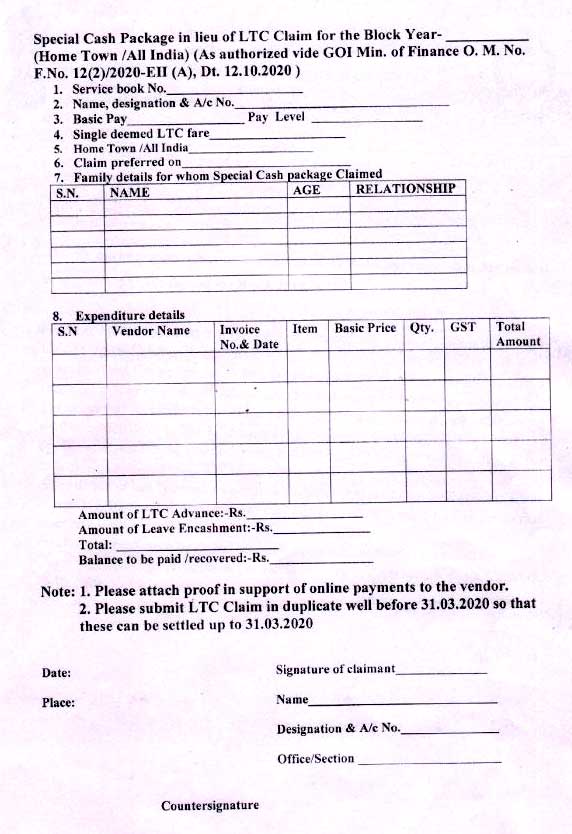

Special Cash Package In Lieu Of LTC Fare For CG Employees 2018 2021

CBDT Notification 2019 Important Amendment In Form 16 Central

India s Dual Tax system Old Vs New Tax Regime Zoho Payroll

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

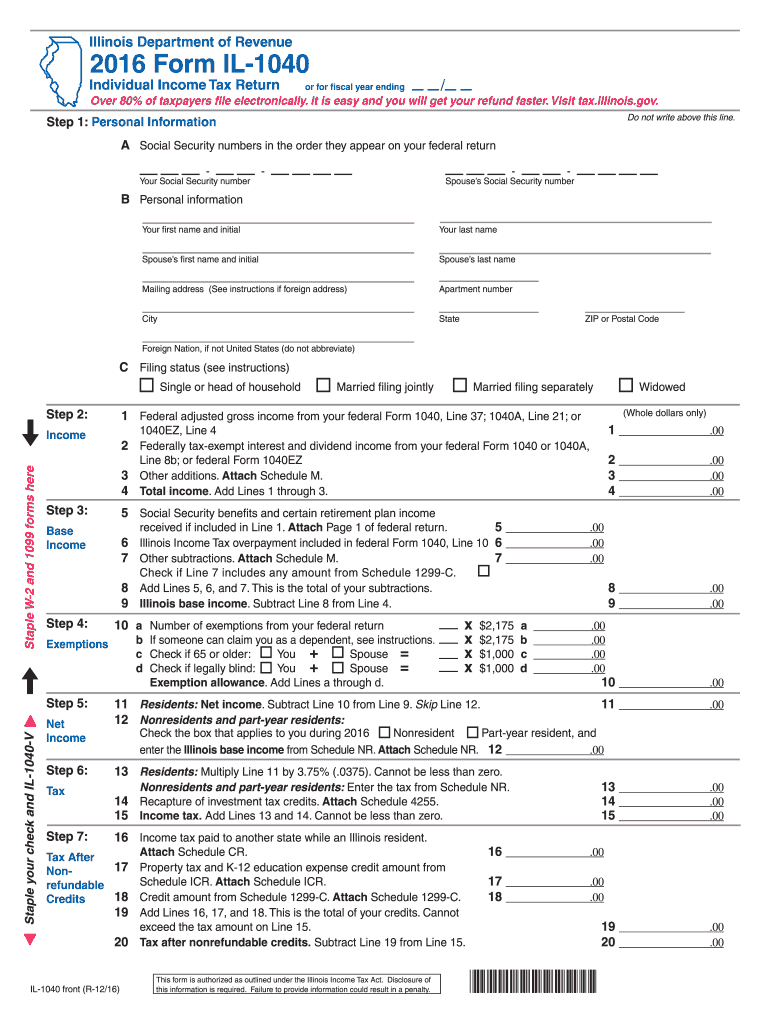

Illinois Form Tax 2016 Fill Out Sign Online DocHub

Income Tax Rebate Hike Rs 5000 Under Section 87A With Automated

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Income Tax Rebate For Central Government Employees - Web 21 sept 2022 nbsp 0183 32 Recently the government announced that the contribution of employers in NPS for the central government would rise from 10 to 14 Additionally the