Income Tax Rebate For Disabled Dependent AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in

Section 80DD of the income tax act provides a flat deduction irrespective of the amount of expenditure incurred by the family of a disabled dependent This is in consideration of the large Deduction under Section 80DD of the income tax act is allowed for a dependent who is differently abled Conditions include being a resident individual

Income Tax Rebate For Disabled Dependent

Income Tax Rebate For Disabled Dependent

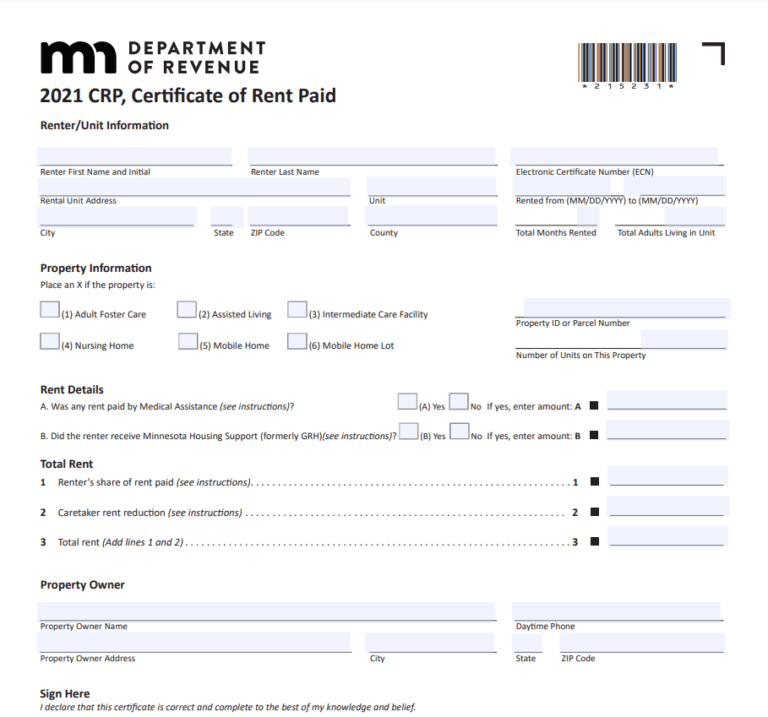

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

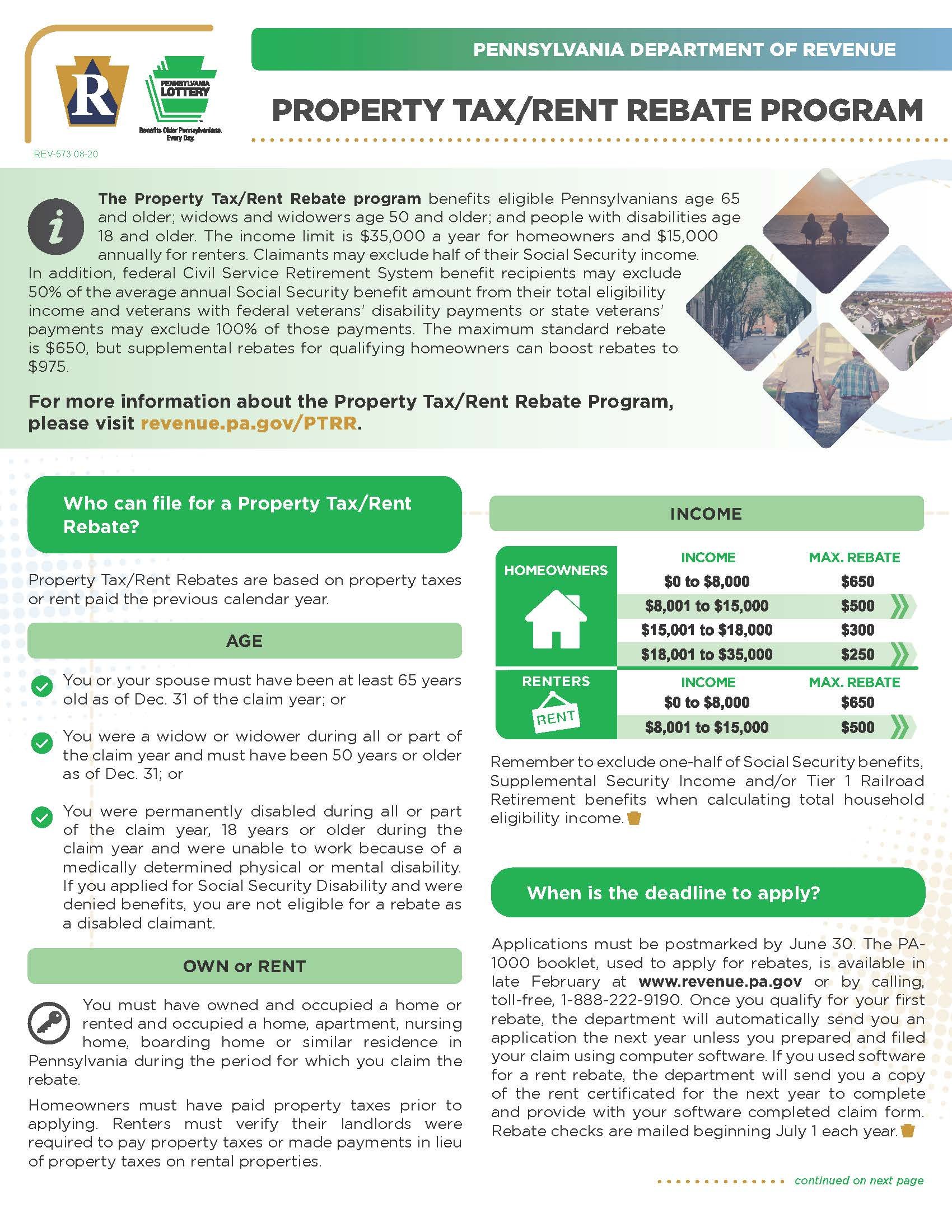

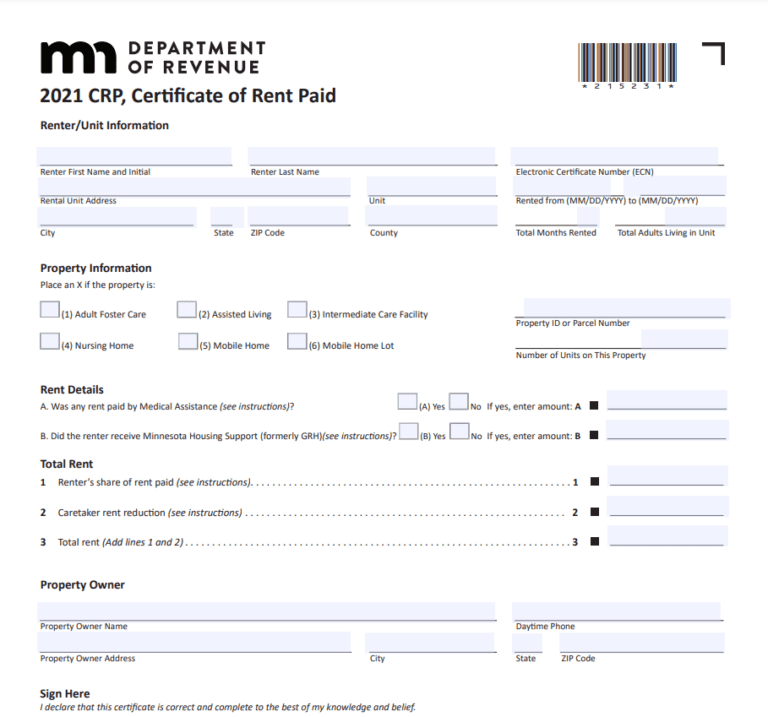

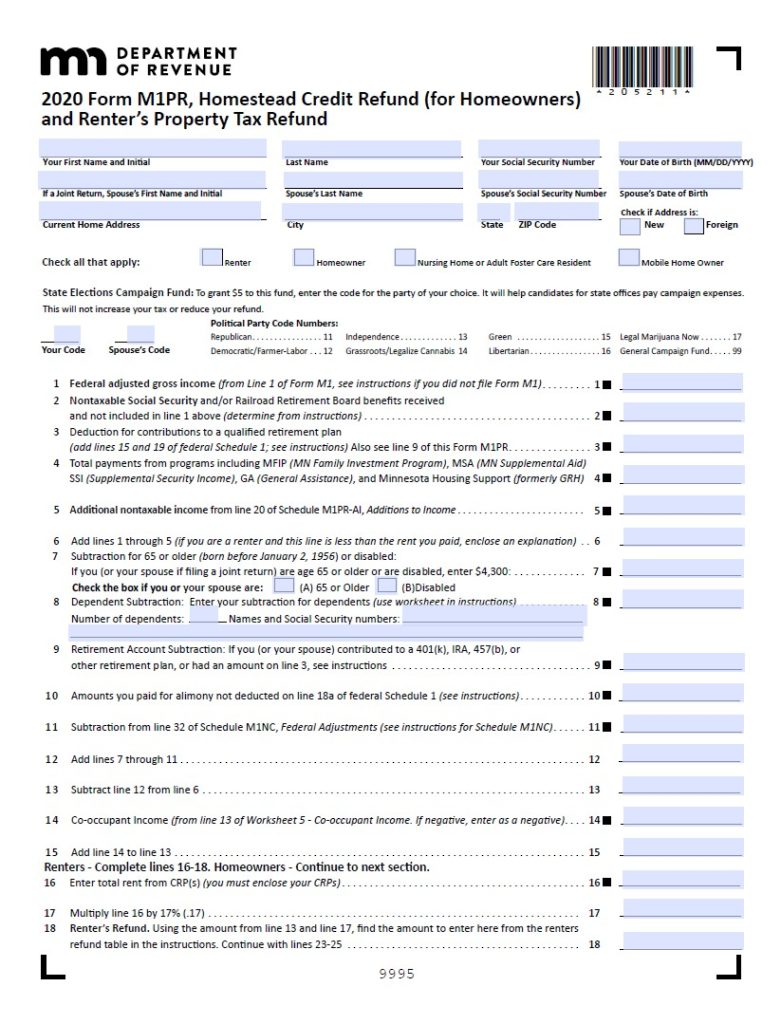

Renters Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Taxpayers who have dependents with specified diseases write to us inquiring about how to get a certificate for claiming deduction under section 80DDB on their Government of India has in order to provide some relief to those who have a dependent with disability or sever disability provided some relief s from Income tax

If you are unable to complete your tax return because of a disability you may be able to obtain assistance from an IRS office or the Volunteer Income Tax Assistance When one of your dependents has a disability the amount you can claim back is higher not just for your child with the disability but for the entire family This

Download Income Tax Rebate For Disabled Dependent

More picture related to Income Tax Rebate For Disabled Dependent

Disabled Person Can Claim Up To Rs 1 25 000 Tax Deduction

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2019/05/19/825456-disabled-businessman-istock-052019.jpg

State Income Tax Rebate Arrives McHenry County Blog

https://mchenrycountyblog.com/wp-content/uploads/2022/10/Inc-Tax-Rebate-10-22-808x1024.png

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A.jpg

The elderly and disabled can receive a tax credit that could reduce and even potentially eliminate the tax they owe for the entire year Here s how to figure out if you If you pay for care for the disabled person you claim as a tax dependent you may be able to benefit from the Child and Dependent Care Credit The credit is non refundable

Having a child with a disability can affect your taxes For example the Earned Income Tax Credit EITC is a refundable tax credit meaning you could Most income is taxable but some is exempt like SSI payments workers comp settlements and some short term disability benefits If you made 50 000 of

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/585/571/585571881/large.png

Disability Tax Rebate For Disabled Child Get The Maximum Disability

https://i.ytimg.com/vi/oppKdSz8XqA/maxresdefault_live.jpg

https://www.irs.gov/pub/irs-pdf/p3966.pdf

AS A PERSON WITH A DISABILITY you may qualify for some of the following tax deductions income exclusions and credits More detailed information may be found in

https://tax2win.in/guide/section-80dd

Section 80DD of the income tax act provides a flat deduction irrespective of the amount of expenditure incurred by the family of a disabled dependent This is in consideration of the large

Tax Rebate For Individuals Swaper Investing Blog

Pa 1000 2021 2024 Form Fill Out And Sign Printable PDF Template SignNow

Income Tax Rebate Under Section 87A

PA Property Tax Rent Rebate Apply By 6 30 2023 Legal Aid Of

Rebate And Releif Of Tax Rebate 87a Of Income Tax Rebate And Relief

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

Renters Rebate Form Printable Rebate Form

Deadline For Tax And Rent Relief Extended

Who Is Eligible For The Child Tax Credit In 2022 Leia Aqui Can You

Income Tax Rebate For Disabled Dependent - You can claim a person with disabilities as a dependent when They have lived with you for more than half of the tax year You have provided at least half of their