Is Nps Under Section 80c Investments of up to Rs 1 5 lakh in NSCs can be made to save taxes under Section 80C NSCs can be bought from designated post offices and come with a lock in period of 5 years The interest is compounded annually

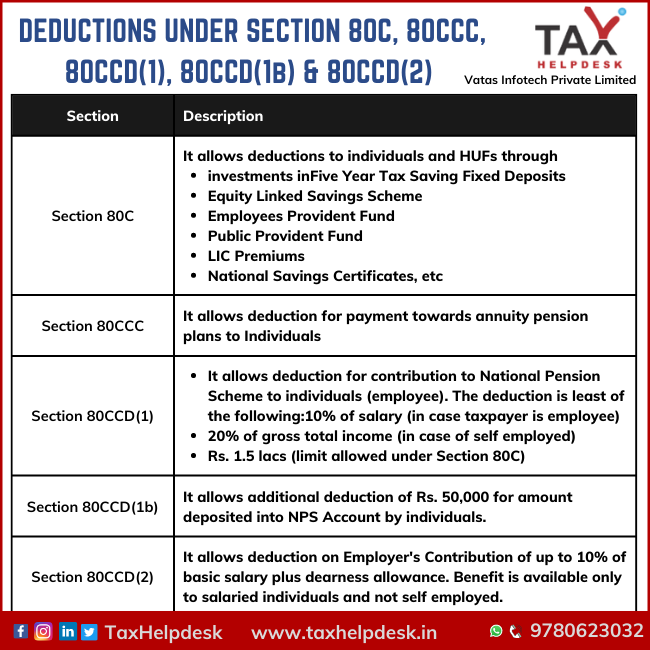

For someone in the 30 per cent tax bracket this is a clear benefit of Rs 15 000 on investment of Rs 50 000 over and above the Rs 1 5 lakh allowed under Section 80 C This article gives an overview of NPS explains NPS Tax On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Act Importantly as per Section 80CCE the aggregate amount of deduction under

Is Nps Under Section 80c

Is Nps Under Section 80c

https://i.ytimg.com/vi/5M1YKYGiLQc/maxresdefault.jpg

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

Section 80C Deduction Under Section 80C In India Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/04/Section80C-infographic-Content.jpg

The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However deductions under Learn how to claim tax deductions under Section 80CCD for NPS contributions Explore limits for employees self employed and employers plus additional benefits Income Tax

Here s how the NPS works under Section 80C 1 Maximum Deduction of Rs 1 5 Lakh Under Section 80C a taxpayer can claim deductions of up to Rs 1 5 lakh on Myth 6 You Cannot Invest in NPS If You ve Exhausted Section 80C Limit Reality Under the old tax regime even if you ve maxed out your Rs 1 5 lakh Section 80C limit you

Download Is Nps Under Section 80c

More picture related to Is Nps Under Section 80c

What Is Section 80C Sharda Associates

https://shardaassociates.in/wp-content/uploads/2021/06/section-80c-cover-amp.jpg

Raising The Limit Under Section 80C What Budget Can Do To Reduce Your

https://img.etimg.com/thumb/msid-67773644,width-640,resizemode-4,imgsize-243707/raising-the-limit-under-section-80c.jpg

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C.jpg

National Pension Schemes provide tax benefits under section 80C Check out Eligibility to get tax exemption other NPS benefits and how it helps in savings Investments of up to Rs 50 000 in NPS are considered for exemption under this section Employer s contribution towards NPS up to 10 comprising basic salary and dearness

No the maximum deduction allowed under Sections 80C 80CCC and 80CCD put together is Rs 1 50 000 Over and above this limit a further deduction of Rs 50 000 is If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

Section 80C Everything To Know Deduction Under 80C Tax Saving

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

https://cleartax.in

Investments of up to Rs 1 5 lakh in NSCs can be made to save taxes under Section 80C NSCs can be bought from designated post offices and come with a lock in period of 5 years The interest is compounded annually

https://bemoneyaware.com

For someone in the 30 per cent tax bracket this is a clear benefit of Rs 15 000 on investment of Rs 50 000 over and above the Rs 1 5 lakh allowed under Section 80 C This article gives an overview of NPS explains NPS Tax

A Quick Look At Deductions Under Section 80C To Section 80U

Section 80C Deductions List To Save Income Tax FinCalC Blog

Investments Under Section 80C Section 80C Schemes Deductions Under 80c

Section 80 Deduction Income Tax Deductions Under Section 80C 80CCD

Section 80CCD Deductions For NPS And APY Contributions

Insurance Pension Plans To Be Flexible But NPS Still Cheaper Mint

Insurance Pension Plans To Be Flexible But NPS Still Cheaper Mint

Things To Know About Section 80C Of The Income Tax Act What Is

Here A List Of Types Of Deductions Covered Under Section 80C

Investment Options To Avail Tax Deduction Under Section 80C

Is Nps Under Section 80c - The maximum deduction under Section 80C is capped at INR 1 50 000 which also includes contributions under Sections 80CCC and 80CCD 1 However deductions under