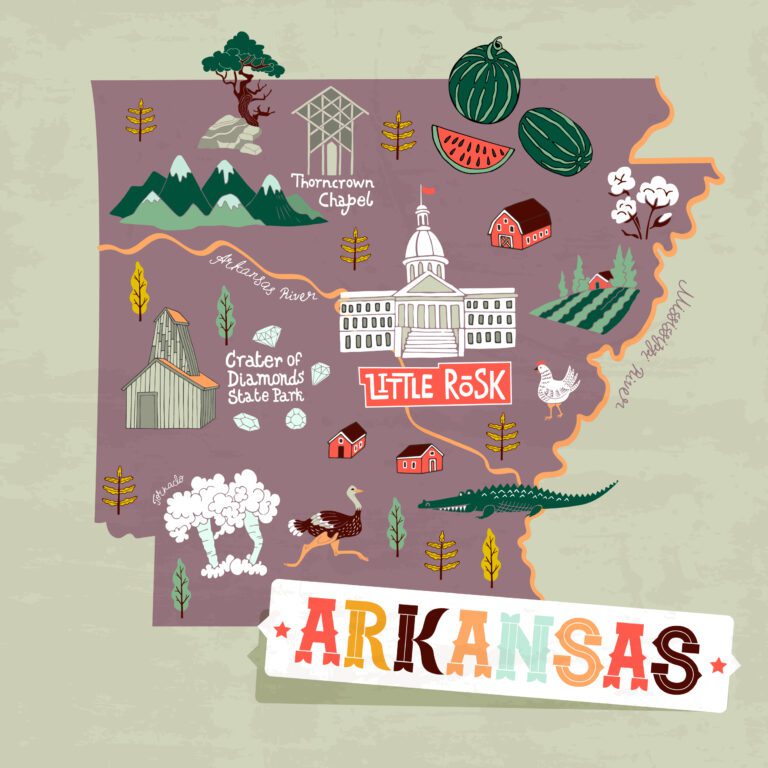

Property Tax Exemption For Disabled Veterans In Arkansas Web Who is eligible for Arkansas Homestead and Personal Property Tax Exemption Resident Veterans who have a service connected 100 permanent and total disability rating from the VA or

Web Disabled Veterans who have lost a limb or the use of a limb are totally blind in one or both eyes or have a 100 disability rating can receive Web i Upon the death of the disabled veteran the surviving spouse and minor dependent children of the disabled veteran shall be exempt from payment of all state taxes on

Property Tax Exemption For Disabled Veterans In Arkansas

Property Tax Exemption For Disabled Veterans In Arkansas

https://cck-law.com/wp-content/uploads/2023/05/Top-15-States-for-100-Disabled-Veteran-Benefits-1.jpg

Missouri Lawmakers Propose Property Tax Exemption For Disabled Veterans

https://themissouritimes.com/wp-content/uploads/2021/12/Screen-Shot-2021-12-10-at-9.55.31-AM-1.png

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Arkansas-100-Disabled-Veteran-Property-Tax-Exemption-768x768.jpg

Web Arkansas Statute 26 3 306 provides tax exemption for homestead and personal property owned by the disabled veteran and with restrictions the surviving spouse and minor Web Arkansas Statute 26 3 306 provides tax exemption for homestead and personal property owned by the disabled veteran and with restrictions the surviving spouse and minor

Web Property Tax Payments for 2023 are due October 15 Property owners can pay their taxes online in per Elected Officials Search The Arkansas Elected Officials Search is an Web The State Law reads a disabled veteran who is service connected one hundred percent total and permanent disabled can be exempt from taxes on his her homestead and

Download Property Tax Exemption For Disabled Veterans In Arkansas

More picture related to Property Tax Exemption For Disabled Veterans In Arkansas

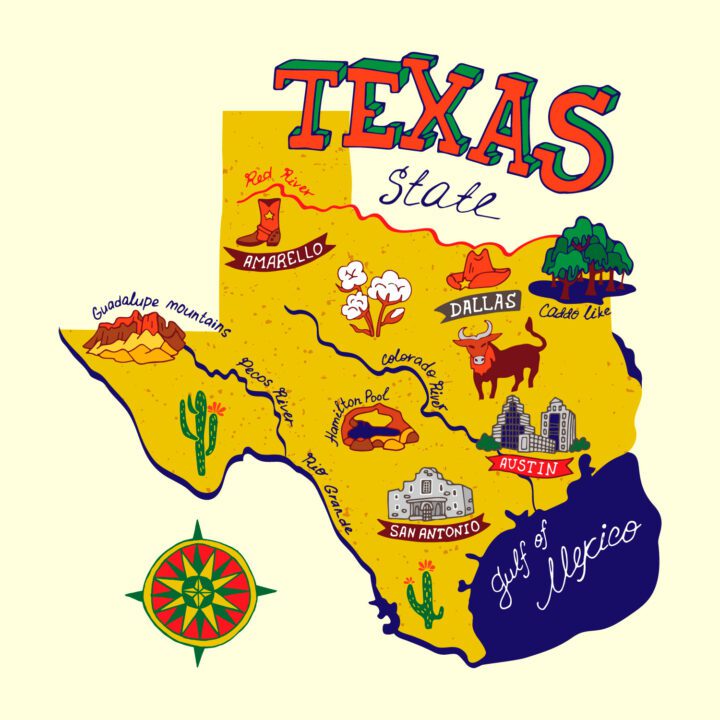

Disabled Veteran Property Tax Exemptions In Texas YouTube

https://i.ytimg.com/vi/4d9PnKtDb-A/maxresdefault.jpg

18 States With Full Property Tax Exemption For 100 Disabled Veterans

https://vaclaimsinsider.com/wp-content/uploads/2021/05/Texas-100-Disabled-Veteran-Property-Tax-Exemption-720x720.jpg

EGR Veteran Pushes For Changes To State s Disabled Veterans Exemption

https://ewscripps.brightspotcdn.com/dims4/default/a5e7454/2147483647/strip/true/crop/1082x1406+0+0/resize/1082x1406!/quality/90/?url=http:%2F%2Fewscripps-brightspot.s3.amazonaws.com%2F21%2F60%2Fedaeae2a495e93a2111d21acaa3d%2Fscreen-shot-2023-02-27-at-9.25.40 PM.png

Web 1 Jan 2020 nbsp 0183 32 a 1 A i A disabled veteran who has been awarded special monthly compensation by the Department of Veterans Affairs for the loss of or the loss of use of Web 25 Juni 2021 nbsp 0183 32 What are the top veteran benefits in Arkansas Are There Special Tax Exemptions For Arkansas Disabled Veterans Homestead and Personal Property Tax Exemption Tax Exemption for Auto Sale

Web Arkansas Statute 26 3 306 provides tax exemption for homestead and personal property owned by the disabled veteran and with restrictions the surviving spouse and minor Web Do I Qualify If you are a 100 service connected disabled veteran unemployable or the unmarried widow you may qualify for exemption from payment of all state taxes on the

100 Percent Disabled Veterans Qualify For The Veterans Property Tax

https://i.ytimg.com/vi/I6ctvDSp2Ck/maxresdefault.jpg

Property Tax Exemption For Disabled Veterans Aiello Law Group

https://www.aiellolawgroup.com/wp-content/uploads/property-tax-exemption-for-disabled-veterans.jpg

https://myarmybenefits.us.army.mil/.../State/T…

Web Who is eligible for Arkansas Homestead and Personal Property Tax Exemption Resident Veterans who have a service connected 100 permanent and total disability rating from the VA or

https://www.veteransunited.com/futurehomeo…

Web Disabled Veterans who have lost a limb or the use of a limb are totally blind in one or both eyes or have a 100 disability rating can receive

18 States With Full Property Tax Exemption For 100 Disabled Veterans

100 Percent Disabled Veterans Qualify For The Veterans Property Tax

New Property Tax Exemption For Disabled Veterans In Illinois Learn

18 States With Full Property Tax Exemption For 100 Disabled Veterans

Property Tax Exemption For Illinois Disabled Veterans

SECO NEWS How To Disabled Veterans Are Entitled To A 50 Property

SECO NEWS How To Disabled Veterans Are Entitled To A 50 Property

18 States With Full Property Tax Exemption For 100 Disabled Veterans

2023 Disabled Veteran Property Tax Exemption Lake County Veterans And

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton

Property Tax Exemption For Disabled Veterans In Arkansas - Web Arkansas Statute 26 3 306 provides tax exemption for homestead and personal property owned by the disabled veteran and with restrictions the surviving spouse and minor