Redundancy Tax Allowance Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of

Your total redundancy package is 35 000 so you ll pay tax on 5 000 The 4 000 in holiday pay and bonus counts as income and will also be taxed You can use our Income tax calculator 2023 24 to work The first 30 000 of any redundancy pay is tax free This amount includes any non cash benefits that form part of your redundancy package such as a company

Redundancy Tax Allowance

Redundancy Tax Allowance

https://i.ytimg.com/vi/JDsHD1IDX6g/maxresdefault.jpg

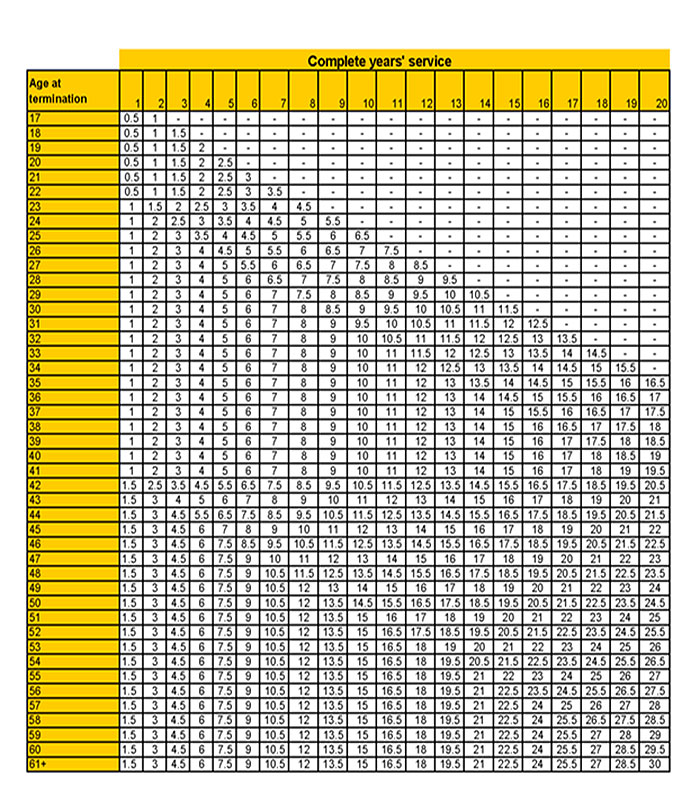

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

An Employee s Guide To Redundancy Neate Pugh

https://www.neateandpugh.com/wp-content/uploads/2022/03/redundancy-individual-1024x1024.png

Are redundancy payments taxable If employees are facing redundancy or considering voluntary redundancy they need to know exactly how much money they If your redundancy payment is made before you leave your job and before your employer issues you with form P45 any taxable amounts such as unpaid wages

Broadly the first 30 000 of any redundancy payment may be paid tax free This includes any statutory amount received under the Employment Protection Consolidation Act Home Life events and personal circumstances Leaving a job and unemployment Redundancy lump sum payments You may receive a lump sum

Download Redundancy Tax Allowance

More picture related to Redundancy Tax Allowance

How To Calculate Your Statutory Redundancy Pay Business Tips YouTube

https://i.ytimg.com/vi/YVQNoJvJlu4/maxresdefault.jpg

Genuine Redundancy Payment Age Increase Babbage Co

https://www.babbage.com.au/wp-content/uploads/2019/11/pt_redundancyageincrease_583724424_720x454.jpg

Marriage Allowance 1Accounts

https://1accountsonline.co.uk/wp-content/uploads/2022/08/Copy-of-Starting-a-business-after-redundancy-blog.png

Up to 30 000 of redundancy pay is tax free You may not be eligible for statutory redundancy pay if your employer offers you a suitable alternative job and you turn it Key facts Only the part of the redundancy payment over the tax exempt threshold of 30 000 count as relevant UK earnings A redundancy payment can be

Tax on your redundancy money How to claim tax back after redundancy or losing your job Step 1 Are you due a tax rebate You might be due a refund if you answer yes to 26 August 2021 See all updates Get emails about this page Contents Help finding work and training Benefits you could get Help with finding and applying for

Ketentuan Tax Allowance Direvisi Proses Pengajuan Lebih Sederhana

https://www.mucglobal.com/storage/files/1596532664_IncomeTax.png

Redundancy For Employees Monarch Solicitors

https://www.monarchsolicitors.com/wp-content/uploads/2020/08/redundancy-for-employees.jpg

https://www.moneyhelper.org.uk/en/work/losing-your...

Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of

https://www.which.co.uk/money/tax/income …

Your total redundancy package is 35 000 so you ll pay tax on 5 000 The 4 000 in holiday pay and bonus counts as income and will also be taxed You can use our Income tax calculator 2023 24 to work

Redundancy Advice For Employers DavidsonMorris

Ketentuan Tax Allowance Direvisi Proses Pengajuan Lebih Sederhana

Tax On Redundancy Payments Davis Grant

Tax On Redundancy Payments TaxAssist Accountants

Marriage Tax Allowance How To Combine Your Tax free Allowance YouTube

The Trials And Tribulations Of Surviving Redundancy

The Trials And Tribulations Of Surviving Redundancy

How Redundancy Affects Your Income Tax Ean Brown Partners Limited

Pay Tax Redundancy Pay Tax Calculator Uk

Tax Reduction Company Inc

Redundancy Tax Allowance - If your redundancy payment is made before you leave your job and before your employer issues you with form P45 any taxable amounts such as unpaid wages