Special Rebate In Income Tax Web 7 f 233 vr 2023 nbsp 0183 32 Eighteen states issued special rebates and payments to tax filers last year The IRS said it will soon issue guidance as to whether those payment will be subject to

Web 9 sept 2023 nbsp 0183 32 In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other payments in 2023 won t have to include Web What is rebate income Your rebate income is the total amount of your taxable income excluding any assessable First home super saver released amount plus the

Special Rebate In Income Tax

Special Rebate In Income Tax

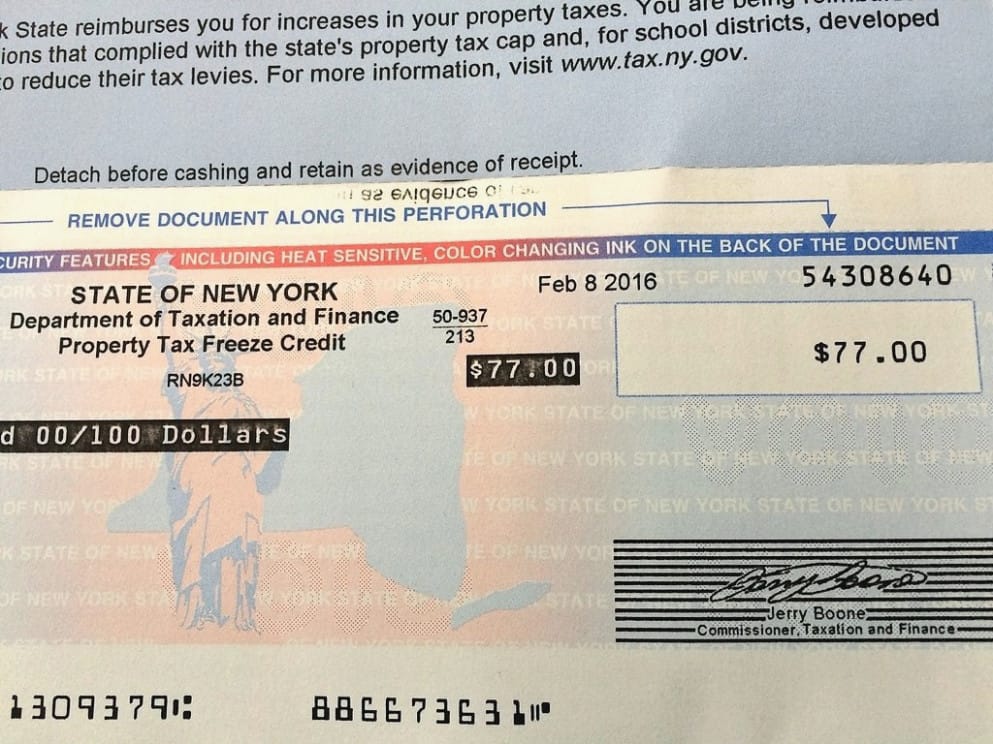

http://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

Rebate In Income Tax Ultimate Guide

https://lh6.googleusercontent.com/V-Vll753sLaCzJIQJfpfrdUH6geIv1Ad7kCiVAgX0UOg34X4YS_4goDP4ijfHdI3xWXK49DAYSOc4OZgf7gXkRt7tqEUbn9tEKr371cu2FncnHq1ZFPoEEBzbfxsFPqFs065SsqWCKzqJ9yg_965

Strategies To Maximize The 2021 Recovery Rebate Credit In 2021 Income

https://i.pinimg.com/originals/04/6c/93/046c93de3420d11217b08ec3f970154b.png

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 10 f 233 vr 2023 nbsp 0183 32 The Internal Revenue Service provided details late Friday on a question that has perplexed tax professionals and held up tax filings this past week clarifying the

Web Il y a 1 jour nbsp 0183 32 The taxpayer will not be entitled to enjoy the tax on the income benefit of reduced tax rate and tax rebate Hence this provision is expected to increase Web More than twenty states issued special tax rebates in 2022 These payments were generally enabled or mandated by higher than expected state revenues and authorized

Download Special Rebate In Income Tax

More picture related to Special Rebate In Income Tax

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 9 sept 2023 nbsp 0183 32 By Kelley R Taylor published 5 minutes ago Following a six month stalemate between Democrat and Republican lawmakers Virginia has a budget Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Web 8 sept 2023 nbsp 0183 32 IR 2023 166 Sept 8 2023 Capitalizing on Inflation Reduction Act funding and following a top to bottom review of enforcement efforts the Internal Revenue Web 20 oct 2020 nbsp 0183 32 Further pension received by an individual from his former employer is taxable as salary income and therefore will have to be reported under head Income from

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

https://1.bp.blogspot.com/-Ke4rAxpKLcE/XePaYI8rcnI/AAAAAAAALKI/-yZ-xBI_4fojq9hdLG6dgXgOF6VVPgeoQCNcBGAsYHQ/s1600/Tax%2BSlab%2Bfor%2BF.Y.%2B2019-20.jpg

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

https://i.pinimg.com/originals/2d/3d/8c/2d3d8c83aee5a3115e206b0fac97c875.jpg

https://www.cnn.com/2023/02/07/success/taxable-payments-irs

Web 7 f 233 vr 2023 nbsp 0183 32 Eighteen states issued special rebates and payments to tax filers last year The IRS said it will soon issue guidance as to whether those payment will be subject to

https://www.kiplinger.com/taxes/will-your-state-rebate-check-be-taxed

Web 9 sept 2023 nbsp 0183 32 In most cases according to the IRS taxpayers who receive special state payments one time refunds rebates or other payments in 2023 won t have to include

Interim Budget 2019 20 The Talk Of The Town Trade Brains

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

2007 Tax Rebate Tax Deduction Rebates

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Georgia Income Tax Rebate 2023 Printable Rebate Form

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Special Rebate In Income Tax - Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your