Tax Credit Child Care Expenses The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify

Tax Credit Child Care Expenses

Tax Credit Child Care Expenses

https://www.taxuni.com/wp-content/uploads/2022/10/Child-Tax-Credit-CTC-Update-TaxUni-Cover-1-1536x864.jpg

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/styles/original_optimized/public/3.4.4_figure1.png?itok=Mb9RnH1n

Tax Credit Or FSA For Child Care Expenses Which Is Better

https://static.wixstatic.com/media/62b39d_9cd40e7758b749f88e3057d23a1a03f5~mv2.jpg/v1/fill/w_980,h_438,al_c,q_85,usm_0.66_1.00_0.01,enc_auto/62b39d_9cd40e7758b749f88e3057d23a1a03f5~mv2.jpg

You can claim from 20 to 35 of your care expenses up to a maximum of 3 000 for one person or 6 000 for two or more people tax year 2023 Benefits of the tax credit The Child and Dependent Care Credit is a tax break specifically for working people to help offset the costs associated with caring for a child or dependent with disabilities Child and Dependent Care Credit Expenses In 2021 for the first time the credit is fully refundable if the taxpayer or the taxpayer s spouse if married filing jointly had a principal place of abode in the United States for more than one half of 2021 This means that an eligible family can get it even if they owe no federal income tax

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to The child and dependent care credit is a tax credit offered to taxpayers who pay out of pocket expenses for childcare The credit provides relief to individuals and spouses who pay for

Download Tax Credit Child Care Expenses

More picture related to Tax Credit Child Care Expenses

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

https://static.twentyoverten.com/5afae91ee233a94fd2b8b963/E4jh24nT7K/1616431654979.png

Child Care Tax Savings 2021 Curious And Calculated

https://www.kitces.com/wp-content/uploads/2021/03/04CHAN1.png

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

http://www.taxpolicycenter.org/sites/default/files/4.2.6-table1_4.png

Credit for Child and Dependent Care Expenses For tax year 2021 only the top credit percentage of qualifying expenses increased from 35 to 50 Some taxpayers receive dependent care benefits from their employers which may also be called flexible spending accounts or reimbursement accounts Child care expenses are amounts you or another person paid to have someone else look after an eligible child so you could earn income go to school or carry on research under a grant If eligible you can claim certain child care expenses as a deduction on your personal income tax return

Thanks to a temporary change codified in the American Rescue Plan parents or guardians can now claim a maximum credit of 4 000 50 of 8 000 in expenses for one child and 8 000 for two or A median income family with two kids under age 13 will receive up to 8 000 towards their child care expenses when they file taxes for 2021 compared with a maximum of 1 200 previously

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

https://www.taxpolicycenter.org/sites/default/files/4.4.6_-_table_1.png

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

http://www.taxpolicycenter.org/sites/default/files/4.2.6-figure1_0.png

https://www. nerdwallet.com /article/taxes/child-and...

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

https://www. irs.gov /publications/p503

To be able to claim the credit for child and dependent care expenses you must file Form 1040 1040 SR or 1040 NR and meet all the tests in Tests you must meet to claim a credit for child and dependent care expenses next

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

What Is The Child Tax Credit And How Much Of It Is Refundable 2022

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Childcare Expenses Abstract Concept Vector Illustration Child Care Tax

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

What You Need To Know About The Child And Dependent Care Tax Credit

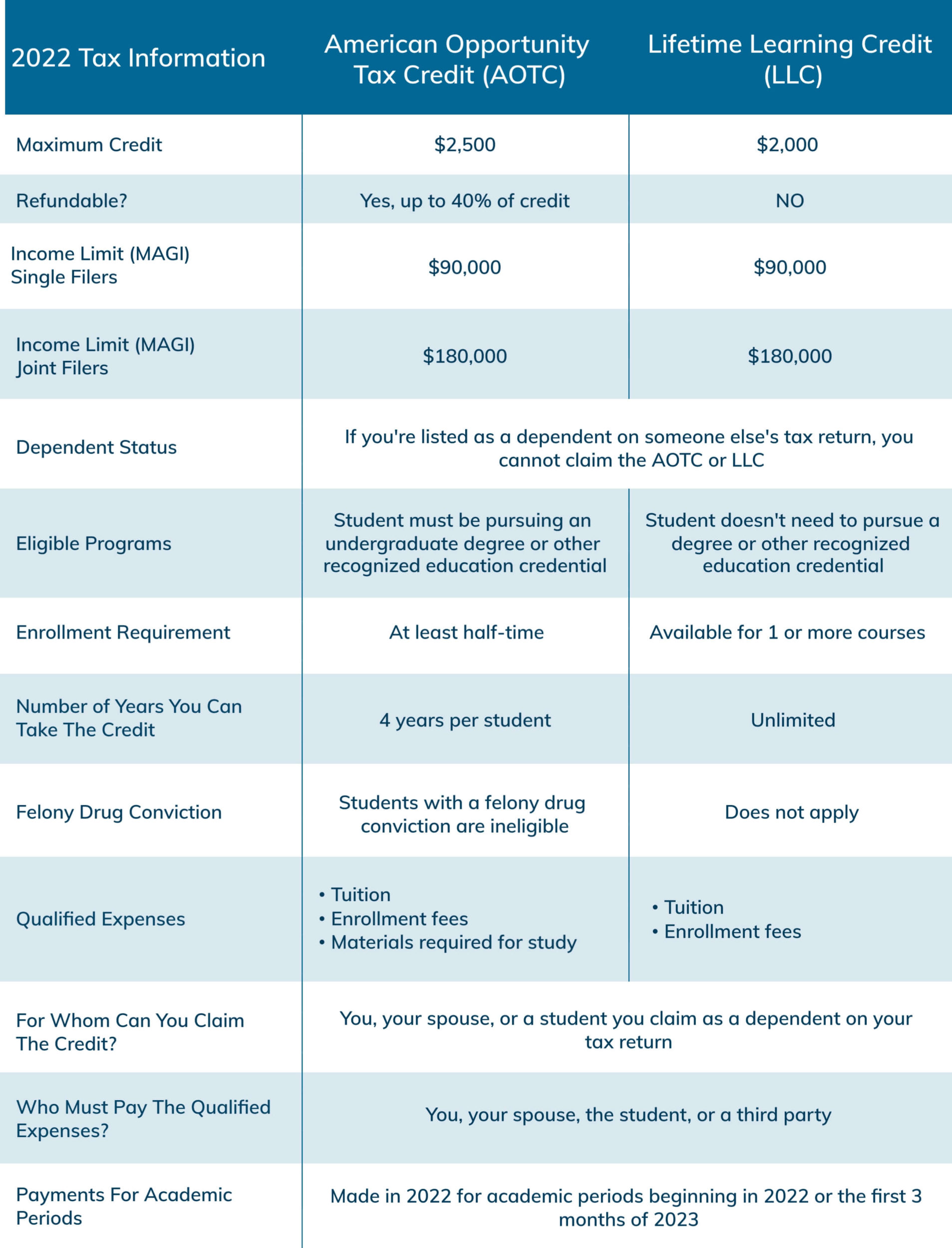

2022 Education Tax Credits Are You Eligible

Claiming Childcare Expenses In Canada Blueprint Accounting

Tax Credit Child Care Expenses - Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the child and dependent care credit works if you qualify and how to