Tax Credit Formula Here s a general high level formula for how the various pieces work together gross income adjustments adjusted gross income AGI deductions taxable income x tax rate s tax liability tax credits Read

Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000 You figure your foreign tax credit and the foreign tax credit limit on Form 1116 Foreign Tax Credit Your foreign tax credit cannot be more than your total U S tax liability

Tax Credit Formula

Tax Credit Formula

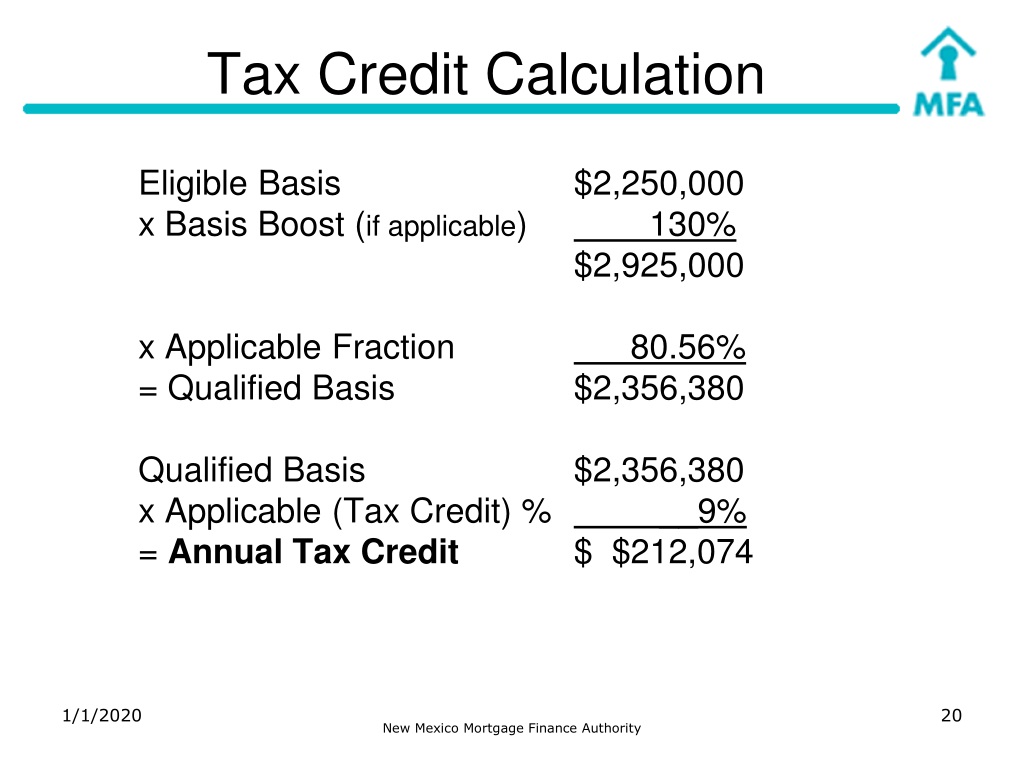

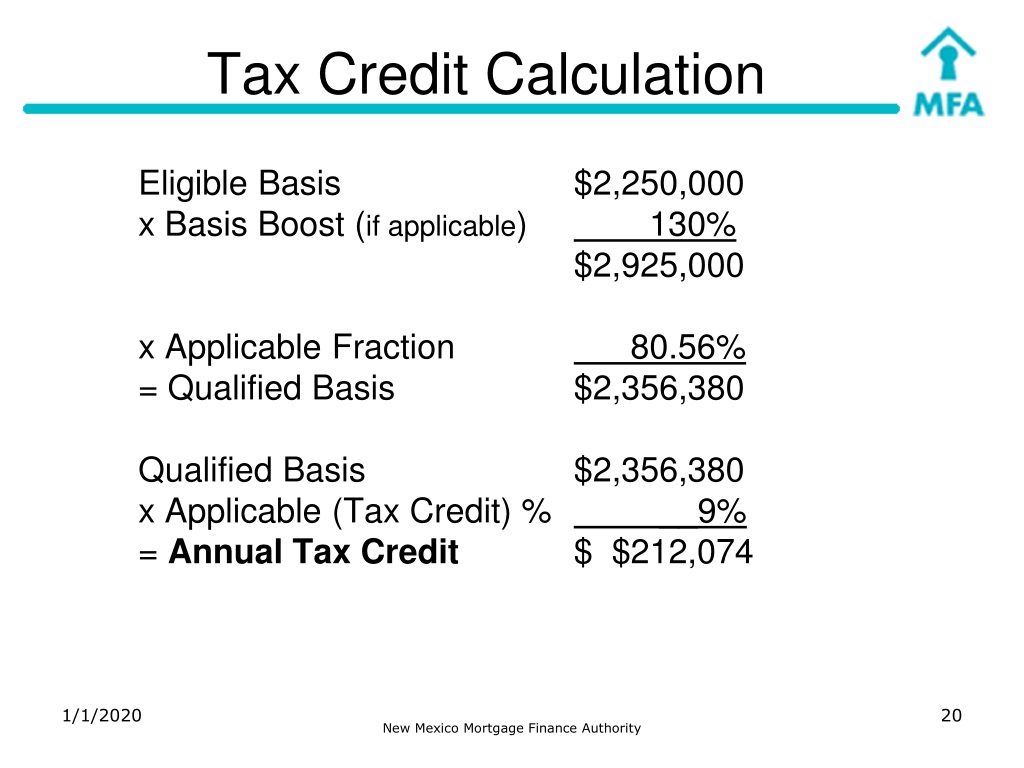

https://image5.slideserve.com/9304489/tax-credit-calculation-l.jpg

What Is Input Tax Credit ITC INSIGHTSIAS Simplifying UPSC IAS

https://www.insightsonindia.com/wp-content/uploads/2020/12/ITC.png

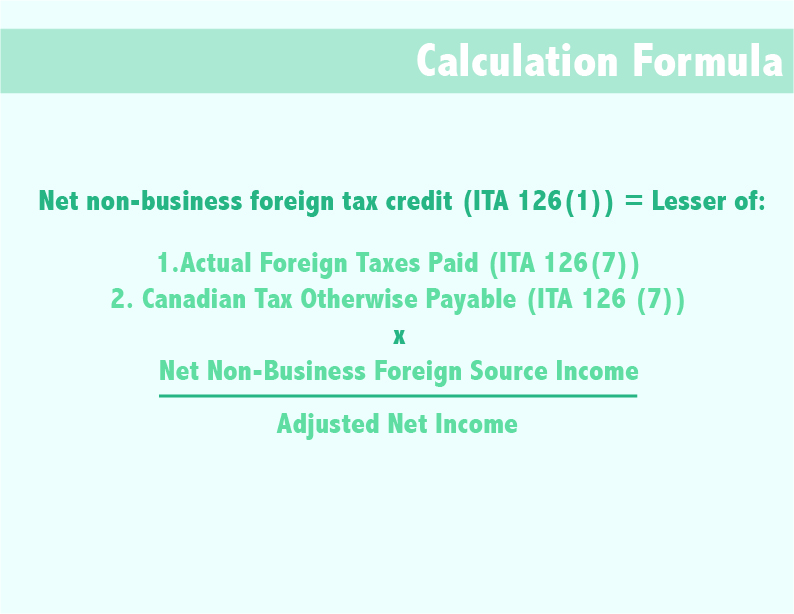

Foreign Tax Credits For Canadians Madan CA

http://madanca.com/wp-content/uploads/2019/11/Image-1-1.jpg

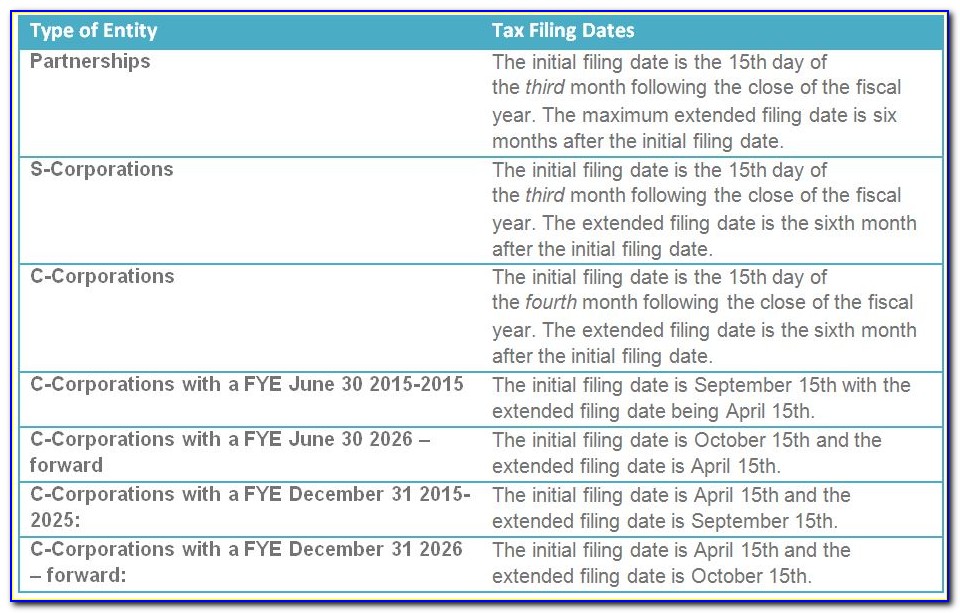

Tax credit awards are made up of a number of elements The amount of any award depends on the elements that are included in the award and the household income If you Calculating your Foreign Tax Credit FTC and carryover Here s the formula you should use to calculate the maximum foreign tax credits you can use Foreign sourced income total taxable income US tax liability

The calculation of tax credit amount of your eligibility for tax credits will often depend on your income The exact number used is generally either your adjusted gross income AGI or your modified adjusted gross What Is the Earned Income Tax Credit EITC The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that

Download Tax Credit Formula

More picture related to Tax Credit Formula

What Is A Tax Credit Tax Credits Explained

https://media.valuethemarkets.com/img/Whatisataxcredit__685660f27b96fbc6e0edb67eb5c59039.jpg

Fixing The Federal EV Tax Credit Flaws Redesigning The Vehicle Credit

https://evadoption.com/wp-content/uploads/2021/04/Current-Federal-EV-tax-credit-formula-sample-EVs.png

R d Tax Credit Formula Form Resume Examples aZDYRjZ579

https://www.viralcovert.com/wp-content/uploads/2019/01/rd-tax-credit-formula.jpg

Credits for foreign taxes are determined on a country by country basis The amount of foreign tax credit in respect of the tax paid in a country shall not exceed the same proportion of the tax against which the tax credit is The R D tax credit is a tax incentive in the form of a tax credit for U S companies to increase spending on research and development in the U S A tax credit generally reduces the amount of tax owed or increases a tax refund

Discover the secrets of R D tax credit calculation Choose between RRC and ASC methods to maximize savings and gain a competitive advantage Unlike a tax deduction which reduces the amount of your income that is subjected to income tax child tax credit cut down your tax liability directly For example if you owe

https://hesabdarema.com/wp-content/uploads/2022/04/Tax-credit.jpg

Tax Credit Universal Credit Impact Of Announced Changes House Of

https://commonslibrary.parliament.uk/wp-content/uploads/2015/11/IDS.jpg

https://www.empower.com/the-currency/…

Here s a general high level formula for how the various pieces work together gross income adjustments adjusted gross income AGI deductions taxable income x tax rate s tax liability tax credits Read

https://www.nerdwallet.com/article/tax…

Tax credits directly reduce the amount of tax you owe giving you a dollar for dollar reduction of your tax liability A tax credit valued at 1 000

How To Calculate Tax On Salary Wholesale Deals Save 40 Jlcatj gob mx

Tax Deduction Vs Tax Credit What s The Difference With Table

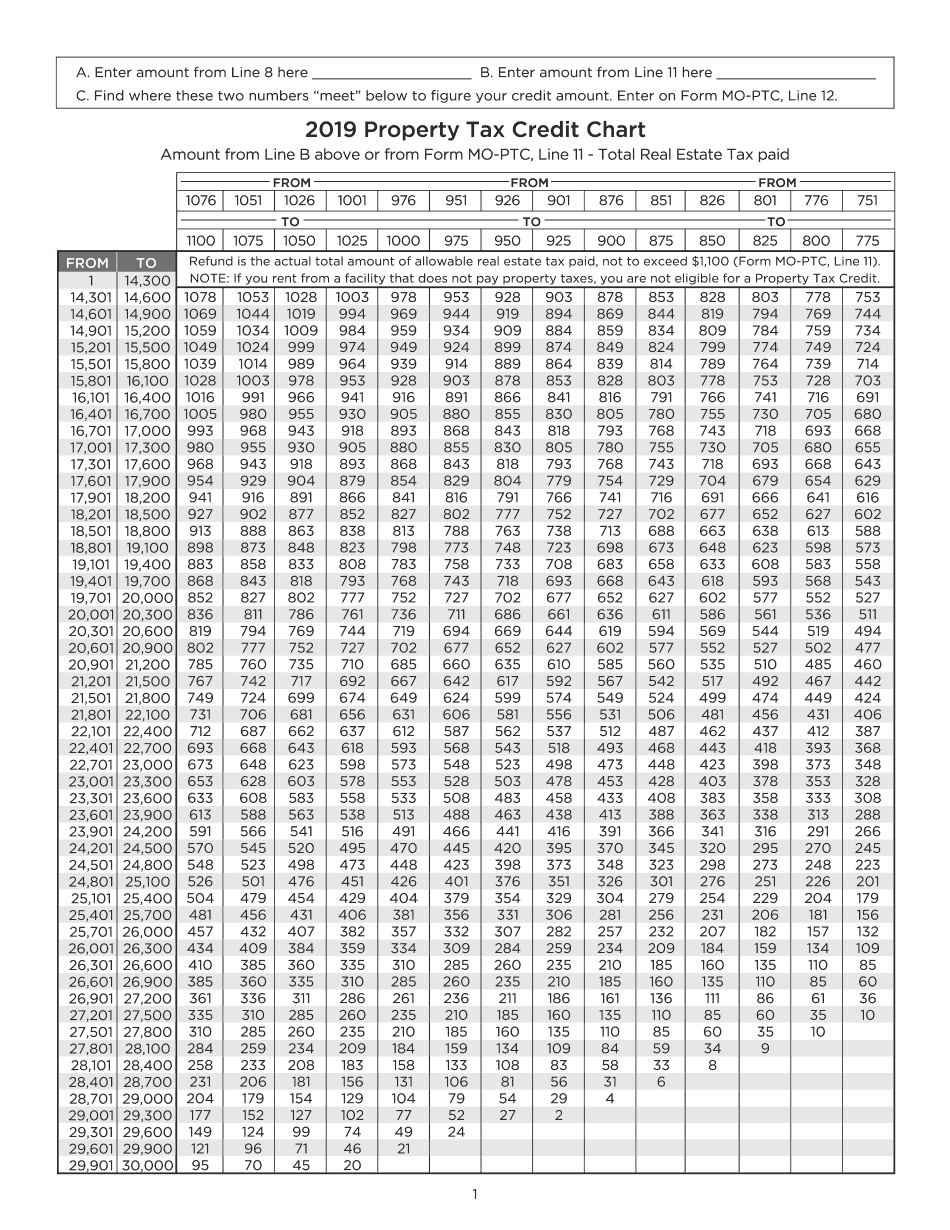

Edit Document Property Tax Credit Chart Form With Us Fastly Easyly

Maximum Line Of Credit Calculator VinaLeonard

New Tax Credit Helps Entrepreneurs Start Businesses Flickr

New Tax Credit Helps Entrepreneurs Start Businesses Flickr

Tax Reduction Company Inc

Individual Tax WEC CPA Blog

R D Tax Credit Calculator How Much Can You Claim RAndD Tax

Tax Credit Formula - The calculation of tax credit amount of your eligibility for tax credits will often depend on your income The exact number used is generally either your adjusted gross income AGI or your modified adjusted gross