Tax Deduction Georgia 529 Verkko Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint

Verkko Georgia s 529 Plan was established in 2002 and allows Georgia tax filers to deduct up to 8 000 per year per beneficiary if filing MJF 4 000 for all other filers Earnings in Verkko 26 marrask 2023 nbsp 0183 32 Do you get a tax deduction for contributing to a 529 plan There isn t a 529 federal tax deduction but there may be for state income tax 529 contributions

Tax Deduction Georgia 529

Tax Deduction Georgia 529

https://www.road2college.com/wp-content/uploads/2017/12/Map-of-529-State-Tax-Deductions.png

GEORGIA 529 Plan Upcoming Changes For 2021 YouTube

https://i.ytimg.com/vi/fKRQExl9bbY/maxresdefault.jpg

How Much Is Your State s 529 Plan Tax Deduction Really Worth

https://d3tc5xafqqxqk8.cloudfront.net/wp-content/uploads/2023/04/27141121/US-TAX-nl-1200x675.png

Verkko In fact the Georgia state tax benefits for 529 plans just got better The state tax deduction has been increased from 2 000 to 4 000 per year per beneficiary for Verkko 9 jouluk 2021 nbsp 0183 32 Contributors can deduct 4 000 per beneficiary and 8 000 per beneficiary for joint filers Note Georgia residents only receive a deduction for

Verkko Path2College 529 Plan offers compelling income tax benefits Georgia taxpayers filing jointly can deduct up to 8 000 per year per beneficiary in the Path2College 529 Plan Verkko 20 maalisk 2023 nbsp 0183 32 For contributions made to a Path2College 529 Plan account by April 18 2023 Georgia taxpayers may be eligible for a state income tax deduction up to

Download Tax Deduction Georgia 529

More picture related to Tax Deduction Georgia 529

Georgia 529 Plans Learn The Basics Get 30 Free For College Savings

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/01/Georgia-529-Plans.jpg

529 Tax Guide

https://www.americanfunds.com/advisor/img/content/college/tax-map/us-map.png

How To Report 529 Distributions On Tax Return Fill Online Printable

https://www.pdffiller.com/preview/416/852/416852962/big.png

Verkko Contributions made to the Path2College 529 Plan by April 15 are eligible for a Georgia income tax deduction for the previous year Limitations apply See disclosure Verkko The Department of Revenue does not administer Georgia s Section 529 Plan Information about the Plan can be obtained at www path2college529 or by calling 877 424

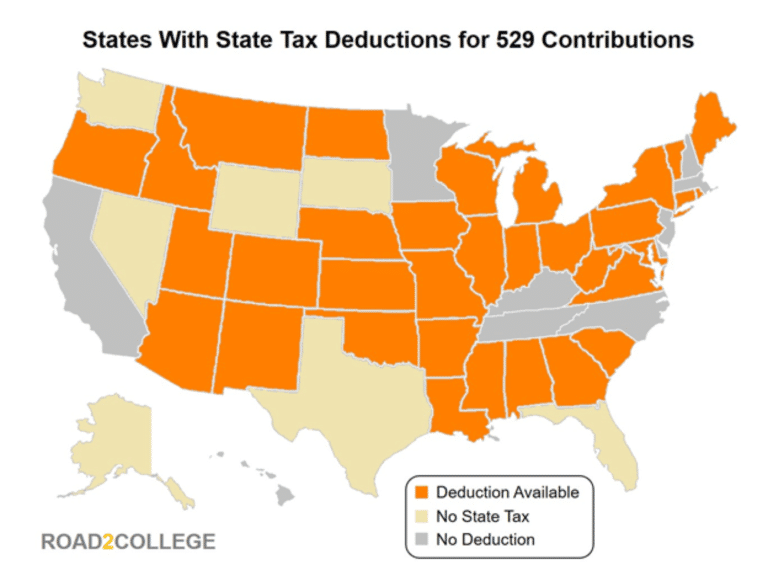

Verkko 4 kes 228 k 2020 nbsp 0183 32 State by State Tax Deduction Rules for 529 Plans While most states tax deduction rules allow families to subtract 529 contributions from their gross income the rules vary from state to Verkko Backer Upromise Georgia Financial Aid Average Cost Of College In Georgia When saving for college in Georgia it s important to take into consideration the cost of

Georgia Doubles Deduction For 529 Education Savings Plans Acumen

https://acumenwealth.com/app/uploads/2020/07/Student-Loan-1200x660.jpg

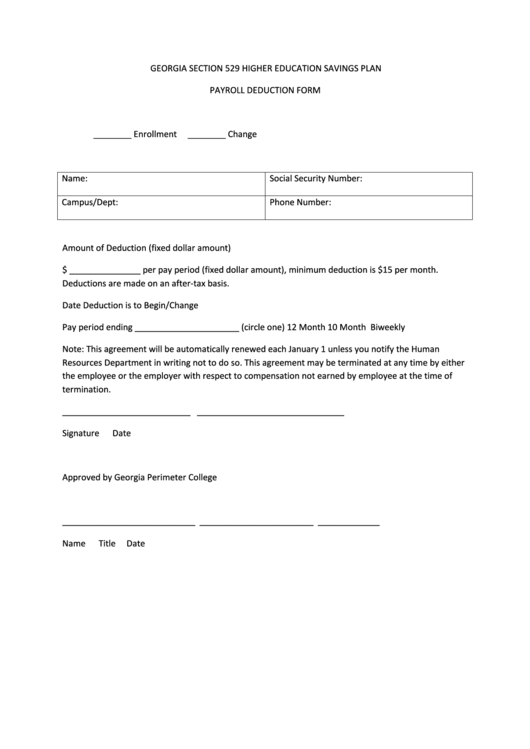

Payroll Deduction Form Georgia Section 529 Higher Education Savings

https://data.formsbank.com/pdf_docs_html/162/1623/162334/page_1_thumb_big.png

https://www.path2college529.com/resources/faq

Verkko Georgia taxpayers may be eligible for a Georgia income tax deduction on contributions made to a Path2College 529 Plan up to 8 000 per year per beneficiary for joint

https://gsfc.georgia.gov/programs-and-regulations/path2college-529-plan

Verkko Georgia s 529 Plan was established in 2002 and allows Georgia tax filers to deduct up to 8 000 per year per beneficiary if filing MJF 4 000 for all other filers Earnings in

One BIG 2017 Georgia 529 Plan Change For College OXYGen Financial

Georgia Doubles Deduction For 529 Education Savings Plans Acumen

Comparing Your 529 In State Tax Deduction Vs Better Out of State Plans

Your State May Allow A Tax Deduction For A 529 Contribution

State Tax Deduction Or Credit For Contributions To A 529 Plan Meld

How Much Is Your State s 529 Plan Tax Deduction Really Worth

How Much Is Your State s 529 Plan Tax Deduction Really Worth

529 Plan State Tax Deduction Limits And How To Choose A 529 Plan And

Georgia Recognizes Embryos As Dependents For A 3 000 State Income Tax

A Guide To Understanding The Maryland 529 Tax Deduction Bay Point Wealth

Tax Deduction Georgia 529 - Verkko 3 hein 228 k 2023 nbsp 0183 32 The Georgia 529 plan offers tax benefits to residents who save for a college education and for K 12 expenses Read about the plan and its tax benefits