Tax Return From Donations Verkko You can claim a deduction for a donation of 850 500 000 that you have made to a university or other institution of higher education receiving public funding or to an associated university fund within the EEA for the purpose of promoting science or arts How to claim For the 2022 tax year

Verkko You are liable to pay tax on a gift worth at least 5 000 You are also liable to pay tax if the same donor gives you several gifts in the course of 3 years and their total value exceeds 5 000 If you receive such gifts you must file a return to the Tax Administration Verkko 9 elok 2023 nbsp 0183 32 How much can you donate free of tax As a donor you can give a person a tax exempt gift worth less than 5 000 every 3 years The above threshold concerns the donor

Tax Return From Donations

Tax Return From Donations

https://images.sampletemplates.com/wp-content/uploads/2017/03/Tax-Receipt-Letter-for-Donation.jpg

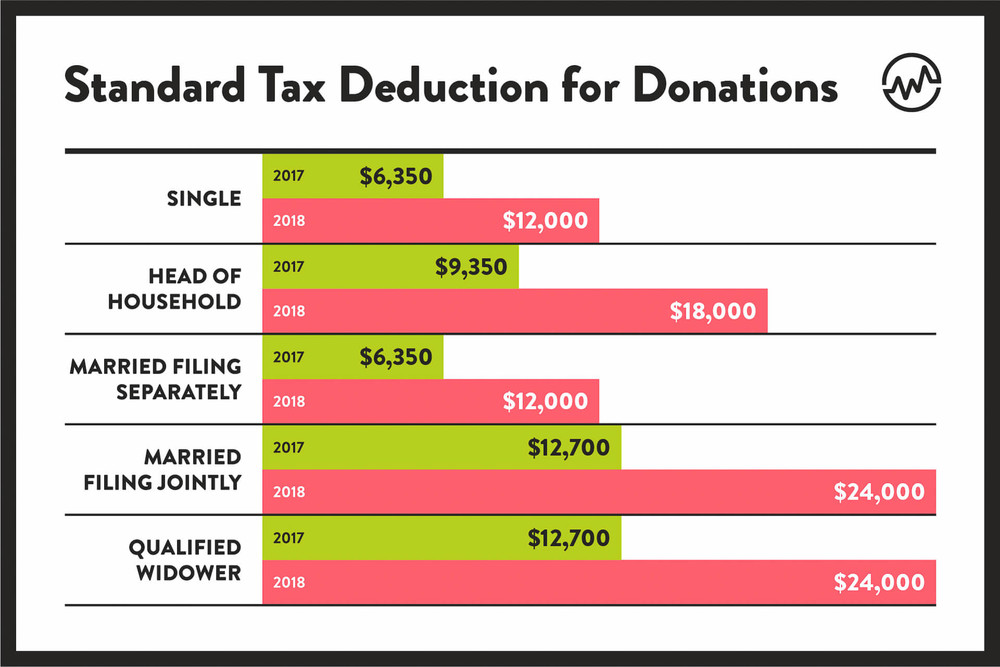

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)

2022 Form 1040 Schedule A Instructions

https://www.investopedia.com/thmb/RJrvfnucLlWh0sDmKGbD0poyjp8=/1386x1298/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png

Verkko 27 marrask 2023 nbsp 0183 32 A temporary tax law ushered in by the Coronavirus Aid Relief and Economic Security Act CARES Act allowed taxpayers to claim up to 600 in cash donations to qualified charities on their Verkko 7 kes 228 k 2023 nbsp 0183 32 Charitable Contributions A searchable database of organizations eligible to receive tax deductible charitable contributions Amount and types of deductible contributions what records to keep and how to report contributions How donors charities and tax professionals must report non cash charitable contributions

Verkko 15 marrask 2023 nbsp 0183 32 To claim a charity tax deduction on your taxes you must have contributed money or goods to a tax exempt organization received nothing in return for your gift and then itemize the donation on your Verkko 25 marrask 2023 nbsp 0183 32 1 Plan Your Giving There are many tax planning opportunities with charitable donations that you can take advantage of to give you the largest deduction possible If you know that you will be

Download Tax Return From Donations

More picture related to Tax Return From Donations

Bunching Up Charitable Donations Could Help Tax Savings

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

Income Tax Return Form Excel Download Fill Online Printable

https://www.pdffiller.com/preview/100/113/100113192/large.png

Tax Deductible Donation Receipt Template Charlotte Clergy Coalition

https://www.charlotteclergycoalition.com/wp-content/uploads/2018/08/tax-deductible-donation-receipt-template-tax-donation-form-template-donation-receipt-form-template-ricdesign-donation-receipt-form-template.jpg

Verkko 12 jouluk 2023 nbsp 0183 32 This total would exceed the standard deduction by 7 300 Your additional tax savings would be 7 300 multiplied by the marginal tax rate for your income bracket If your 2024 taxable income is Verkko 25 helmik 2023 nbsp 0183 32 Money from an individual retirement account IRA can be donated to charity What s more if you ve reached the age where you need to take required minimum distributions RMDs from your

Verkko 22 marrask 2022 nbsp 0183 32 A Guide to Tax Deductions for Charitable Contributions Here s how your philanthropic giving can lower your tax bill By Beth Braverman Dec 15 2022 at 1 29 p m Most Americans plan to Verkko In order to take a tax deduction for a charitable contribution to an IRS qualified 501 c 3 public charity you ll need to forgo the standard deduction in favor of itemized deductions That means you ll list out all of your deductions expecting that they ll add up to more than the standard deduction The most common expenses that qualify

Where To Find Your Prior Year AGI PriorTax

https://www.priortax.com/filing-late-taxes/wp-content/uploads/2016/02/AGI-1040.jpg

IRS New Tax Return Transcript Tax Deduction Irs Tax Forms

https://imgv2-1-f.scribdassets.com/img/document/386835937/original/1982329eec/1562647296?v=1

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/...

Verkko You can claim a deduction for a donation of 850 500 000 that you have made to a university or other institution of higher education receiving public funding or to an associated university fund within the EEA for the purpose of promoting science or arts How to claim For the 2022 tax year

https://www.vero.fi/.../property/gifts/taxable-gifts-and-tax-exempt-gifts

Verkko You are liable to pay tax on a gift worth at least 5 000 You are also liable to pay tax if the same donor gives you several gifts in the course of 3 years and their total value exceeds 5 000 If you receive such gifts you must file a return to the Tax Administration

40 Donation Receipt Templates Letters Goodwill Non Profit

Where To Find Your Prior Year AGI PriorTax

32 Amended Tax Return Letter Sample Your Letter

Completed Sample IRS Form 709 Gift Tax Return For 529 Superfunding

Tax Return An Irs Tax Return Transcript

FREE 12 Donation Receipt Forms In PDF MS Word Excel

FREE 12 Donation Receipt Forms In PDF MS Word Excel

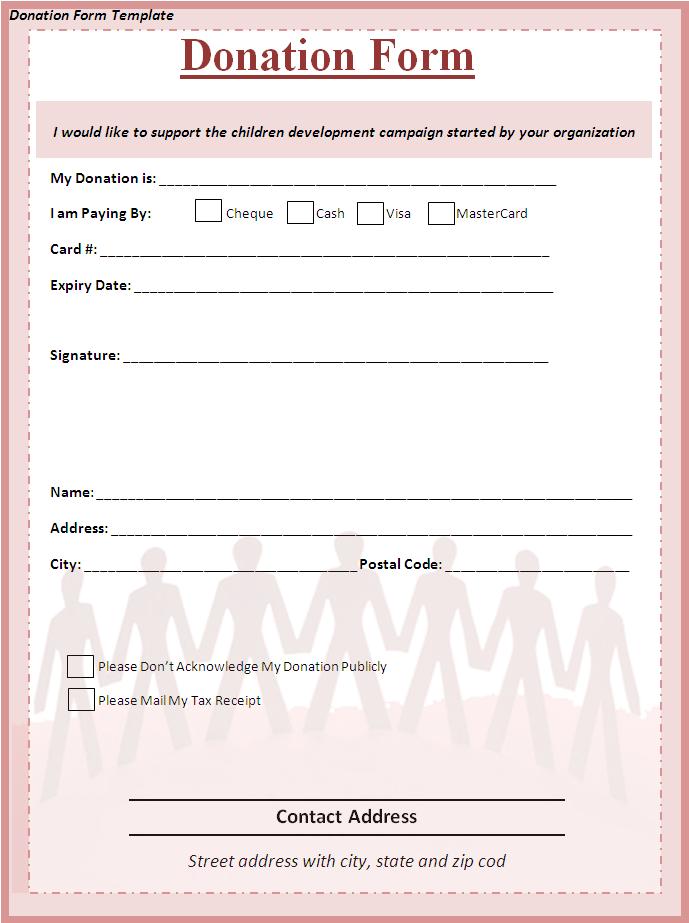

Free Donation Forms Free Word Templates

43 FREE Donation Request Letters Forms Template Lab

How To Respond To Non Filing Of Income Tax Return Notice

Tax Return From Donations - Verkko 25 marrask 2023 nbsp 0183 32 1 Plan Your Giving There are many tax planning opportunities with charitable donations that you can take advantage of to give you the largest deduction possible If you know that you will be