Tesla Tax Credit Refundable Or Nonrefundable If your modified AGI is below the threshold in 1 of the 2 years you can claim the credit If you do not transfer the credit it is nonrefundable when you file your taxes so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Credit amount

Note For businesses the tax credits are nonrefundable so you can t get back more on the credit than you owe in taxes Tax exempt entities have the option to take a direct payment in lieu of the credit This business tax credit amount applies to deliveries now The federal EV tax credit worth up to 7 500 is a nonrefundable tax credit that has been an effective way to lower the cost of EV ownership for taxpayers The Inflation Reduction Act of 2022 changed this tax credit by extending its life through 2032 and expanding it to cover more vehicles

Tesla Tax Credit Refundable Or Nonrefundable

Tesla Tax Credit Refundable Or Nonrefundable

https://i1.wp.com/dirtyoldcars.com/wp-content/uploads/2017/01/Tesla-rebate-incentives-1.jpg?fit=1148%2C759

.jpg)

The Tesla EV Tax Credit

https://assets.website-files.com/5ffe1568b0a42818305550d1/61a7b32488c9853167ea489b_EV Tax Credits (Dec 2021).jpg

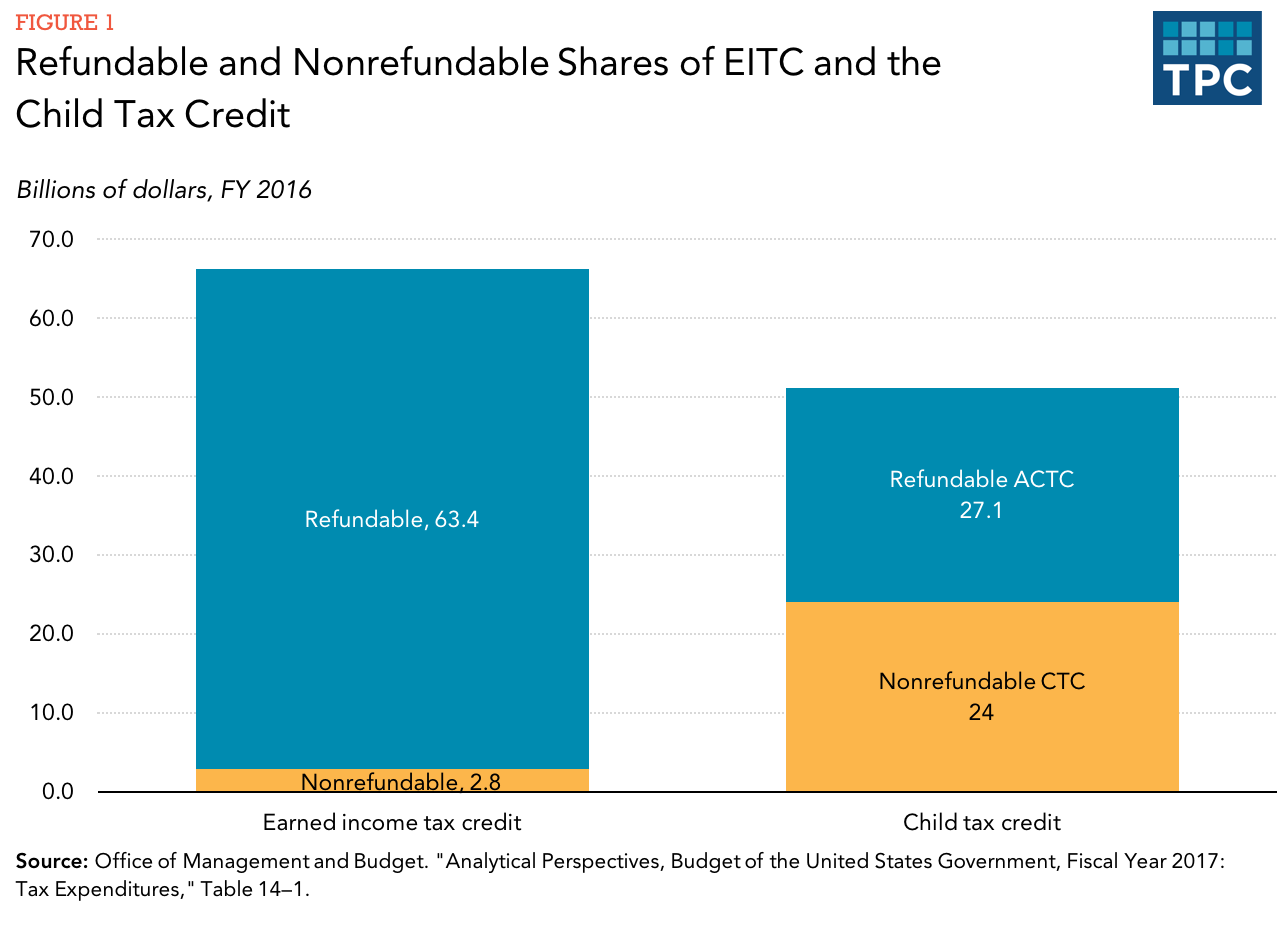

What Is The Difference Between Refundable And Nonrefundable Credits

http://www.taxpolicycenter.org/sites/default/files/4.3.2-figure1_0.png

It is nonrefundable so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Find information on credits for used clean vehicles and new EVs purchased in 2023 or after Who qualifies You may qualify for a credit up to 7 500 for buying a qualified new car or light truck You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas will qualify for a

The complication comes in the fact that the credit is not refundable A nonrefundable credit can reduce your total taxes owed but not below zero In other words if you owed no taxes but purchased a qualified EV you would not receive a refund from the credit The credit can only offset taxes owed Select Documents Select IRA Clean Vehicle Credit Report Review the IRS website for a full list of requirements Your 2023 Clean Vehicle Report IRS form 15400 is available by request through your Tesla Account

Download Tesla Tax Credit Refundable Or Nonrefundable

More picture related to Tesla Tax Credit Refundable Or Nonrefundable

Tesla s Genius Pricing Plan To Save You Thousands My Tech Methods

https://mytechmethods.com/wp-content/uploads/2021/09/tesla-tax-credit-2021-copy-2.jpg

Why You Should Wait To Buy A Tesla My Tech Methods

https://mytechmethods.com/wp-content/uploads/2021/02/tesla-tax-credit-2021.jpg

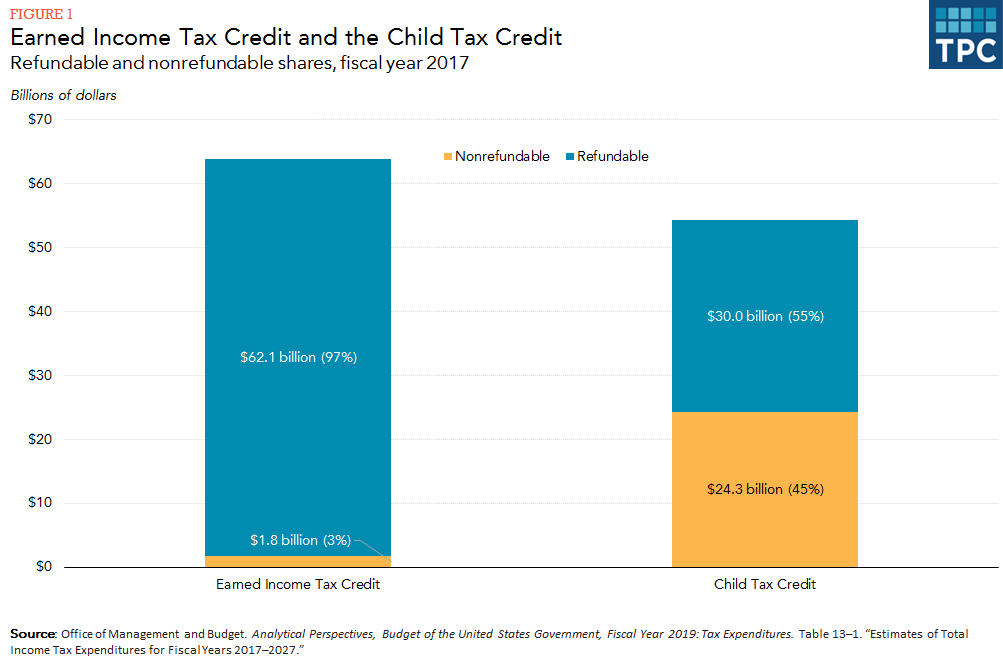

What Is The Difference Between Refundable And Nonrefundable Credits

https://www.taxpolicycenter.org/sites/default/files/4.5.2.png

The credit is non refundable so you won t get a refund for the unused portion of it In addition you can t carry the credit over to your next year s return To qualify for the Clean Vehicle Credit you must purchase and place in service a qualified motor vehicle and the following must be true You may be eligible for a tax credit if you purchase a plug in electric car including a Tesla Here s what you need to know about the electric car tax credit What s a tax credit A tax credit reduces the amount of tax you owe It reduces your tax liability dollar for dollar Non refundable tax credits expire the year they re used or not used

The language describing the EV tax credit as non refundable simply means that you will not get back more money than you are supposed to have paid in taxes throughout the year For instance if you made 58 576 and used the standard deduction your total tax liability for the year is only 5147 Tesla tax credits are non refundable meaning they cannot be received as cash back However if the tax credit exceeds your tax liability the unused portion can be carried forward and applied to future tax years

Is Tesla Tax Credit And Rebates Real YouTube

https://i.ytimg.com/vi/ijyuWJi5R2E/maxresdefault.jpg

Hot Order A Tesla By Monday To Get Full 7 500 Tax Credit CleanTechnica

https://cleantechnica.com/files/2018/10/Model-S.jpg

https://www.irs.gov/credits-deductions/credits-for...

If your modified AGI is below the threshold in 1 of the 2 years you can claim the credit If you do not transfer the credit it is nonrefundable when you file your taxes so you can t get back more on the credit than you owe in taxes You can t apply any excess credit to future tax years Credit amount

.jpg?w=186)

https://www.tesla.com/support/incentives

Note For businesses the tax credits are nonrefundable so you can t get back more on the credit than you owe in taxes Tax exempt entities have the option to take a direct payment in lieu of the credit This business tax credit amount applies to deliveries now

Refundable Non Refundable Tax Credits YouTube

Is Tesla Tax Credit And Rebates Real YouTube

How To Qualify For Tesla Tax Credit In 2023 ZiiSaa

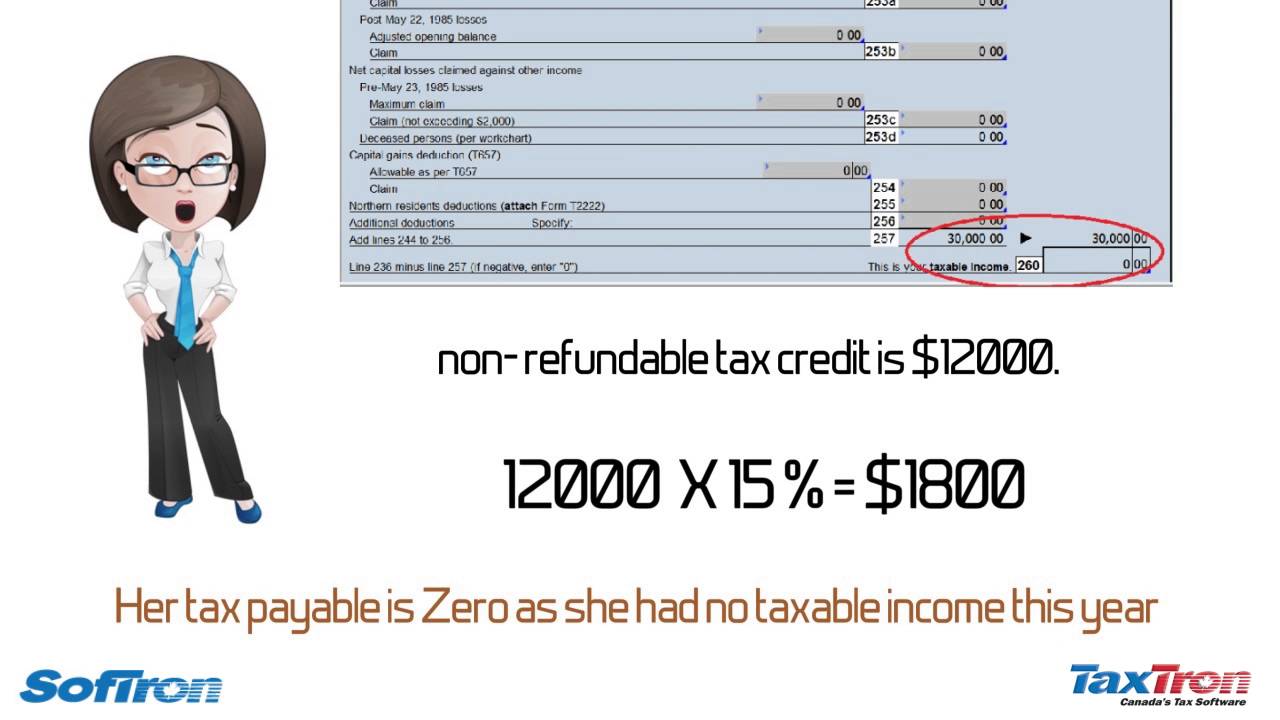

TAX TIP REFUNDABLE Vs NONREFUNDABLE CREDIT YouTube

This Month Is Your Last Chance To Get The Full EV Tax Credit On A Tesla

Tesla Buyers May See 7 000 Tax Credits From President Biden Soon

Tesla Buyers May See 7 000 Tax Credits From President Biden Soon

What Are Non Refundable Tax Credits YouTube

Refundable Vs Non Refundable Tax Credits

How Are Non Refundable Tax Credits Applied Leia Aqui How Does A

Tesla Tax Credit Refundable Or Nonrefundable - A purchase of a Tesla vehicle may qualify for the Clean Vehicle Tax Credit Tax credits directly decrease the amount you owe in taxes and come in two forms refundable and nonrefundable A nonrefundable tax credit can reduce your tax liability to zero dollars but you do not get a refund for any amount below zero dollars