Vpf Tax Rebate Web 2 avr 2021 nbsp 0183 32 New Delhi Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021 22 that PF contributions over Rs

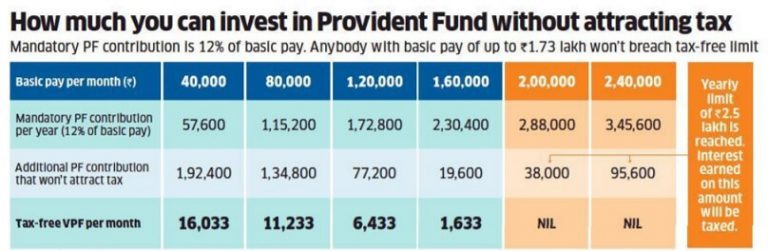

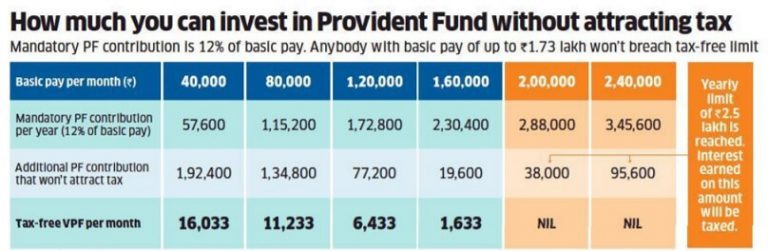

Web 9 f 233 vr 2022 nbsp 0183 32 So the required VPF contribution to keep overall contributions below Rs 2 5 lakh every financial year will also reduce proportionately By the way only EPF is not Web 7 avr 2021 nbsp 0183 32 Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021 22 to levy income tax on interest earned on employee s contribution towards the Employee Provident Fund or EPF if the sum is

Vpf Tax Rebate

Vpf Tax Rebate

https://www.canarahsbclife.com/content/dam/choice/blog-inner/images/Voluntary-Provident-Fund--detail.jpg

Tax Forms MIT VPF

https://vpf.mit.edu/sites/default/files/2019-07/45338914584_61fa55a363_b.jpg

Voluntary Provident Fund VPF Tax Exemption

https://www.fisdom.com/wp-content/uploads/2021/08/72-768x576.jpg

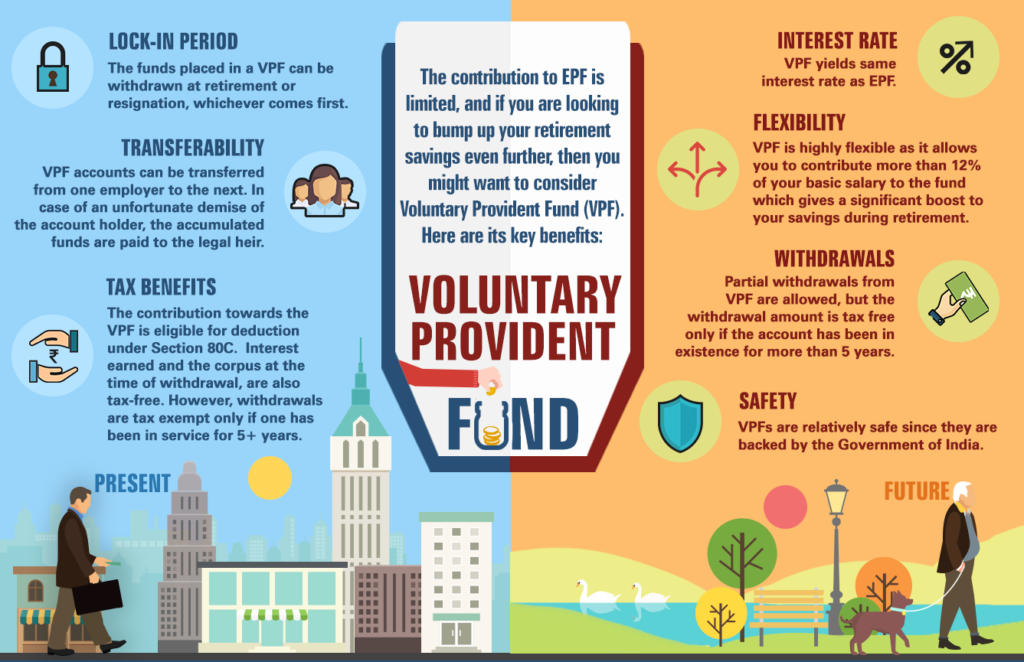

Web 28 mars 2023 nbsp 0183 32 Tax benefits VPF falls under the EEE category which means the contributions interest and withdrawals are exempt from tax However withdrawals Web 3 mai 2023 nbsp 0183 32 VPF can help you retire with tax free and guaranteed Rs 3 crore in 30 years Voluntary Provident Fund VPF calculation 2023 An employee can contribute up to Rs 2 5 lakh in a year towards VPF

Web 9 f 233 vr 2023 nbsp 0183 32 Last updated on February 9th 2023 INDEX What is a VPF Features of VPF Scheme How does Voluntary Provident Fund work Tax Benefits available under VPF Web 3 f 233 vr 2021 nbsp 0183 32 New Delhi The Union Budget 2021 22 proposed to tax interest earned on EPF contribution above 2 5 lakh in a year Although this rule has made VPF investment

Download Vpf Tax Rebate

More picture related to Vpf Tax Rebate

The VPF Tax In India What To Expect

https://griffinschein.com/wp-content/uploads/2022/08/epf-calculator-850x425.png

VPF Tax Free Interest Tax Saving Voluntary Provident Fund

https://i.ytimg.com/vi/JAIKEU64ZK4/maxresdefault.jpg

EPF PPF And VPF Tax Saving Investments For Guaranteed Returns YouTube

https://i.ytimg.com/vi/dbxbBR7it10/maxresdefault.jpg

Web 11 sept 2023 nbsp 0183 32 Updated On 09 Sep 2023 If you are looking for a long term investment option with high returns and low risk factors you can opt for the Voluntary Provident Web 29 mars 2023 nbsp 0183 32 Eligibility VPF is referred as an extended version of Employee Provident Fund Only salaried individuals employees getting monthly salary in a specific salary account can avail the benefits of VPF

Web 24 juil 2022 nbsp 0183 32 Updated Jul 24 2022 07 06 AM IST Know the maximum investment in VPF for tax free interest on EPF account Photo BCCL The Central government notified that the Employees Provident Fund EPF Web 17 avr 2023 nbsp 0183 32 VPF Contributions are eligible for tax deduction under Section 80C salaried employees are eligible for a VPF tax exemption on the interest earned from this scheme

Tax On EPF VPF Contribution Above 2 5 Lakhs

https://bemoneyaware.com/wp-content/uploads/2021/03/epf-returns-tax.jpg

What Is Vpf Tax Benefits Of Voluntary Provident Fund

https://navbharattimes.indiatimes.com/thumb/88829343/what-is-vpf-tax-benefits-of-voluntary-provident-fund-88829343.jpg?imgsize=23554&width=700&height=525&resizemode=75

https://www.timesnownews.com/business-eco…

Web 2 avr 2021 nbsp 0183 32 New Delhi Finance Minister Nirmala Sitharaman has announced in the Union Budget 2021 22 that PF contributions over Rs

https://stableinvestor.com/2022/02/maximum-vpf-investment-tax-free-epf...

Web 9 f 233 vr 2022 nbsp 0183 32 So the required VPF contribution to keep overall contributions below Rs 2 5 lakh every financial year will also reduce proportionately By the way only EPF is not

VPF A Good Tax Saving Retirement Option

Tax On EPF VPF Contribution Above 2 5 Lakhs

Bank FDs Best Ways To Save Tax The Economic Times

VPF Meaning Benefits And More Wealthpedia

What Is VPF Voluntary Provident Fund

Epf contribution tax free

Epf contribution tax free

Photo2

VPF Interest Rate Eligibility Withdrawal Rules And Tax Benefits

EPF PPF VPF Rules In Hindi

Vpf Tax Rebate - Web Updated on Apr 29th 2023 4 min read CONTENTS Show Voluntary Provident Fund VPF is a further extension of the Employees Provident Fund EPF It is a voluntary