Work From Home Tax Deduction 2023 Working from home deduction changes for 2022 23 Last updated 15 February 2023 Print or Download The record keeping requirements and methods for calculating working from home deductions has changed

The CRA discontinued the flat rate method of claiming work from home expenses for the 2023 tax year Introduced in 2020 the temporary flat rate method allowed eligible workers to deduct 2 for Eligible employees who worked from home in 2023 will be required to use the detailed method to claim home office expenses The temporary flat rate method does not apply to the 2023 tax year How work from home expense calculations have been updated for the 2022 tax year

Work From Home Tax Deduction 2023

Work From Home Tax Deduction 2023

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

https://images.ctfassets.net/ifu905unnj2g/1Lfz3unAOechDi2fmnqNjD/7ccd0ab7358e142ce34f14c41013d3f2/Schedule_A_Form_1040.png

Goodwill Donation Spreadsheet Template 2017 With Irs Donation Value

https://db-excel.com/wp-content/uploads/2019/01/goodwill-donation-spreadsheet-template-2017-with-irs-donation-value-guide-2017-spreadsheet-lovely-donation-value-601x850.jpg

Home Office Tax Deduction Work from Home Write Offs for 2023 Can you claim the home office tax deduction this year Here s a guide to claiming deductions and other tips on how to handle your federal taxes if you are an employee working from home

This calculator covers the 2013 14 to 2022 23 income years You can use either the revised fixed rate method or actual cost method to work out your deduction Your results are based on the information you provide and the rates available at On 15 February 2023 the ATO finalised its new more stringent regime for Work From Home WFH tax deductions The change which was scheduled for 1 January in draft PCG 2022 D4 will now be in force from 1 March 2023

Download Work From Home Tax Deduction 2023

More picture related to Work From Home Tax Deduction 2023

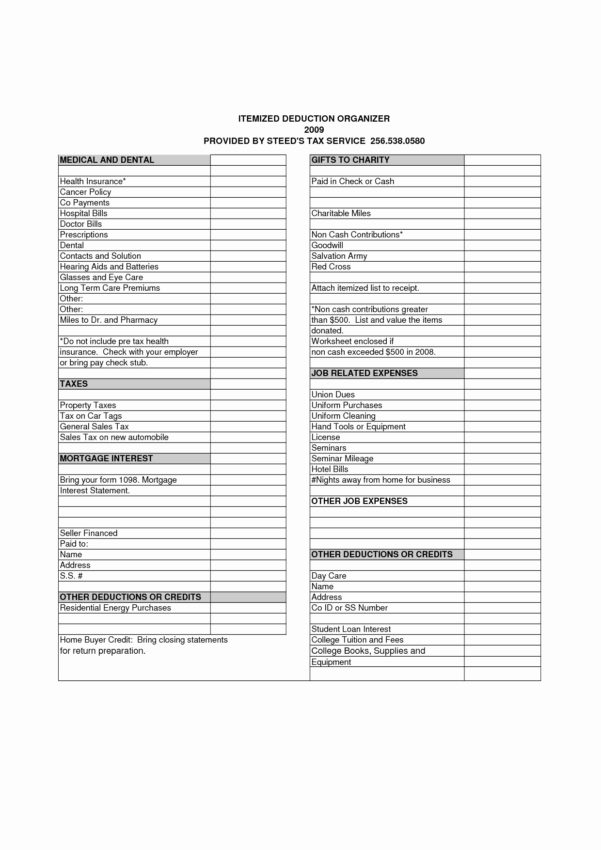

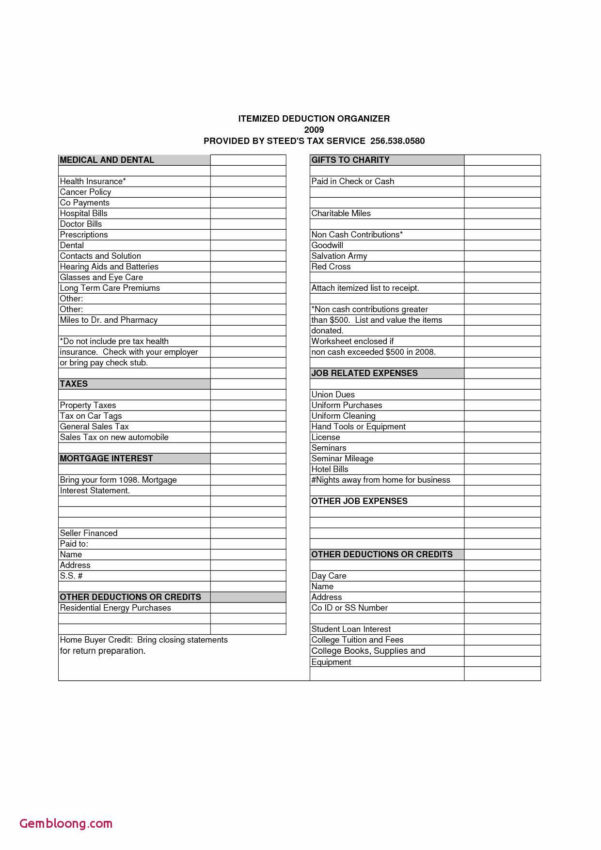

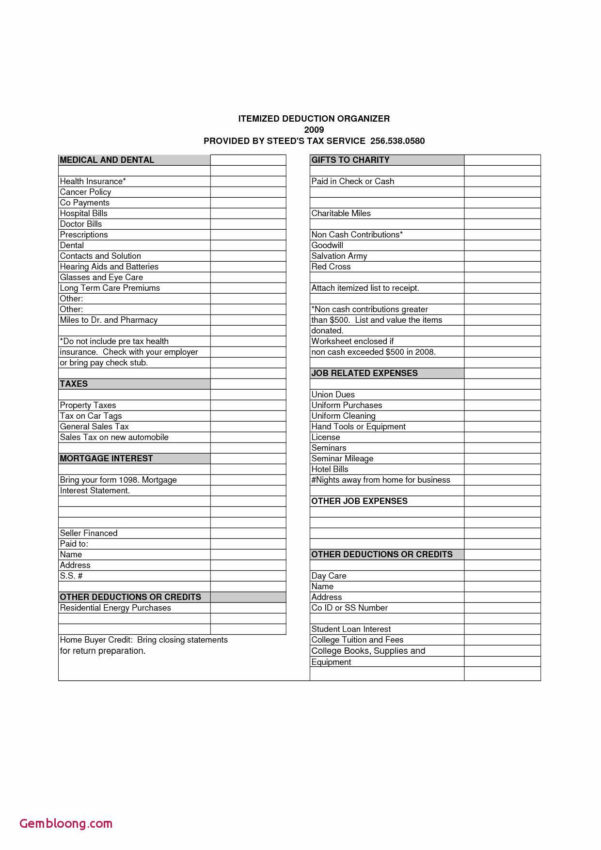

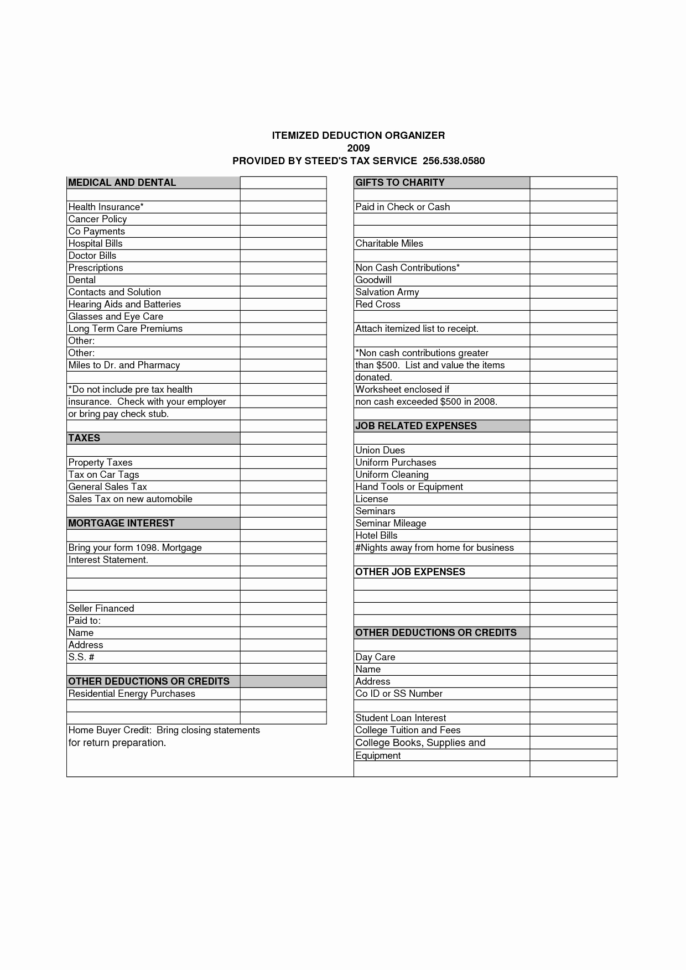

8 Best Images Of Tax Preparation Organizer Worksheet Individual

http://www.worksheeto.com/postpic/2015/05/small-business-tax-deduction-worksheet_449268.png

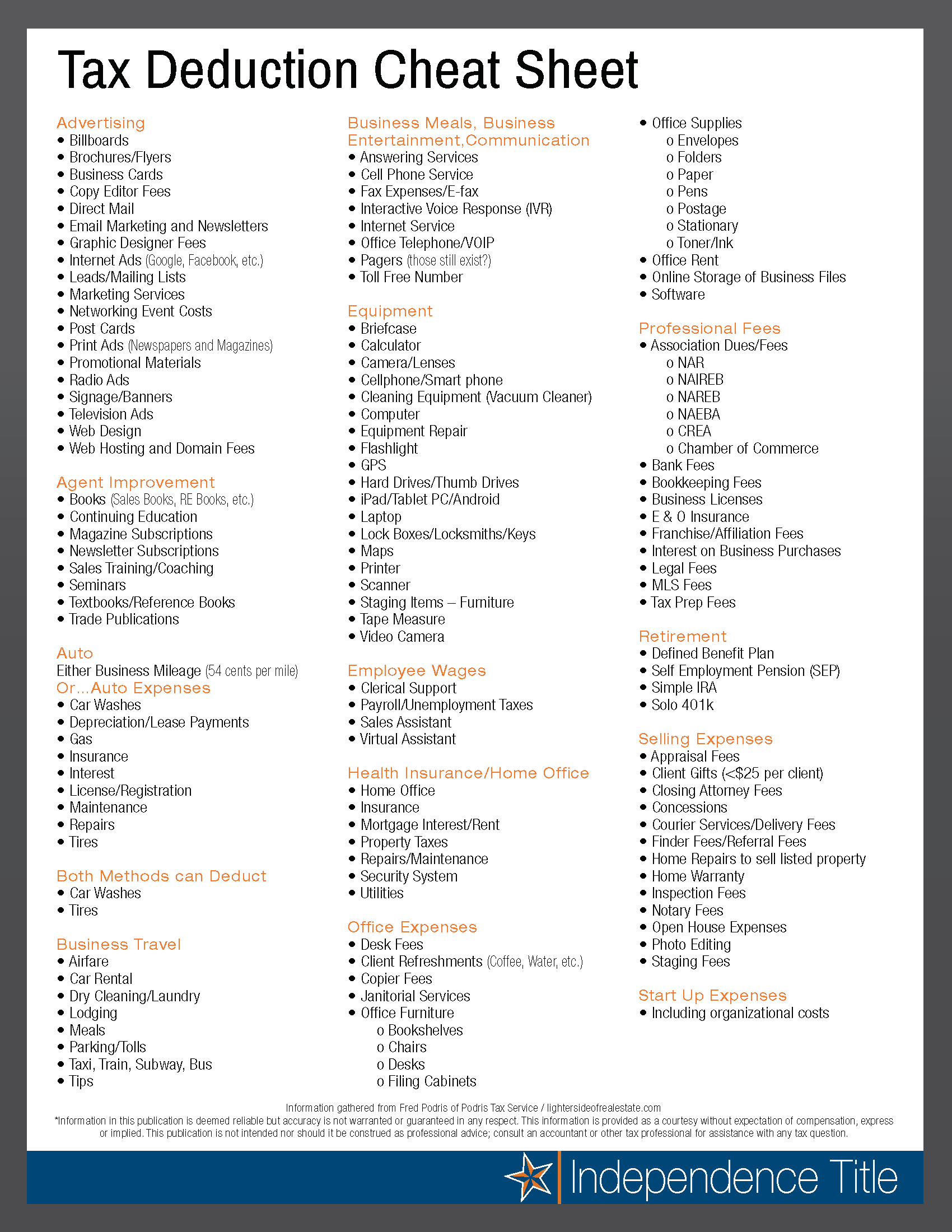

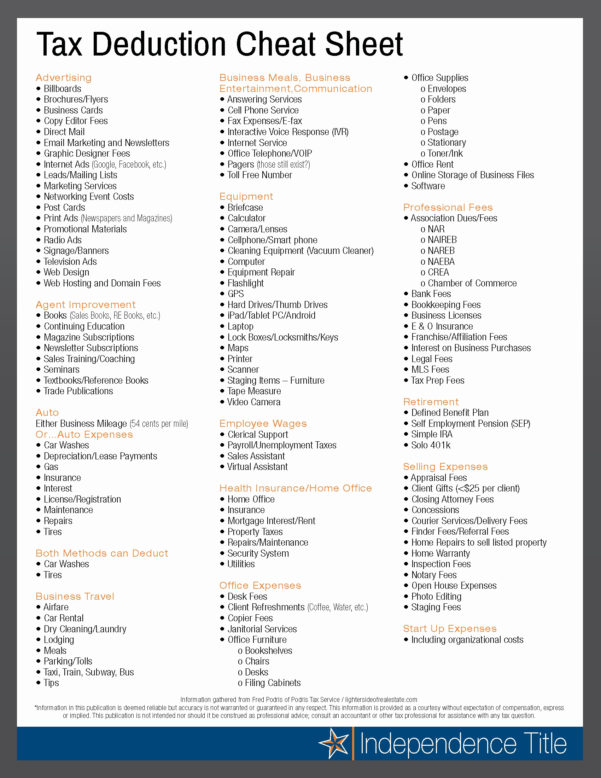

Tax Deduction Spreadsheet Throughout Tax Deduction Cheat Sheet For Real

https://db-excel.com/wp-content/uploads/2019/01/tax-deduction-spreadsheet-throughout-tax-deduction-cheat-sheet-for-real-estate-agents-independence-title.png

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents

http://lightersideofrealestate.com/wp-content/uploads/2015/12/agent-deduction-cheat-sheet.jpg

A proposed change to the way Australians claim back tax deductions for working from home could mean some lose out on more than 1 300 a year according to tax agents You can claim a fixed rate of 67 cents for each hour you work from home This rate covers energy costs for heating cooling and lighting phone and data usage expenses for your home phone mobile and internet services computer consumables and stationery costs for office supplies like printer ink If you ve bought office

[desc-10] [desc-11]

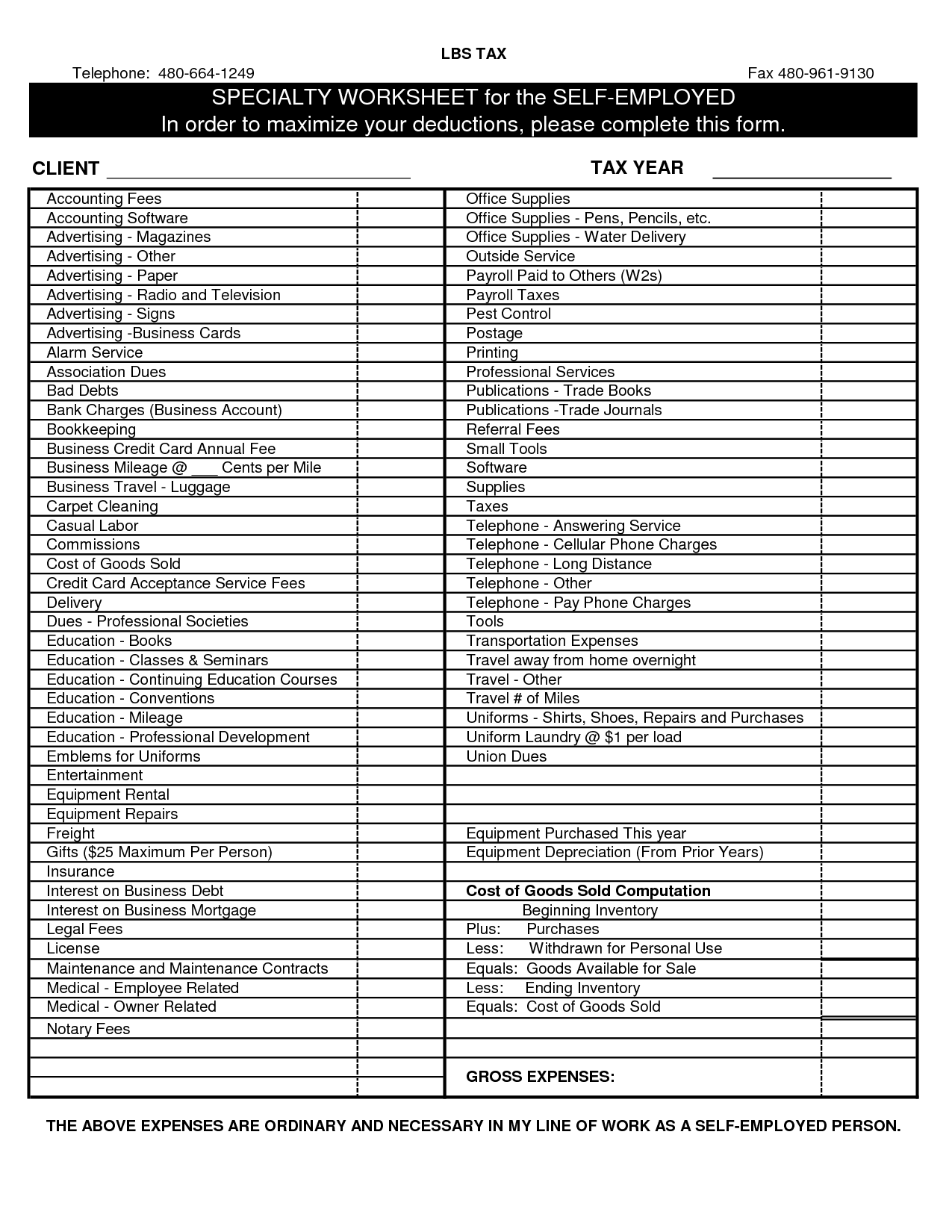

10 Tax Deduction Worksheet Worksheeto

https://www.worksheeto.com/postpic/2012/03/2015-itemized-tax-deduction-worksheet-printable_426931.png

Federal Tax Deductions Worksheet

https://www.pdffiller.com/preview/391/382/391382225/large.png

https://www.ato.gov.au/tax-and-super-professionals/for-tax...

Working from home deduction changes for 2022 23 Last updated 15 February 2023 Print or Download The record keeping requirements and methods for calculating working from home deductions has changed

https://www.thestar.com/business/personal-finance/still-working...

The CRA discontinued the flat rate method of claiming work from home expenses for the 2023 tax year Introduced in 2020 the temporary flat rate method allowed eligible workers to deduct 2 for

The Master List Of All Types Of Tax Deductions infographic Free

10 Tax Deduction Worksheet Worksheeto

Printable Tax Organizer Template

Farm Expenses Spreadsheet Charlotte Clergy Coalition

Business Expenses Deductible List BUNSIS

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

Family Day Care Tax Spreadsheet Printable Spreadshee Family Day Care

Itemized Deductions Worksheet Db excel

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Tax Deduction Worksheet Business Tax Deductions Small Business Tax

Work From Home Tax Deduction 2023 - [desc-13]