Federal Tax Credit Amount A tax credit reduces the specific amount of the tax that an individual owes For example say that you have a 500 tax credit and a 3 500 tax bill The tax credit would reduce your

You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of taxable income A credit is an amount you subtract from the tax you owe This can lower your tax payment or increase your refund Some credits are refundable they can give you money back even if you don t owe any tax To claim credits answer questions in

Federal Tax Credit Amount

Federal Tax Credit Amount

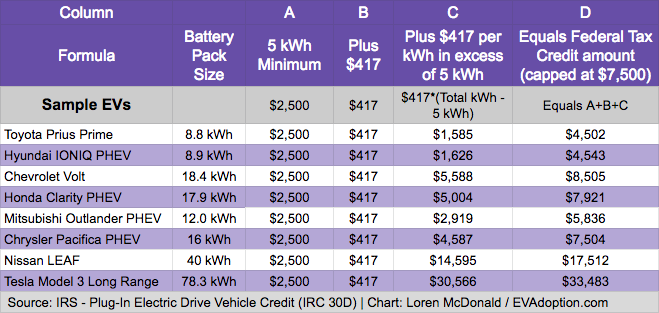

https://evadoption.com/wp-content/uploads/2019/03/Sample-EVs-Federal-EV-tax-credit-amount-calculation.png

How The Federal EV Tax Credit Amount Is Calculated For Each EV EVAdoption

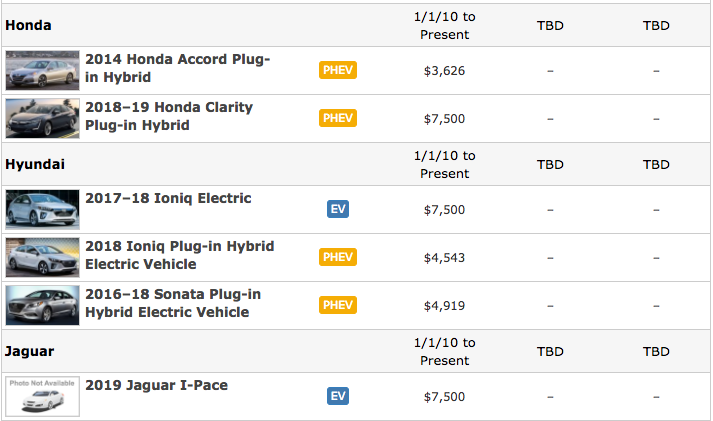

https://evadoption.com/wp-content/uploads/2019/03/Samples-from-FuelEconomy.gov-Federal-Tax-credit-amounts.png

T14 0022 Extend ATRA Earned Income Tax Credit Number Of Returns And

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/T14-0022.gif

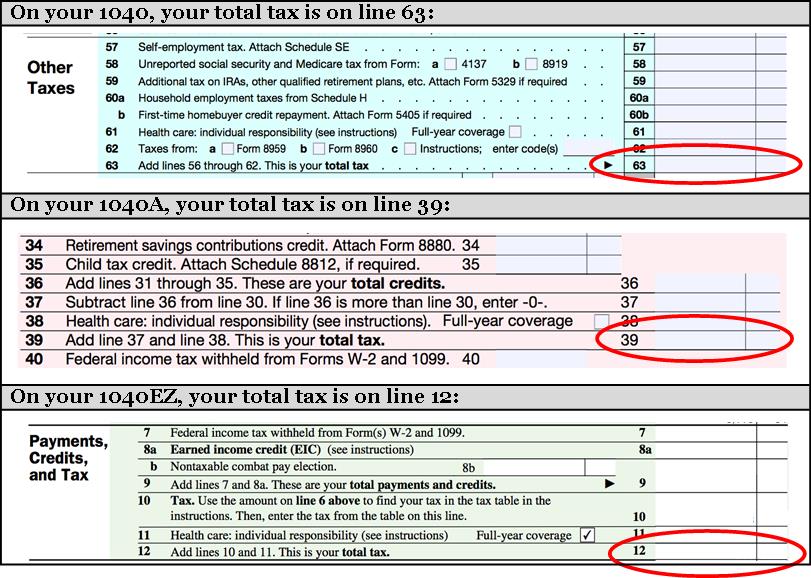

A tax credit is the dollar for dollar amount of money that taxpayers subtract directly from the income taxes owed A federal tax credit is granted by the federal government Claim this amount if you were 65 years of age or older on December 31 2023 and your net income line 23600 of your return is less than 98 309 If your net income was 42 335 or less claim 8 396 on line 30100 of your return

A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000 The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance

Download Federal Tax Credit Amount

More picture related to Federal Tax Credit Amount

TaxTips ca 2023 Non Refundable Personal Tax Credits Tax Amounts

https://www.taxtips.ca/nrcredits/2023-personal-tax-credits.jpg

Analysis Of The Cost of Living Refund Act Of 2019 Tax Foundation

https://files.taxfoundation.org/20190305125014/FF640_1.png

Today The 1 875 Federal Tax Credit For GM Is Gone

https://cdn.motor1.com/images/custom/federal-tax-credit-amount-april-1-2020.png

A tax credit is a benefit that lowers your taxes owed by the amount of the credit Tax credits can be nonrefundable refundable or partially refundable Credits provide a dollar for dollar reduction in the amount of taxes you owe Some tax credits are refundable meaning you can be paid for the value of the credit even if it exceeds your tax

A tax credit is a dollar amount that you can subtract from your income tax to reduce your overall tax liability So while a tax refund simply represents the difference between the taxes you paid versus the taxes you actually owe a tax credit is a benefit that directly reduces your tax burden The earned income tax credit EIC or EITC is for low and moderate income workers See qualifications and credit amounts for 2023 2024

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/736x/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.jpg

T14 0047 Eliminate Income Threshold For The Refundable Child Tax

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/T14-0047.gif?itok=5kNtR7oI

https://www.investopedia.com/terms/t/taxcredit.asp

A tax credit reduces the specific amount of the tax that an individual owes For example say that you have a 500 tax credit and a 3 500 tax bill The tax credit would reduce your

https://www.irs.gov/credits-and-deductions

You can use credits and deductions to help lower your tax bill or increase your refund Credits can reduce the amount of tax due Deductions can reduce the amount of taxable income

Earned Income Tax Credit City Of Detroit

See The EIC Earned Income Credit Table Income Tax Return Income

Taxes From A To Z 2014 F Is For Foreign Tax Credit

Is The 2020 Child Tax Credit A Refundable Credit Leia Aqui Is The IRS

Fixing The Federal EV Tax Credit Flaws Redesigning The Vehicle Credit

Ev Tax Credit 2022 Cap Stamps Podcast Bildergallerie

Ev Tax Credit 2022 Cap Stamps Podcast Bildergallerie

Rebate Process Efficiency Maine

Electric Vehicle Tax Credit Amount Electric Vehicle Tax Credits What

Can You Use The 30 Federal Tax Credit For Solar The Energy Miser

Federal Tax Credit Amount - A tax credit lowers the amount of money you must pay the IRS Not to be confused with deductions tax credits reduce your final tax bill dollar for dollar That means that if you owe Uncle Sam 5 000 a 2 000 credit would shave 2 000 off your total tax bill and you would only owe 3 000