Is Sales Tax On Vehicle Purchase Deductible Web 11 Dez 2022 nbsp 0183 32 If you bought a vehicle for business you could deduct the sales tax on the business tax return In this case you must fill in Schedule C Form 1040 and cannot

Web 3 Feb 2023 nbsp 0183 32 If you file using only the standard deduction you cannot claim the sales tax deduction In order to claim the deductions two things must be present You itemize Web The IRS allows you to deduct sales tax you paid on a car purchase by itemizing on Schedule A on Form 1040 If you don t itemize you can t

Is Sales Tax On Vehicle Purchase Deductible

Is Sales Tax On Vehicle Purchase Deductible

https://multichannelmerchant.com/wp-content/uploads/2020/12/online-sales-tax-keyboard-feature-cropped.jpg

Sales Tax You Pay On Rent Depends On Where You Live

https://www.azcentral.com/gcdn/-mm-/47c683c6bf1f4284c82caa7f005ce65ecbb2dc0b/c=0-260-3703-2343/local/-/media/Phoenix/2014/12/28/B9315535737Z.1_20141228110410_000_G4M9ER7T0.1-0.jpg?width=3200&height=1801&fit=crop&format=pjpg&auto=webp

Do You Have To Pay Sales Tax On A Semi Truck In Florida RCTruckStop

https://rctruckstop.com/wp-content/uploads/2023/01/sales-tax-2.jpg

Web 27 Nov 2023 nbsp 0183 32 VAT when buying or selling a car Are you buying or selling a car Check what VAT is due when buying or selling a car in the EU or when buying a car outside the Web May 31 2019 6 35 PM You can deduct sales tax on a new or used purchased or leased vehicle or boat but if you live in a state with a state income tax it probably isn t to your

Web 24 Jan 2022 nbsp 0183 32 A vehicle sales tax deduction allows car buyers to deduct sales tax from the purchase of a vehicle Not everyone can take this deduction though Tax filers Web 24 Feb 2020 nbsp 0183 32 If you meet certain conditions per the IRS you may be able to deduct the sales tax from your vehicle purchase You ll Have to Itemize One of the conditions is

Download Is Sales Tax On Vehicle Purchase Deductible

More picture related to Is Sales Tax On Vehicle Purchase Deductible

The Difference Between Sales Tax And Use Tax A Guide For E commerce

https://thetaxvalet.com/wp-content/uploads/2023/04/Jurence11938_blog_post_header_receipts_bright_colors_cubic_styl_e35d9bff-bb41-4d84-a105-4243f79d4141.png

How Much Are Sales Tax On Cars In Ontario Loans Canada

https://loanscanada.ca/wp-content/uploads/2023/05/Tax-On-Cars-In-Ontario.png

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Web 30 M 228 rz 2022 nbsp 0183 32 You may be able to deduct the car sales tax you paid when you bought a new or used vehicle from a dealer or private seller The amount owed in car sales tax will be clear on the purchase order that ll Web 16 Mai 2022 nbsp 0183 32 If you use a vehicle as part of your business operations such as to deliver products or drive to worksites your company may be eligible for certain tax deductions

Web 25 Feb 2021 nbsp 0183 32 You can enter the sales tax you paid for the car you purchased in 2020 by going to Federal gt Deductions and Credits gt Estimates and Other Taxes Paid gt Sales Web 10 Dez 2019 nbsp 0183 32 Sales tax on a car or automobile purchase might be deductible It depends on the taxpayer s circumstances Generally the following conditions must all be

Sales Tax Struggles

https://www.budgetease.biz/hubfs/BE Blog 10.26.21.jpg

Sales Tax Technology Tax Consulting Sales Tax Technology

https://i.pinimg.com/originals/46/89/8c/46898c3797181b93284a7ff7a7c2f694.jpg

https://www.jdpower.com/cars/shopping-guides/how-to-qualify-for-the...

Web 11 Dez 2022 nbsp 0183 32 If you bought a vehicle for business you could deduct the sales tax on the business tax return In this case you must fill in Schedule C Form 1040 and cannot

https://savingtoinvest.com/can-i-claim-the-sales-tax-on-my-new-or-used...

Web 3 Feb 2023 nbsp 0183 32 If you file using only the standard deduction you cannot claim the sales tax deduction In order to claim the deductions two things must be present You itemize

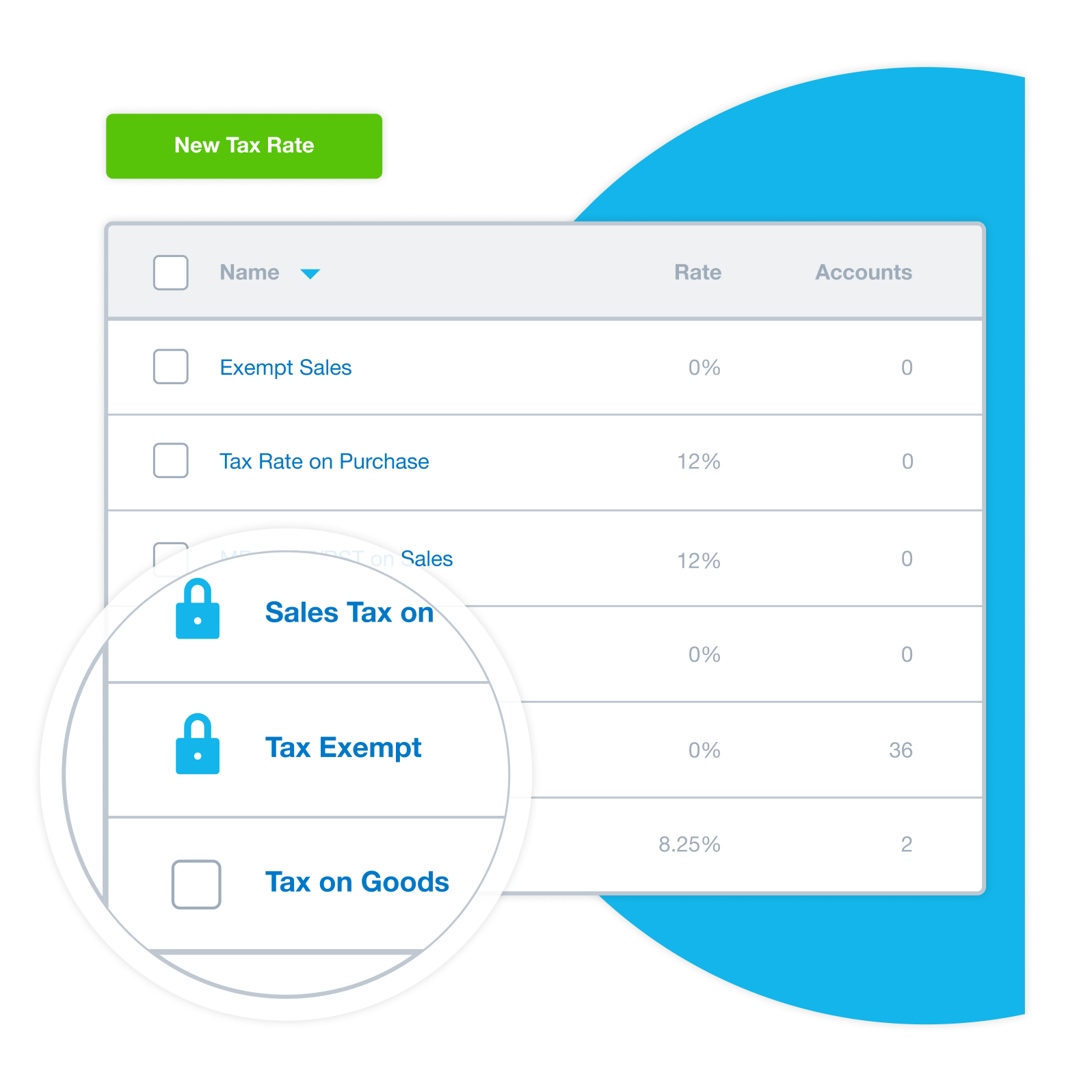

Sales Tax Software Xero PH

Sales Tax Struggles

Sales Tax Changes For Utilities

Texas House Passes Bill That Would Remove Sales Tax On Menstrual

FLORIDA SALES TAX COUPONS V DISCOUNTS

Sales Tax Withholding Rates How To Deduct Sales Tax With Practical

Sales Tax Withholding Rates How To Deduct Sales Tax With Practical

Sales Tax By State Should You Charge Sales Tax On Digital Products

6 3 3 Adjusting The Sales Tax On An Invoice On Vimeo

Washington Sales Tax For Businesses A Complete Guide FreeCashFlow io

Is Sales Tax On Vehicle Purchase Deductible - Web 24 Feb 2020 nbsp 0183 32 If you meet certain conditions per the IRS you may be able to deduct the sales tax from your vehicle purchase You ll Have to Itemize One of the conditions is