New York State Heat Pump Tax Credit NYS Clean Heat rebates can be combined with federal tax credits included in the Inflation Reduction Act Now you can save even more when you make the switch to heat pumps and other clean efficient solutions Learn More

New York State and energy companies are offering rebates to lower your bills and stay comfortable year round with state of the art heating and cooling technology Ready to start saving Answer a few simple questions about your Instructions for Form IT 267 Geothermal Energy System Credit General information You may claim a credit for qualified geothermal energy system equipment and expenditures installed at

New York State Heat Pump Tax Credit

New York State Heat Pump Tax Credit

https://media1.moneywise.com/a/23311/heat-pump-tax-credit-rebate_facebook_thumb_1200x628_v20220927160351.jpg

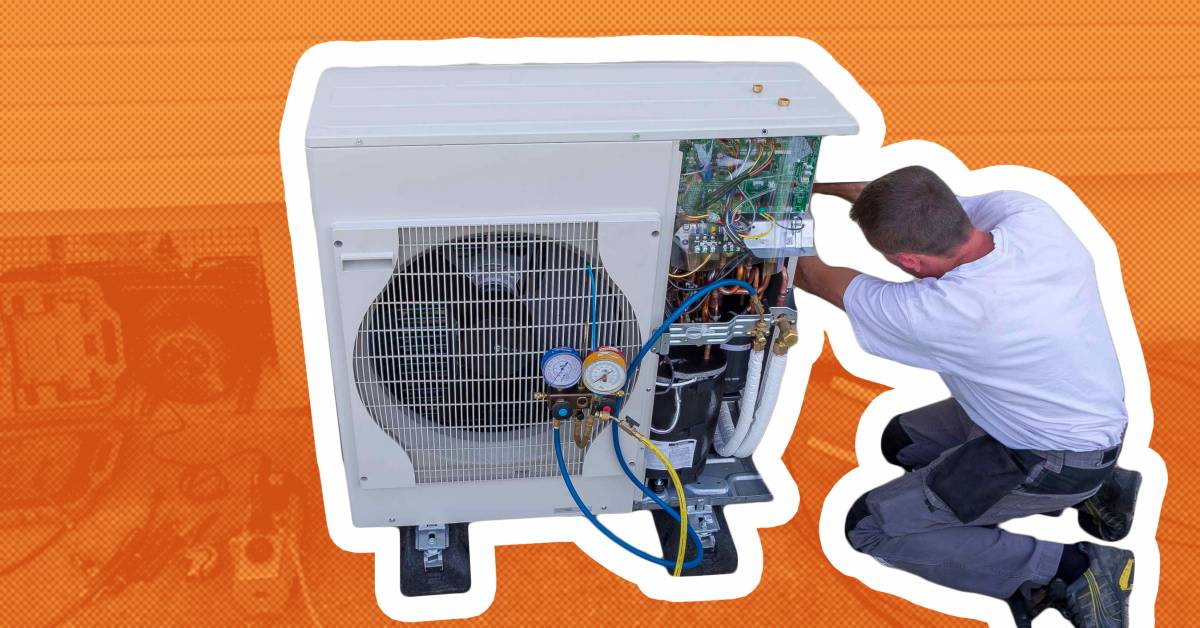

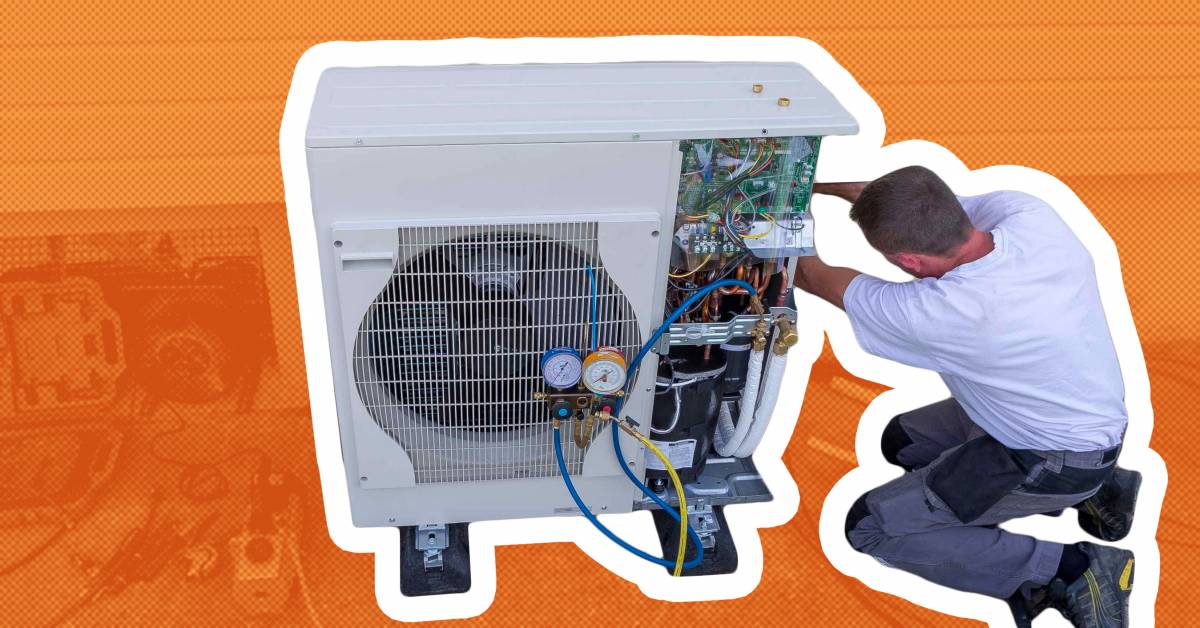

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-scaled.jpg

New York State s Climate Council Wants Heat Pumps In All New Homes By 2024

https://s.hdnux.com/photos/01/23/34/06/21873031/4/rawImage.jpg

The clean heating fuel credit is available to taxpayers for the purchase of bioheating fuel used for space heating or hot water production for residential purposes within Research available State incentives and federal tax credits for your heat pump purchase and factor them into your budgeting Be sure to file for any tax credits you may be eligible for to receive refunds

Governor Kathy Hochul today announced 10 million is now available to advance new zero emission homes in New York State The Building Better Homes Zero Emission Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax

Download New York State Heat Pump Tax Credit

More picture related to New York State Heat Pump Tax Credit

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/QX3ShkFit/1600x837/heat-pump-1-1660837497727.jpg?position=top

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/bjAd12-bt/1024x536/heat-pump-2-1660837533114.jpg

Get Ready New York State Heat Dome On The Way

https://townsquare.media/site/10/files/2023/07/attachment-gettyimages-1546735790-594x594.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

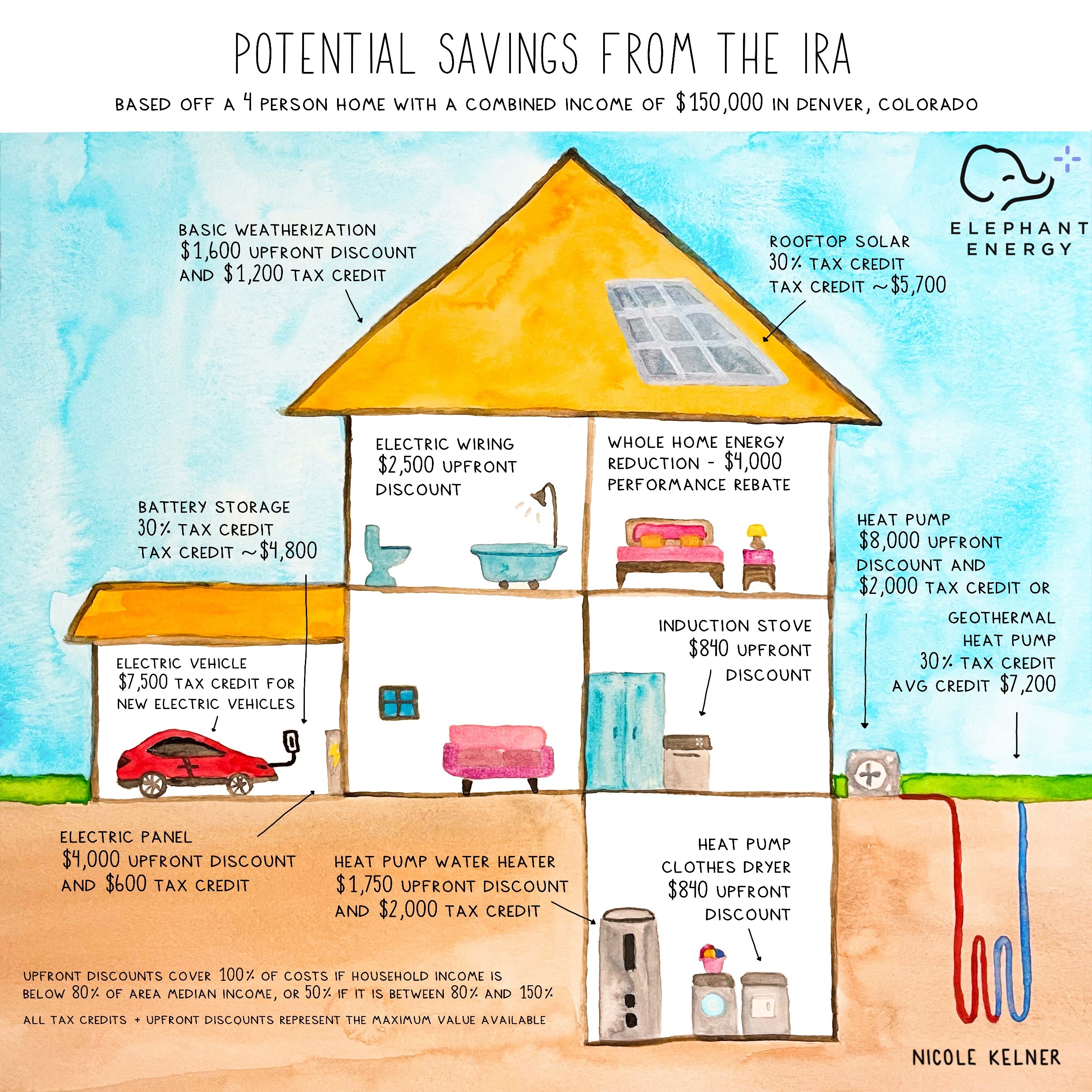

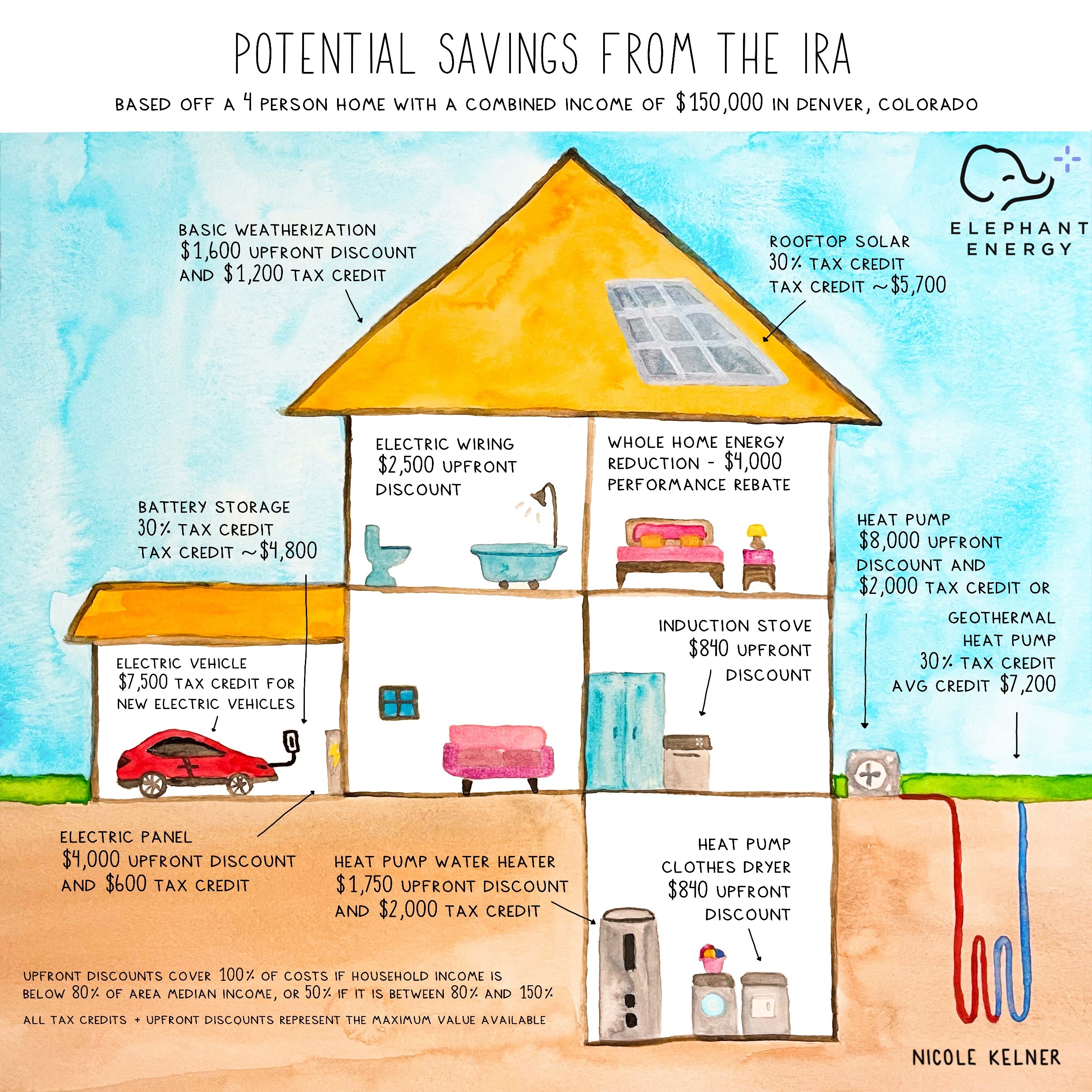

Learn how to get rebates for installing heat pumps that can save you up to 30 on your energy costs and reduce your carbon footprint Find out if you are eligible how to apply and what incentives are available for electric or combination New Yorkers can often combine these IRA benefits with State incentives and programs to maximize savings on electric vehicles solar panels energy efficiency upgrades heat pumps

NYS Clean Heat also provides rebates for ground source heat pumps which are eligible for a 30 IRA tax credit and 25 New York State income tax credit Heat pump systems are being For more information on Federal Tax Credits please visit EnergyStar gov ELIGIBILITY NYS Clean Heat rebates are available to all customers statewide through their electric utility

Inflation Reduction Act IRA The Ultimate Guide To Saving

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-118.png

https://cleanheat.ny.gov

NYS Clean Heat rebates can be combined with federal tax credits included in the Inflation Reduction Act Now you can save even more when you make the switch to heat pumps and other clean efficient solutions Learn More

https://cleanheat.ny.gov › find-available …

New York State and energy companies are offering rebates to lower your bills and stay comfortable year round with state of the art heating and cooling technology Ready to start saving Answer a few simple questions about your

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

Inflation Reduction Act IRA The Ultimate Guide To Saving

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

The Inflation Reduction Act pumps Up Heat Pumps Hvac

Heat Pump Tax Credit

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting

Heat Pump Geothermal Tax Credit PumpRebate

Case Study Framework For Minnesota s Heat Pump Transition

Tax Credits On Electric Cars Heat Pumps Will Help Low Income

New York State Heat Pump Tax Credit - Governor Kathy Hochul today announced 10 million is now available to advance new zero emission homes in New York State The Building Better Homes Zero Emission