Nps Comes Under Section 80c Web 29 M 228 rz 2021 nbsp 0183 32 NPS is one of the listed investment options in which you can invest and save tax under Section 80C The deduction limit for this section is Rs 1 5 lakhs and you can invest the entire amount in NPS if you wish and claim the deduction

Web Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section 80CCE Rs 50 000 80CCD 2 Employer s contribution towards NPS outside Rs 1 50 000 limit under Section 80CCE Central government employer 14 of basic salary DA Others 10 of basic Web 26 Feb 2021 nbsp 0183 32 If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh Here is a look at the tax benefits one gets by investing in NPS

Nps Comes Under Section 80c

Nps Comes Under Section 80c

https://i.ytimg.com/vi/5M1YKYGiLQc/maxresdefault.jpg

NPS Tier 2 Account Tax Saver Account Scheme Section 80C Tax Benefit

https://i.ytimg.com/vi/NeUiXT3laiU/maxresdefault.jpg

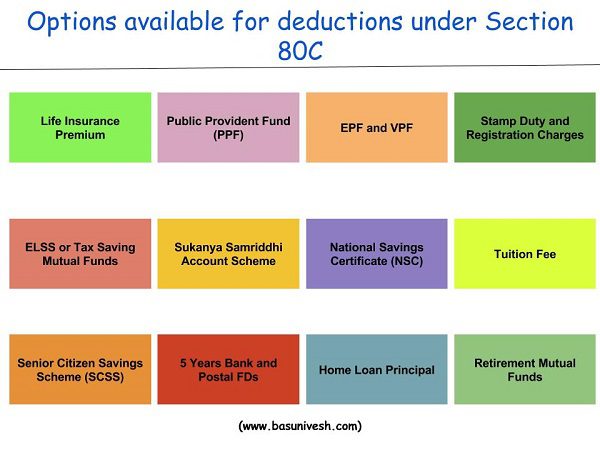

Deduction Under Section 80C A Complete List BasuNivesh

https://b2382649.smushcdn.com/2382649/wp-content/uploads/2016/07/Section-80C-Options.jpg?lossy=1&strip=1&webp=1

Web The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and Web 1 Sept 2020 nbsp 0183 32 On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Act Importantly as per Section 80CCE the aggregate amount of deduction under Section 80C 80CCC and 80CCD 1 cannot exceed Rs 1 50 000 in a financial year

Web 25 Feb 2016 nbsp 0183 32 Your contribution to NPS can be claimed under Section 80CCD1 b as well as Section 80C So If you have can use other investments to claim 1 5 lakh deduction under 80C then you can claim your NPS contribution first under 80CCD1 b for 50 000 then remaining along with other investments under 80C for 1 5 lakh So the total deduction Web 25 Mai 2023 nbsp 0183 32 Contribution to employee s pension account referred to in Section 80CCD Therefore any payment made by your employer to your pension account is a part of your taxable salary How to check if your taxable salary includes employer s contribution to pension account Check your Form 16 See our GUIDE to understand form 16 here

Download Nps Comes Under Section 80c

More picture related to Nps Comes Under Section 80c

Tax Benefits Under NPS Deductions Under Section 80CCD 1B Of Income

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80-ccd-1b.jpg

Here A List Of Types Of Deductions Covered Under Section 80C

https://okcredit-blog-images-prod.storage.googleapis.com/2020/11/80c.jpg

Section 80CCD 1B Deduction NPS Scheme Tax Benefits Alankit

https://www.alankit.com/blog/blogimage/NPS-80CCD.jpg

Web 4 Jan 2024 nbsp 0183 32 It is to be noted that deductions under Chapter VI A deduction Section 80C 80D 80E and so on are not available for taxpayers who opt for the New Tax regime However salaried individuals can Web 20 Sept 2022 nbsp 0183 32 Under this section one can claim deductions for investment in NPS for up to Rs 50 000 This is over and above the Section 80C deductions This is over and above the Section 80C deductions In other words one can claim a tax deduction of up to Rs 2 lakh by simply investing in NPS i e investing Rs 1 5 lakh under Section 80C and

Web 1 What are the tax benefits under NPS Tax Benefit available to Individual Any individual who is Subscriber of NPS can claim tax benefit under Sec 80 CCD 1 with in the overall ceiling of Rs 1 5 lac under Sec 80 CCE Exclusive Tax Web 26 M 228 rz 2019 nbsp 0183 32 Section 80 CCD 1 Under Section 80CCD 1 both salaried as well as self employed may save tax by contributing towards NPS However there is a cap on the maximum amount that one may invest for

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

National Pension Scheme NPS Tax Benefits How To Save Tax NPS

https://i.ytimg.com/vi/WCOgUXdgRxU/maxresdefault.jpg

https://community.greythr.com/t/nps-comes-under-section-80c-or-80-ccd...

Web 29 M 228 rz 2021 nbsp 0183 32 NPS is one of the listed investment options in which you can invest and save tax under Section 80C The deduction limit for this section is Rs 1 5 lakhs and you can invest the entire amount in NPS if you wish and claim the deduction

https://cleartax.in/s/80c-80-deductions

Web Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section 80CCE Rs 50 000 80CCD 2 Employer s contribution towards NPS outside Rs 1 50 000 limit under Section 80CCE Central government employer 14 of basic salary DA Others 10 of basic

Exploring NPS Tax Benefits How 80CCD 1B Section Helps You Save On Taxes

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C Its Allied Sections

How To Claim Deduction For Pension U s 80CCD Learn By Quicko

NPS Tax Benefit Experts Differ On How To Claim Additional NPS Tax

How To Claim Section 80CCD 1B TaxHelpdesk

How To Claim Section 80CCD 1B TaxHelpdesk

Deductions Under Section 80C To 80U Deduction Full Revision In 20

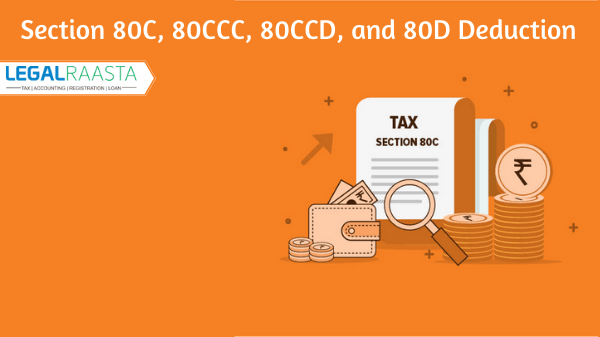

Section 80C 80CCC 80CCD And 80D Deduction Complete Guide

Section 80C Deduction Under Section 80C In India Paisabazaar

Nps Comes Under Section 80c - Web The NPS scheme holds immense value for anyone who works in the private sector and requires a regular pension after retirement The scheme is portable across jobs and locations with tax benefits under Section 80C and