Housing Loan Tax Benefit India How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs While applying for a home loan individuals can get home loan tax benefits under different sections like Section 80 EEA Section 24b which provides income tax benefits of up to

Housing Loan Tax Benefit India

Housing Loan Tax Benefit India

https://i.ytimg.com/vi/M9onZX59zZI/maxresdefault.jpg

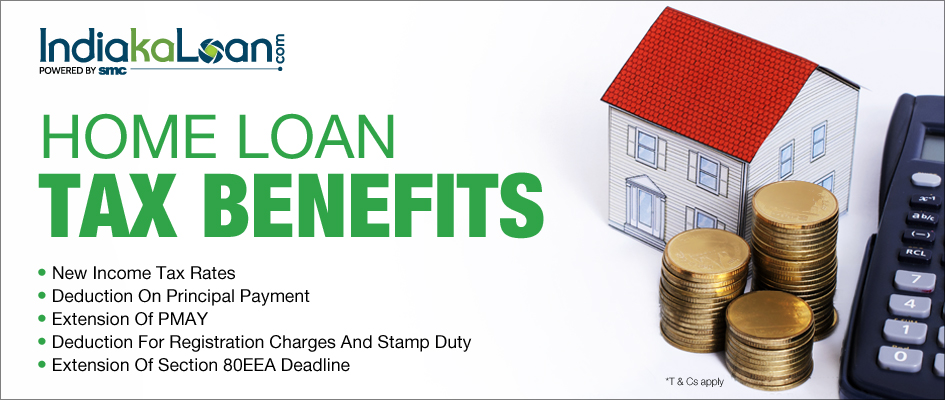

Home Loan Tax Benefits

https://www.indiakaloans.com/blog/wp-content/uploads/2020/02/Home-Loan-Tax-Benefits_Blog-Creative.jpg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/11/Tax-Saving-Benefits-of-having-property-through-Home-Loan-1.png

Section 80EE of the Income Tax Act allows a deduction of up to Rs 50 000 per financial year on the interest portion of a residential house property loan The Understand tax savings on a home loan under sections 24 80EE and 80C Home loan customers should be aware of the EMI or interest rate tax benefits as they could reduce taxable income for income tax

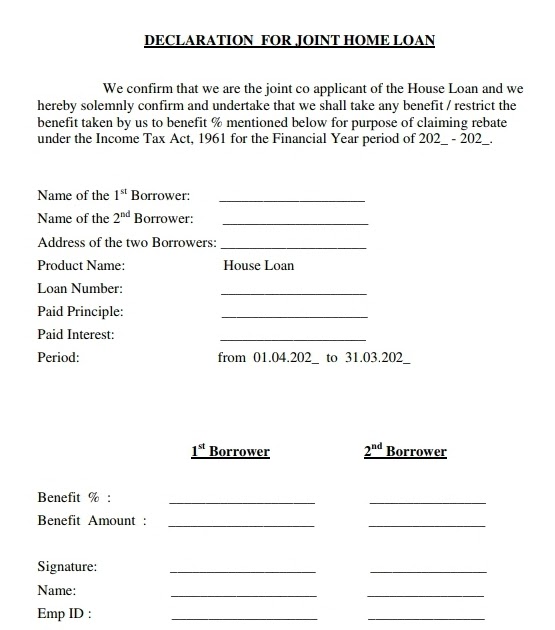

To encourage citizens to invest in property the government provides a range of home loan tax exemptions and deductions under the Income Tax Act of 1961 All home loan Joint owners can avail tax benefits on a joint home loan if they are co owners and co borrowers Tax benefits are based on ownership percentage Deductions include

Download Housing Loan Tax Benefit India

More picture related to Housing Loan Tax Benefit India

Avail Joint Home Loan To Get These Amazing Benefits Homes Loans Blog

https://homesandloansblog.files.wordpress.com/2021/08/home-loan-tax-benefit.jpg

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

Do You Know How To Get An Annual Housing Loan Tax Benefit Of Rs 5 Lakh

https://blogger.googleusercontent.com/img/a/AVvXsEjEBgXwUxM8gpiEQforulKfUR_9km9BUjn7CBdHLf0KDs6wj2mchTC2y1IfzcbrYC2pvx55p47c81e8ZCsITBZasS2DQ3cJdY7LbUKKKAzfwjQbJHOQ-XlAYAAg26_waKNhnmtQNdqDio3QPh5tttvYjqDfPNpudf5En7ebIFs_YrEo00V-6njDO6EwcQ=s16000

The Indian government provides a way to fulfil this dream by encouraging citizens to invest in a house property It offers various benefits on the repayment of a Home Loan through Pankaj Gadgil MD CEO Aditya Birla Housing Finance says taking a home loan can provide significant tax savings Also the tax benefit is available to taxpayers who opt

Home Loan Income Tax Benefits For interest paid on home loans for affordable housing an additional Rs 1 5 lakh tax deduction under Section 80EE can be availed till 31 March Whether you have one home loan or more the deduction allowable under Section 80 C for repayment of home loan is restricted to Rs 1 50 lakh together with various other eligible

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

https://housing.com/news/home-loans-…

How much tax benefit can I get on home loan Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs

Home Construction Loan How To Claim Tax Benefits Loan Trivia

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Declaration For Housing Loan PDF Loans Government

Income Tax Benefits On Home Loan Loanfasttrack

Home Loan Tax Benefits MeidilighT

How Housing Loan Tax Benefit

How Housing Loan Tax Benefit

Joint Home Loan Declaration Form For Income Tax Savings And Non

What Are The Tax Benefit On Home Loan FY 2020 2021

Housing Loan Tax Benefit India - A regular home loan offers various tax benefits These include a deduction of up to Rs 1 5 lakh on the principal repayment under section 80C of the income tax Act and up to Rs 2