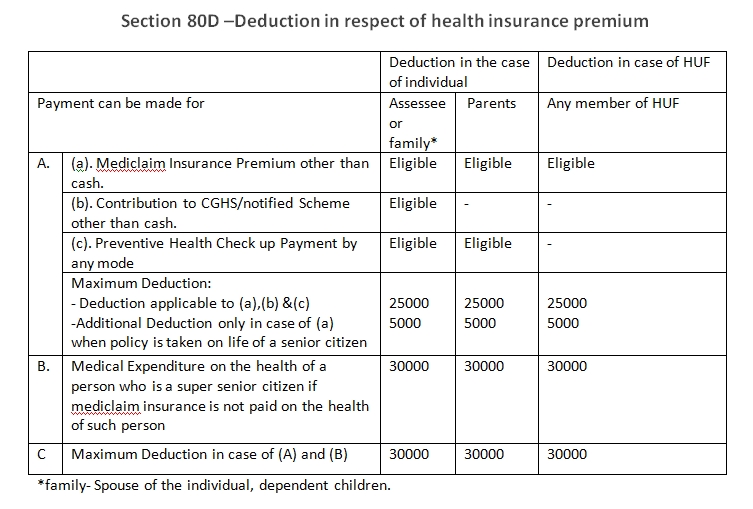

Income Tax Relief Under Section 80d Verkko 27 tammik 2023 nbsp 0183 32 Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premium medical expenditure and preventive health checkup in a financial year

Verkko 20 jouluk 2023 nbsp 0183 32 Section 80D of the Income Tax Act 1961 is a vital tool for reducing your tax burden while investing in your well being It allows you to claim deductions on expenses related to medical insurance and preventive healthcare Let s break down the key points Who can claim the deduction Verkko 14 maalisk 2022 nbsp 0183 32 Section 80D permits a deduction of 25 000 for self spouse and dependent children However for parents it is dependent on their age Let s state a fact As per the Central Board of Direct

Income Tax Relief Under Section 80d

Income Tax Relief Under Section 80d

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Income Tax Relief Service For Individuals In Decatur And Atlanta GA

https://accoladeaccounting.com/wp-content/uploads/2021/07/tax-relief-scaled.jpg

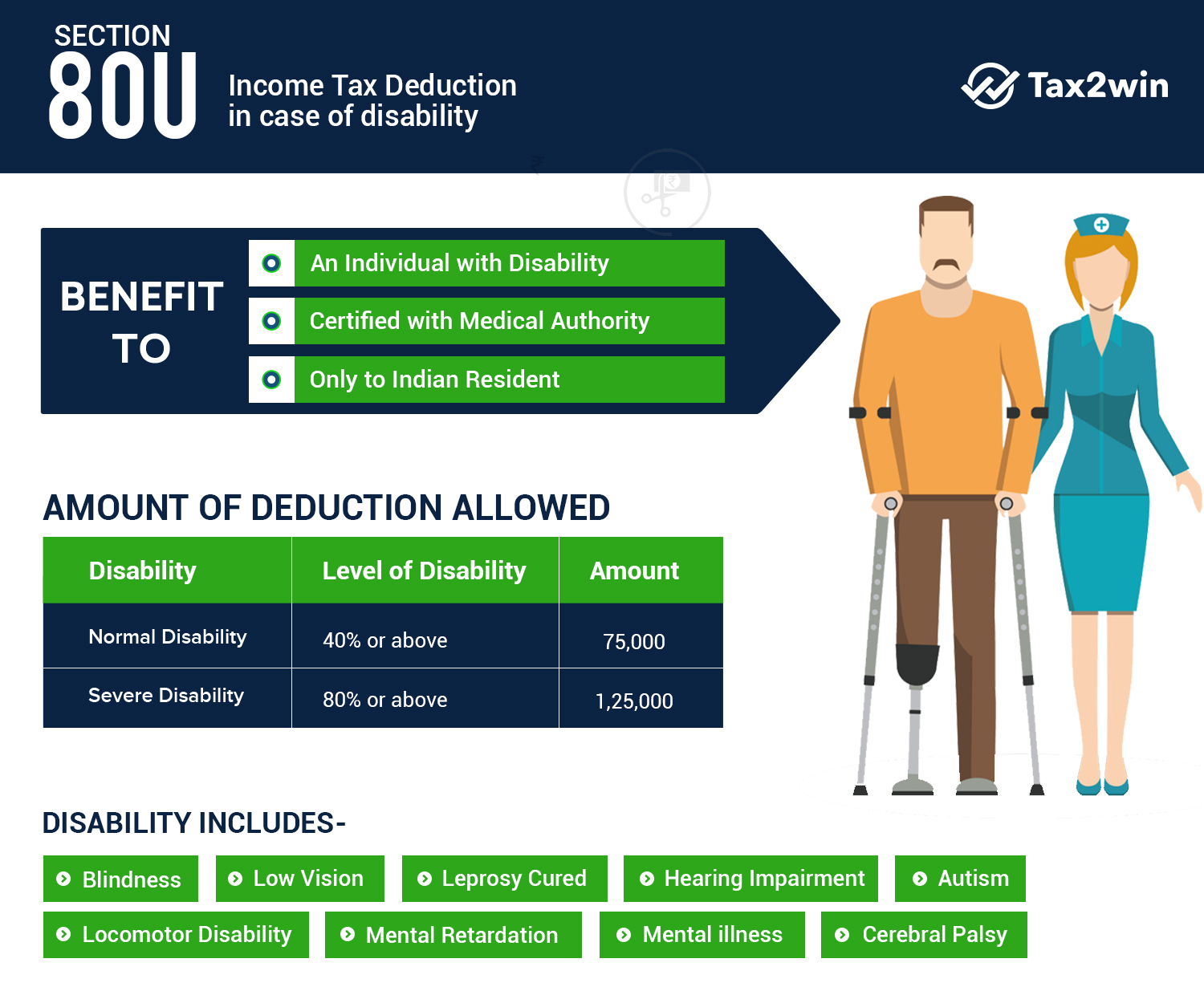

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80dd.jpg

Verkko 24 lokak 2023 nbsp 0183 32 Every individual or HUF can claim a deduction under section 80D of the income tax act for the medical insurance done by them Sec 80D of Income Tax Act also offers the benefit in case the health insurance is taken to cover their spouse dependent children or parents Limit of tax deduction under section 80D Verkko 26 syysk 2023 nbsp 0183 32 Unless lower rates are provided in a tax treaty tax rates are 35 on employment income and 30 on dividends interest however interest income is normally not taxable for a non resident and royalties In principle no itemised deductions are allowed against the aforementioned income When the 35 tax at source tax is

Verkko Section 80D of the Income Tax Act provides individuals with a deduction in respect of medical insurance premiums paid This section is aimed at encouraging taxpayers to avail medical insurance coverage for themselves and their families Under Section 80D taxpayers can claim deductions on the premiums paid for medical insurance policies Verkko 22 maalisk 2023 nbsp 0183 32 Study grants and other grants are regarded as income for the tax year in which they are paid On the pre completed tax return for 2022 grants paid by private parties are listed as taxable income even if the total amount of grant income does not exceed 24 761 09 However you still do not need to pay tax on the grants

Download Income Tax Relief Under Section 80d

More picture related to Income Tax Relief Under Section 80d

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

https://www.indianivesh.in/CmsApp/MediaGalary/images/Section 80D_1-202003061333183976953.jpg

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

Verkko Income Tax Act Section 80D authorises tax deductions up to 25 000 for self and family covers spouse and children on health insurance premiums paid If your parents are over 60 the deduction Verkko 20 jouluk 2023 nbsp 0183 32 After you have logged in to MyTax click the Tax cards and prepayments link under Tax cards and prepayments 2024 Click the Request a new tax card button Click Select the short tax card request request a tax card for wage or benefit income fringe benefits and study grant report commuting expenses and

Verkko 22 hein 228 k 2020 nbsp 0183 32 The Section 80D deduction applies to the premiums paid towards health insurance for self and family members The biggest advantage for the taxpayer is that they can claim deduction u s 80D along with the deduction claimed under Section 80C CCC CCD Table of Content What is Section 80D Tax deductions under Verkko However what makes it more lucrative is that the deduction is over and above limit stipulated under Section 80C of the Income Tax Act 1961 Tax Deductions Available for Health Insurance under Section 80D The amount of deduction on health insurance premium paid ranges from 25 000 to a maximum of 1 00 000 deduction eligible if

Section 80d Of Income Tax Section 80d Medical Expenditure Trutax

https://www.trutax.in/blog/wp-content/uploads/2021/05/section-80d-of-income-tax-act-1-1024x576.png

What Is Section 80D Of Income Tax Deduction For Medical Health

https://cdnlearnblog.etmoney.com/wp-content/uploads/2023/03/Tax-Deduction_80d-768x319.jpg

https://learn.quicko.com/section-80d-deduction-for-medical-insurance...

Verkko 27 tammik 2023 nbsp 0183 32 Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical insurance premium medical expenditure and preventive health checkup in a financial year

https://taxguru.in/income-tax/section-80d-income-tax-deduction-related...

Verkko 20 jouluk 2023 nbsp 0183 32 Section 80D of the Income Tax Act 1961 is a vital tool for reducing your tax burden while investing in your well being It allows you to claim deductions on expenses related to medical insurance and preventive healthcare Let s break down the key points Who can claim the deduction

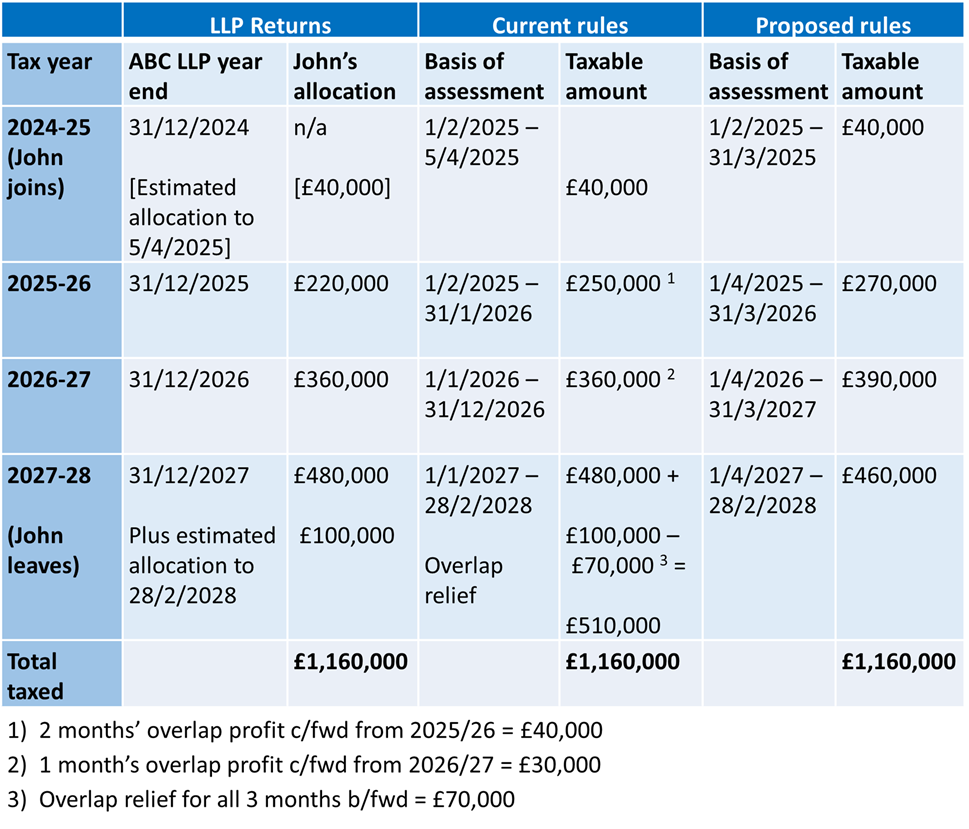

Business Profit Tax Changes 2023 24 Basis Period BDO

Section 80d Of Income Tax Section 80d Medical Expenditure Trutax

Income Tax Deduction Under Section 80C To 80U FY 2022 23

What Is Section 80D Of Income Tax Act How To Claim Deduction U s 80D

Income Tax Relief Under Section 89 I Arrear Of Salary I Relief Under

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Income Tax Relief Medical Cost Doubles In 5 Years Will Budget 2024

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Income Tax Relief Under Section 80d - Verkko Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance premium mode other than cash contribution to CGHS