Tax Benefit Under Section 80d Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and

To promote the adoption of health insurance the government has incentivised its purchase by offering tax benefits under Section 80D What is Section 80D Under section Under Sec 80D of the Income Tax Act the following deductions are allowed for health insurance premiums and medical expenses Expenses incurred on

Tax Benefit Under Section 80d

Tax Benefit Under Section 80d

https://www.dialabank.com/wp-content/uploads/2019/11/Section-80D.jpg

Section 80D Deduction In Respect Of Health Or Medical Insurance

https://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

Section 80D Of Income Tax 80D Deduction For Medical Insurance Mediclaim

https://www.fincash.com/b/wp-content/uploads/2017/01/Deductions-Under-Section-80D-1.png

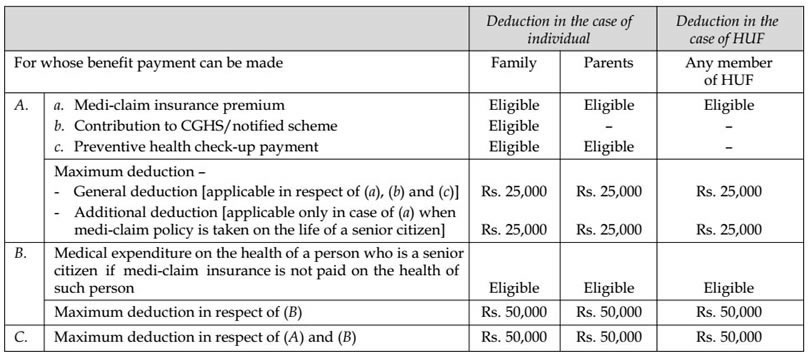

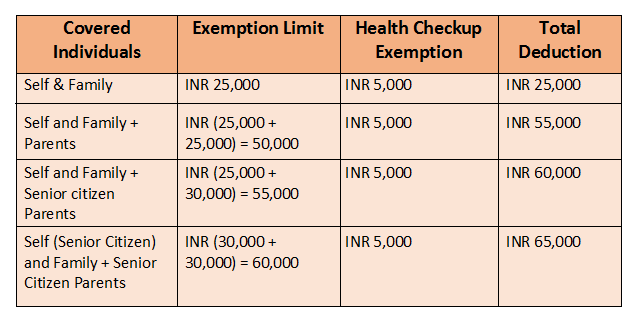

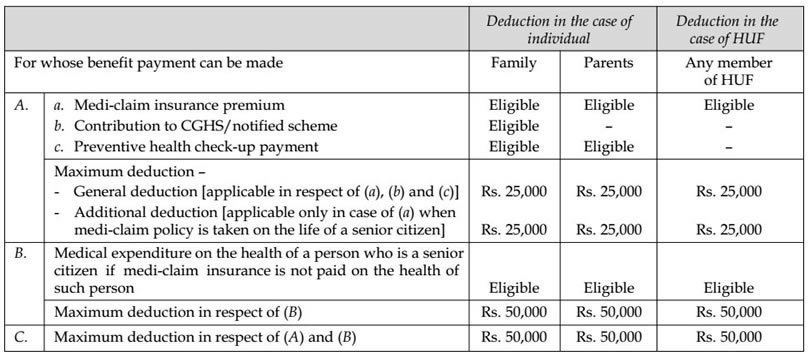

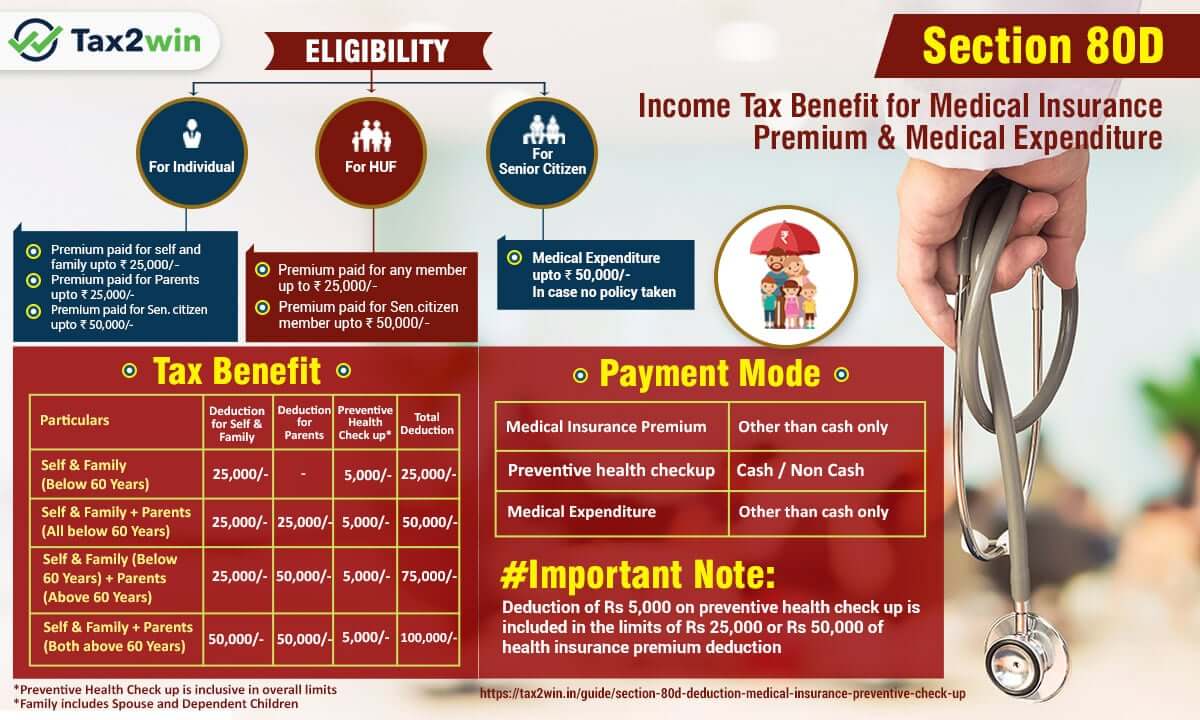

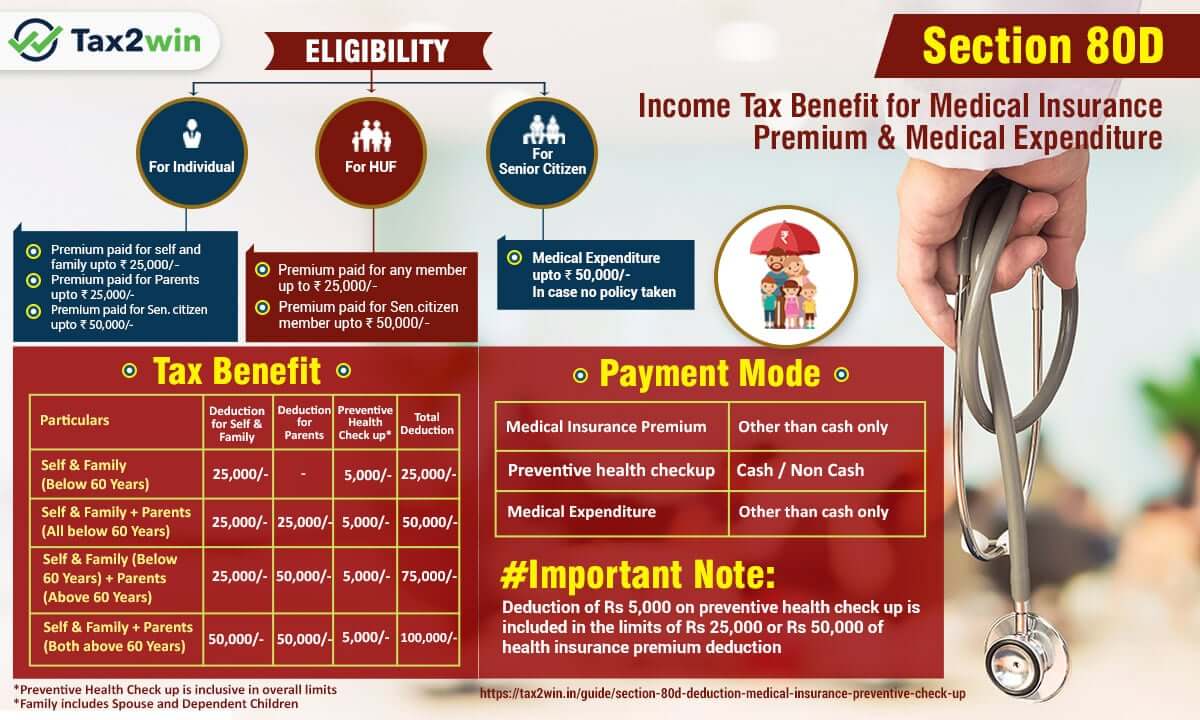

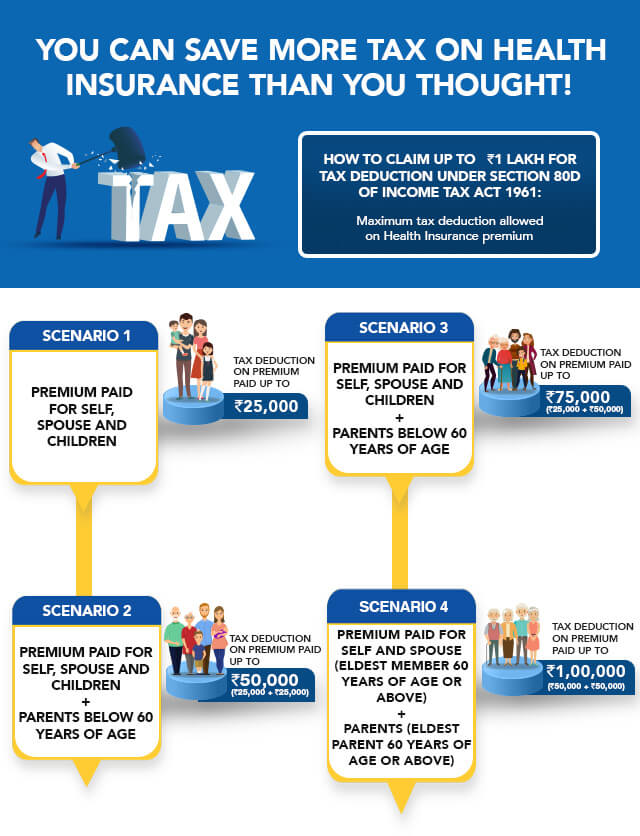

Section 80D of the Income Tax Act of 1961 allows taxpayers to claim deductions for the premiums paid on health or medical insurance policies The section is implemented to urge people to Here is a table that illustrates the different slabs of health insurance tax benefit 80D limit available under Section 80D depending upon who is covered in the health insurance

Section 80D is quite a beneficial tax saving vehicle under the Income Tax Act which allows taxpayers to claim tax deductions of up to 25 000 on premiums paid for health insurance policies You can claim a tax deduction of up to Rs 25 000 each year for health insurance premiums under Section 80D of the Income Tax Act If you are a senior citizen this amount goes up to Rs

Download Tax Benefit Under Section 80d

More picture related to Tax Benefit Under Section 80d

Section 80D Deduction Avail Health Insurance Tax Benefit Under

https://i.ytimg.com/vi/OVNKyB31bgQ/maxresdefault.jpg

All You Need To Know About Section 80D Of Income Tax Act Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/07/Section-80D.jpg

How To Save Tax On Health Insurance Premiums Under Section 80D GQ India

https://media.gqindia.com/wp-content/uploads/2018/07/tax-top-image2-1366x768.jpg

Section 80D of the Income Tax Act in India provides deductions on premiums paid for health insurance policies offering taxpayers an opportunity to reduce their taxable income Here s a detailed breakdown of the benefits Section 80D of the Income Tax Act provides tax relief for various healthcare expenses including health insurance premiums preventive health check ups and even

Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check up and 2 Under Section 80D of the Income Tax Act an individual can claim a deduction for the following medical expenses incurred during the financial year Medical insurance premium

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

https://i.ytimg.com/vi/Q6z6wI7m9Eo/maxresdefault.jpg

What Is Section 80D Of Income Tax Act How To Claim Deduction U s 80D

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/06/section-80d.jpg

https://tax2win.in › guide

Under Section 80D of the Income Tax Act in India taxpayers can claim a deduction for medical insurance premiums paid for themselves and

https://www.bankbazaar.com › tax

To promote the adoption of health insurance the government has incentivised its purchase by offering tax benefits under Section 80D What is Section 80D Under section

Section 80D Tax Benefit For Health Medical Treatment Premium AY

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Health Insurance Tax Benefits Under Section 80D FY2020 Personal

Section 80DD Of Income Tax Act Deductions For Disabled Persons Tax2win

Health Insurance Tax Benefits Under Section 80D

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

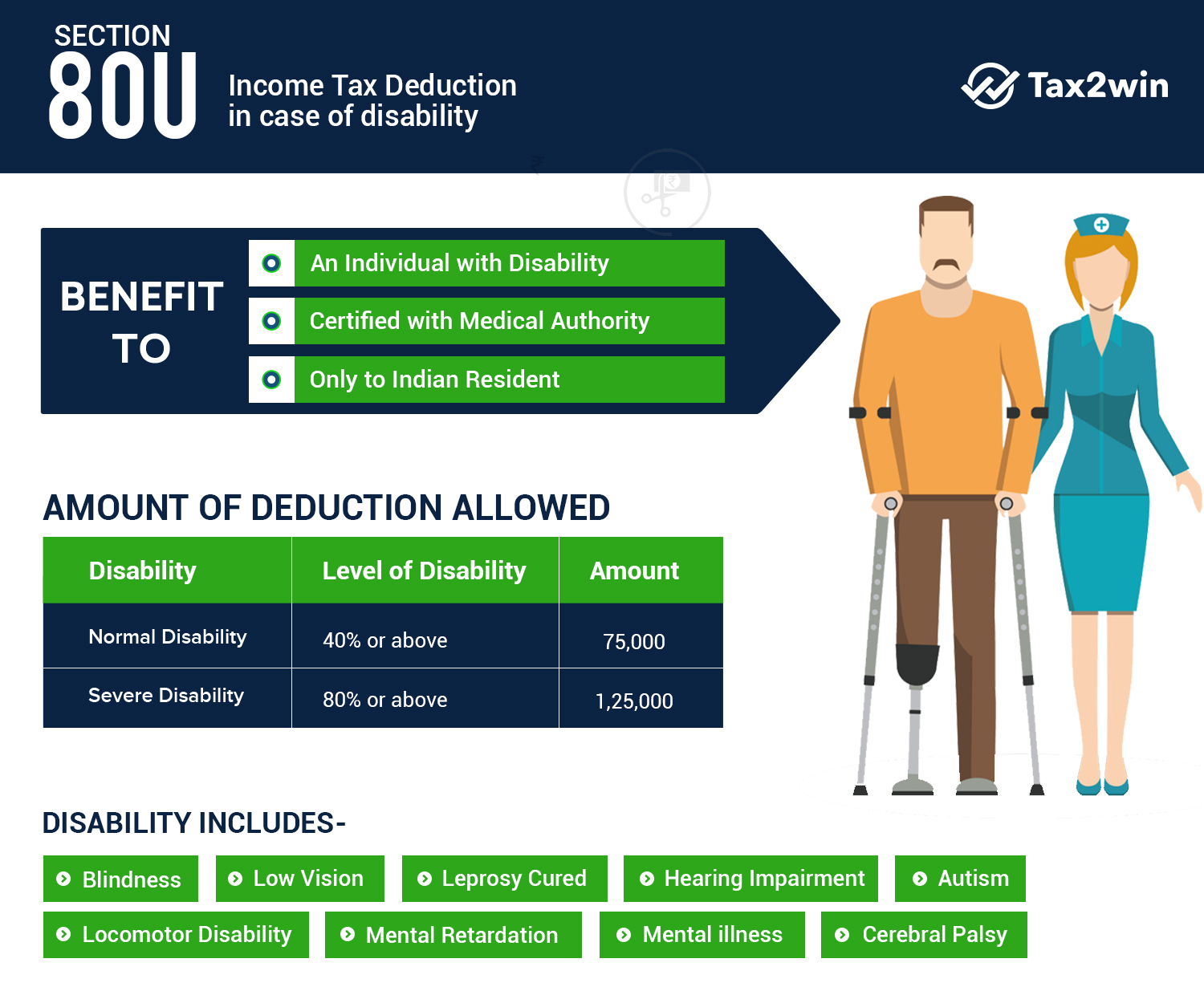

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Health Insurance Deduction U S 80D Income Tax Deductions Exemptions

Tax Benefits Under Section 80D Health Insurance Policies Health

Tax Benefit Under Section 80d - Here is a table that illustrates the different slabs of health insurance tax benefit 80D limit available under Section 80D depending upon who is covered in the health insurance