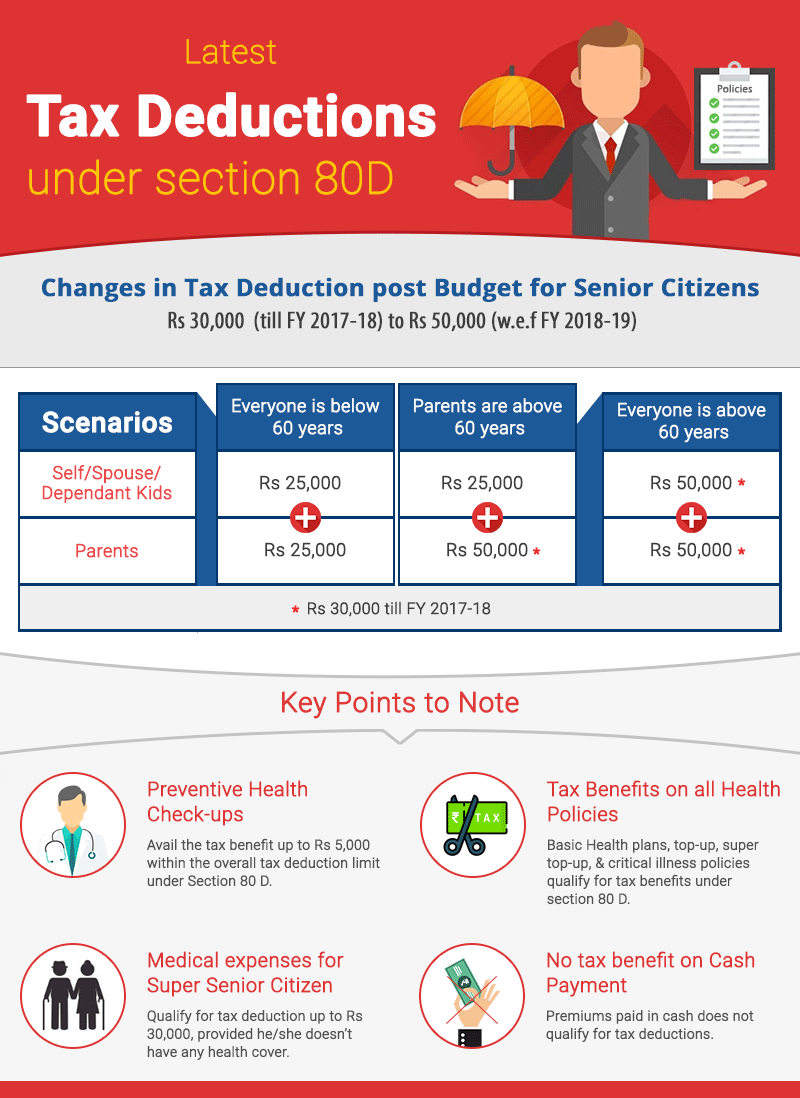

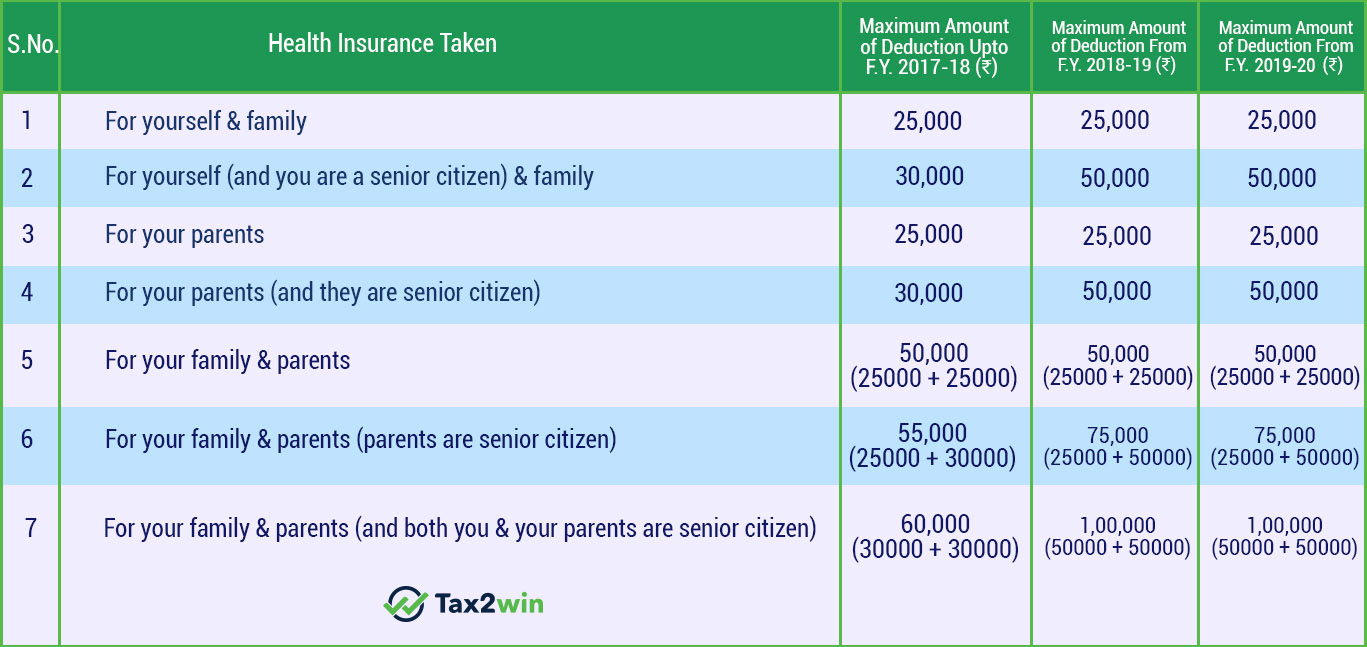

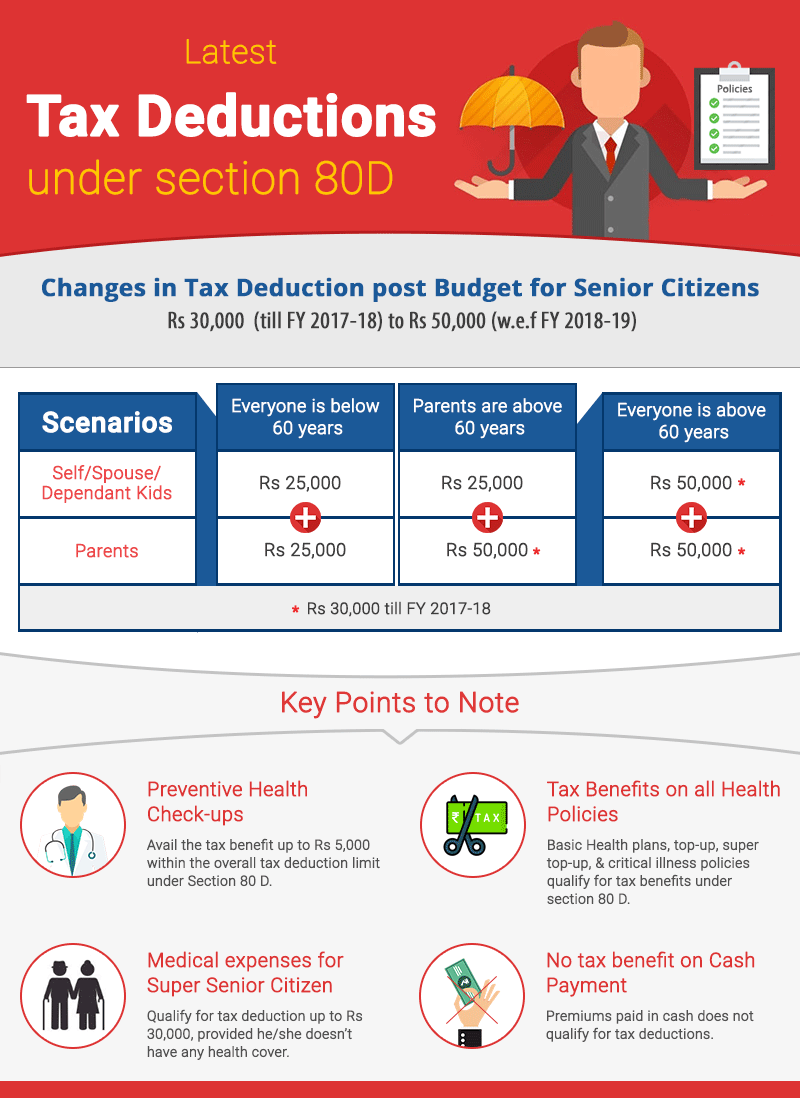

Tax Rebate Under Section 80d Web Deduction under section 80D Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D

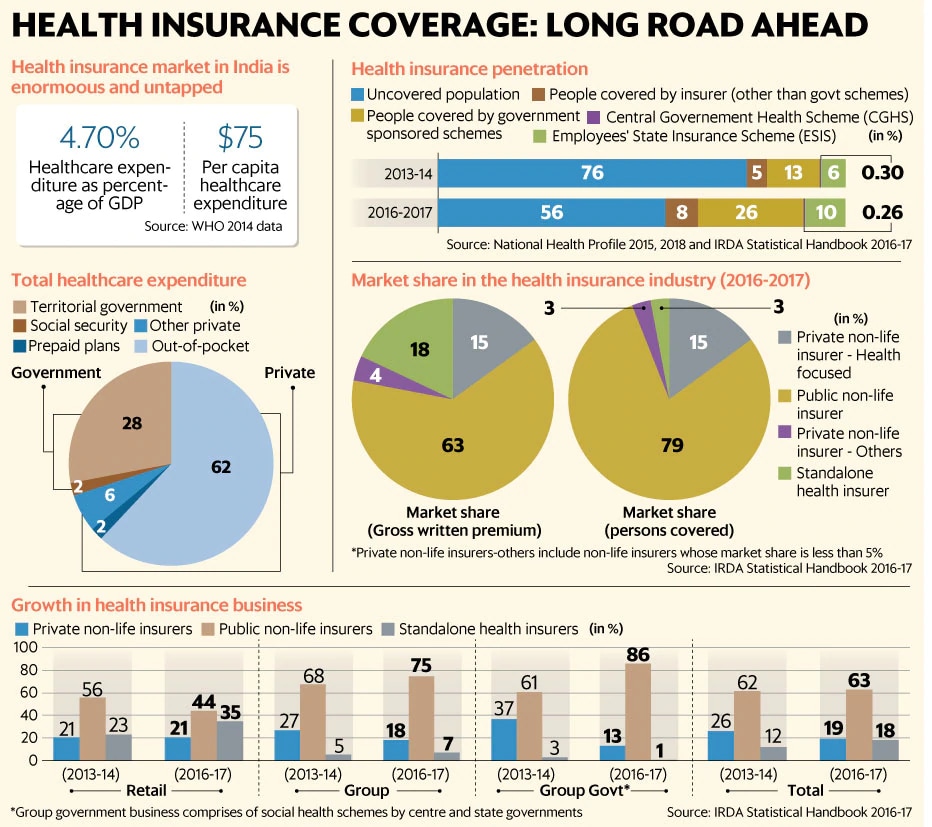

Web 9 mars 2023 nbsp 0183 32 The limits to claim tax deduction under Section 80D depends on who is included under the health insurance coverage Hence depending on the taxpayer s Web 15 f 233 vr 2023 nbsp 0183 32 How much tax is saved under Section 80D Similarly if the taxable income is between Rs 5 lakh and Rs 10 lakh the amount of tax saved for deduction of Rs

Tax Rebate Under Section 80d

Tax Rebate Under Section 80d

https://www.myrealdata.in/wp-content/uploads/2019/07/tax-deductions-under-section-80D.png

New Tax Benefits Under Section 80D ComparePolicy

https://www.comparepolicy.com/blogs/wp-content/uploads/2018/02/Tax-Deduction-under-Section-80D.png

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-768x650.jpg

Web 6 lignes nbsp 0183 32 Ans You can avail tax exemption of up to Rs 25 000 in a financial year on health insurance Web 12 sept 2023 nbsp 0183 32 Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take advantage of Section 80D s

Web 18 juil 2023 nbsp 0183 32 A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in

Download Tax Rebate Under Section 80d

More picture related to Tax Rebate Under Section 80d

80D Tax Deduction Under Section 80D On Medical Insurance

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

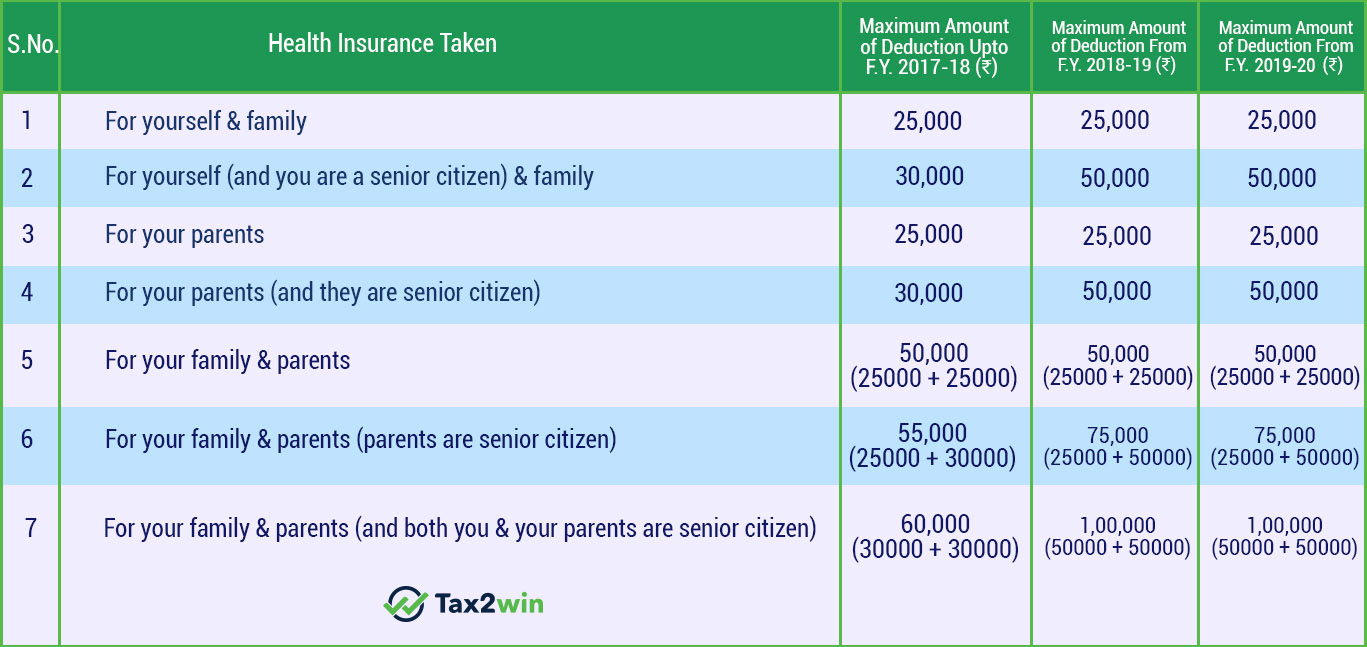

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Web 20 sept 2019 nbsp 0183 32 Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions

Web 27 janv 2023 nbsp 0183 32 Section 80D of Income Tax Act allows a deduction to an Individual including non resident individuals or HUF for the amount paid towards medical Web Section 80D offers tax deductions on health insurance premiums of up to a maximum limit of 25 000 in a financial year You can claim deductions for a policy bought for yourself

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/10/Section-80D-Summary.jpg

Section 80D Deduction In Respect Of Health Or Medical Insurance

http://incometaxmanagement.com/Pages/Tax-Ready-Reckoner/GTI/Tax-Deductions/Maximum Deduction Amount under Section 80D.jpg

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Deduction under section 80D Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D

https://www.etmoney.com/learn/income-tax/everything-you-need-to-know...

Web 9 mars 2023 nbsp 0183 32 The limits to claim tax deduction under Section 80D depends on who is included under the health insurance coverage Hence depending on the taxpayer s

How To Claim Health Insurance Under Section 80D From 2018 19

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

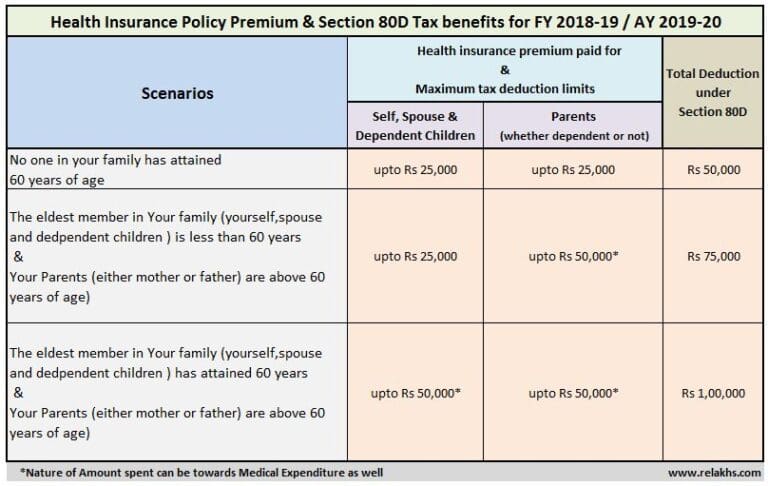

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

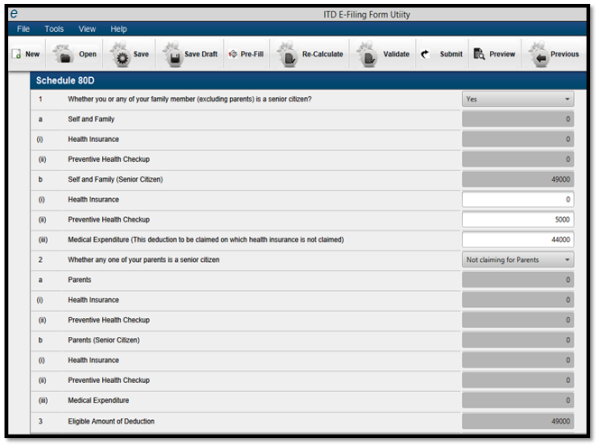

How To Make A Tax Claim Of Medical Expenditure Under 80D

DEDUCTION UNDER SECTION 80C TO 80U PDF

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

Deduction Under 80D Tips Before Investing In A Health Insurance Plan

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Tax Rebate Under Section 80d - Web 8 juil 2020 nbsp 0183 32 The amount of deduction on health insurance premium paid ranges from 25 000 to a maximum of 1 00 000 deduction eligible if Self Senior Citizen and family